Mileage Reimbursement Taxable Income The business mileage rate for 2024 is 67 cents per mile You may use this rate to reimburse an employee for business use of a personal vehicle and under certain

Employer provided reimbursements cause no income taxes for you if the amounts are based on actual expenses or if they do not exceed the norms established If your mileage reimbursement is taxable include it as income on Form W 2 for employees or Schedule C for self employed individuals If it s not taxable ensure

Mileage Reimbursement Taxable Income

Mileage Reimbursement Taxable Income

https://companymileage.com/wp-content/uploads/2016/11/mileage-reimbursement-for-employees.jpg

Business Mileage Rate Increase

https://www.cshco.com/wp-content/uploads/taxguidance_car_email.jpg

Is Employee Mileage Reimbursement Taxable

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Is employee mileage reimbursement taxable_featured.jpg#keepProtocol

A mileage reimbursement is non taxable if it is part of an accountable plan with a mileage rate that does not exceed the IRS standard business rate 0 67 mile for 2024 To How to determine whether specific types of benefits or compensation are taxable Procedures for computing the taxable value of fringe benefits Rules for withholding

If done under an accountable plan these reimbursements are not considered taxable income The Internal Revenue Service sets a standard mileage rate every year which for 2023 stands at 65 5 cents Are mileage reimbursements taxable If the reimbursement is based on the IRS standard rate and equals the expenses incurred by the employee then no the reimbursement is not considered taxable

Download Mileage Reimbursement Taxable Income

More picture related to Mileage Reimbursement Taxable Income

Employee Guide To Taxable Mileage Expense Reimbursement SmartMoneyToolbox

https://www.smartmoneytoolbox.com/wp-content/uploads/2022/07/pexels-mike-b-170286-980x552.jpg

Is A Mileage Reimbursement Taxable

https://www.mburse.com/hubfs/2020-chevy-malibu copy.jpg#keepProtocol

Vehicle Programs Is Mileage Reimbursement Taxable Motus

https://www.motus.com/wp-content/uploads/2022/02/Is-Mileage-Reimbursement-Taxable.jpg

If you meet the rules for expense reimbursement up to the limits your payments received will be non taxable If you don t meet the rules for reimbursement the payments will be considered compensation Mileage reimbursement is not considered taxable income as long as you do it right In this short article you will learn how to avoid pitfalls and get your

Yes reimbursements based on the federal mileage rate are tax deductible And since they aren t considered income they re non taxable for your employees But if you provide Mileage deductions can add up to significant savings for taxpayers Self employed workers and business owners are eligible for the largest tax deductible

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

Non taxable Allowance For Transport Costs

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-3396669-1920w.jpeg

https://www.irs.gov/publications/p15b

The business mileage rate for 2024 is 67 cents per mile You may use this rate to reimburse an employee for business use of a personal vehicle and under certain

https://www.vero.fi/en/individuals/deductions/...

Employer provided reimbursements cause no income taxes for you if the amounts are based on actual expenses or if they do not exceed the norms established

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

Is Mileage Reimbursement Considered Taxable Income TripLog

What Expenses Does A Mileage Reimbursement Include

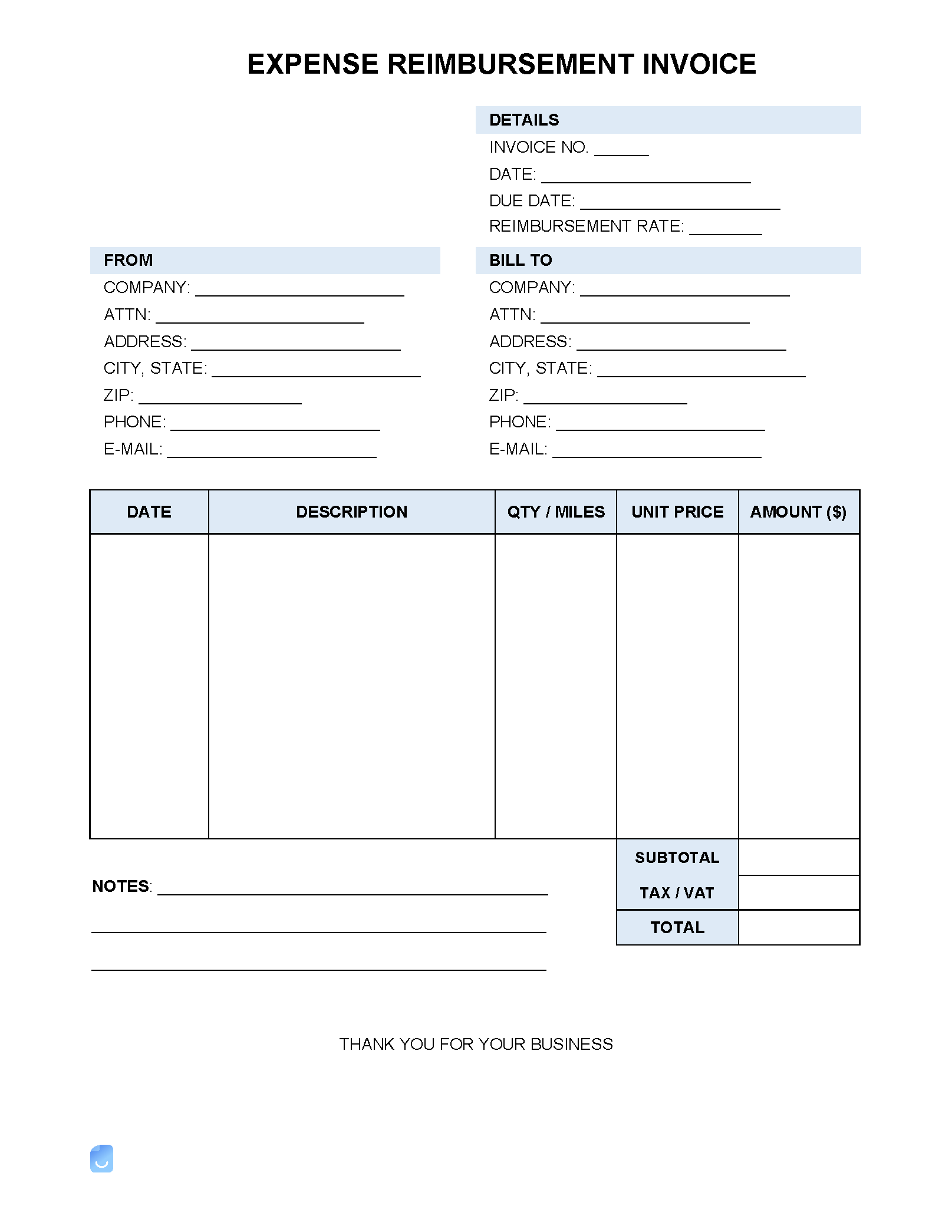

Expense Reimbursement Invoice Template Invoice Maker

Is Travel Reimbursement Taxable Exploring The Tax Implications The

Is Travel Reimbursement Taxable Exploring The Tax Implications The

Is Travel Reimbursement Taxable Exploring The Tax Implications The

Mileage Reimbursement Rates Increase For Inflation

Is Work From Home Reimbursement Taxable Under Income Tax Expert

Mileage Reimbursement Taxable Income - IRS Mileage Reimbursement Rates Before we talk about the current rates it s necessary to point out that the standard rates set by the IRS only specify the maximum rate at