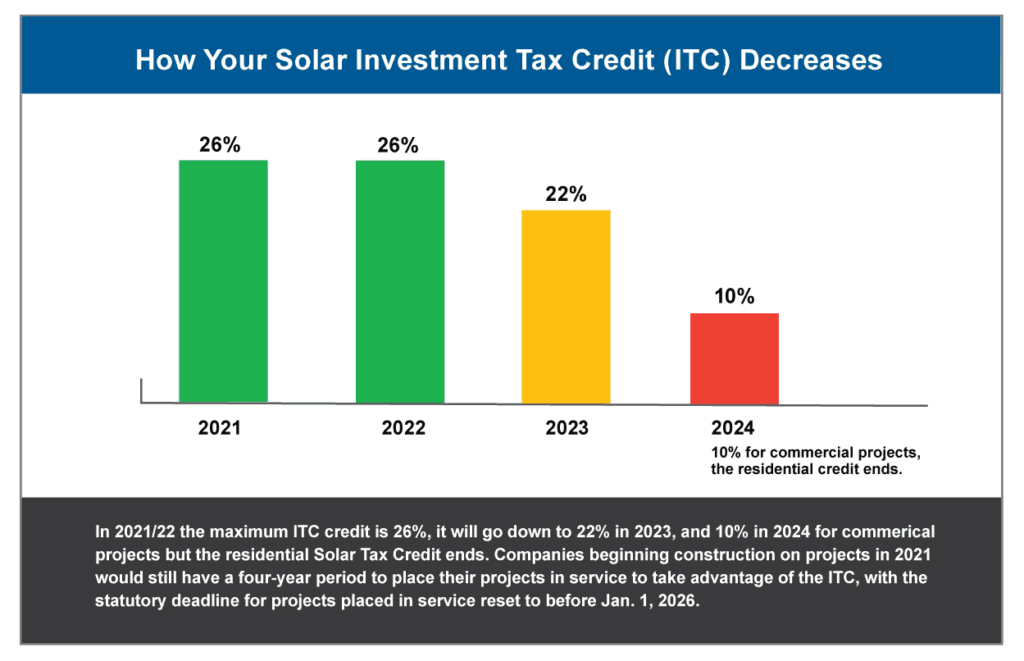

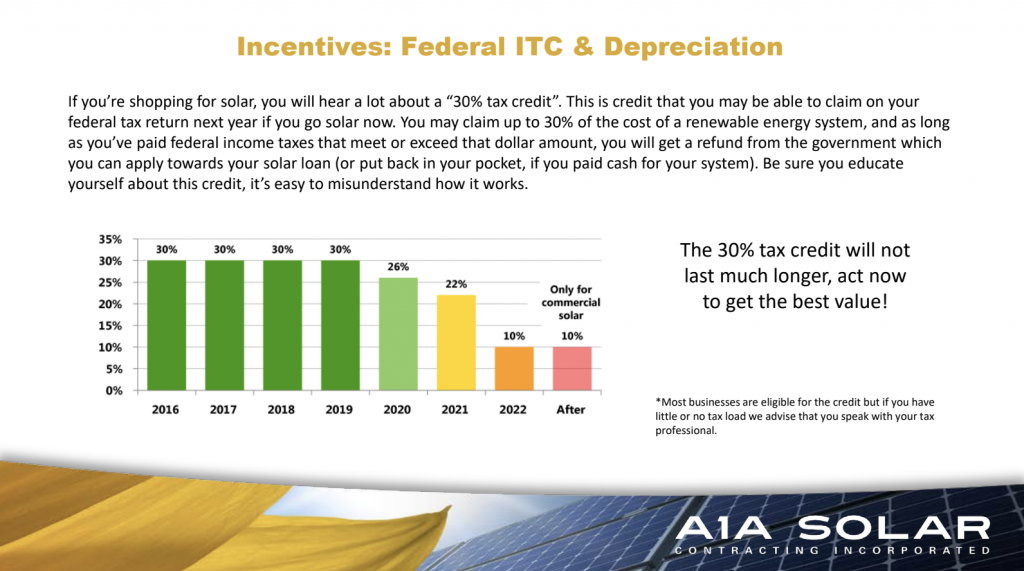

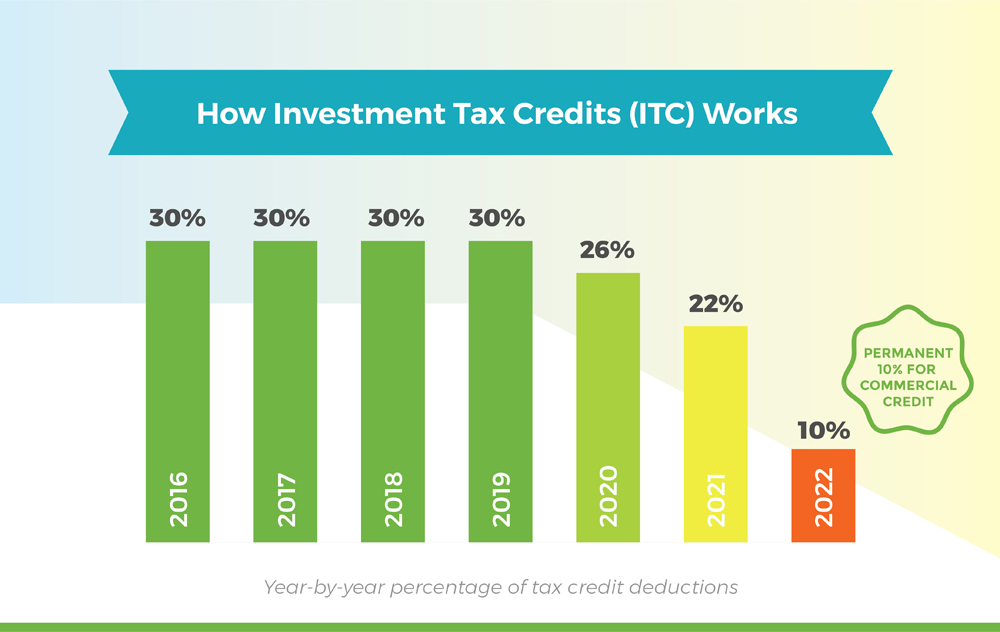

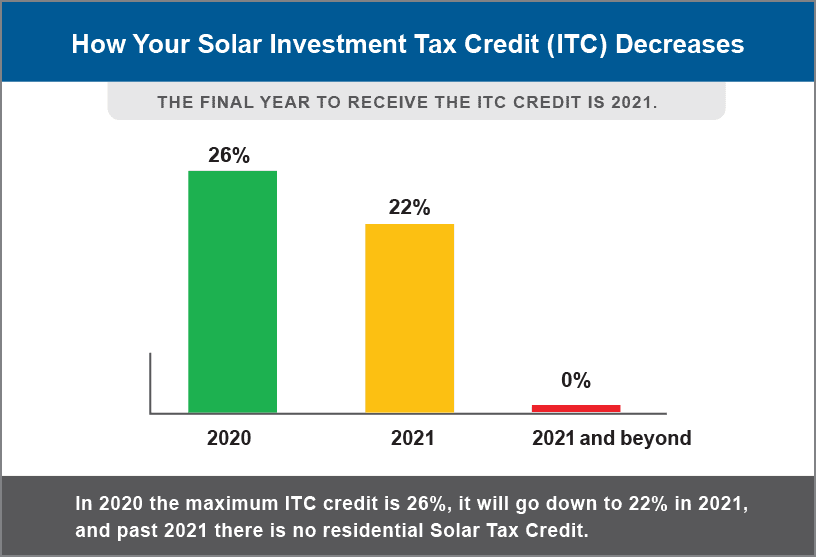

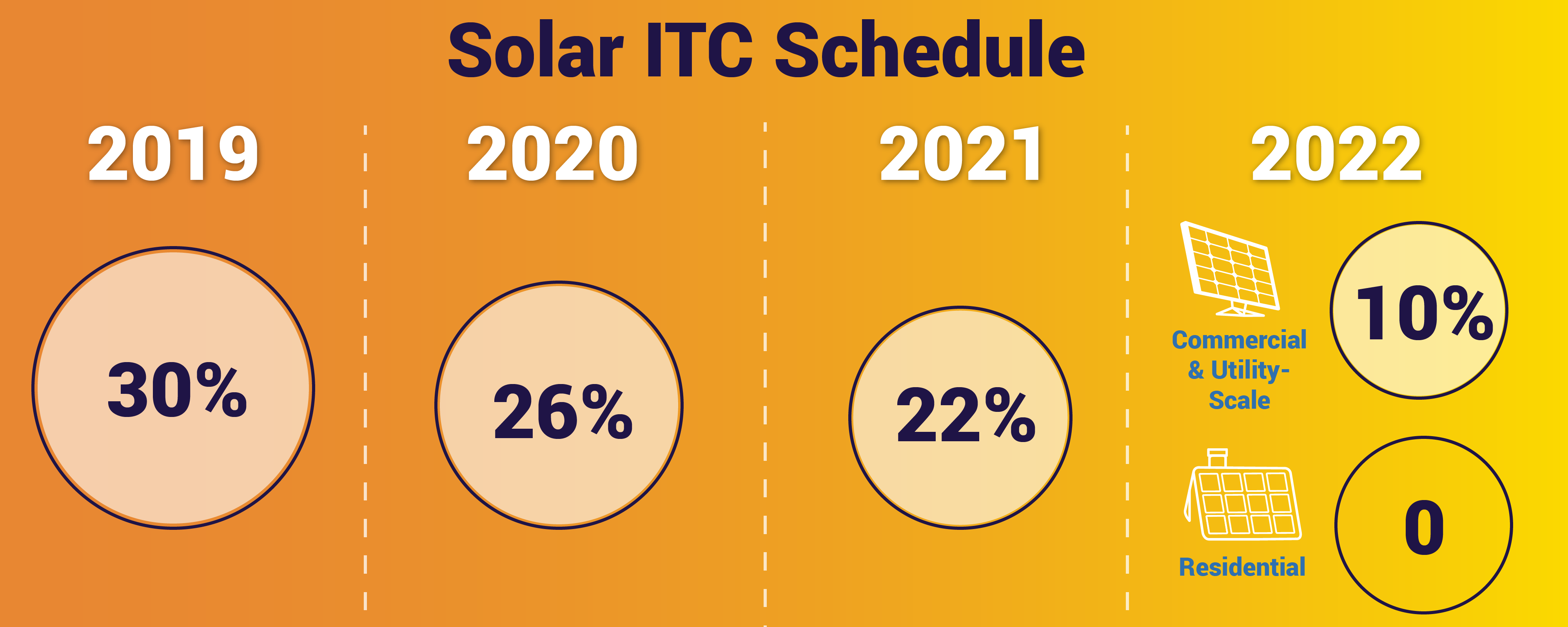

Solar Energy Tax Rebates Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

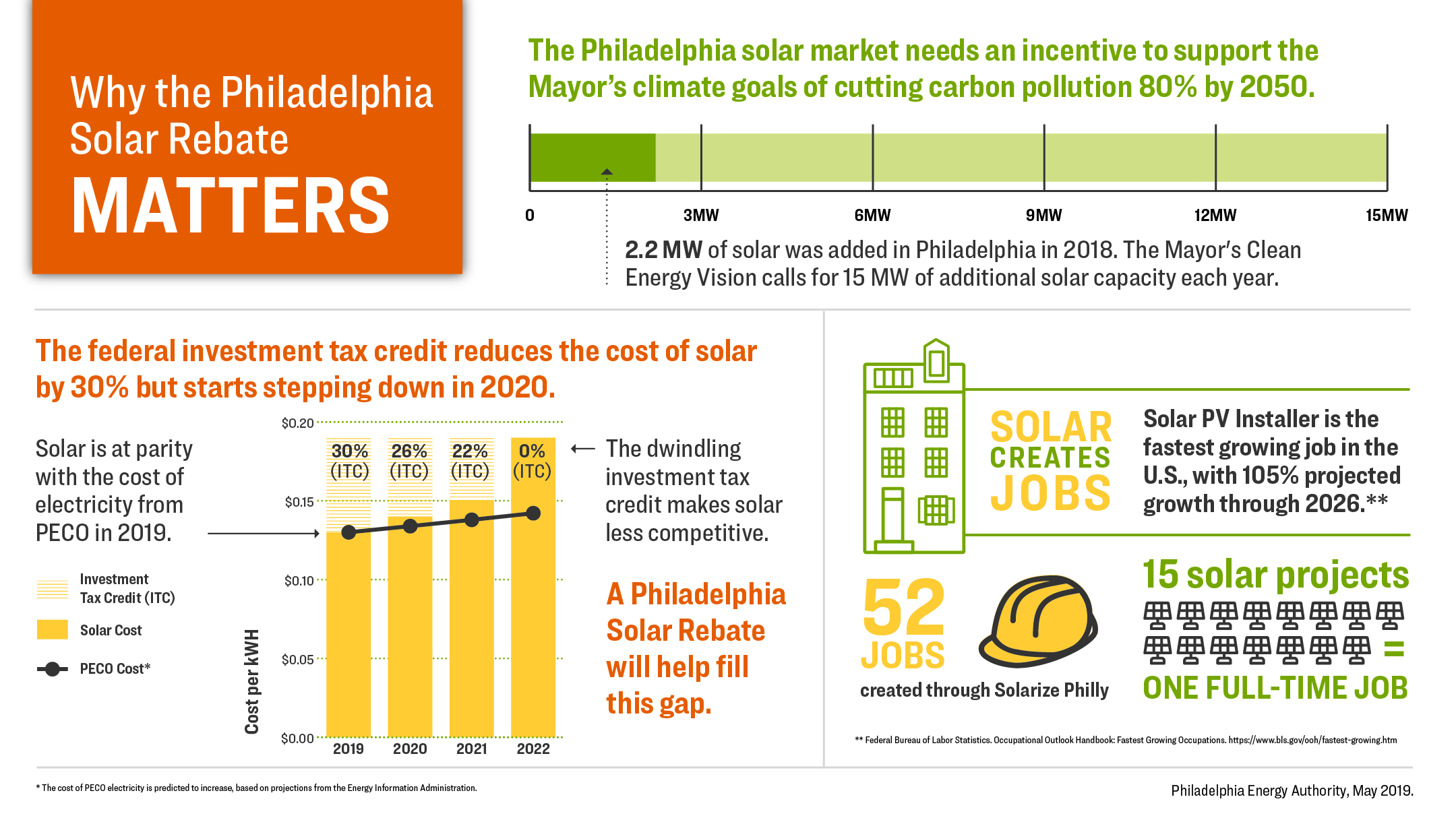

Web 26 juil 2023 nbsp 0183 32 Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

Solar Energy Tax Rebates

.png)

Solar Energy Tax Rebates

https://s3.amazonaws.com/solarassets/wp-content/uploads/Pick My Solar LIVE (10).png

Alternate Energy Hawaii

http://alternateenergyhawaii.com/ugc/aei/solar-tax-credits.jpg

Solar Tax Credit Everything A Homeowner Needs To Know Credible

https://www.credible.com/blog/wp-content/uploads/2021/07/Solar-tax-incentives-available-to-consumers-infographic.png

Web 8 sept 2022 nbsp 0183 32 Let s take a look at the biggest changes and what they mean for Americans who install rooftop solar The ITC increased in amount and its timeline has been extended Those who install a PV system between Web 27 avr 2023 nbsp 0183 32 Individuals who pay personal income tax are eligible for a solar energy tax credit if the solar PV panels are new and unused and are brought into use for the first

Web 28 ao 251 t 2023 nbsp 0183 32 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing

Download Solar Energy Tax Rebates

More picture related to Solar Energy Tax Rebates

Solar Energy Tax Credits By State MD NJ PA VA DC FL

https://www.solarenergyworld.com/wp-content/uploads/2021/01/ITC-chart-horizontal2021-FA-1024x661.png

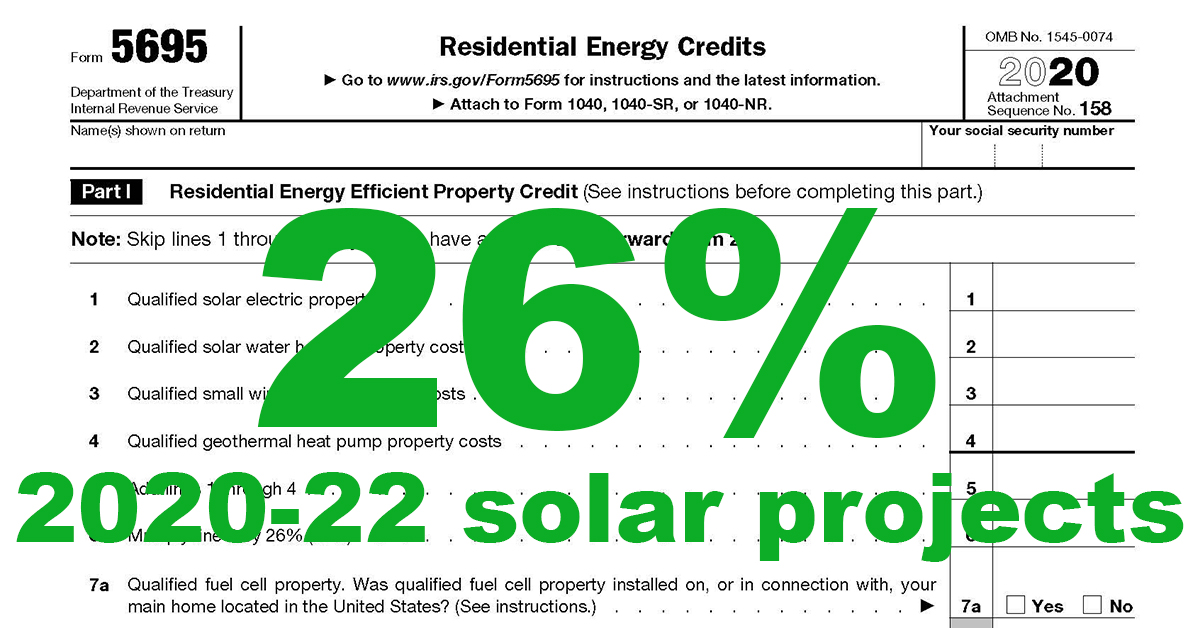

How To Claim The Federal Solar Tax Credit SAVKAT Inc

https://savkat.com/wp-content/uploads/2019/09/IRS-Form-5695-SAVKAT-Solar.jpg

Councilwoman Reynolds Brown Introduces Legislation To Establish A Solar

https://philaenergy.org/wp-content/uploads/2019/05/SOLARINFOGRAPHIC-V11-1.jpg

Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC Web 7 sept 2023 nbsp 0183 32 Advertisement 183 Scroll to continue The Energy Community Tax Credit Bonus program provides 10 extra tax credits to solar and storage projects on top of the 30

Web 6 ao 251 t 2022 nbsp 0183 32 Here s what they re doing different Rebates for retrofitting homes Tax credits to reduce energy leakage Americans could receive tax credits to cover 30 of the costs of home improvements that Web 7 ao 251 t 2023 nbsp 0183 32 Solar Tax Credit By State in 2023 The Ultimate Federal Solar Energy Tax Credit Guide By Lauren Murphy Lexie Pelchen Contributor Editor Updated Aug 7

Federal Solar Tax Credit Save Money On Solar KC Green Energy

https://www.kcgreenenergy.com/content/uploads/2018/08/updated-2020-federal-tax-incentive-for-solar-panels.png

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

https://a1asolar.com/wp-content/uploads/2018/10/tax-credit-chart-1024x571.png

.png?w=186)

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in

Solar Energy Tax Credits By State MD NJ PA VA DC FL

Federal Solar Tax Credit Save Money On Solar KC Green Energy

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How The Inflation Reduction Act Of 2022 Can Lower Your Energy Bills

Federal Solar Tax Credits For Businesses Department Of Energy

Energy Efficient Rebates Tax Incentives For MA Homeowners

Energy Efficient Rebates Tax Incentives For MA Homeowners

Solar Investment Tax Credit ITC SEIA

Higher Renewable Capacity Additions In AEO2016 Reflect Policy Changes

Puget Sound Solar LLC

Solar Energy Tax Rebates - Web 10 ao 251 t 2023 nbsp 0183 32 The U S Treasury Department and the Internal Revenue Service on Thursday issued final rules for a new program that will boost tax credits for qualified