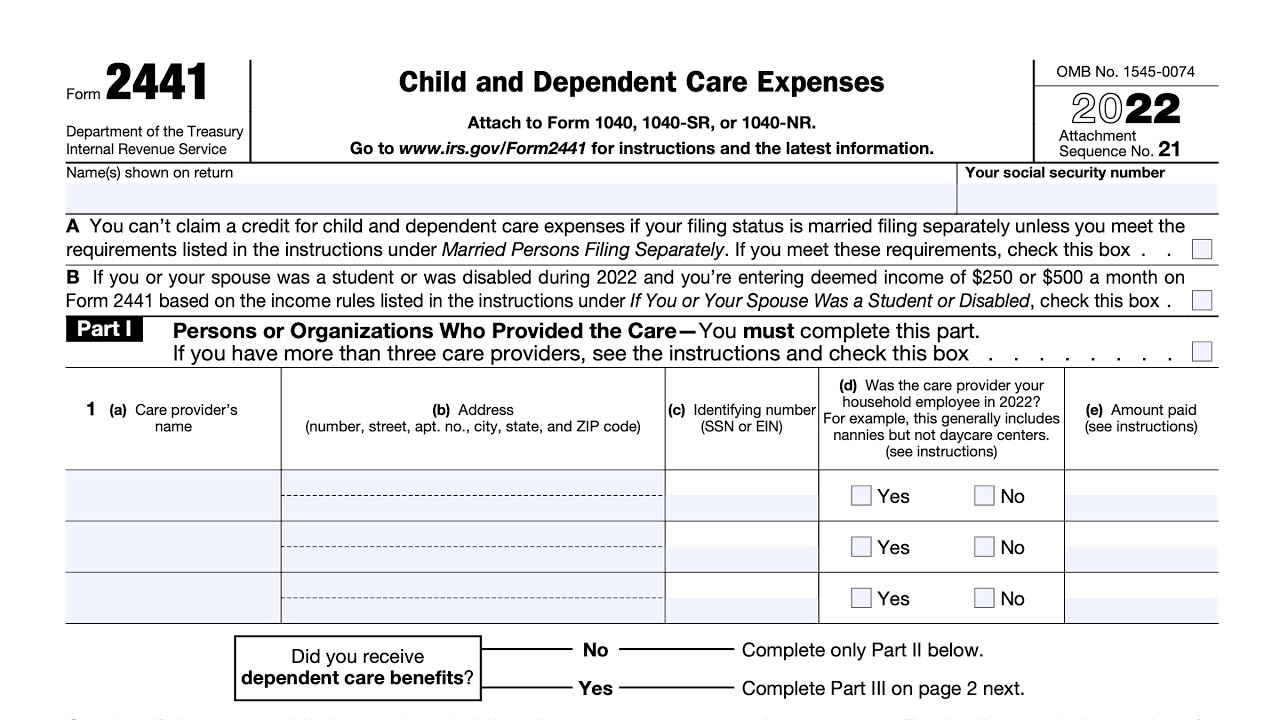

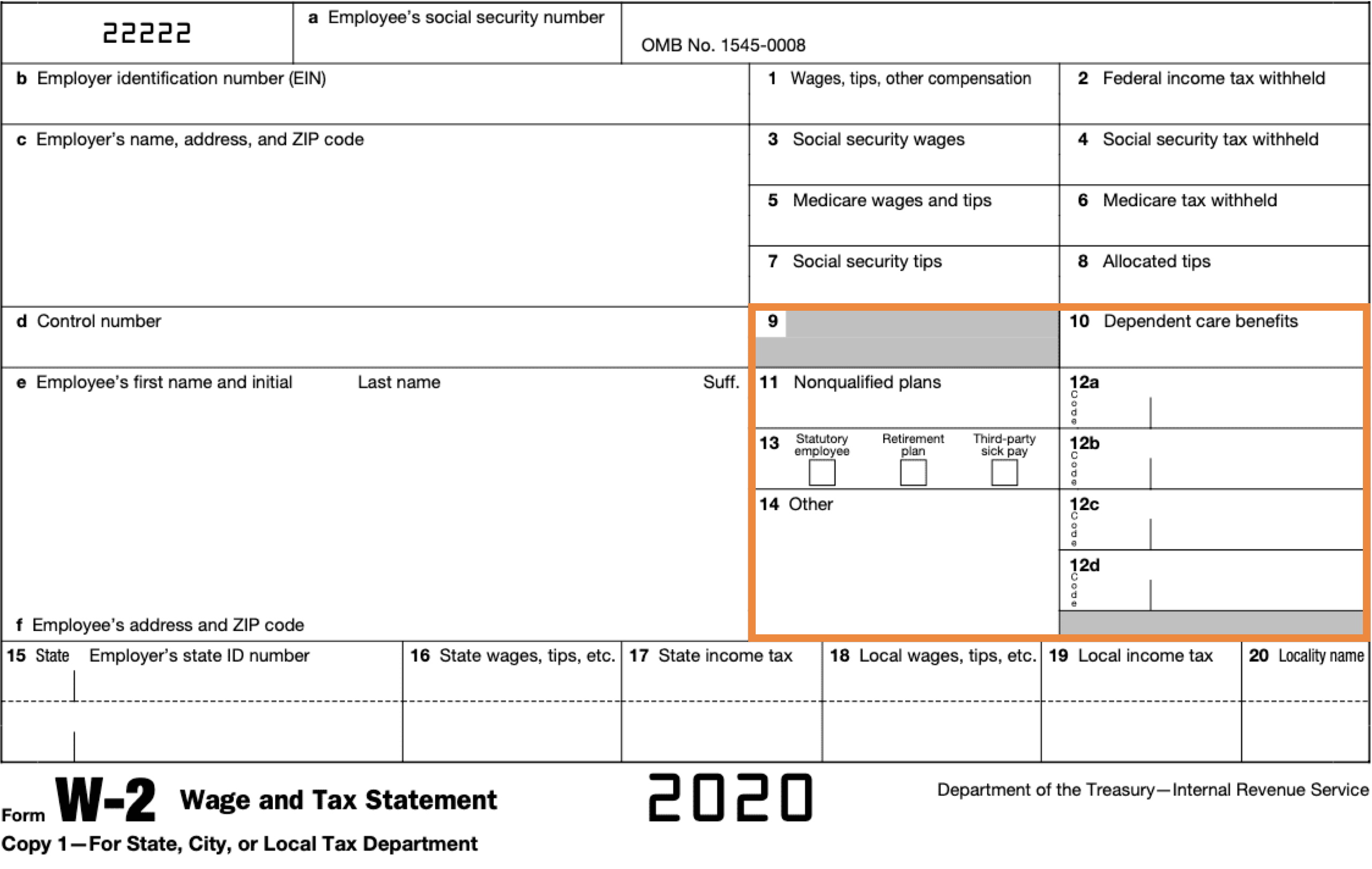

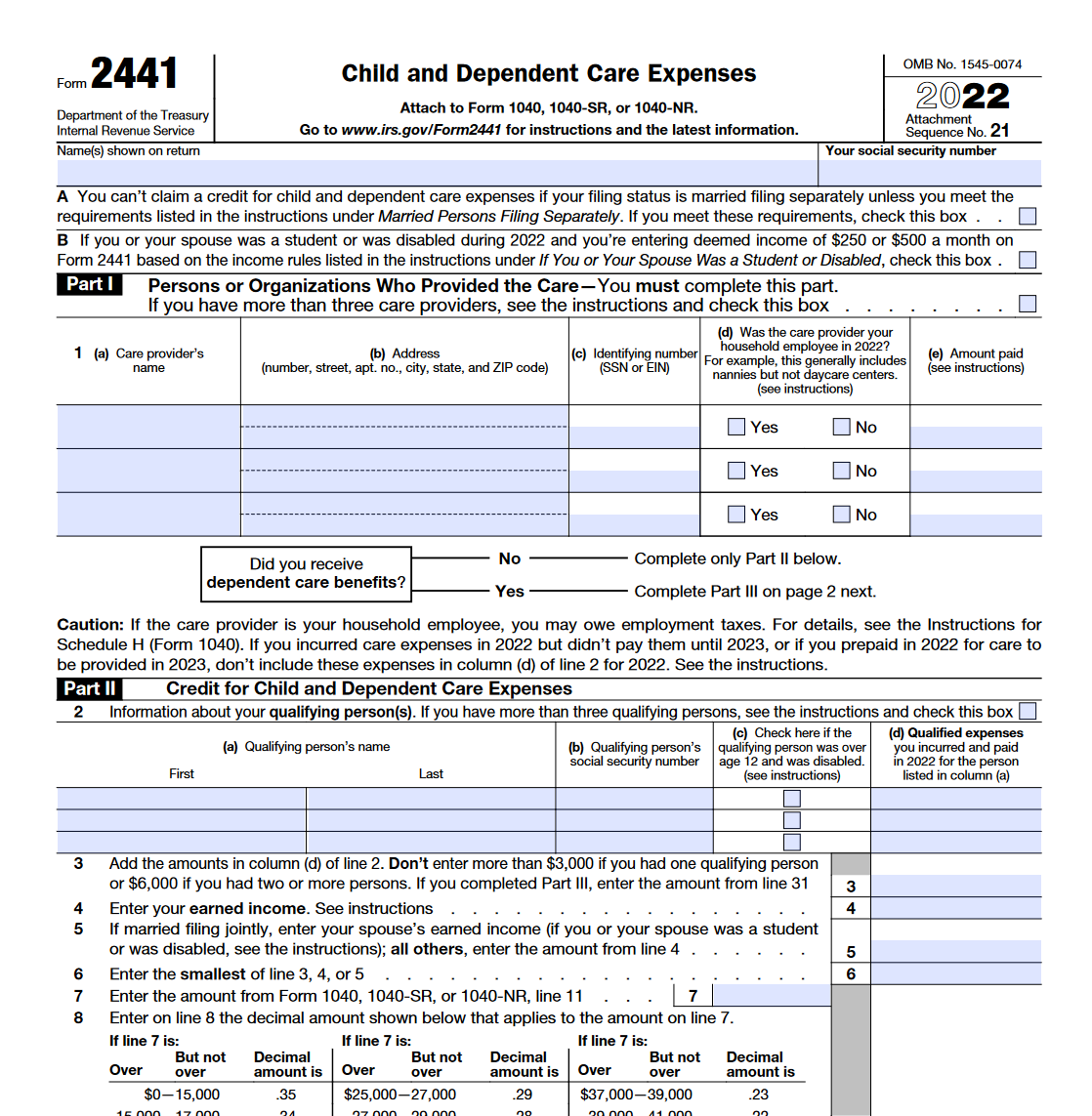

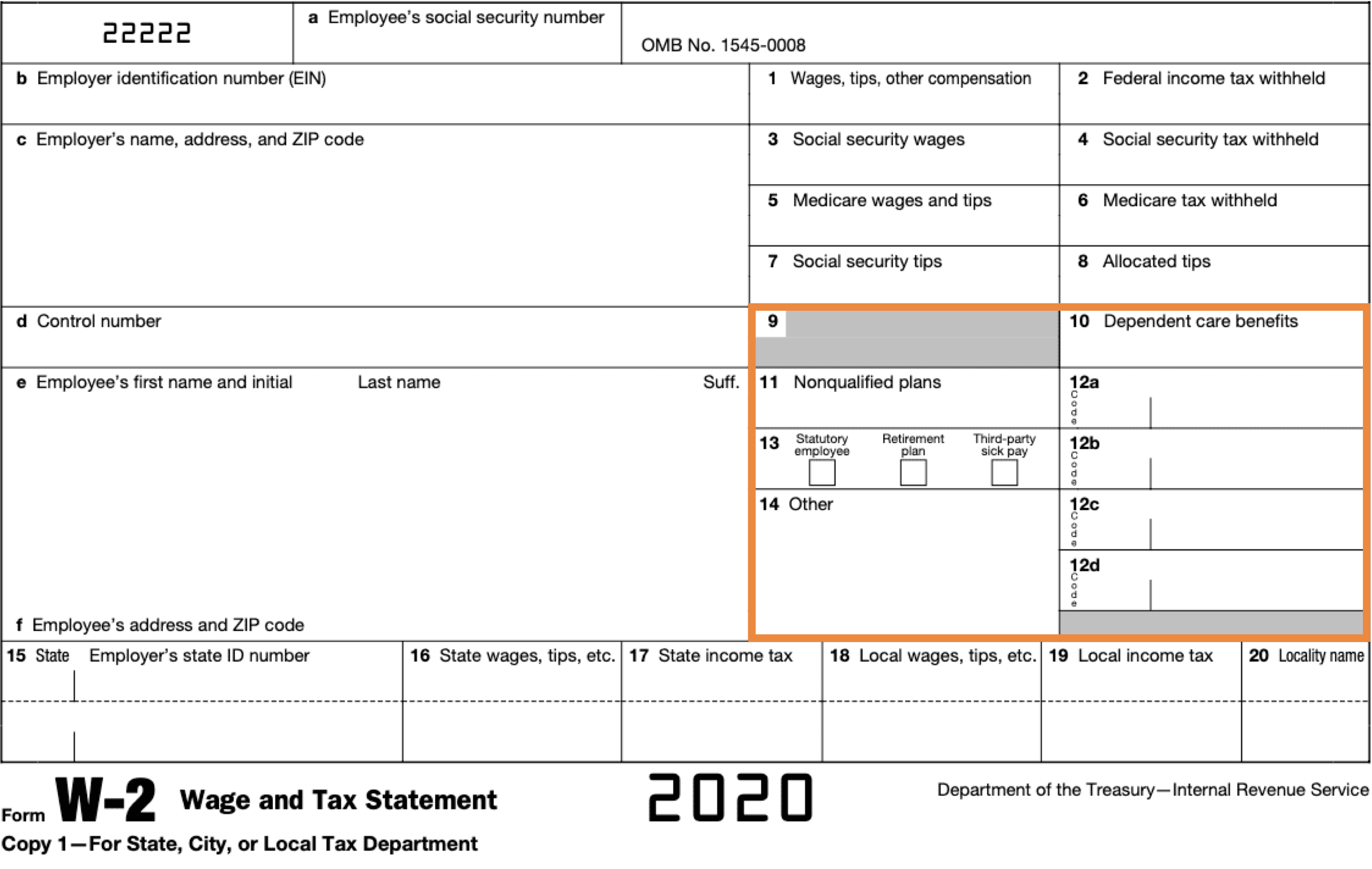

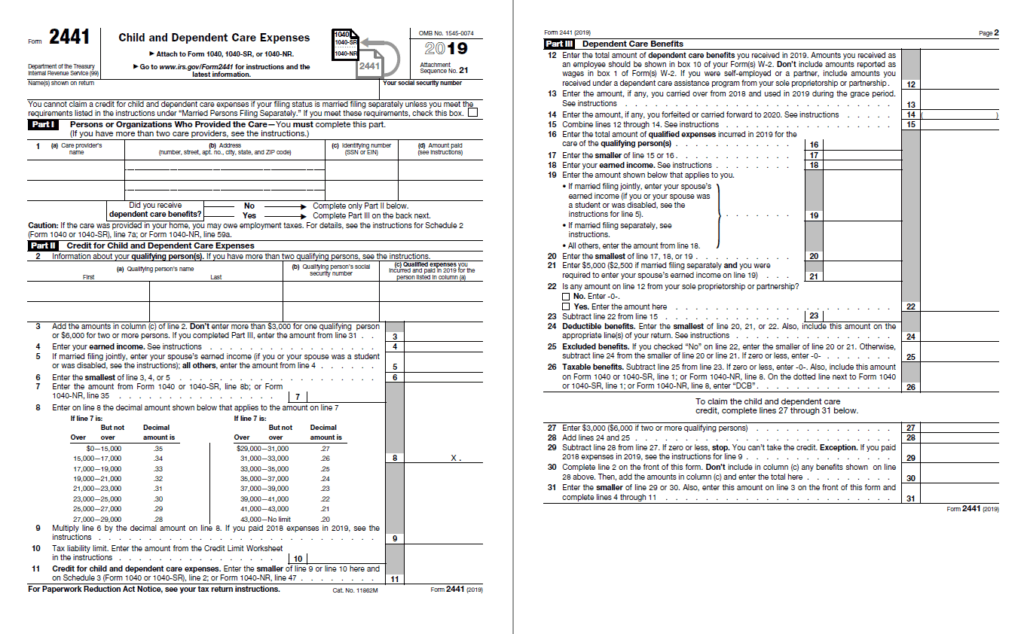

Irs Dependent Care Benefits Dependent care benefits If you received any dependent care benefits from your employer during the year you may be able to exclude all or part of them from your income You must complete Form 2441 Part III before you can figure the amount of your credit See Dependent Care Benefits under How To Figure the Credit later

The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503 Child and Dependent Care Expenses For information regarding changes to the credit for 2021 only see Q6 through Q14 Frequently Asked Questions Child and Dependent Care Credit flexible benefit plans My spouse and I both work and are eligible for the child and dependent care credit May I include my 5 year old son s private kindergarten tuition as a qualified expense on Form 2441 Child and Dependent Care Expenses

Irs Dependent Care Benefits

Irs Dependent Care Benefits

https://i.ytimg.com/vi/j4Q723KbP7U/maxresdefault.jpg

What Are Dependent Care Benefits On W2

https://help.onpay.com/hc/article_attachments/360080629532/2020-12-21_12-23-01_copy__1_.png

8 Incredible Tips What Is Dependent Care Credit Outbackvoices

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Child and Dependent Care Credit Information If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for child and dependent care expenses Your federal income tax may be reduced by claiming the Credit for Child and Dependent IR 2021 105 May 10 2021 WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended period for incurring claims generally are not taxable

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to care Dependent care benefits can include amounts paid for items other than the care of your child such as food and schooling only if the items are incidental to the care of the child and can t be separated from the total cost G 10 Credit for Child Dependent Care Expenses Screening Sheet Can You Claim the Child and Dependent Care Credit step

Download Irs Dependent Care Benefits

More picture related to Irs Dependent Care Benefits

Dependent Care Benefits The DeHayes Group

https://b2059642.smushcdn.com/2059642/wp-content/uploads/2021/12/Benefits-of-Dependent-Care-FSAs-Blog-1200x736-1.jpg?lossy=1&strip=1&webp=1

IRS Form 2441 Child And Dependent Care Expenses Forms Docs 2023

https://blanker.org/files/images/form-2441.png

IRS Sets New Rules On Cryptocurrency Trading

https://image.cnbcfm.com/api/v1/image/106910918-1626285229297-gettyimages-963468264-_DHP4870.jpeg?v=1626285285&w=1920&h=1080

If you paid a day care center a qualifying relative or other qualifying care provider to care for your child or other qualifying individual so that you and or your spouse could work or look for work you may be eligible to claim the Child and Dependent Care Credit on your 2021 tax return Dependent care benefits include tax credits and employee benefits such as daycare allowances for the care of their dependents The IRS provides a child and dependent care tax credit

You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities Credit for Child and Dependent Care Expenses For tax year 2021 only the top credit percentage of qualifying expenses increased from 35 to 50 Some taxpayers receive dependent care benefits from their employers which may also be called flexible spending accounts or reimbursement accounts

Benefits 101 The Dependent Care FSA The Spot

https://spotlight.lehigh.edu/sites/spotlight.lehigh.edu/files/IMG_6302.jpg

Dependent Care Fsa Income Limit Reactive Cyberzine Image Library

https://www.wexinc.com/wp-content/uploads/2021/11/WEX_ContributionLimitsChart_Blog-2022-1024x768.jpg

https://www.irs.gov/publications/p503

Dependent care benefits If you received any dependent care benefits from your employer during the year you may be able to exclude all or part of them from your income You must complete Form 2441 Part III before you can figure the amount of your credit See Dependent Care Benefits under How To Figure the Credit later

https://www.irs.gov/newsroom/child-and-dependent...

The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503 Child and Dependent Care Expenses For information regarding changes to the credit for 2021 only see Q6 through Q14

Dependent Care Benefits Overview Criteria Types

Benefits 101 The Dependent Care FSA The Spot

IRS Issues Guidance On Taxability Of Dependent Care Assistance Programs

Dependent Care Benefits AwesomeFinTech Blog

Fsa Irs Dependent Care Fsa

Hints For Choosing The Right Child Care Center Site Title

Hints For Choosing The Right Child Care Center Site Title

IRS Pledges More Audits Of Wealthy Better Customer Service Metro US

Dependent Care Flex Spending Account BPC Employee Benefits

CARE SHARE

Irs Dependent Care Benefits - If you care for a child or adult who is incapable of self care who lives in your home for at least eight hours each day and whom you can claim as a