2023 Federal Ev Charger Rebate Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

During the 2023 tax season taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed at their homes in 2022 It s a one time nonrefundable As of January 1 2023 the credit for qualified refueling property subject to depreciation equals 6 with a maximum credit of 100 000 for each single item of property for each charging port fuel dispenser or storage property

2023 Federal Ev Charger Rebate

2023 Federal Ev Charger Rebate

https://incentiverebate360.com/wp-content/uploads/2023/03/2023-Federal-EV-Charging-Infrastructure-Rebates-–-Part-2.jpg

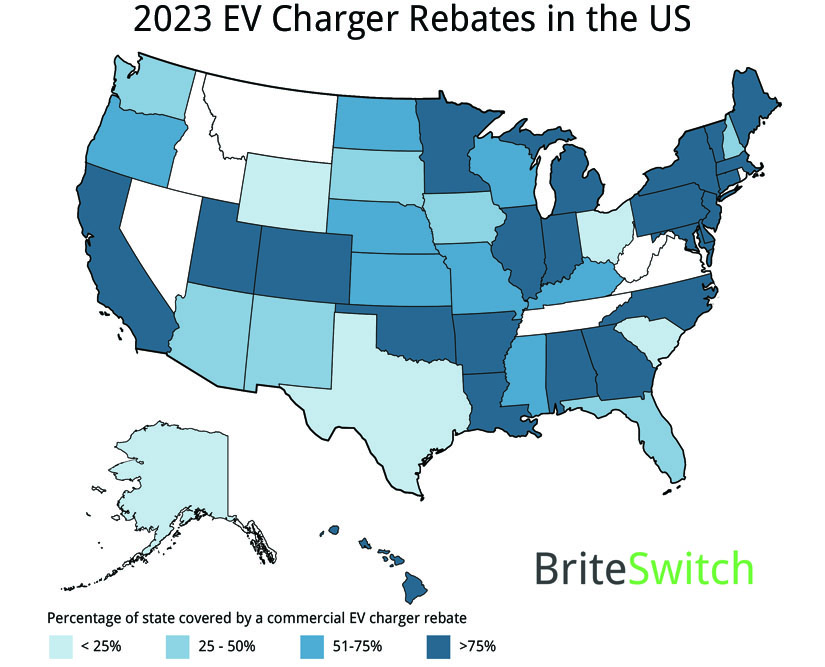

EV Charger Rebates Trends For 2023

https://briteswitch.com/img/2023-ev-charger-rebates-1280x720.jpg

Top EV Charger Rebates In BC For 2023 TCA Electric

https://www.tcaelectric.ca/wp-content/uploads/2023/06/2023-06-14-ev-charger-rebates-bc-TCA.jpg

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit Plug in electric vehicles and fuel cell vehicles placed in service in 2023 or later may be eligible for a federal income tax credit of up to 7 500

The US Treasury s EV charger tax credit which is claimed using IRS Form 8911 is limited to 1 000 for individuals claiming for home EV chargers and 100 000 up from 30 000 for business Thanks to the Inflation Reduction Act IRA EV chargers installed between the beginning of 2023 and the end of 2032 might be eligible for the Alternative Fuel Infrastructure Tax Credit The federal EV charger tax credit can reduce installation costs by 30 up to 1 000

Download 2023 Federal Ev Charger Rebate

More picture related to 2023 Federal Ev Charger Rebate

Canadian Home EV Chargers Incentives Rebates 2023 Carnex Blog

https://blog.carnex.ca/wp-content/uploads/2023/03/Canadian-Home-EV-Chargers-Incentives-Rebates-2023.jpg

The Federal EV Charger Tax Credit Is Back For 2023 What To Know

https://cdn.mos.cms.futurecdn.net/WehGDJbBd9sN3wAohrQJ9X.jpg

EV Charger Rebates For Condos And Apartments JPlug io

https://jplug.io/wp-content/uploads/2023/04/Rebates-Images.png

The federal tax credit for electric vehicles Clean Vehicle tax credit in 2023 is 7 500 for a new EV and 4 000 for a pre owned EV if the EV qualifies Forty one states plus the District of If you purchase EV charging equipment for a business fleet or tax exempt entity you may be eligible for a tax credit Starting on Jan 1 2023 the value of this credit is 6 of the cost of property subject to depreciation with a maximum credit of

PIEG offers residential customers a 600 rebate for the purchase of an ENERGY STAR qualified Level 2 EV charging station a 1 500 rebate for the purchase of a new EV and a 750 rebate for the Electric Vehicles Home Chargers Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership

Conn EV Rebate Reforms Include Point of sale Vouchers Energy News

https://i0.wp.com/energynews.us/wp-content/uploads/2022/05/51966740654_739b5cd9c7_k.jpg?fit=1200%2C800&ssl=1

2023 EV Charger Incentives Rebates AmpUp

https://ampup.io/wp-content/uploads/2023/01/ev-charger-incentives-1024x300.png

https://www.irs.gov › credits-deductions › credits-for...

Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

https://www.forbes.com › ... › ev-charger-tax-credit

During the 2023 tax season taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed at their homes in 2022 It s a one time nonrefundable

EV Charger Rebates Trends For 2023

Conn EV Rebate Reforms Include Point of sale Vouchers Energy News

New EV Charger Rebate Is Live Now

New EV Charger Rebate Helps Spur EV Adoption Rate

Electric Vehicle EV Incentives Rebates

B C Introduced New Rebates For EV Chargers Foreseeson EVSE

B C Introduced New Rebates For EV Chargers Foreseeson EVSE

Ev Rebates By State 2022 Rebate2022

Electric Vehicle Supply Equipment EVSE Rebate Program

Electric Vehicle Rebates And Incentives The Monarch Press

2023 Federal Ev Charger Rebate - Plug in electric vehicles and fuel cell vehicles placed in service in 2023 or later may be eligible for a federal income tax credit of up to 7 500