Rebate Taxable Income Web 1 d 233 c 2022 nbsp 0183 32 In many cases your tax rebate check isn t directly related to deductions and credits you claim on a return What is a tax rebate Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer

Web The income tax treatment of rebates however has been a simmering dispute for more than 50 years leaving uncertainty for both payers and recipients as to characterization Web Generally speaking the IRS considers transaction related points or rewards as rebates and not as taxable income Think of the rebate as a discount you ll receive on your

Rebate Taxable Income

Rebate Taxable Income

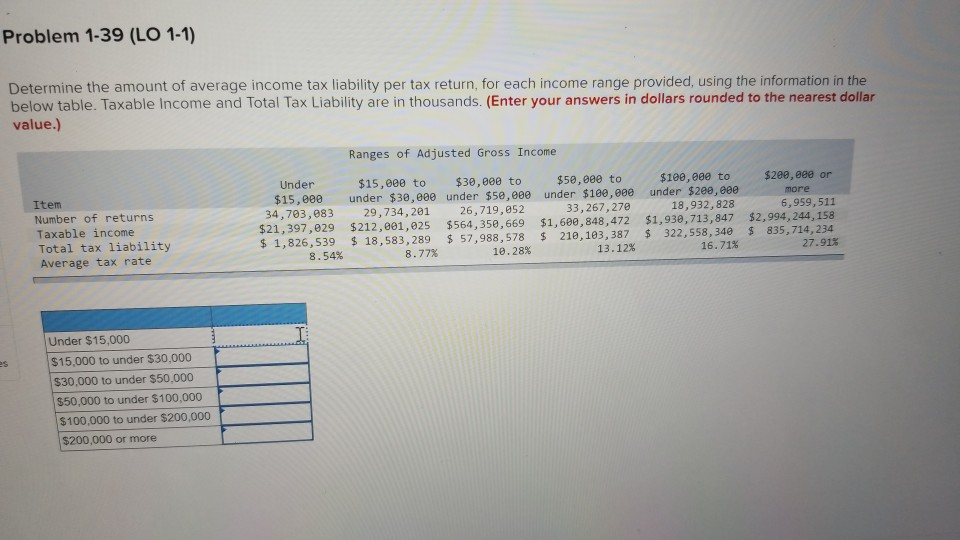

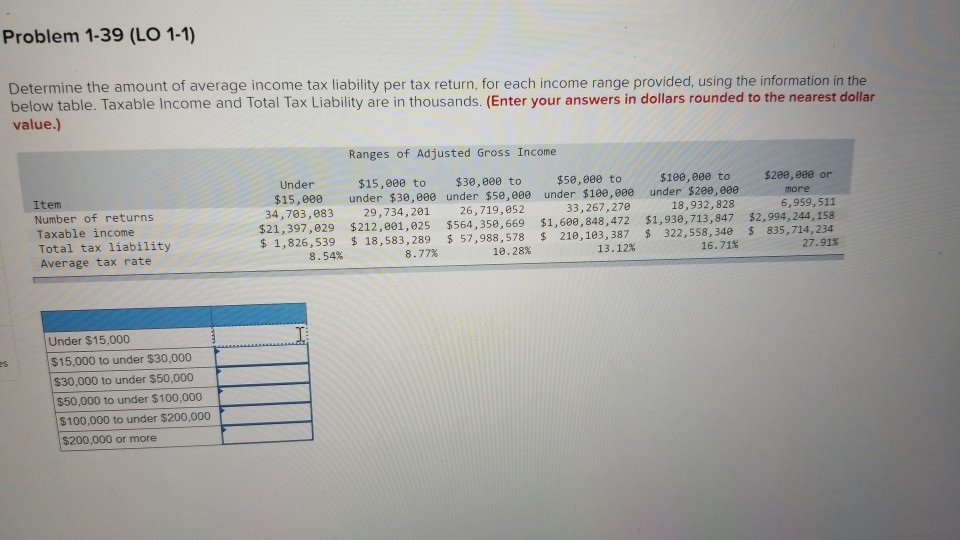

https://media.cheggcdn.com/media/9ec/9ec51619-cf20-4157-94f9-e208f37c3ee5/image.png

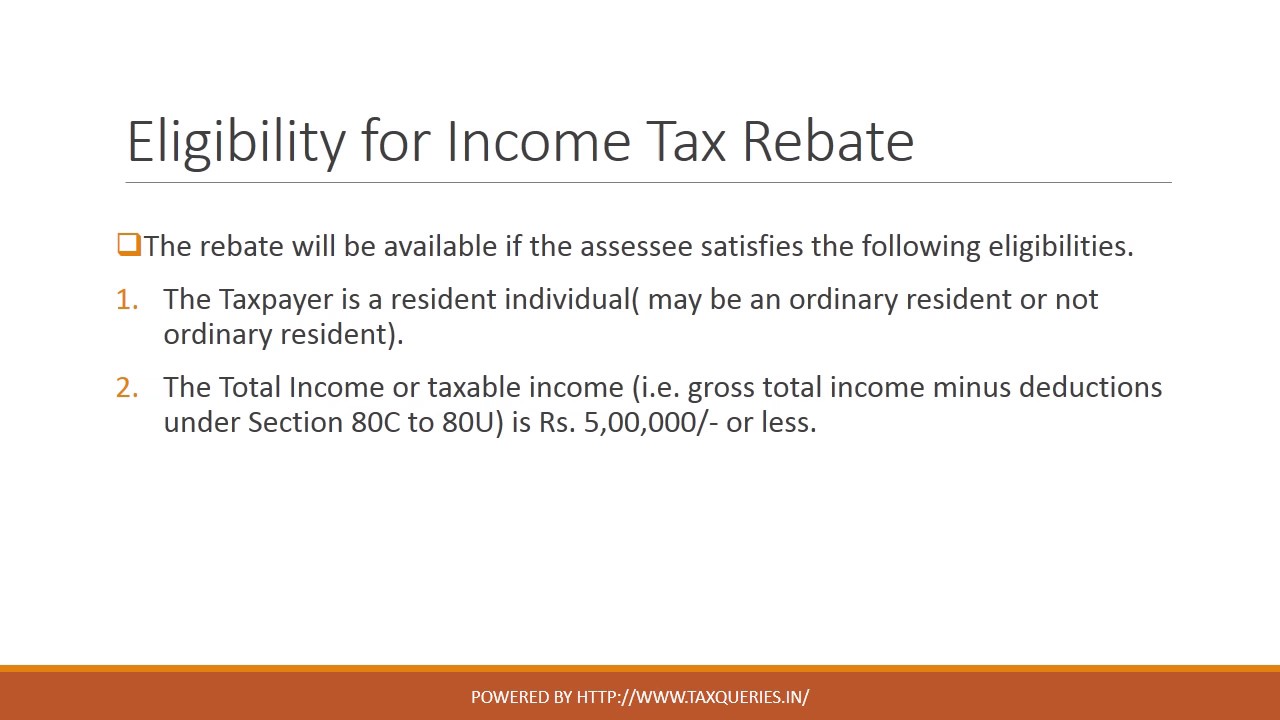

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

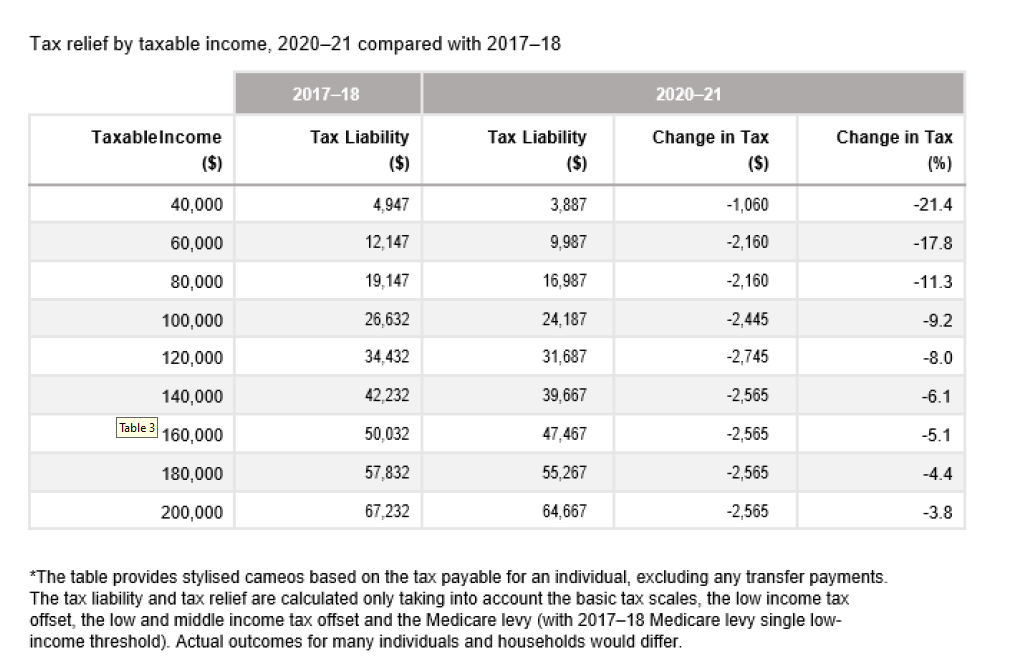

Budget 2020 Individuals Tax Accounting Adelaide

https://www.taxaccountingadelaide.com/wp-content/uploads/2020/10/00.png

Web 5 mai 2022 nbsp 0183 32 If earned through the use of the card like a cash back bonus the rewards are viewed by the IRS as a rebate and not taxable income Web 11 sept 2017 nbsp 0183 32 Rebates Cash rebates from a dealer or manufacturer for an item you for items you buy are tax free They are viewed in the tax law as merely reducing the

Web Your rebate income is the total amount of your taxable income excluding any assessable First home super saver released amount plus the following amounts if they apply to you Web Tax deductions and allowances i e capital allowances writing down allowances and investment allowances are no longer given on expenditure funded by capital grants

Download Rebate Taxable Income

More picture related to Rebate Taxable Income

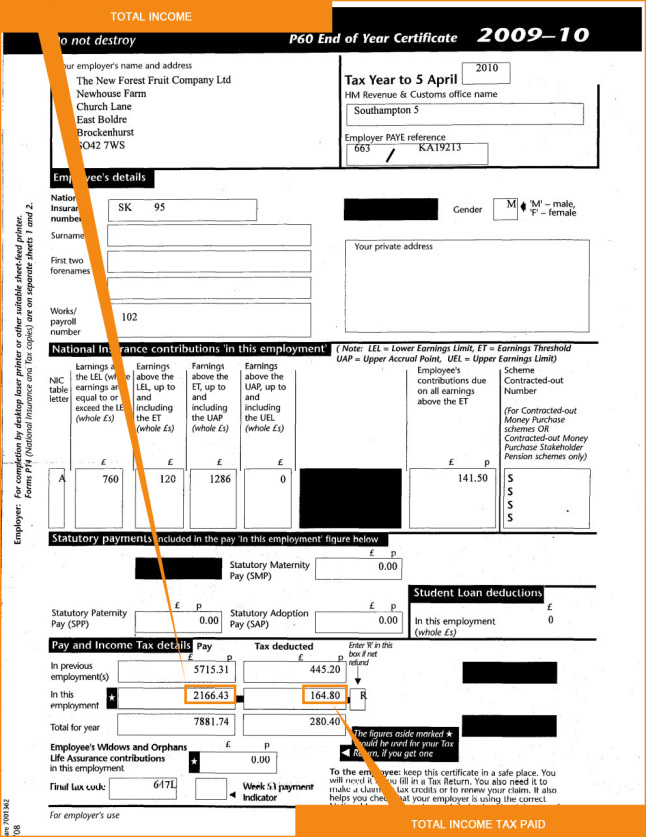

How To Check Your P60 Form Or Payslips For Tax Rebate Payslips

https://2.bp.blogspot.com/-tNjqvAH2t64/WR69z06vpyI/AAAAAAAAA2o/dUZJLwtG9DsF9ja5Gyg3NX3sd5ZIpZZegCLcB/s1600/tax%2Brebate.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Web There are two basic arguments to support the conclusion that the rebate payments should not be taxable First it may be argued that the LI rebate should not be treated as a Web 9 sept 2023 nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have

Web 12 janv 2023 nbsp 0183 32 Tax Benefit A tax benefit is an allowable deduction on a tax return intended to reduce a taxpayer s burden while typically supporting certain types of commercial activity A tax benefit allows Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

Deferred Tax And Temporary Differences The Footnotes Analyst

https://www.footnotesanalyst.com/wp-content/uploads/2022/04/FAG-DT1.png

https://turbotax.intuit.com/tax-tips/tax-relief/wh…

Web 1 d 233 c 2022 nbsp 0183 32 In many cases your tax rebate check isn t directly related to deductions and credits you claim on a return What is a tax rebate Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer

https://www.journalofaccountancy.com/issues/2008/oct/tax_treatment_of...

Web The income tax treatment of rebates however has been a simmering dispute for more than 50 years leaving uncertainty for both payers and recipients as to characterization

Is Costco Rebate Taxable Income CostcoRebate

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

INCOME TAX REBATE YouTube

How Does Private Health Insurance Affect My Tax Return Compare Club

Section 87A Tax Rebate Under Section 87A

Bonus Tax Rate 2018 Museumruim1op10 nl

Bonus Tax Rate 2018 Museumruim1op10 nl

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

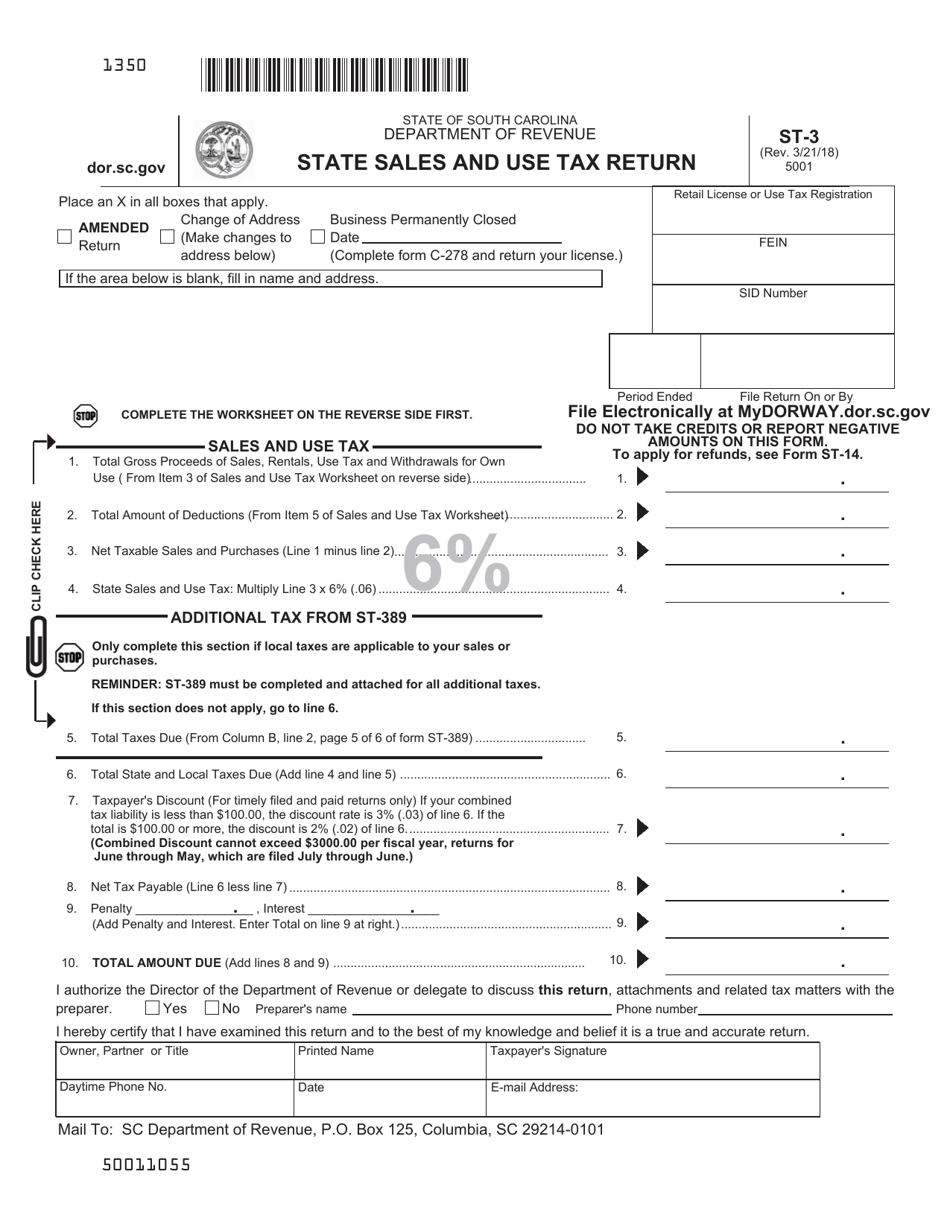

Sales And Use Tax Return Form St John The Baptist Parish Printable

Can I Claim Ppi Back From My Catalogue

Rebate Taxable Income - Web 5 mai 2022 nbsp 0183 32 If earned through the use of the card like a cash back bonus the rewards are viewed by the IRS as a rebate and not taxable income