Irs Free File Recovery Rebate Credit Web 13 janv 2022 nbsp 0183 32 If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The fastest way to get your tax

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web IRS Free File Prepare and file your federal income tax return for free 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When

Irs Free File Recovery Rebate Credit

Irs Free File Recovery Rebate Credit

https://www.rebate2022.com/wp-content/uploads/2022/08/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

IRS CP 12R Recovery Rebate Credit Overpayment

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

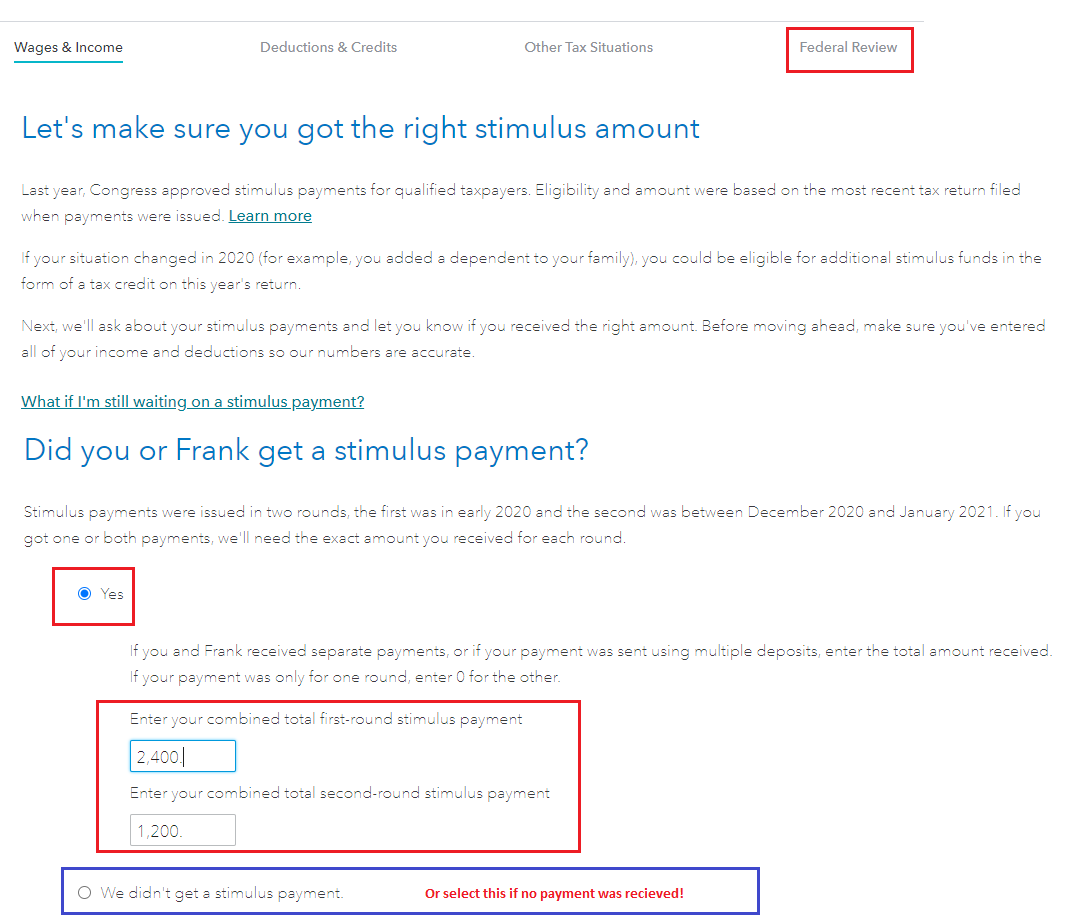

Web 20 d 233 c 2022 nbsp 0183 32 File your 2021 tax return electronically and the tax software will help you figure your 2021 Recovery Rebate Credit Your Recovery Rebate Credit will reduce Web 10 d 233 c 2021 nbsp 0183 32 A1 If you re eligible you must file a 2020 tax return to claim the 2020 Recovery Rebate Credit even if you usually don t file a tax return You will need the

Web 10 d 233 c 2021 nbsp 0183 32 You must file a 2020 tax return to claim a Recovery Rebate Credit even if you don t usually file a tax return The Recovery Rebate Credit Worksheet in the 2020 Web 16 nov 2022 nbsp 0183 32 IRS Free File is a great option for people who are only filing a tax return to claim the Recovery Rebate Credit Free File Fillable Forms is the only IRS Free File

Download Irs Free File Recovery Rebate Credit

More picture related to Irs Free File Recovery Rebate Credit

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108Part2-764112.jpg

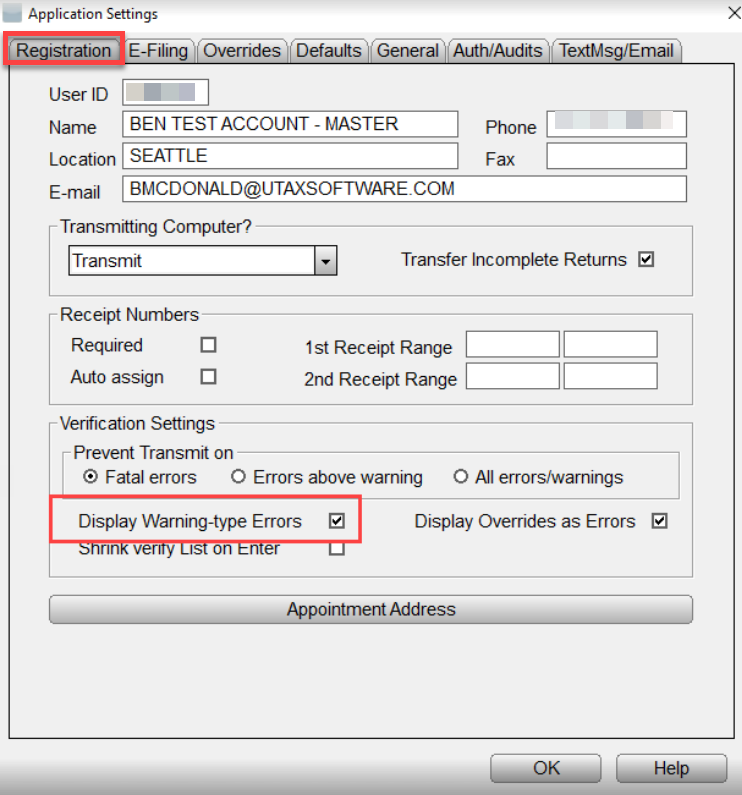

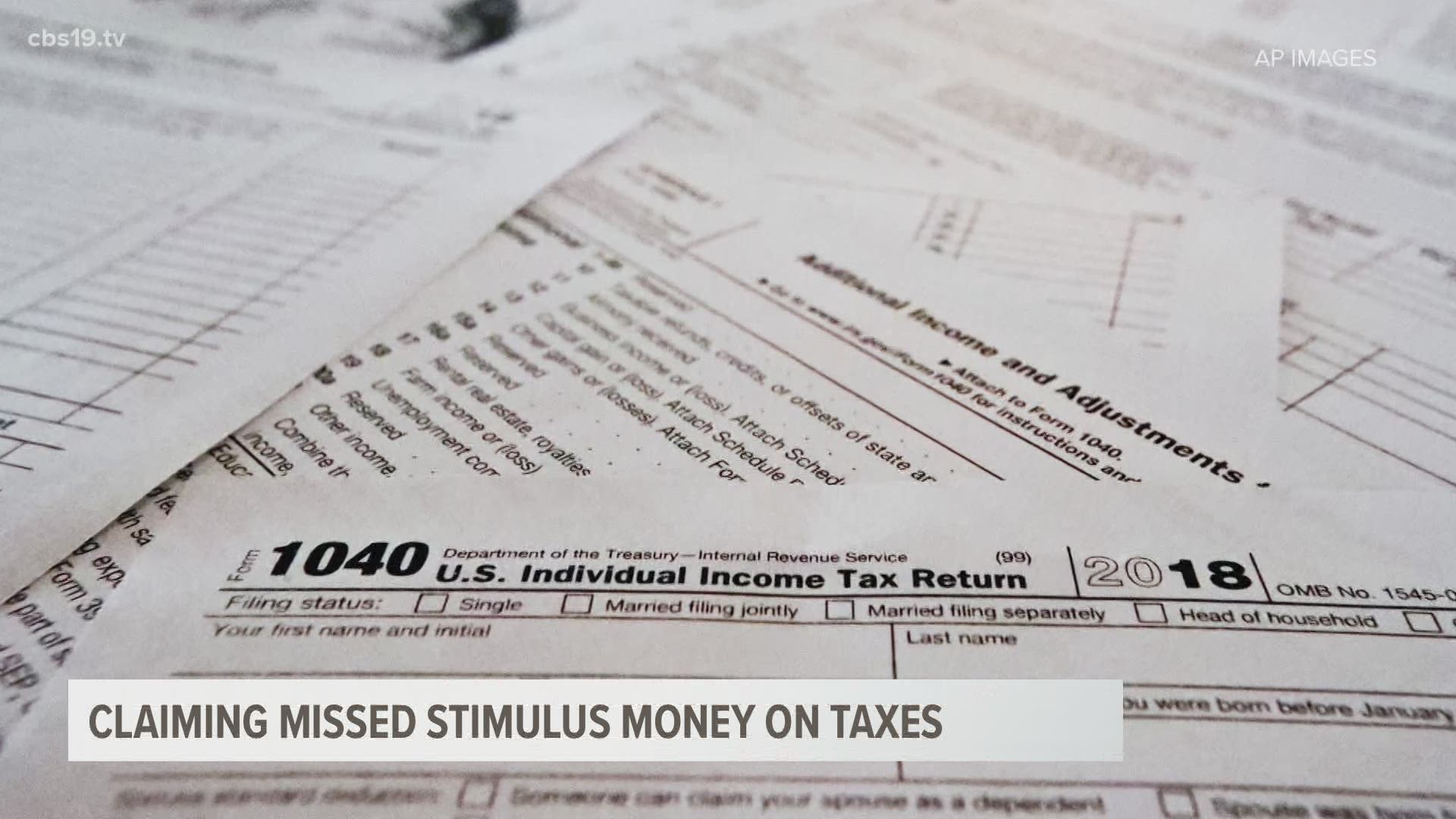

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

Web 2021 Recovery Rebate Credit 2021 Economic Impact Payments 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim Web IRS gov rrc claiming the Recovery Rebate Credit if you aren t required to file a tax return claiming the Recovery Rebate Credit if you aren t required to file a tax return 2020

Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim Web 14 oct 2022 nbsp 0183 32 Recovery Rebate Credit or stimulus payments State of play If you missed out on the third round of stimulus checks also called Economic Impact Payments you

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-8.png?fit=1060%2C795&ssl=1

What Is The Recovery Rebate Credit CD Tax Financial

https://cdtax.com/wp-content/uploads/2021/02/Recovery-Rebate-Worksheet-1-1187x1536.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The fastest way to get your tax

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-d...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

1040 Recovery Rebate Credit Drake20

Federal Recovery Rebate Credit Recovery Rebate

1040 Rebate Recovery Recovery Rebate

1040 Line 30 Recovery Rebate Credit Recovery Rebate

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Why Did My Refund Go Down After The IRS Adjusted My Tax Return aving

What If I Did Not Receive Eip Or Rrc Detailed Information

Irs Free File Recovery Rebate Credit - Web 16 nov 2022 nbsp 0183 32 IRS Free File is a great option for people who are only filing a tax return to claim the Recovery Rebate Credit Free File Fillable Forms is the only IRS Free File