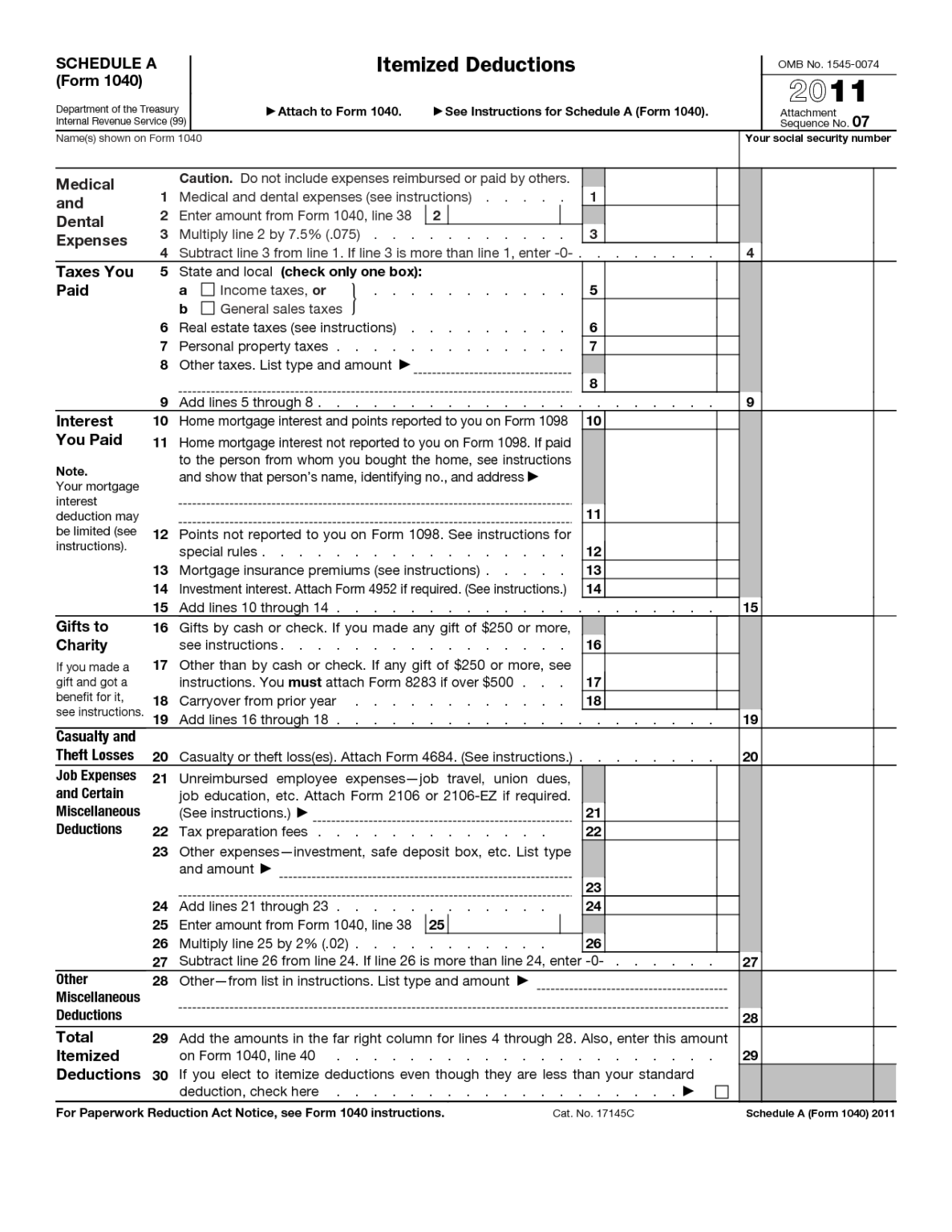

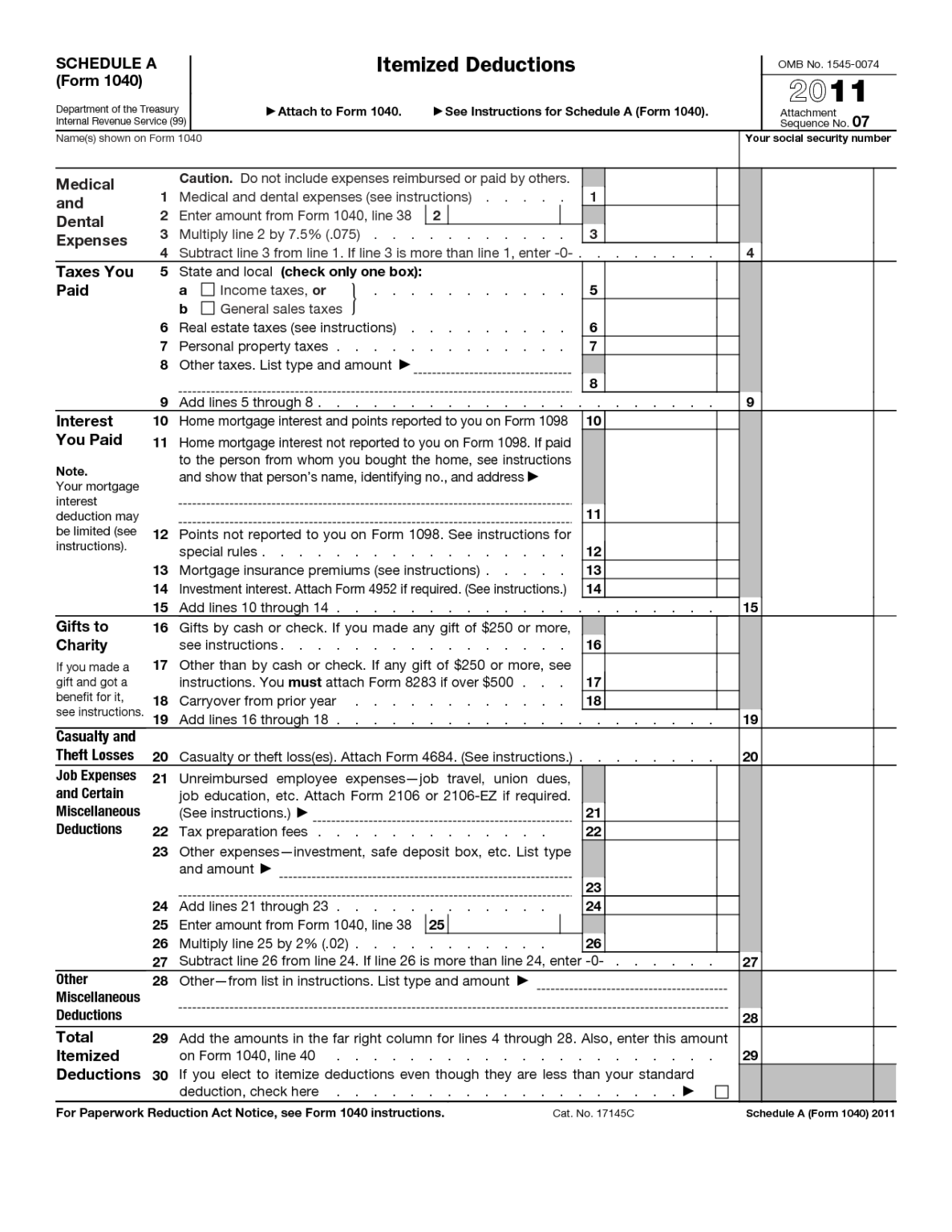

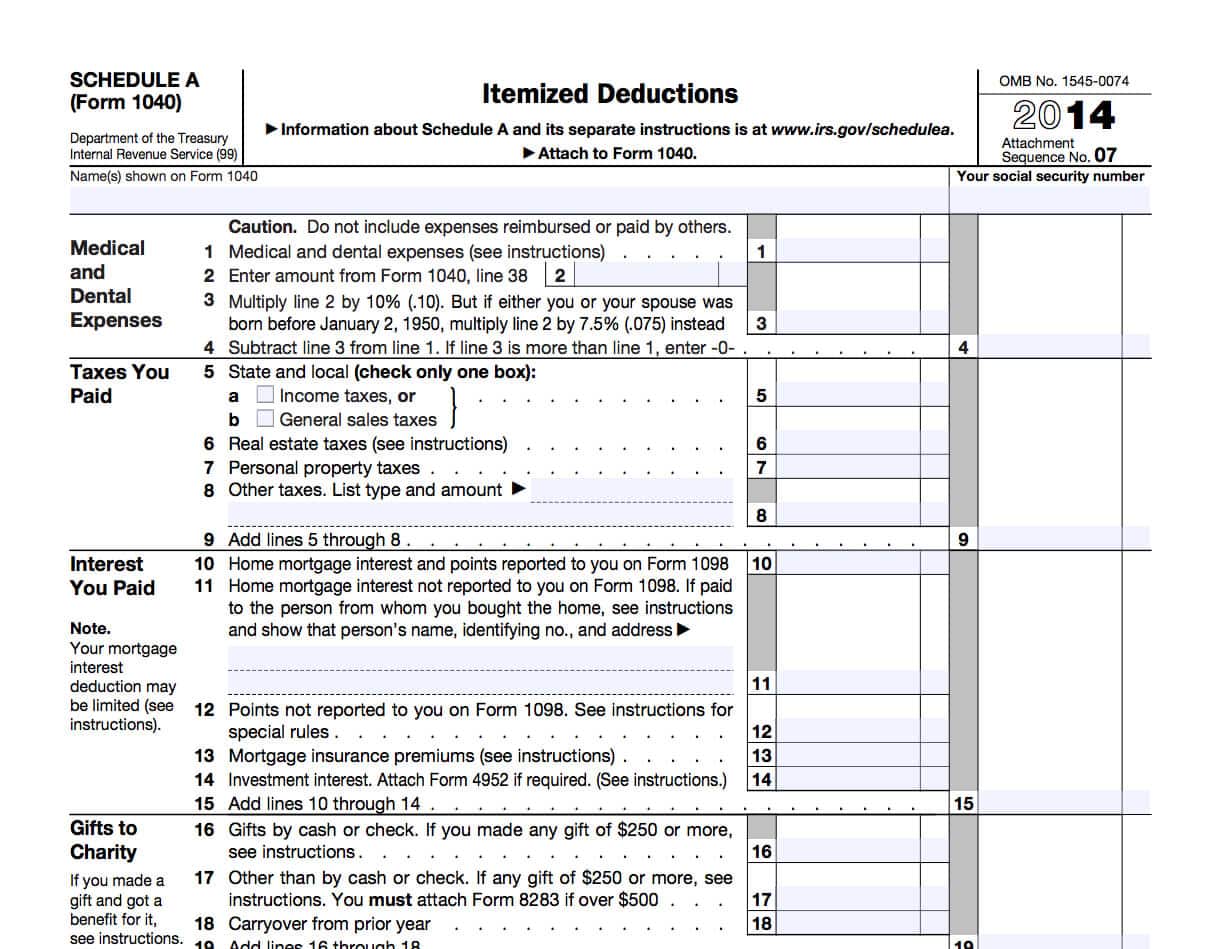

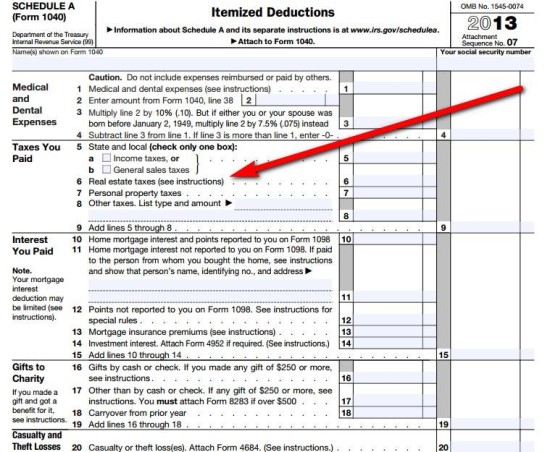

Irs Property Tax Deduction You deduct the tax in the taxable year you pay them The categories of deductible taxes are State local and foreign income taxes or state and local general sales taxes in lieu

The property tax deduction is great for homeowners Here s how it works in 2023 2024 and what you can do to save money Learn about the tax benefits and credits for homeowners such as mortgage interest real property taxes energy efficient improvements and more Find out what s new and what s

Irs Property Tax Deduction

Irs Property Tax Deduction

https://imageio.forbes.com/specials-images/dam/imageserve/781839868/0x0.jpg?format=jpg&width=1200

Rental Property Tax Forms What Is Required Real Property Management

https://rpmmultisite.s3-us-west-2.amazonaws.com/wp-content/uploads/2016/01/11193518/ThinkstockPhotos-167467072.jpg

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

What Is the Property Tax Deduction State and local property taxes are generally eligible to be deducted from the property owner s federal income taxes Deductible real If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your deductions on Schedule A of Form 1040 Still need to file An expert can help

The Internal Revenue Service IRS allows you to get some of your money back in the form of a property tax deduction for the cost of taxes that you must pay to local taxing Learn what property taxes are how to deduct them from your federal income taxes and what limits and rules apply Find out what types of property are deductible and

Download Irs Property Tax Deduction

More picture related to Irs Property Tax Deduction

Example Tax Deduction System For A Single Gluten free GF Item And

https://www.researchgate.net/profile/Julio-Bai/publication/274087526/figure/tbl1/AS:391861509345282@1470438472540/Example-tax-deduction-system-for-a-single-gluten-free-GF-item-and-calculations-for-tax.png

Kurzstudie Tax Deduction Scheme Belgien EUKI

https://www.euki.de/wp-content/uploads/2019/09/20180827_BE_Tax-deductions_Study-pdf.webp

Tax Deduction Worksheet Small Business Tax Small Business Tax

https://i.pinimg.com/originals/80/f5/2d/80f52dac2182daa554539d9580ab22d3.png

The property tax deduction allows you as a homeowner to write off state and local taxes you paid on your property from your federal income taxes This includes your How to claim the property tax deduction If you decide to claim the property tax deduction you can do so by completing a Schedule A form and submitting it to the IRS with

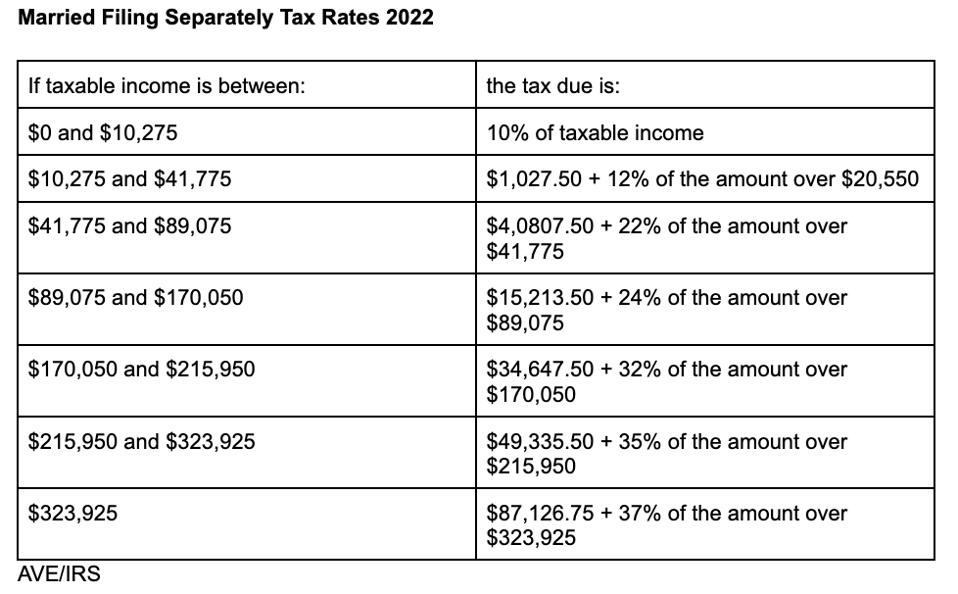

Under current tax law you may deduct up to 10 000 5 000 if single or married and filing separately of property taxes and either state and local income taxes or sales taxes Property tax is deducted as an itemized personal deduction on IRS Schedule A This means you may deduct your property taxes only if you itemize your personal deductions instead of taking

Self Employment Tax Deduction Worksheet

https://1044form.com/wp-content/uploads/2020/08/8-best-images-of-tax-itemized-deduction-worksheet-irs-1187x1536.png

What Are Pre tax Deductions Before Tax Deduction Guide

https://synder.com/blog/wp-content/uploads/sites/5/2023/03/what-are-pre-tax-deductions.png

https://www.irs.gov/taxtopics/tc503

You deduct the tax in the taxable year you pay them The categories of deductible taxes are State local and foreign income taxes or state and local general sales taxes in lieu

https://www.nerdwallet.com/article/taxes/property-tax-deduction

The property tax deduction is great for homeowners Here s how it works in 2023 2024 and what you can do to save money

How To Claim A IRS Medical Expense Tax Deduction 2020 2021 Tax

Self Employment Tax Deduction Worksheet

Charitable Contributions And How To Handle The Tax Deductions

How To Deduct Property Taxes On IRS Tax Forms

Tax Deduction On House Rent U S 80GG Without HRA For Employees

Section 194K Tax Deduction On Income From Mutual Fund Units

Section 194K Tax Deduction On Income From Mutual Fund Units

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

Progressive Charlestown Local Charities Lose Tax exempt Status

IRS Announces 2022 Tax Rates Standard Deduction

Irs Property Tax Deduction - If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your deductions on Schedule A of Form 1040 Still need to file An expert can help