Travel Reimbursement Taxable Income Are employee reimbursement expenses taxable income How do you qualify Learn more about IRS rules and accountable reimbursement plans

When employers reimburse employees at or below the IRS standard mileage rate these payments are generally not considered taxable income This means that Deductible travel expenses include Travel by airplane train bus or car between your home and your business destination Fares for taxis or other types of

Travel Reimbursement Taxable Income

Travel Reimbursement Taxable Income

https://www.tffn.net/wp-content/uploads/2023/01/is-travel-reimbursement-taxable-income.jpg

Non taxable Allowance For Transport Costs

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-3396669-1920w.jpeg

Is A Mileage Reimbursement Taxable

https://www.mburse.com/hubfs/2020-chevy-malibu copy.jpg#keepProtocol

If your business uses an accountable plan reimbursements are not taxable You do not have to withhold or contribute income FICA or unemployment taxes To have an accountable plan your employees If your assignment is indefinite you must include in your income any amounts you receive from your employer for living expenses even if they are called travel allowances and

Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they travel away If a reimbursement plan is deemed accountable the reimbursements are not considered taxable income to the employee However if a reimbursement plan is deemed as nonaccountable the

Download Travel Reimbursement Taxable Income

More picture related to Travel Reimbursement Taxable Income

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

https://www.tffn.net/wp-content/uploads/2023/01/is-travel-reimbursement-taxable.jpg

![]()

How To Set Informed Income Goals Solopreneur Profit Coach

https://www.atpeacewithmoney.com/wp-content/uploads/2019/01/rawpixel-1054583-unsplash.jpg

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

https://www.lihpao.com/images/illustration/is-travel-reimbursement-taxable-1.jpg

Reasonable travel expenses can generally be deducted from taxable income by a company when its employees incur costs while traveling away from home specifically for business According to the Internal Revenue Service IRS travel reimbursements must adhere to specific guidelines to be considered non taxable for employees The

Generally travel reimbursements are excludable if they would be deductible as ordinary and necessary business expenses under Code 162 a Travel ANSWER Per diem payments are often used to simplify compliance with the accountable plan rules that allow business travel reimbursements to be excluded

Is Work From Home Reimbursement Taxable Under Income Tax Expert

https://www.thetaxheaven.com/public/uploads/news-147.png

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

https://www.justworks.com/blog/expense…

Are employee reimbursement expenses taxable income How do you qualify Learn more about IRS rules and accountable reimbursement plans

https://accountinginsights.org/irs-mileage-rates...

When employers reimburse employees at or below the IRS standard mileage rate these payments are generally not considered taxable income This means that

Super Income V2 Android

Is Work From Home Reimbursement Taxable Under Income Tax Expert

Travel Reimbursement Form PDF Printable Download Etsy

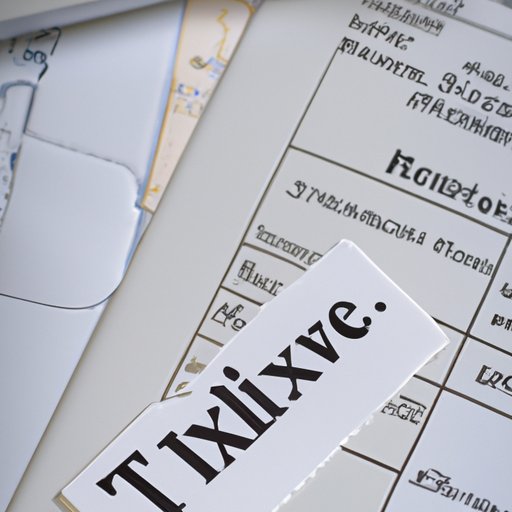

Income TAX Table Dr Salim TAX RATE SCHEDULE FOR PERSONAL INCOME

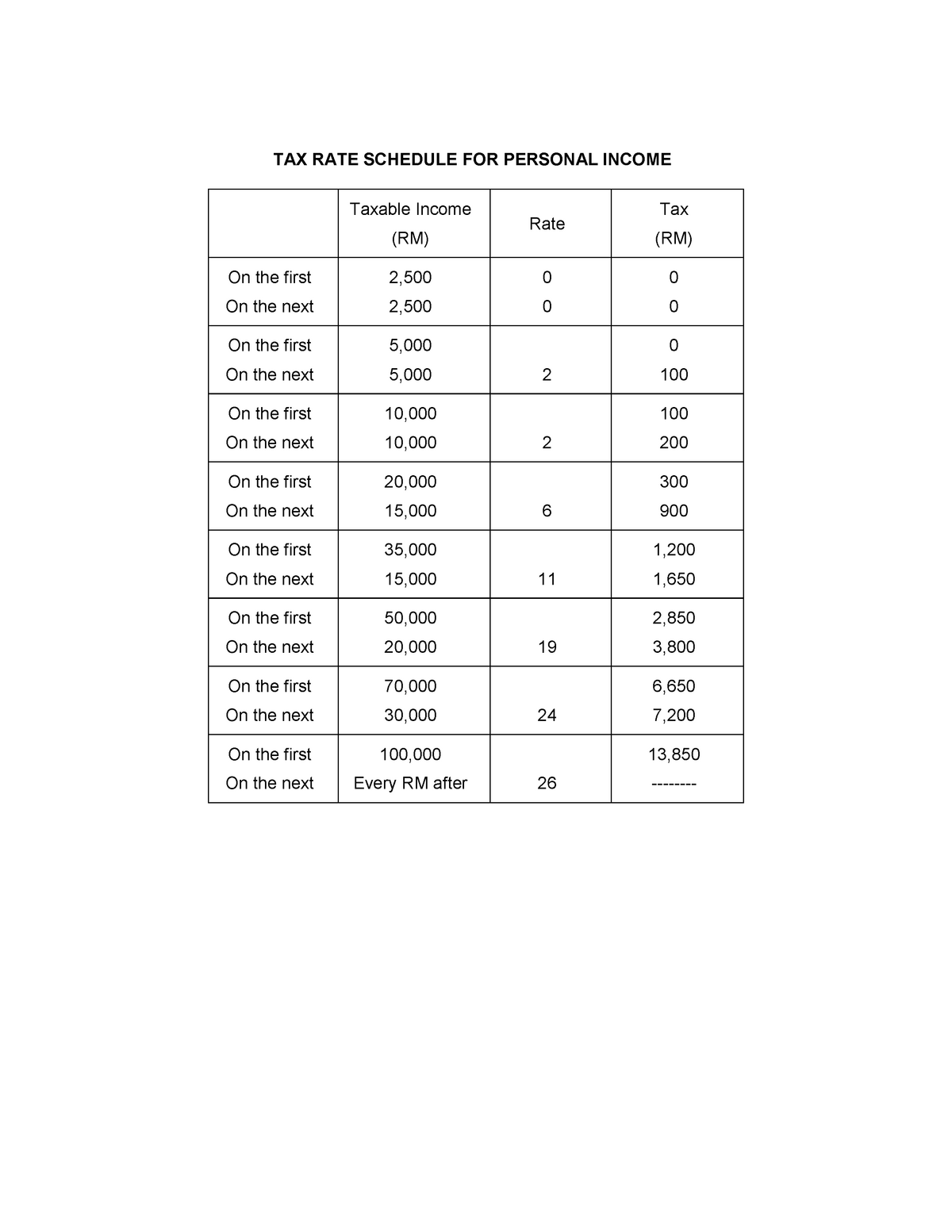

Solved Parent Corporation s Current year Taxable Income Chegg

All things spatial November 2016

All things spatial November 2016

Cash Flow Basics Disbursement Vs Reimbursement

Is Tuition Reimbursement Considered Taxable Income Zippia

Tax Saving Under New Tax Regime How Much Tax You Will Save In Revised

Travel Reimbursement Taxable Income - If you use your own car for work purposes and are reimbursed by your employer for the related expenses the mileage reimbursement generally isn t taxable income if it s paid