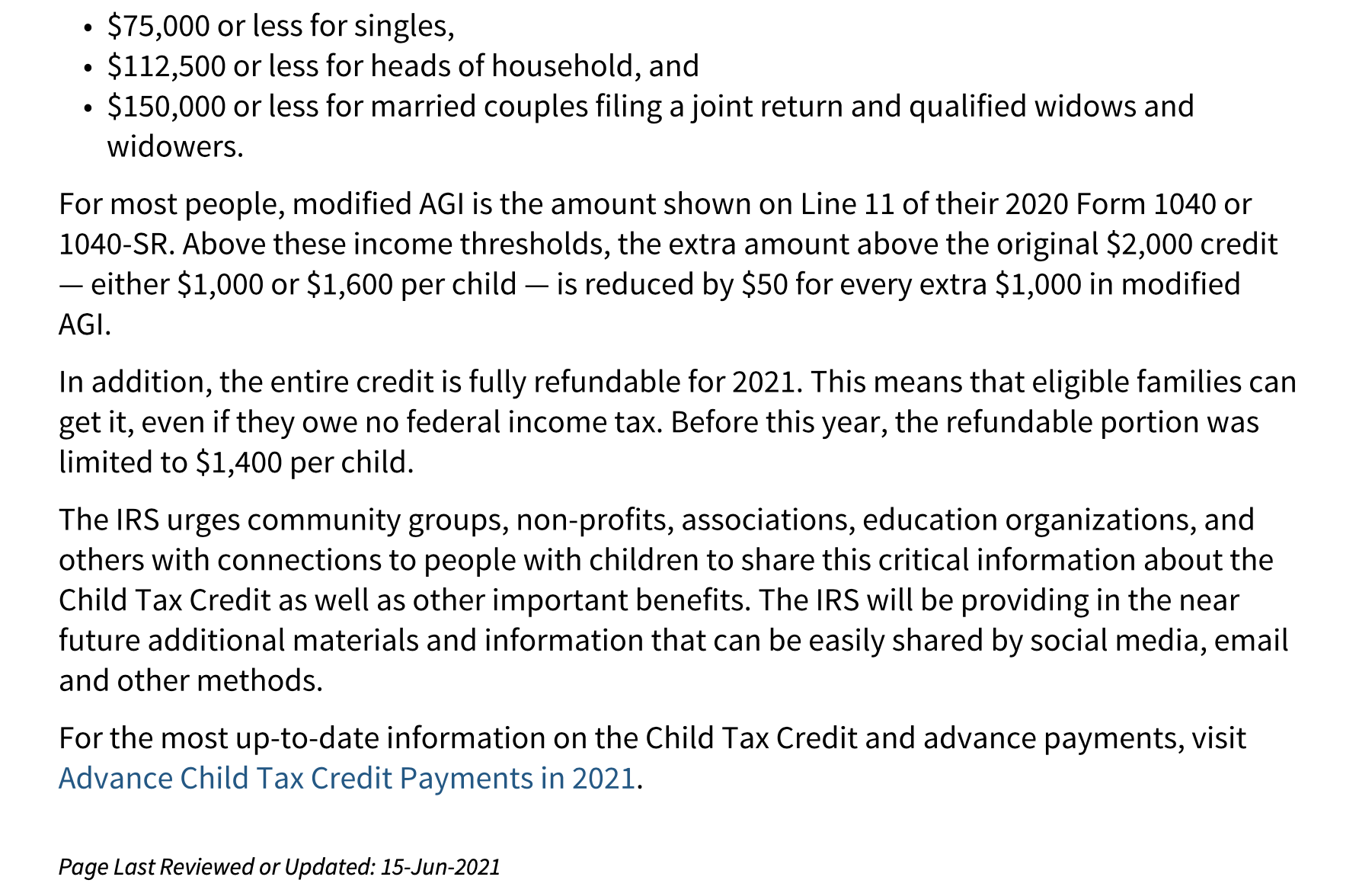

Irs Child Tax Credit 2023 Schedule Use Schedule 8812 Form 1040 to figure your child tax credit CTC credit for other dependents ODC and additional child tax credit ACTC The CTC and ODC are nonrefundable credits The ACTC is a refundable credit Future Developments

Page Last Reviewed or Updated 02 Nov 2023 Information about Schedule 8812 Form 1040 Additional Child Tax Credit including recent updates related forms and instructions on how to file Use Schedule 8812 Form 1040 to figure the additional child tax credit The additional child tax credit may give you a refund even if you do Click to expand Key Takeaways The Child Tax Credit CTC can reduce the amount of tax you owe by up to 2 000 per qualifying child If you end up owing less tax than the amount of the CTC you may be able to get a refund using the Additional Child Tax Credit ACTC

Irs Child Tax Credit 2023 Schedule

Irs Child Tax Credit 2023 Schedule

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

Irs Child Tax Credit Problems Alreda

https://www.hrblock.com/tax-center/wp-content/uploads/2018/03/CP79.png

IRS FORM 12333 PDF

https://www.irs.gov/pub/xml_bc/24811v08.gif

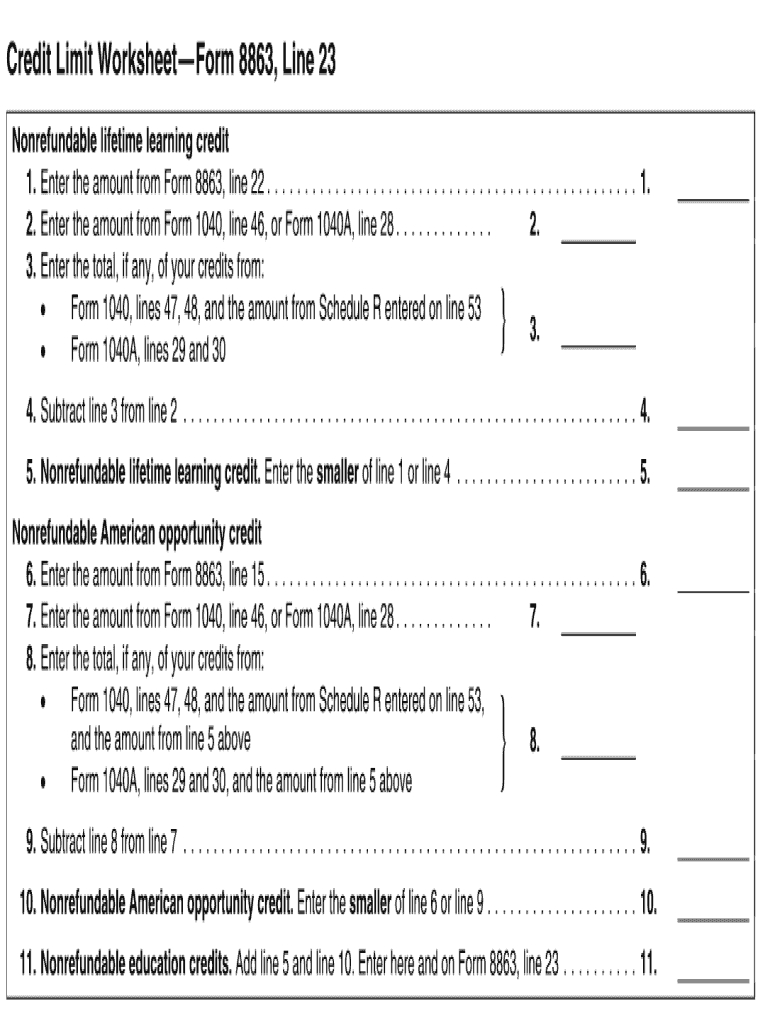

For 2023 taxes for returns filed in 2024 the Child Tax Credit is worth 2 000 for each qualifying child You can claim this full amount if your income is at or below the modified adjusted gross income threshold see the income phase out information below The refundable Additional Child Tax Credit is worth up to 1 600 See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers How much is the 2023 child tax credit Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child

Download Irs Child Tax Credit 2023 Schedule

More picture related to Irs Child Tax Credit 2023 Schedule

Earned Income Credit 2022 Calculator INCOMEBAU

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

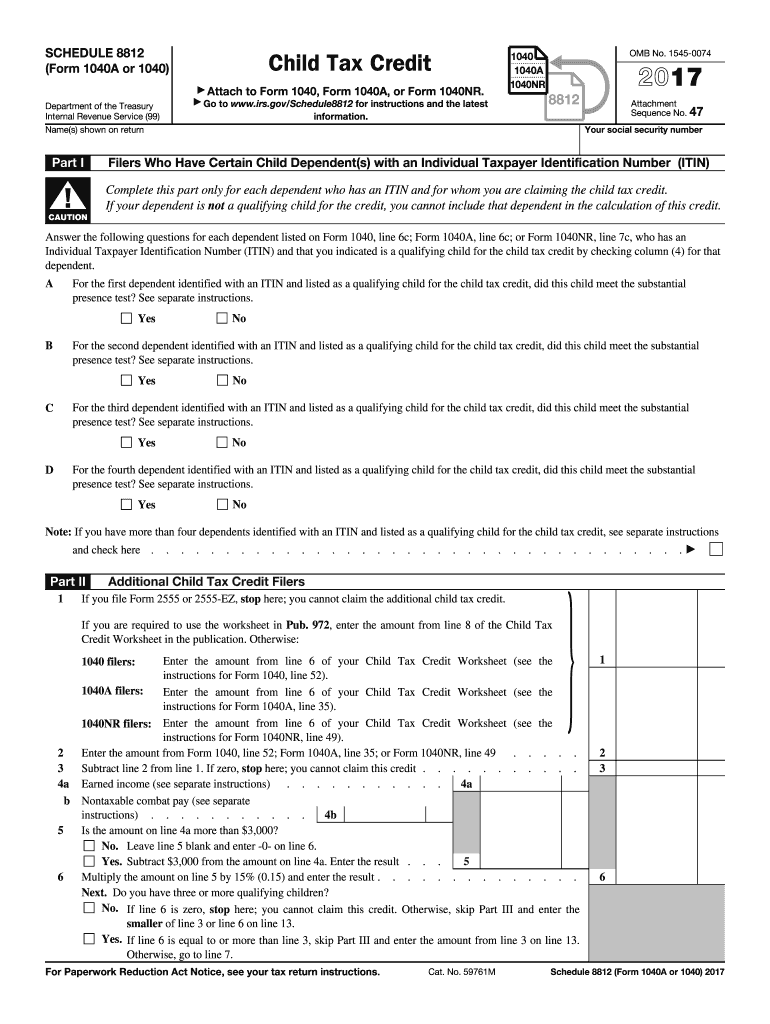

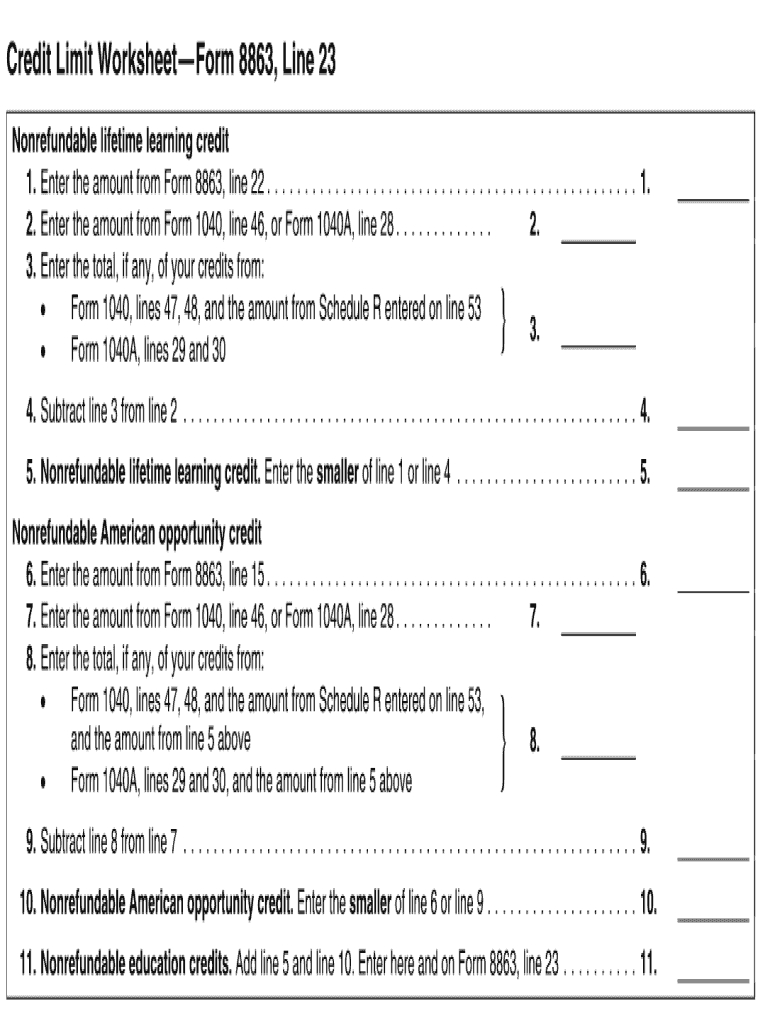

Irs Credit Limit Worksheet 2021

https://i2.wp.com/www.pdffiller.com/preview/6/895/6895661/large.png

Tax Credit Limit Worksheet Worksheet Resume Examples

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2020/02/child-tax-credit-worksheet-help.jpg

How the child tax credit will look in 2023 The child tax credit isn t going away but it has returned to its previous levels There are a handful of requirements that you and your Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you may

The child tax credit CTC is a federal tax benefit that provides financial support for taxpayers with children This year the credit has been in and out of the news as lawmakers had hoped The 2023 Child Tax Credit Payment Schedule Only Annual Tax Credits For Now Sarah Nieschalk Published June 27 2023 If you re looking for a payment schedule to your child credit well the good news is there still is a child tax credit

Child Tax Credits Form IRS Free Download

https://www.formsbirds.com/formimg/child-tax-credits-form/781/child-tax-credits-form-irs-l1.png

How Many Monthly Child Tax Credit Payments Were There Leia Aqui How

https://news.coconinokids.org/wp-content/uploads/2021/06/IRS-03.png

https://www.irs.gov/instructions/i1040s8

Use Schedule 8812 Form 1040 to figure your child tax credit CTC credit for other dependents ODC and additional child tax credit ACTC The CTC and ODC are nonrefundable credits The ACTC is a refundable credit Future Developments

https://www.irs.gov/forms-pubs/about-schedule-8812-form-1040

Page Last Reviewed or Updated 02 Nov 2023 Information about Schedule 8812 Form 1040 Additional Child Tax Credit including recent updates related forms and instructions on how to file Use Schedule 8812 Form 1040 to figure the additional child tax credit The additional child tax credit may give you a refund even if you do

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

Child Tax Credits Form IRS Free Download

2022 Education Tax Credits Are You Eligible

IRS 1040 Schedule 8812 2017 Fill Out Tax Template Online US Legal

T14 0048 Eliminate Income Threshold For The Refundable Child Tax

Credit Limit Worksheet 2016 Db excel

Credit Limit Worksheet 2016 Db excel

Earned Income Credit Worksheet 2023

Form 8863 Fillable Pdf Printable Forms Free Online

Child Tax Credits Form 2 Free Templates In PDF Word Excel Download

Irs Child Tax Credit 2023 Schedule - Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th Families who normally aren t required to file an income tax return should use this Non Filers Tool to register quickly for the expanded and newly advanceable Child Tax Credit from the American Rescue Plan Child Tax Credit Portal