Irs Child Tax Credit 2023 Portal The Child Tax Credit Update Portal allows families to verify their eligibility for the payments and if they choose to unenroll or opt out from receiving the monthly payments so they can receive a lump sum when they file their tax return next year

To access the Child Tax Credit Update Portal you must enter your IRS username and password if you have existing accounts such as Get Transcript Online Account or Identity Protection PIN The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment

Irs Child Tax Credit 2023 Portal

Irs Child Tax Credit 2023 Portal

http://refundschedule.us/wp-content/uploads/2022/01/IRS-Child-Tax-Credit-Portal-Login-Advance-Update-Bank-Information-Payments-Dates-Phone-Number-Stimulus.jpg

How To Use The IRS Child Tax Credit Update Portal CTC UP Get It Back

https://www.taxoutreach.org/wp-content/uploads/CTC-UP-14-copy-624x1024.png

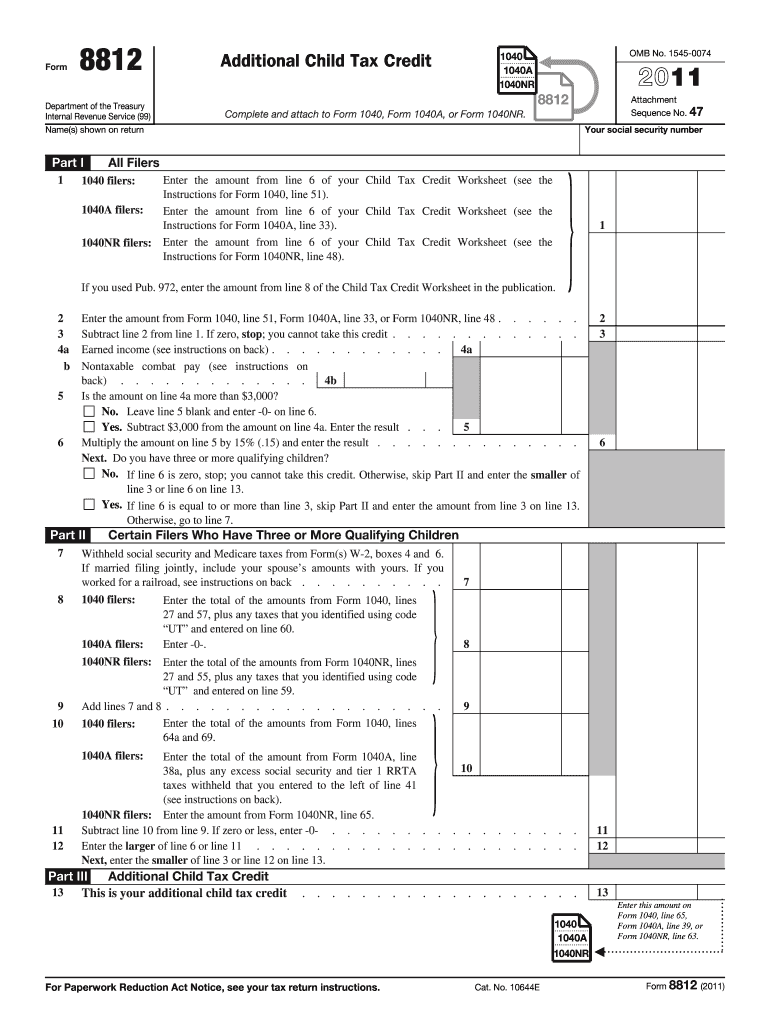

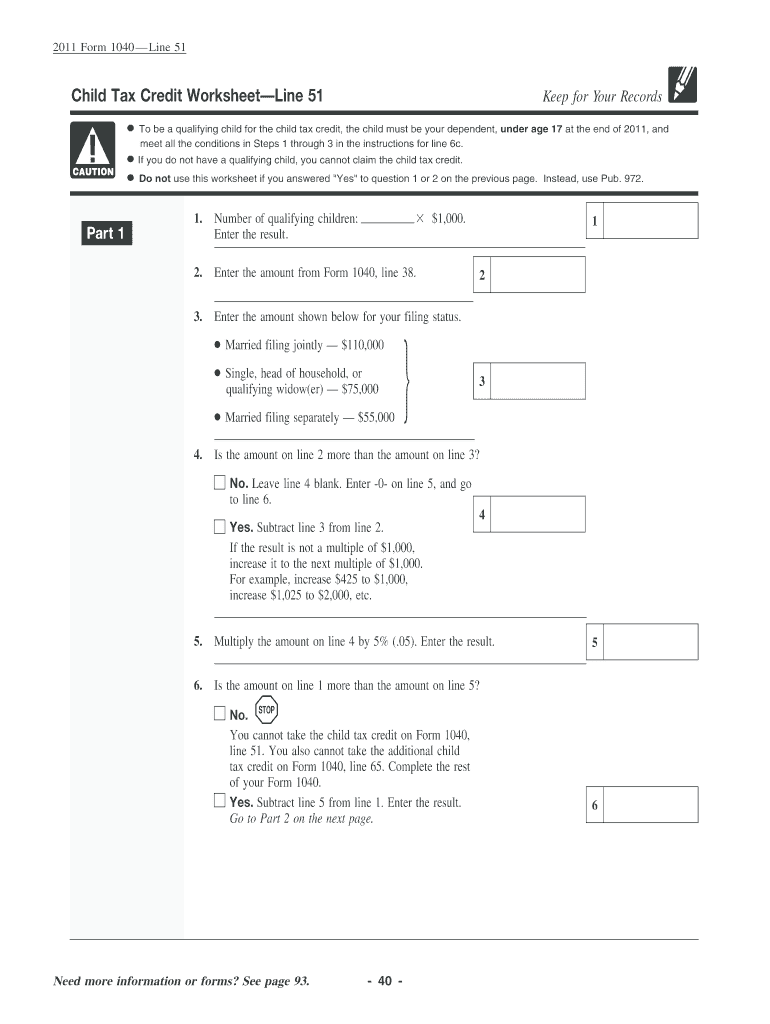

2023 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-tax-credits-form-irs-d1.png

The Child Tax Credit Update Portal is a secure password protected tool available to any eligible family with internet access and a smart phone or computer It is designed to enable them to manage their Child Tax Credit payments including if they choose unenrolling from monthly payments WASHINGTON The Internal Revenue Service has launched a new feature allowing any family receiving monthly Child Tax Credit payments to quickly and easily update their mailing address using the Child Tax Credit Update Portal found exclusively on IRS gov

The Child Tax Credit Update Portal is a secure password protected tool available to any eligible family with internet access and a smart phone or computer It is designed to enable them to manage their Child Tax Credit accounts Get your advance payments total and number of qualifying children in your online account You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account

Download Irs Child Tax Credit 2023 Portal

More picture related to Irs Child Tax Credit 2023 Portal

How To Use The IRS Child Tax Credit Update Portal CTC UP Get It Back

https://www.taxoutreach.org/wp-content/uploads/CTC-UP-33-2-1-962x1024.png

IRS CTC How Do I Access The IRS Child Tax Credit Update Portal CTC

https://help.id.me/hc/article_attachments/4403019059479/Member_Facing_Screen.png

Child Tax Credit 2023 Changes Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/100/19/100019284/big.png

If you are receiving monthly advance payments of the Child Tax Credit you can make certain changes in the Child Tax Credit Update Portal by 11 59 p m Eastern Time on October 4 to affect the next scheduled payment on October 15 2021 Another tool the Child Tax Credit Update Portal will initially enable anyone who has been determined to be eligible for advance Child Tax Credit payments to see that they are eligible and unenroll or opt out of the advance payment program if they prefer

File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit The Child Tax Credit Update Portal CTC UP allows a taxpayer to check enrollment for payments unenroll from the program update bank account information and update their address As of August 19 2021 1 8 million taxpayers have unenrolled

What Is The Child Tax Credit And How Much Of It Is Refundable

https://i0.wp.com/www.brookings.edu/wp-content/uploads/2021/01/Who-gets-the-Child-Tax-Credit-in-2020_by-income.png?w=768&crop=0%2C0px%2C100%2C9999px&ssl=1

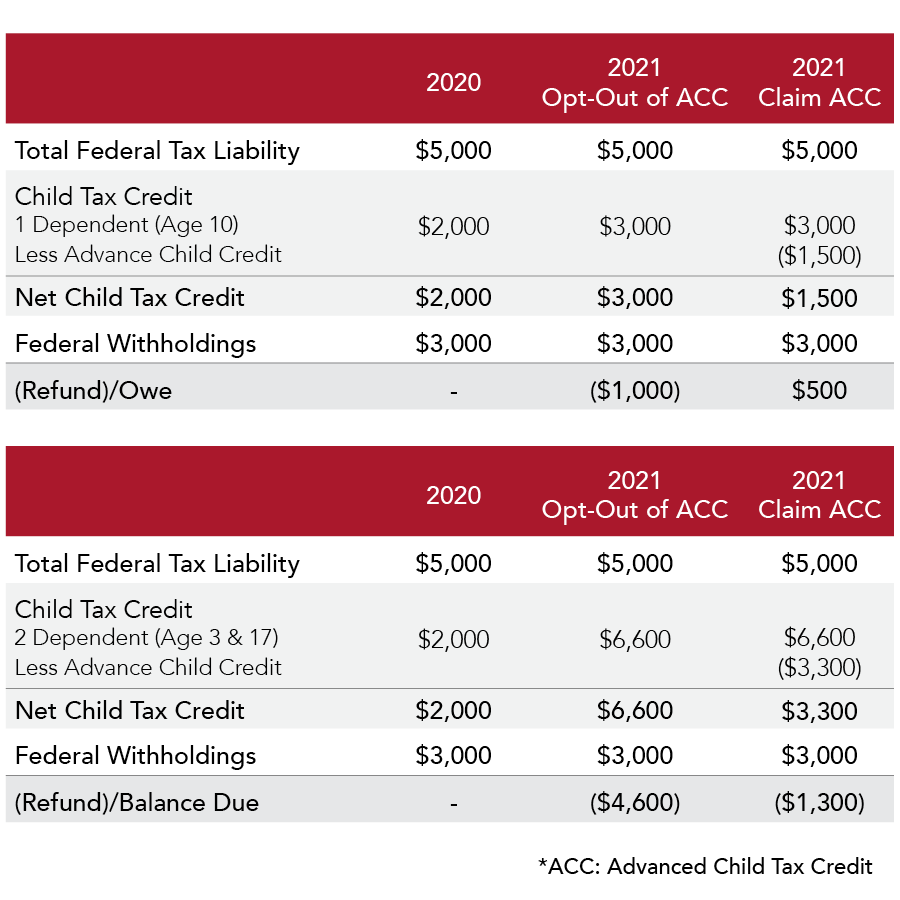

2021 Child Tax Credit What Should I Know Collins Consulting

https://hs-2666538.f.hubspotemail.net/hub/2666538/hubfs/21021005_-_Child_Tax_Credit_Tables2.png?upscale=true&width=1200&upscale=true&name=21021005_-_Child_Tax_Credit_Tables2.png

https://www.irs.gov/newsroom/irs-announces-two-new...

The Child Tax Credit Update Portal allows families to verify their eligibility for the payments and if they choose to unenroll or opt out from receiving the monthly payments so they can receive a lump sum when they file their tax return next year

https://www.irs.gov/newsroom/child-tax-credit-most-eligible-families-will...

To access the Child Tax Credit Update Portal you must enter your IRS username and password if you have existing accounts such as Get Transcript Online Account or Identity Protection PIN

Child Tax Credit IRS To Open Portals On July 1 Checks Will Begin July

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credit 2022 Schedule Payments

Child Tax Credits Irs How To Make The Most Of The Child Tax Credit

Irs Child Tax Credit Problems Alreda

Irs Child Tax Credit Child Tax Credit Changes Hinman Financial

Irs Child Tax Credit Child Tax Credit Changes Hinman Financial

T14 0048 Eliminate Income Threshold For The Refundable Child Tax

Child Tax Deduction 2011 2023 Form Fill Out And Sign Printable PDF

Child Credit Tax Fill Online Printable Fillable Blank PdfFiller

Irs Child Tax Credit 2023 Portal - The child tax credit CTC allows eligible parents and caregivers to reduce their tax liability and might even result in a tax refund