Reimbursement Taxable Income Verkko Tax exempt and taxable reimbursements of expenses are reported to the Incomes Register Some taxable reimbursements of expenses can be paid without withholding

Verkko 20 huhtik 2021 nbsp 0183 32 The income type Taxable reimbursement of expenses 353 is used to report taxable reimbursement of expenses paid for non business travel from which Verkko 4 p 228 iv 228 228 sitten nbsp 0183 32 Normally the meaning of royalties and compensation for use is cash reimbursement payable in exchange for an intangible right of some kind From the

Reimbursement Taxable Income

Reimbursement Taxable Income

https://www.tffn.net/wp-content/uploads/2023/01/is-travel-reimbursement-taxable-income.jpg

Is Travel Reimbursement Taxable Exploring The Tax Implications The

https://www.lihpao.com/images/illustration/is-travel-reimbursement-taxable-income-3.jpg

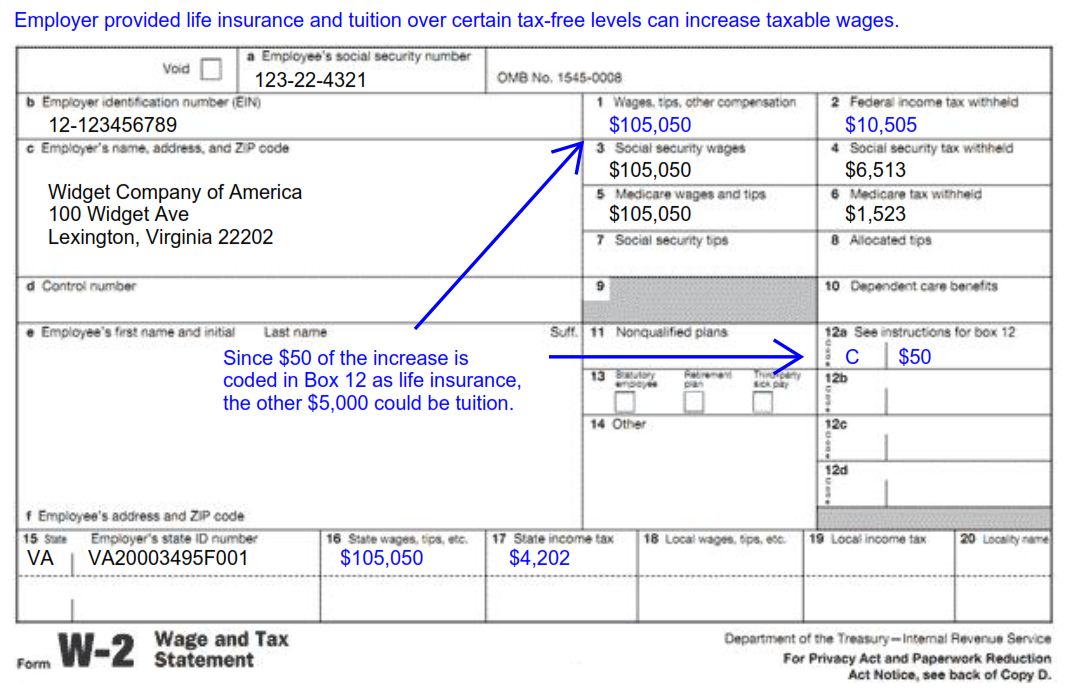

Is Tuition Reimbursement Taxable A Guide ClearDegree

https://www.cleardegree.com/wp-content/uploads/2020/04/CD-BLog-Image-4-3-1536x1122.jpg

Verkko 25 lokak 2018 nbsp 0183 32 Finance Your Business Reimbursable Expenses Vs Taxable Income by Danielle Smyth Published on 25 Oct 2018 Whether you run a small business or Verkko 14 lokak 2022 nbsp 0183 32 Are reimbursements taxable When you give money to an employee you typically have to withhold and contribute taxes on the payment So are

Verkko But now you re wondering will you owe taxes on the amount of the reimbursement Answer In short no But that s provided your employer completes the pay stub accurately as part of their expense Verkko In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is

Download Reimbursement Taxable Income

More picture related to Reimbursement Taxable Income

Is A Mileage Reimbursement Taxable

https://www.mburse.com/hubfs/2020-chevy-malibu copy.jpg

Payment Or Reimbursement Of Medical Expenses By The Employer Is It

https://i.ytimg.com/vi/ei12uB8pdoE/maxresdefault.jpg

Is A Car Allowance Or Mileage Reimbursement Taxable Income

https://www.mburse.com/hs/cta/cta/default/2511299/d01bfc0d-c8af-4f10-b226-6e39650b1f5a.png

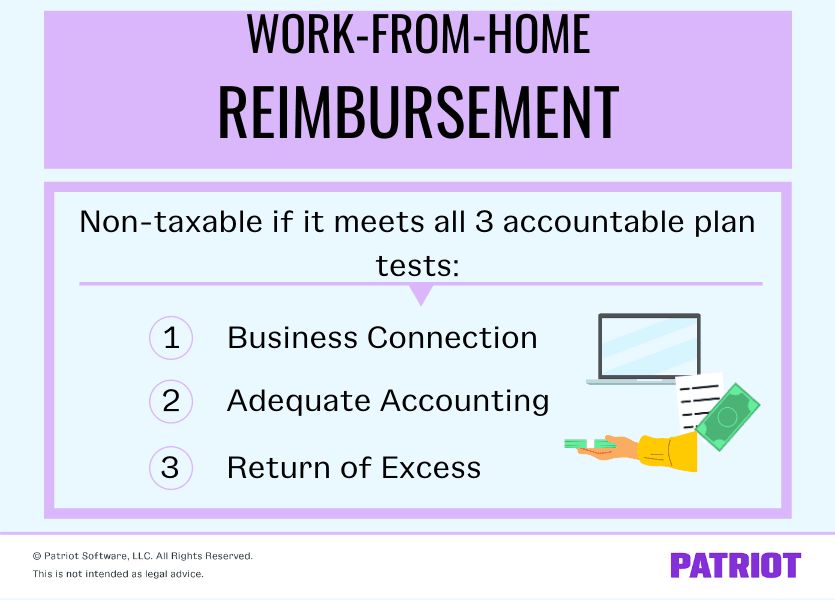

Verkko 1 jouluk 2023 nbsp 0183 32 Accountable Plan A plan for reimbursing employees for business expenses Under this plan the reimbursement that the employee receives for the expenses is not included in his her income Verkko 16 helmik 2022 nbsp 0183 32 When choosing to reimburse expenses under a non accountable plan the amount employees are paid is considered income for tax purposes Companies

Verkko 3 toukok 2021 nbsp 0183 32 Reimbursement Compensation paid by an organization for out of pocket expenses incurred or overpayment made by an employee customer or other party Reimbursement of Verkko Meaning of reimbursement 2 1 The term reimbursement has not been defined in the Income tax Act 1961 IT Act It is also not defined in the Central Goods and Service

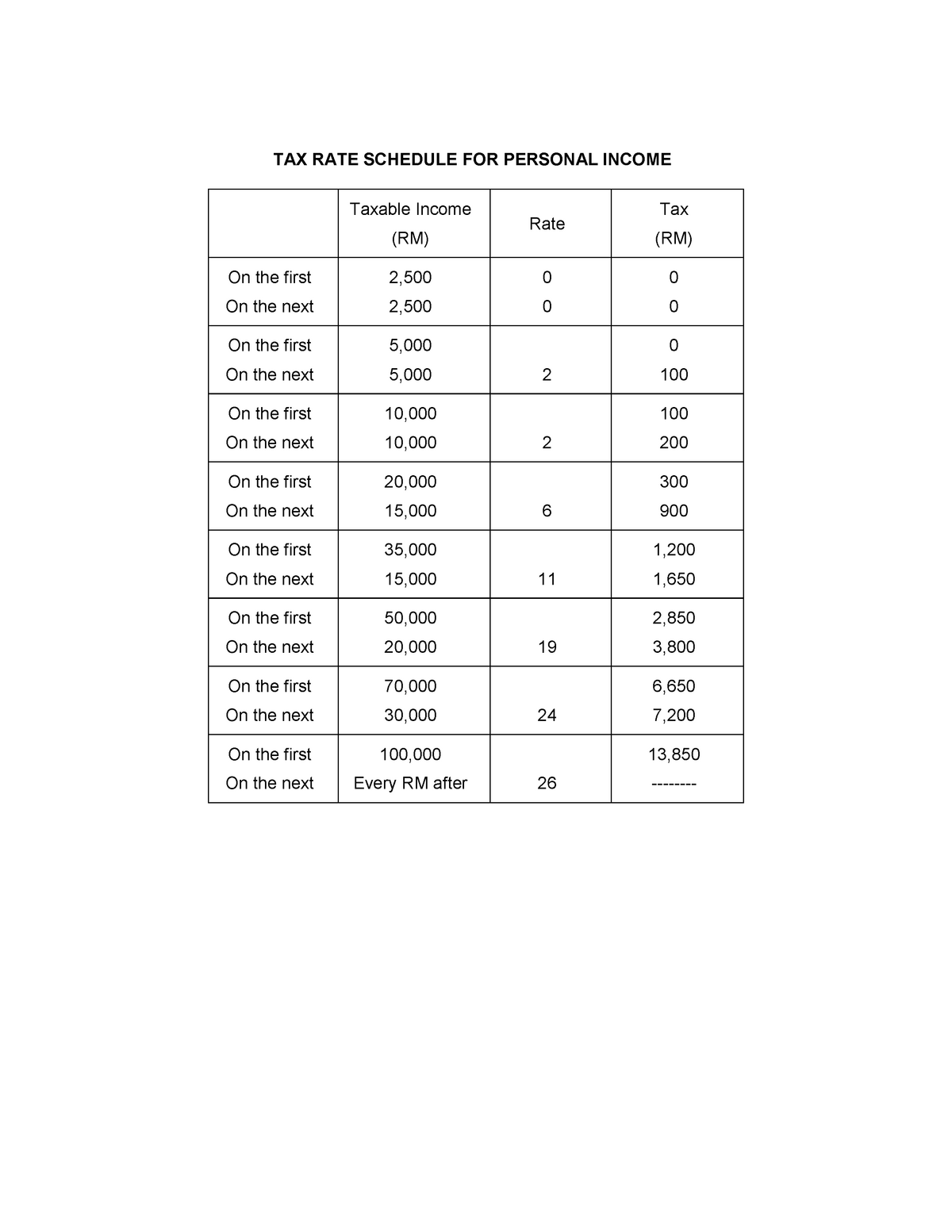

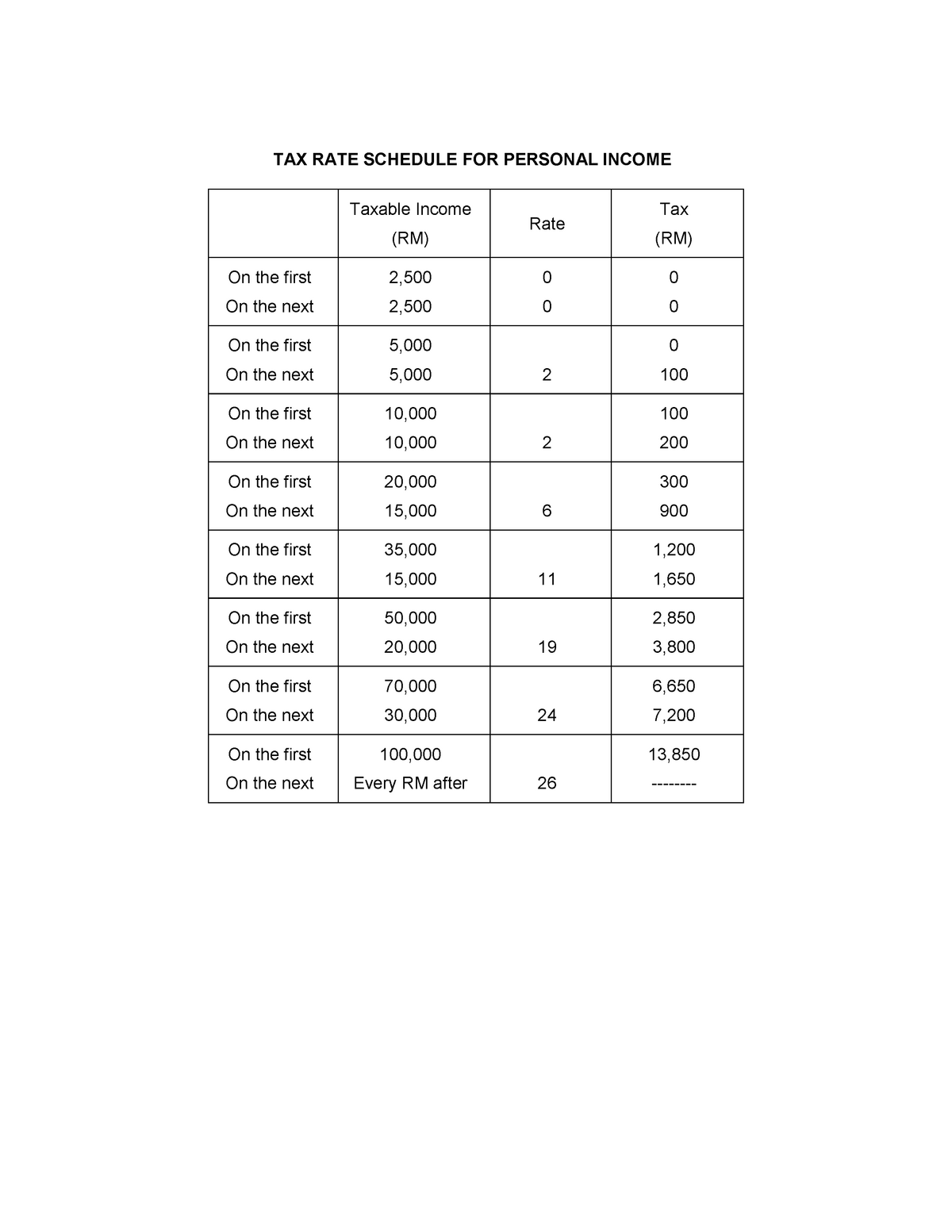

Income TAX Table Dr Salim TAX RATE SCHEDULE FOR PERSONAL INCOME

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1861edc2fdc7ff1c203dd4031b6b148f/thumb_1200_1553.png

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

https://www.vero.fi/en/incomes-register/companies-and-organisations/...

Verkko Tax exempt and taxable reimbursements of expenses are reported to the Incomes Register Some taxable reimbursements of expenses can be paid without withholding

https://www.vero.fi/en/incomes-register/companies-and-organisations/...

Verkko 20 huhtik 2021 nbsp 0183 32 The income type Taxable reimbursement of expenses 353 is used to report taxable reimbursement of expenses paid for non business travel from which

Is Mileage Reimbursement Considered Taxable Income TripLog

Income TAX Table Dr Salim TAX RATE SCHEDULE FOR PERSONAL INCOME

Income Tax Free Of Charge Creative Commons Clipboard Image

Are Reimbursements Taxable How To Handle Surprise Employee Expenses

What Is Pre Tax Commuter Benefit

Taxable Income Notes TAXABLE INCOME The Tax Concept Of Income Is

Taxable Income Notes TAXABLE INCOME The Tax Concept Of Income Is

USDA Announces SY2023 24 Reimbursement Rates School Nutrition Association

What is taxable income Financial Wellness Starts Here

Work from home Reimbursement Definition Taxes Policy

Reimbursement Taxable Income - Verkko In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is