Irs Child Tax Rebate Web 24 ao 251 t 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than

Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a Web The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under

Irs Child Tax Rebate

Irs Child Tax Rebate

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

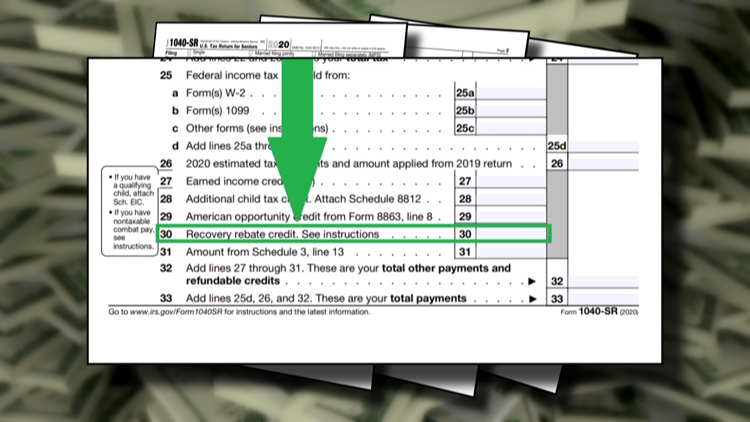

IRS Update Advance Child Tax Credit Rebate Recovery Credit IRS

https://i.ytimg.com/vi/9RU-6Lq-HnI/maxresdefault.jpg

Irs Child Tax Credit Joint Custody Trending US

https://www.c1stcreditunion.com/webres/Image/Blog/1140-child-tax-credit-check_web.jpg

Web 9 nov 2021 nbsp 0183 32 IR 2021 218 November 9 2021 The Internal Revenue Service today updated frequently asked questions FAQs for the 2021 Child Tax Credit and Advance Web Specifically the Child Tax Credit was revised in the following ways for 2021 The credit amount was increased for 2021 The American Rescue Plan increased the amount of the

Web 17 mai 2021 nbsp 0183 32 Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above The American Web 20 d 233 c 2022 nbsp 0183 32 Your Recovery Rebate Credit on your 2020 tax return will reduce the amount of tax you owe for 2020 or be included in your tax refund Here s how eligible individuals

Download Irs Child Tax Rebate

More picture related to Irs Child Tax Rebate

Child Tax Credit Update IRS To Send Millions Of Letters About Payments

https://www.gannett-cdn.com/presto/2021/04/02/NAAS/cd8bfbf0-9adb-42d0-9db2-ca6f0c6c9136-jwj_Child_Tax_Credit_0508.jpg?crop=2999,1687,x0,y0&width=2999&height=1687&format=pjpg&auto=webp

2022 Connecticut Child Tax Rebate Bailey Scarano

https://baileyscarano.com/wp-content/uploads/2022/06/Depositphotos_329030836_XL.jpg

Don t Throw Away This Document Why IRS Letter 6419 Is Critical To

https://s.yimg.com/ny/api/res/1.2/4OYAFjIXsnYDmjmZ7QkqcQ--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTY0NQ--/https://s.yimg.com/uu/api/res/1.2/BRtzh_mMX1wzFAZahv.6dw--~B/aD0yNTM2O3c9Mzc3NDthcHBpZD15dGFjaHlvbg--/https://media.zenfs.com/en/usa_today_money_325/227811b899d24c79db176d75a43b49e9

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web Advance Child Tax Credit payments are early payments from the Internal Revenue Service IRS of 50 percent of the estimated amount of the Child Tax Credit that a taxpayer may

Web 14 juin 2021 nbsp 0183 32 The advance Child Tax Credit payments which will generally be made on the 15th of each month create financial certainty for families to plan their budgets Eligible Web 18 mai 2021 nbsp 0183 32 It increases the existing tax benefit from 2 000 up to 3 600 for younger kids and 3 000 for older ones for the 2021 tax year It also broadens the umbrella of who s

Irs Child Tax Credit Problems Alreda

https://abc3340.com/resources/media2/16x9/full/1015/center/80/fd6b701f-7ecd-4887-af86-4f3dedf20152-large16x9_thumb_85700.png

CT Families Should Begin Receiving Child Tax Rebates This Week

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

Web 24 ao 251 t 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than

https://www.irs.gov/coronavirus/coronavirus-tax-relief-and-economic...

Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a

Irs Child Tax Credit Fill Out And Sign Printable PDF Template SignNow

Irs Child Tax Credit Problems Alreda

Child Tax Credit 2020 Changes Bezyah

IRS Reopens Registration For Economic Impact Payment VA News

Got Kids Watch Out For IRS Child Tax Credit Letter 6419 In Late

RI Child Tax Rebate Available McKee Kicks Off Program In Newport

RI Child Tax Rebate Available McKee Kicks Off Program In Newport

IRS Child Tax Credit The 3 600 Stimulus Check You Need Is Coming

Governor Lamont Announces Families Can Apply For The 2022 Connecticut

West Hartford Residents Apply By July 31 For CT Child Tax Rebate We

Irs Child Tax Rebate - Web 9 nov 2021 nbsp 0183 32 IR 2021 218 November 9 2021 The Internal Revenue Service today updated frequently asked questions FAQs for the 2021 Child Tax Credit and Advance