Irs Gov Rebate Stimulus Web 15 mars 2023 nbsp 0183 32 However people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021 Securely access

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 22 mars 2023 nbsp 0183 32 You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn t get an Economic Impact Payment or got less than the full amount It is important to understand

Irs Gov Rebate Stimulus

Irs Gov Rebate Stimulus

https://www.usatoday.com/gcdn/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?width=1320&height=990&fit=crop&format=pjpg&auto=webp

![]()

Irs Gov Stimulus Payment Status StimulusInfoClub

https://img.stimulusinfoclub.com/wp-content/uploads/irs-gov-stimulus-check-tracking-system.jpeg

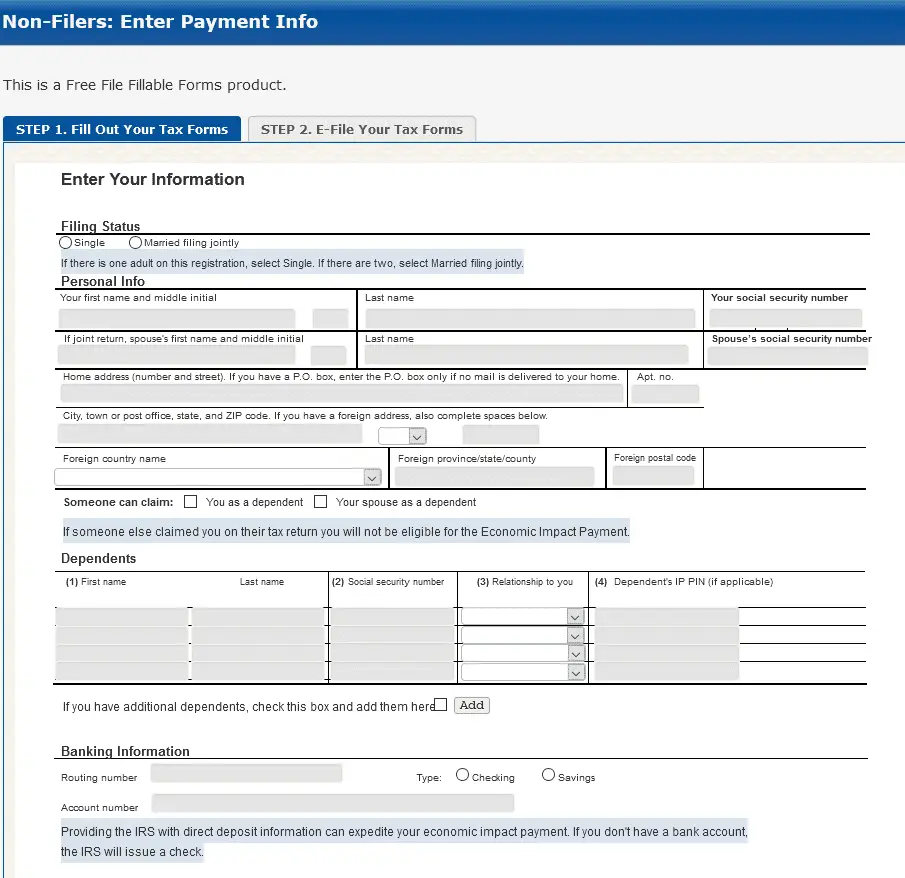

IRS 1040 NonFilers Stimulus Check Recovery Rebate Credit Walk Through

https://i.pinimg.com/736x/18/51/29/185129d90a4f4082ee6490b2462c4166.jpg

Web The IRS has issued all first second and third Economic Impact Payments Most eligible people already received their Economic Impact Payments People who are missing Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early opportunity Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Download Irs Gov Rebate Stimulus

More picture related to Irs Gov Rebate Stimulus

IRS Stimulus Check Status Tracker 2021 Guide Social Security Portal

https://i0.wp.com/socialsecurityportal.com/wp-content/uploads/2021/03/Get-an-update-on-third-stimulus-deposit-date.png?w=1200&ssl=1

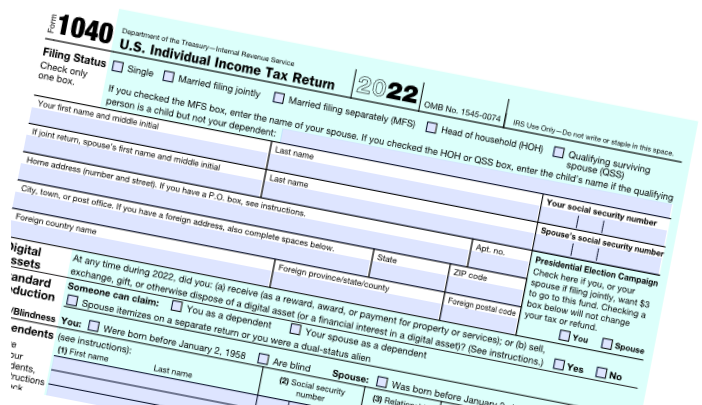

IRS Says State Issued Stimulus Payments Are Not Taxable CPA Practice

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2023/02/1040-2022-IRS-from-PDF.png

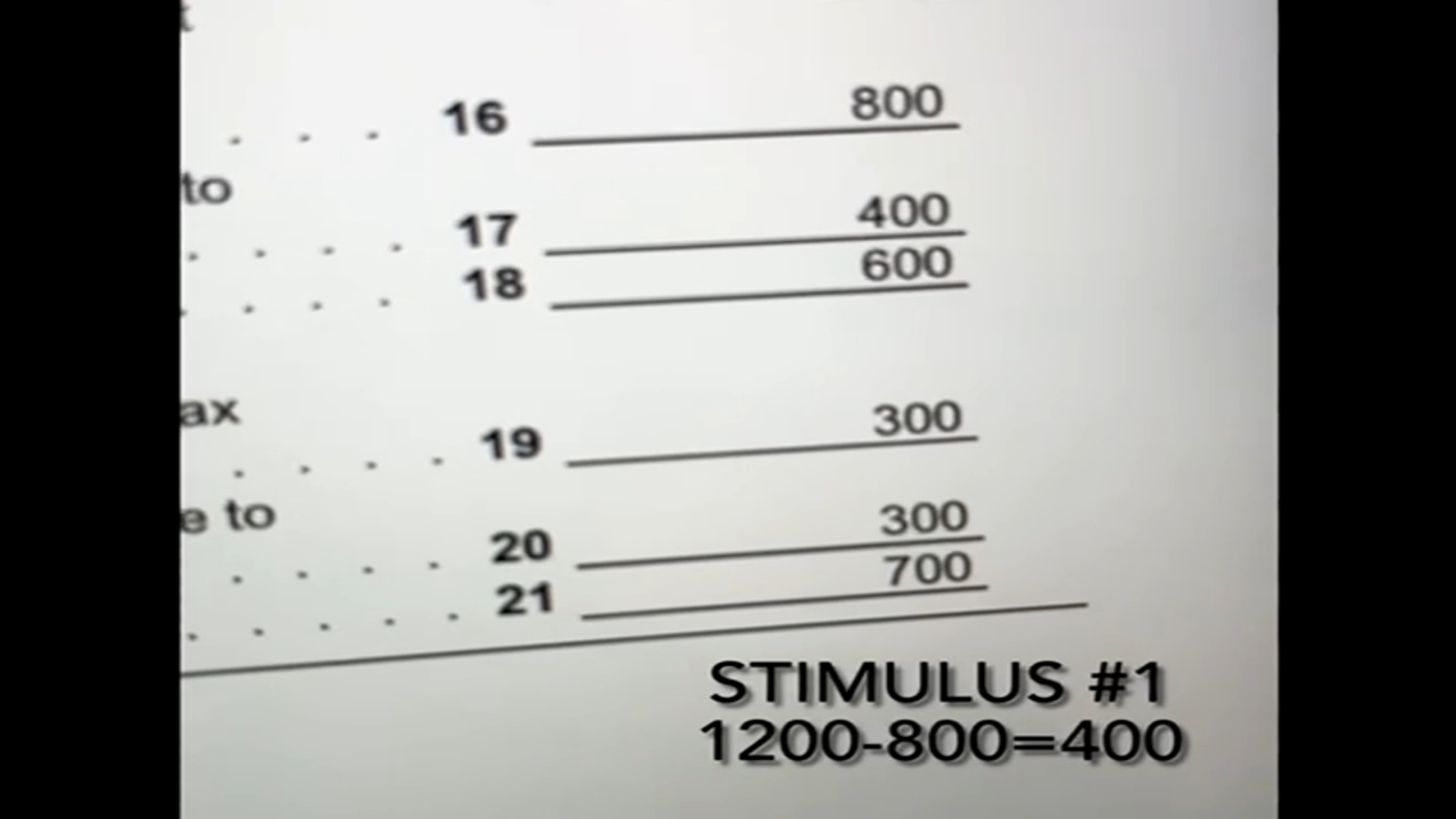

Recovery Rebate Credit 2020 Calculator KwameDawson

https://www.irstaxapp.com/wp-content/uploads/2021/01/irs-update-stimulus-1024x475.png

Web 9 mai 2023 nbsp 0183 32 Home Taxes Tax refunds Check your tax refund status Check your federal or state tax refund status If you expect a federal or state tax refund you can track its Web Internal Revenue Service An official website of the United States government Helping people understand and meet their tax responsibilities How can we help you File Your Taxes for Free Sign in to Your

Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return Web 16 f 233 vr 2021 nbsp 0183 32 WASHINGTON The IRS announced today that as required by law all legally permitted first and second round of Economic Impact Payments have been issued

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

New Stimulus Check You Still Have Time To Apply To Get This IRS Refund

https://www.tododisca.com/en/wp-content/uploads/2023/07/The-IRS-is-still-sending-tax-rebates-from-2019.jpg

https://www.irs.gov/coronavirus/economic-i…

Web 15 mars 2023 nbsp 0183 32 However people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021 Securely access

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

/https://specials-images.forbesimg.com/imageserve/144085132/0x0.jpg)

How To Get Stimulus Checks On Tax Return Irs Stimulus Check How Can I

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Irs Recovery Rebate Credit Number IRSYAQU

9 Million IRS Stimulus Payments Mails Are You One Of Them Internal

Irs Gov Stimulus Payment Status StimulusInfoClub

Irs gov App Stimulus Guide APK

Irs gov App Stimulus Guide APK

Wheres My Stimulus How To Redeem Payment With IRS Recovery Rebate Tax

Irs Gov Non Filers Form For Stimulus Check StimulusInfoClub

6 000 Stimulus Checks Could Be Coming The Only Question Now Is When

Irs Gov Rebate Stimulus - Web Starting in March 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act provided Economic Impact Payments of up to 1 200 per adult for eligible