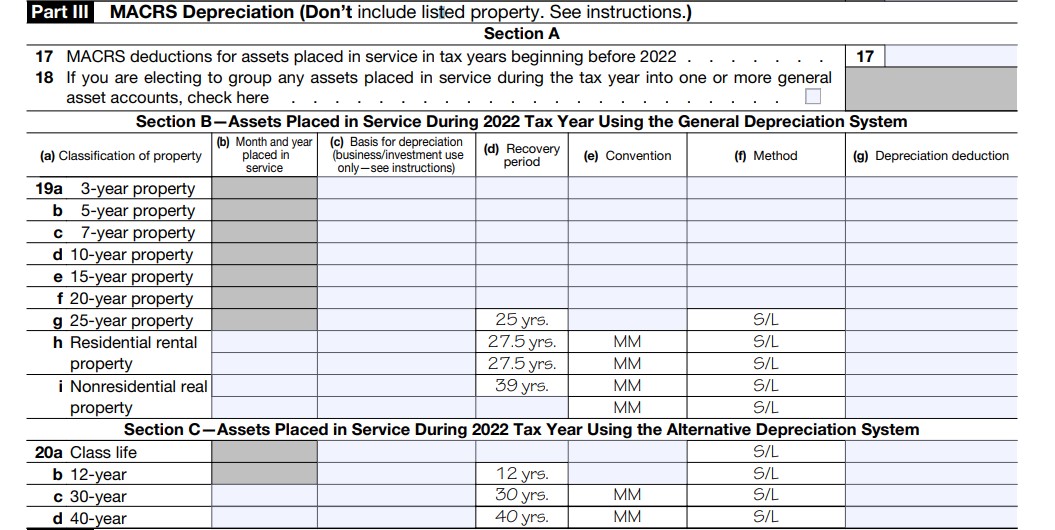

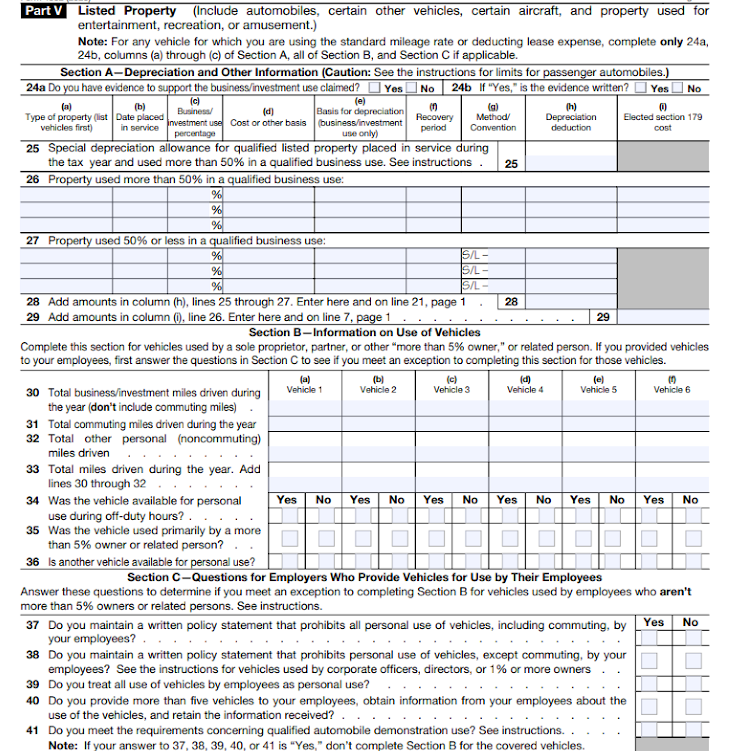

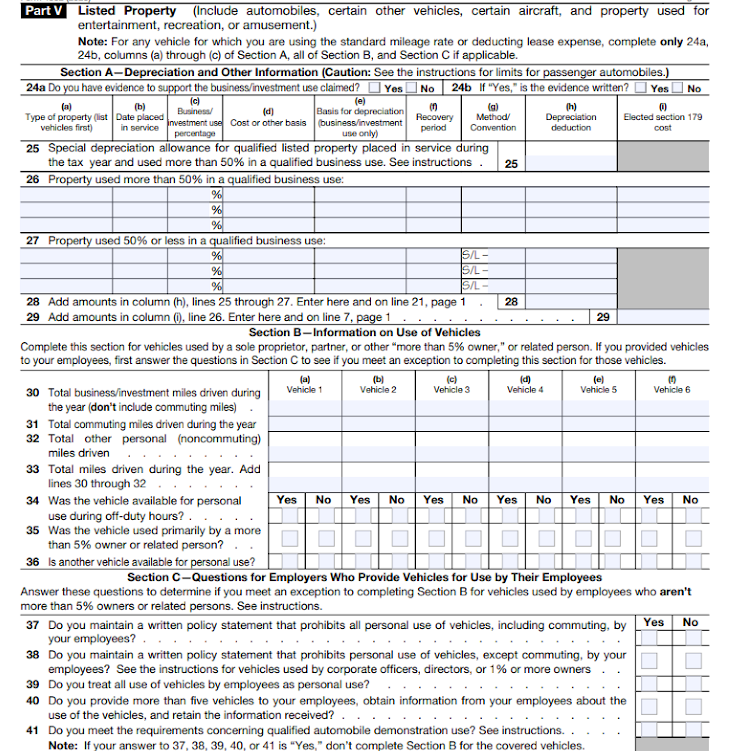

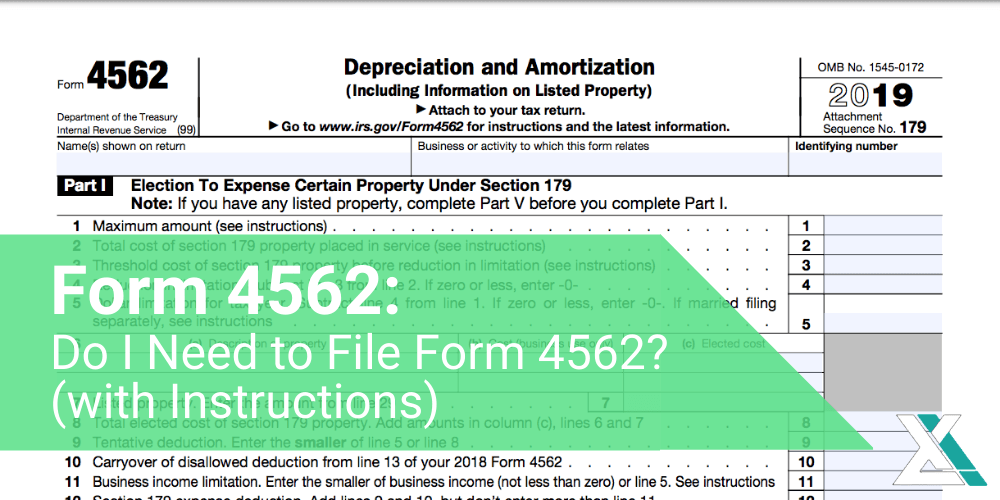

Irs Form Depreciation Rental Property Information about Form 4562 Depreciation and Amortization including recent updates related forms and instructions on how to file Form 4562 is used to claim a depreciation amortization deduction to expense certain property and to note the business use of cars property

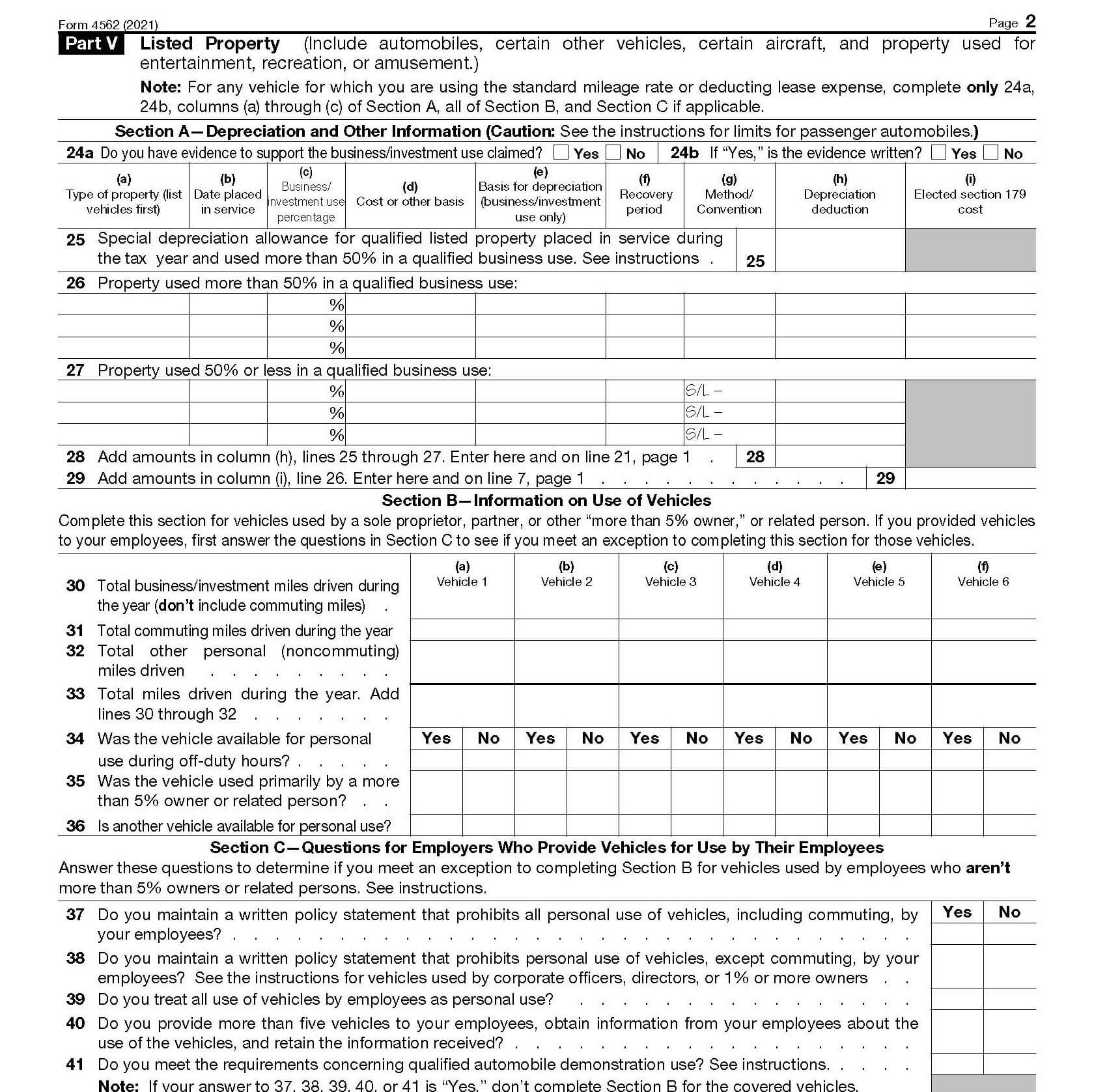

Special depreciation allowance for qualified listed property placed in service during the tax year and used more than 50 in a qualified business use See instructions If you re eligible report your rental property s depreciation on IRS Form 4562 How To Calculate Rental Property Depreciation Step 1 Determine the Adjusted Basis of the Property The first step is to determine the adjusted basis of

Irs Form Depreciation Rental Property

Irs Form Depreciation Rental Property

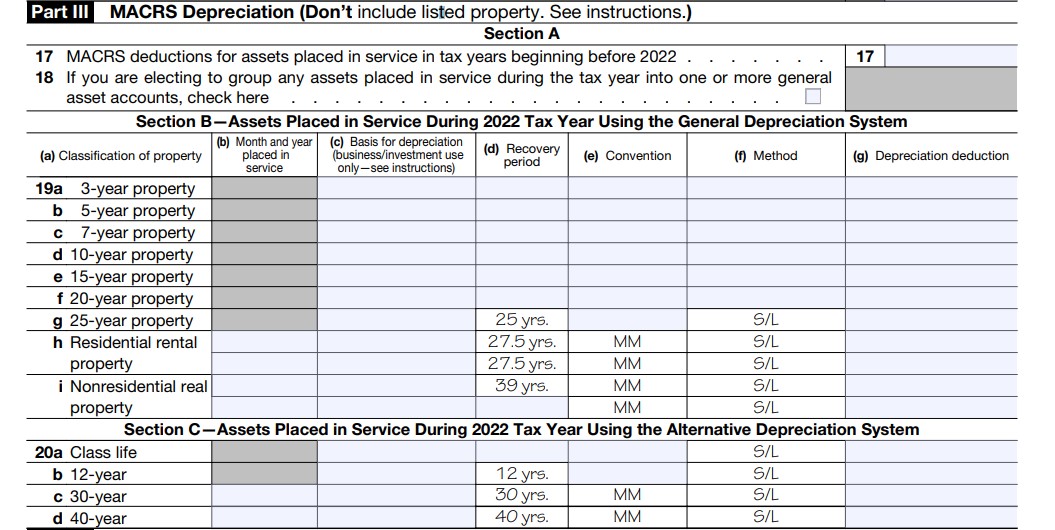

https://fitsmallbusiness.com/wp-content/uploads/2023/04/Screenshot_IRS-Form-4562-Part-III.jpg

IRS Form 4562 Walkthrough Depreciation And Amortization YouTube

https://i.ytimg.com/vi/ysxPWH4P8x4/maxresdefault.jpg

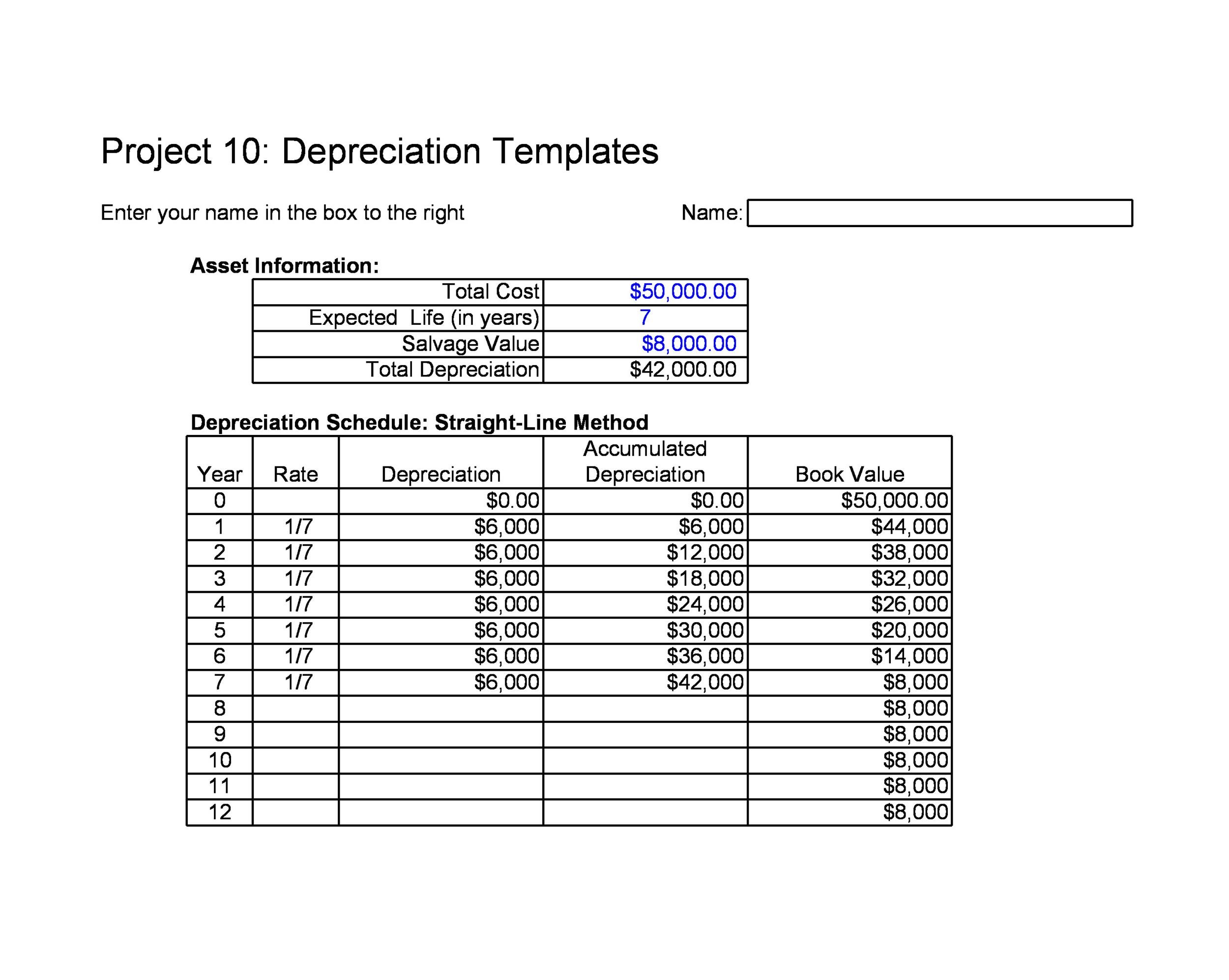

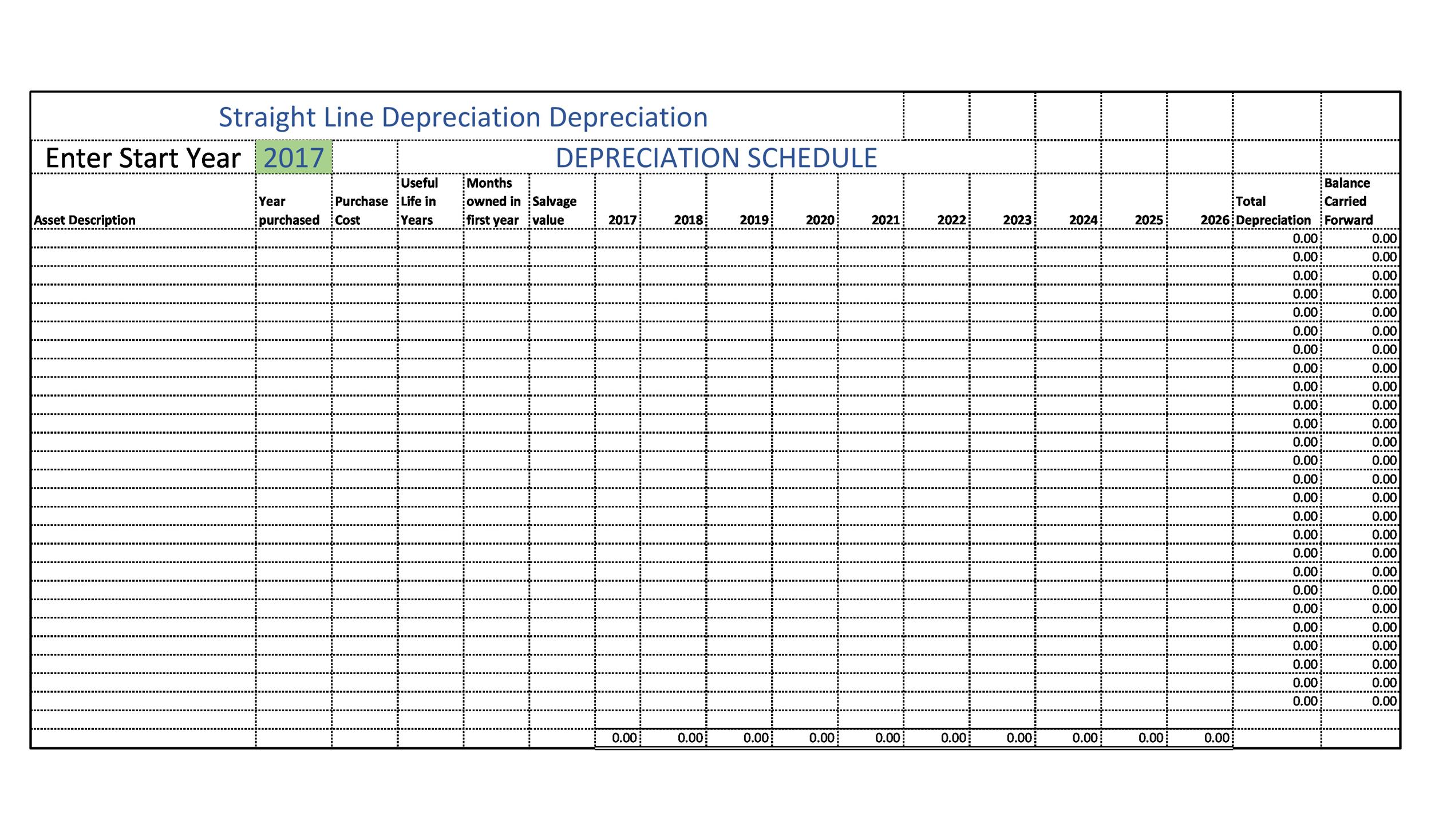

A Free Rental Property Depreciation Spreadsheet Template

https://wp-assets.stessa.com/wp-content/uploads/2022/09/17155135/rental-property-depreciation-spreadsheet.jpeg

Depreciation of rental property starts when the property is placed in service and ends when either you have deducted your entire cost basis in the property or you remove the property from service For residential rental property it typically takes 27 5 years to fully recover your cost basis IRS Form 4562 Depreciation and Amortization is used to depreciate or amortize property you ve bought for your business Once you understand what each part of this tax form does you can plan ways to use it to reduce your tax burden

IRS Form 4562 needs to be submitted if you re depreciating or amortizing deductions on big ticket items In this guide we break down the form part by part According to the IRS you can depreciate a rental property if it meets all of these requirements You own the property you are considered to be the owner even if the property is subject

Download Irs Form Depreciation Rental Property

More picture related to Irs Form Depreciation Rental Property

Rental Property Depreciation How It Works How To Calculate More 2024

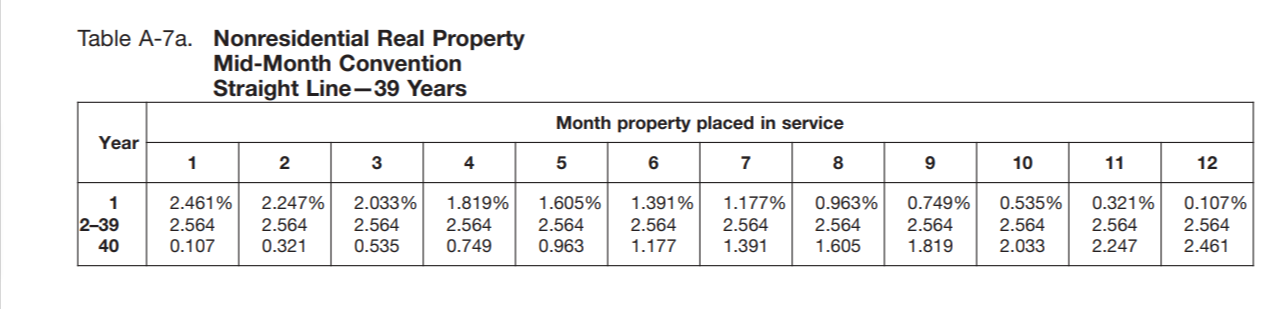

https://fitsmallbusiness.com/wp-content/uploads/2023/04/Screenshot_Table-A-7a-from-IRS-Publication-946.png

How To Complete IRS Form 4562

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f4562_part5.jpg

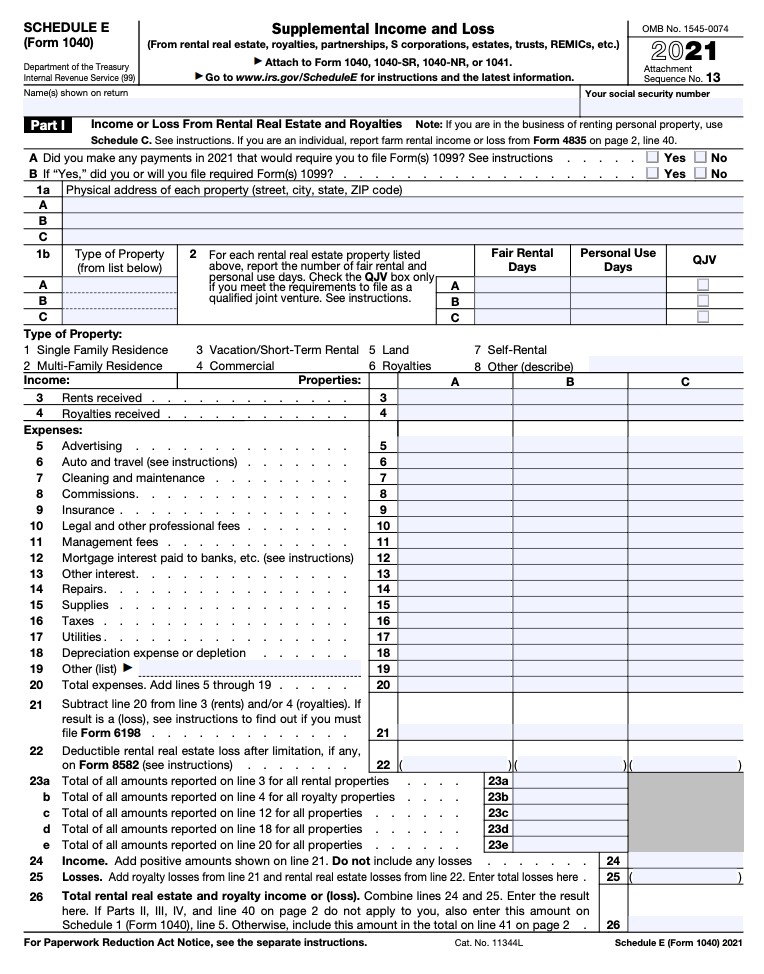

Schedule E Tax Form Survival Guide For Rental Properties 2021 Tax Year

https://resources.hemlane.com/content/images/2021/12/Schedule-E-Property-Management-2022-IRS-pg.1.png

There are different IRS forms to fill out to list your total income expenses and depreciation for each rental property If you have more than one rental property you must enter the To claim rental property depreciation you ll file IRS Form 4562 to get your deduction Review the instructions for Form 4562 if you re filing your tax return on your own or consult a qualified financial advisor or tax accountant for assistance

However the election for residential rental property and nonresidential real property can be made on a property by property basis Once you make this election you can never revoke it You make the election by completing Form 4562 Part III line 20 What is tax depreciation on rental property What are the depreciation systems How is depreciation taxed on the sale of rental property How do you avoid depreciation recapture tax on rental property Managing

Printable Form For Irs Fm 4562 Printable Forms Free Online

https://m.foolcdn.com/media/affiliates/images/Form_4562-07-Part_V_YFb4pRI.width-750.png

Depreciation Schedule Excel Template

https://templatelab.com/wp-content/uploads/2017/08/depreciation-schedule-template-06.jpg

https://www.irs.gov/forms-pubs/about-form-4562

Information about Form 4562 Depreciation and Amortization including recent updates related forms and instructions on how to file Form 4562 is used to claim a depreciation amortization deduction to expense certain property and to note the business use of cars property

https://www.irs.gov/pub/irs-pdf/f4562.pdf

Special depreciation allowance for qualified listed property placed in service during the tax year and used more than 50 in a qualified business use See instructions

Rental Property Depreciation Worksheet Martin Lindelof

Printable Form For Irs Fm 4562 Printable Forms Free Online

Irs Rental Property Depreciation Calculator StrathieFatin

A Free Rental Property Depreciation Spreadsheet Template

Rental Property Depreciation

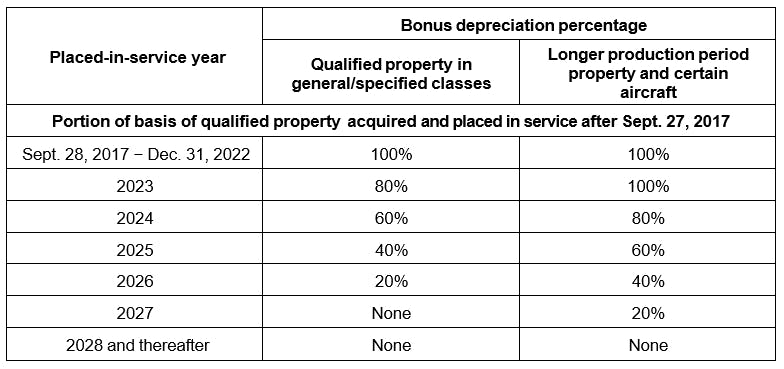

What Is Bonus Depreciation And How Does It Work

What Is Bonus Depreciation And How Does It Work

Form 4562 Do I Need To File Form 4562 with Instructions

Schedule Of Real Estate Owned Excel Template

Macrs Depreciation Table 2017 Cabinets Matttroy

Irs Form Depreciation Rental Property - IRS Form 4562 Depreciation and Amortization is used to depreciate or amortize property you ve bought for your business Once you understand what each part of this tax form does you can plan ways to use it to reduce your tax burden