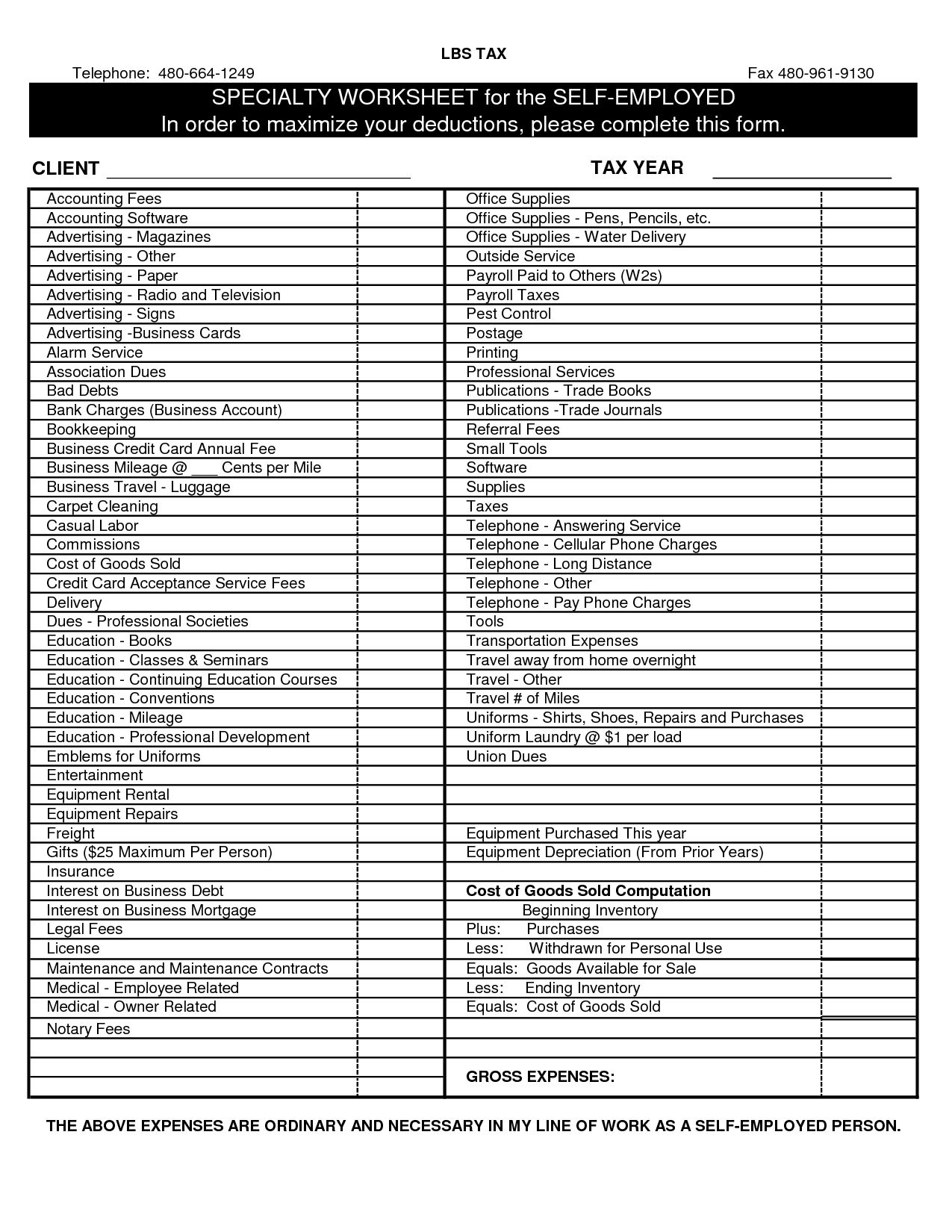

Irs Limit On Property Tax Deduction In 2023 and 2024 the SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of property taxes

You can t deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn t own the home until 2023 Instead you add the 1 375 to the cost The TCJA limits the amount of property taxes you can claim It placed a 10 000 cap on deductions for state local and property taxes collectively beginning in 2018 This ceiling applies to any income taxes

Irs Limit On Property Tax Deduction

Irs Limit On Property Tax Deduction

https://i.pinimg.com/originals/87/61/f1/8761f1219da2fb10478265012850f4fb.jpg

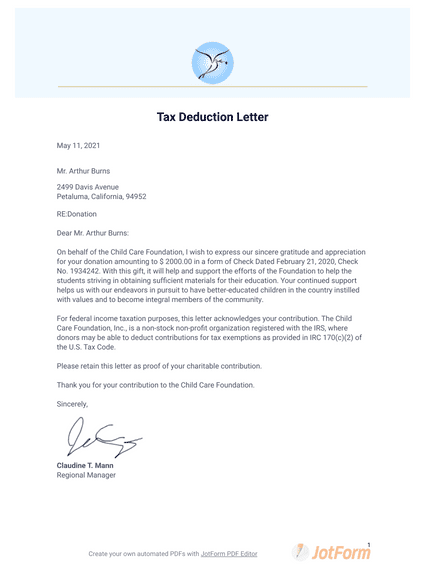

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5.png

State and local property taxes can be deducted from federal income taxes up to a limit These generally don t include taxes on renovations or services The IRS caps the property tax deduction at 10 000 5 000 if you re married filing separately 1 You may think Oh good I don t pay that much for property

Unfortunately property taxes paid on personal use property second homes and vacation homes while still deductible as itemized deductions are subject to the If you itemize your deductions you can deduct the property taxes you pay on your main residence and any other real estate you own The total amount of deductible

Download Irs Limit On Property Tax Deduction

More picture related to Irs Limit On Property Tax Deduction

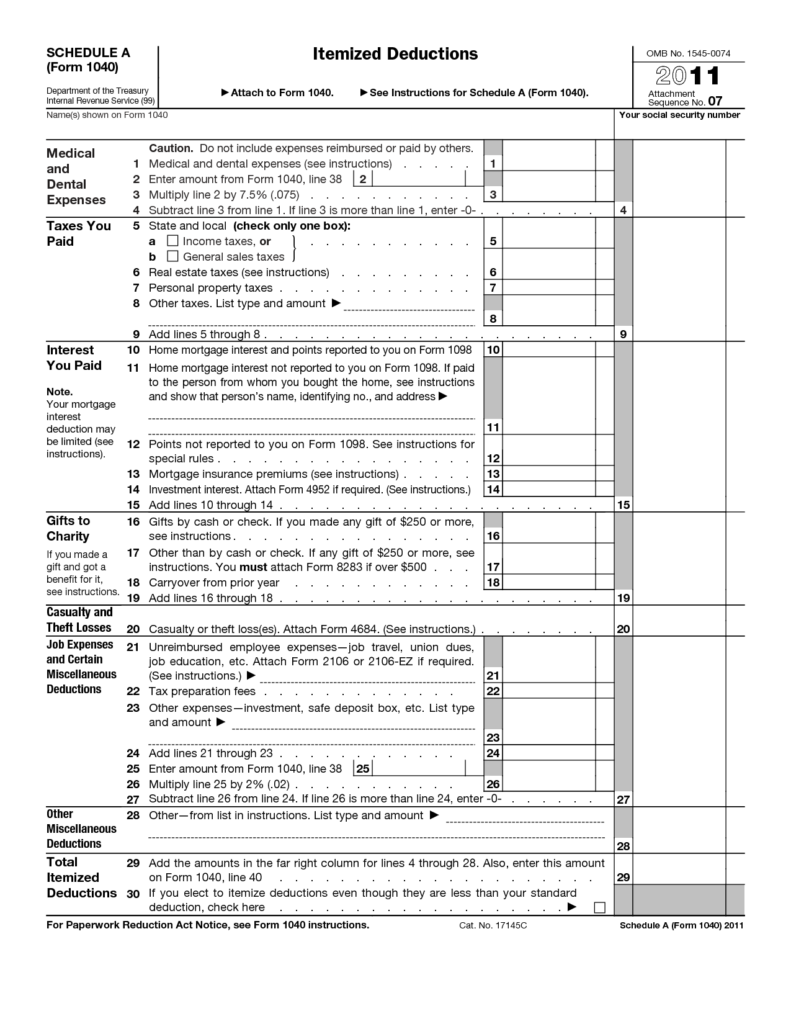

Mortgage Interest Deduction Limit Worksheet

https://i2.wp.com/standard-deduction.com/wp-content/uploads/2020/10/how-to-reduce-your-tax-bill-with-itemized-deductions-bench-2-1024x883.png

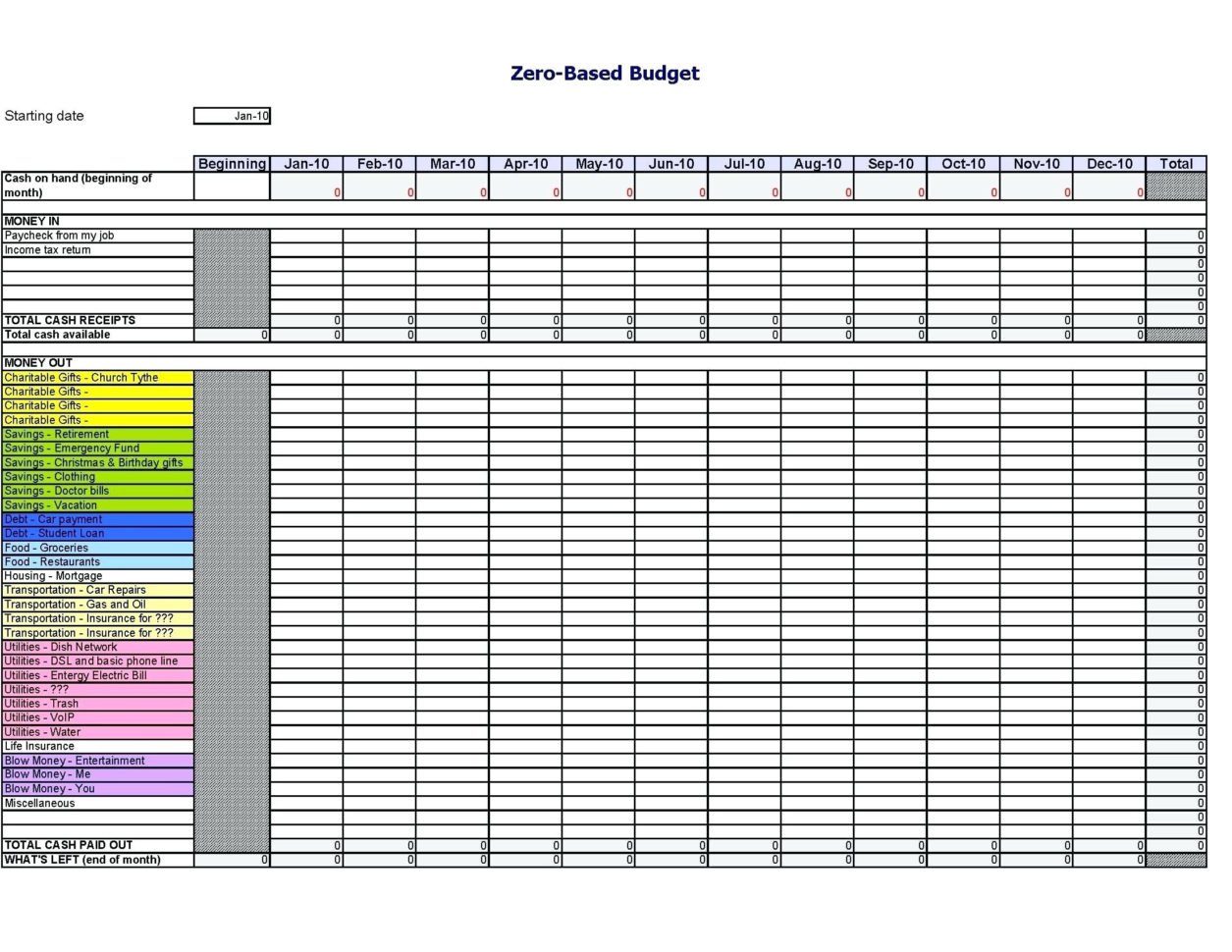

Tax Deduction Excel Template

https://db-excel.com/wp-content/uploads/2019/01/tax-deduction-spreadsheet-excel-for-tax-deduction-spreadsheet-excel-lovely-awesome-template-examples-1255x970.jpg

How 2017 Property Tax Deductions Work NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2018/02/p-69-968x573.jpg

The property tax deduction allows you as a homeowner to write off state and local taxes you paid on your property from your federal income taxes This includes If you decide to claim the property tax deduction you can do so by completing a Schedule A form and submitting it to the IRS with your 1040 income tax

The maximum amount of property taxes you can deduct on your federal income tax return is 10 000 if you re married filing jointly Who is eligible for a property tax deduction You can only deduct You can only deduct your property taxes if you itemize your deductions on Schedule A of Form 1040 This means that your total itemized deductions must exceed

Balanced Measured Approach Needed For Tax Relief Texas School Coalition

https://www.txsc.org/wp-content/uploads/2022/05/Property-Tax-Relief.png

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

https://c1.staticflickr.com/9/8606/28374128013_523fe7f52b_b.jpg

https://www.nerdwallet.com/.../propert…

In 2023 and 2024 the SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of property taxes

https://www.irs.gov/publications/p530

You can t deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn t own the home until 2023 Instead you add the 1 375 to the cost

How Limit On Property State Tax Deduction Could Hurt Suburbs

Balanced Measured Approach Needed For Tax Relief Texas School Coalition

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

Calam o IRS Rules For Tax Relief And Collection Of Tax

What Is The Limit On Property Tax Deductions ClienTax

Taxpayers Want Tax Deduction Limit Doubled Under 80C In Upcoming Budget

Taxpayers Want Tax Deduction Limit Doubled Under 80C In Upcoming Budget

Realtor Tax Deduction Worksheet

What s The Maximum 401k Contribution Limit In 2022 2023

Taxes Crossword WordMint

Irs Limit On Property Tax Deduction - Historically property taxes paid on a home have been deductible without limit However for tax years 2018 through 2025 the TCJA places a 10 000 5 000 for