Irs Mileage Deduction 2023 For 2023 the standard mileage rate for the cost of operating your car for business use is 65 5 cents 0 655 per mile Car expenses and use of the standard mileage rate are explained in chapter 4 Depreciation limits on cars trucks and vans

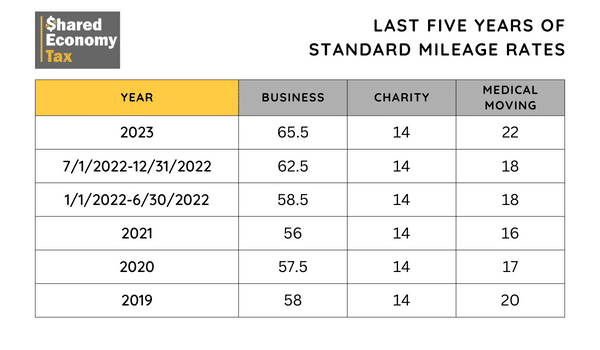

The standard mileage rates for 2023 are Self employed and business 65 5 cents mile Charities 14 cents mile Medical 22 cents mile Moving military only 22 cents mile Find out when you can deduct vehicle mileage For 2023 the business standard mileage rate is 65 5 cents per mile a 3 cent increase from the 62 5 cent rate that applied during the second half of 2022 see our Checkpoint article The rate when an automobile is used to obtain medical care which may be deductible under Code 213 if it is primarily for and essential to the medical

Irs Mileage Deduction 2023

Irs Mileage Deduction 2023

https://www.jreddallcpa.com/wp-content/uploads/2023/02/standard-deduction-2023.jpg

Gas Mileage Calculator 2023 AyreneHailey

https://www.ssacpa.com/wp-content/uploads/2021/12/aaaa-graphic-12-21.jpg

IRS Finally Boosts Mileage Deduction For Rest Of 2022 Standard Mileage

https://i.ytimg.com/vi/9l8O9elspCA/maxresdefault.jpg

The IRS today issued an advance version of Notice 2023 3 providing the standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving purposes in 2023 Notice 2023 3 PDF 105 KB provides that beginning January 1 2023 the standard mileage rates for the use of a The IRS has increased the standard mileage rates to 65 5 cents per miles for business purposes in 2023 up from 58 5 cents in early 2022 and 62 5 cents in the second half of 2022

Beginning on Jan 1 2023 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 5 cents per mile driven for business use up 3 cents from the midyear increase setting the rate for the second half of 2022 Standard mileage rates for 2023 were released December 29 The rate for computing the deductible costs of automobiles operated for a business purpose under I R C 162 is 65 5 cents per mile an increase of 3 cents per mile

Download Irs Mileage Deduction 2023

More picture related to Irs Mileage Deduction 2023

What s The IRS Standard Mileage Rate For 2023 Shared Economy Tax

https://sharedeconomycpa.com/wp-content/uploads/2023/04/last-five-years-of-standard-mileage-reimbursement-rates.png

IRS Standard Deduction 2023 Chart For Married Over 65 Table Taxes

https://dmerharyana.org/wp-content/uploads/2023/02/IRS-Standard-Deduction.png

![]()

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log

https://wssufoundation.org/wp-content/uploads/2020/11/editable-25-printable-irs-mileage-tracking-templates-gofar-mileage-log-for-taxes-template-word-scaled-2048x1449.jpg

The 2024 IRS standard mileage rates are 67 cents per mile for every business mile driven 14 cents per mile for charity and 21 cents per mile for moving or medical The new 2023 standard mileage rate to deduct operating costs and expenses is 65 5 cents per mile and the maximum standard automobile cost for allowance under a fixed and variable rate plan is 60 800

[desc-10] [desc-11]

2019 IRS Mileage Deduction Rates

https://uploads-ssl.webflow.com/5fda9a508c73005e5b84e8d9/6000b6adbcf1866736815155_milage-sheet.jpeg

Business Mileage Deduction 101 How To Calculate For Taxes

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

https://www.irs.gov/publications/p463

For 2023 the standard mileage rate for the cost of operating your car for business use is 65 5 cents 0 655 per mile Car expenses and use of the standard mileage rate are explained in chapter 4 Depreciation limits on cars trucks and vans

https://www.irs.gov/tax-professionals/standard-mileage-rates

The standard mileage rates for 2023 are Self employed and business 65 5 cents mile Charities 14 cents mile Medical 22 cents mile Moving military only 22 cents mile Find out when you can deduct vehicle mileage

IRS Standard Mileage Rates For 2023 2024

2019 IRS Mileage Deduction Rates

What s The IRS Standard Mileage Rate For 2023 Shared Economy Tax

Tax Rates Absolute Accounting Services

IRS Boosting Mileage Deduction As Gas Prices Soar The Hill

Updates To The IRS Mileage Deduction ADKF

Updates To The IRS Mileage Deduction ADKF

25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word EForms

IRS Reporting Requirements For Mileage Deduction MileIQ

Irs Mileage Deduction 2023 - Beginning on Jan 1 2023 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 5 cents per mile driven for business use up 3 cents from the midyear increase setting the rate for the second half of 2022