Irs Solar Tax Credit 2023 Form Department of the Treasury Internal Revenue Service Residential Energy Credits Attach to Form 1040 1040 SR or 1040 NR Go to www irs gov Form5695 for instructions and the

Form 5695 is the official IRS tax form you must use to claim the federal solar tax credit when you file your taxes You can download a copy of Form 5695 PDF on the IRS website The form is updated every year so How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form 1040NR

Irs Solar Tax Credit 2023 Form

Irs Solar Tax Credit 2023 Form

https://powur.solar-energy-quote.com/wp-content/uploads/2022/02/2022-Solar-Tax-Credit-Explained-scaled.jpg

The Solar Tax Credit Explained 2022 YouTube

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2022/12/solar-tax-credit-2023-750x422.png

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house You will need four IRS tax forms to file for your solar tax credit Form 1040 Schedule 3 Form 1040 Form 5695 Instructions for Form 5695 latest version You ll also need Receipts from your solar installation A

Step by step instructions for using IRS Form 5695 to claim the 30 federal solar tax credit This webpage provides an overview of the federal investment and production tax credits for businesses that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP energy generation technologies

Download Irs Solar Tax Credit 2023 Form

More picture related to Irs Solar Tax Credit 2023 Form

IRS Releases Guidance On Low income Solar Tax Credit Booster Pv

https://pv-magazine-usa.com/wp-content/uploads/sites/2/2022/05/61c317382fb30420ae671c03_Group-238-p-1080.jpeg

How Does The Federal Solar Tax Credit Work IVee League Solar

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGGUgZShlMA8=&rs=AOn4CLD0u4VMgupTPJWuWOaZRVksaroCPw

Form 5695 is the IRS document you submit to get a credit on your tax return for installing solar panels or adding to or upgrading a solar system on your home We commonly think of Tax Form 5695 as the Residential Clean How to Claim the Full 30 Solar Tax Credit This Year Claiming the solar tax credit on your taxes is easy Just follow the steps below and receive the credit on your 2022 taxes Ensure your property is eligible for the ITC File the

If you re claiming a tax credit for a solar power system installed after 2022 you ll need to complete IRS form 5695 Insert the total installation purchase and sales tax costs of How does the federal solar tax credit work What costs are covered by the solar tax credit Qualified homes How do I qualify for the solar tax credit What are the benefits of

Federal Solar Tax Credit BenefitsFinder

https://benefitsfinder.com/wp-content/uploads/sites/4/2023/02/federal-solar-tax-credit.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

https://www.irs.gov/pub/irs-pdf/f5695.pdf

Department of the Treasury Internal Revenue Service Residential Energy Credits Attach to Form 1040 1040 SR or 1040 NR Go to www irs gov Form5695 for instructions and the

https://www.energysage.com/solar/how …

Form 5695 is the official IRS tax form you must use to claim the federal solar tax credit when you file your taxes You can download a copy of Form 5695 PDF on the IRS website The form is updated every year so

IRS Solar Tax Credit Reroofing And Roof Repairs Green Ridge Solar

Federal Solar Tax Credit BenefitsFinder

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

Solar Tax Credit Guide And Calculator

2023 Form 941 Pdf Printable Forms Free Online

2023 Form 941 Pdf Printable Forms Free Online

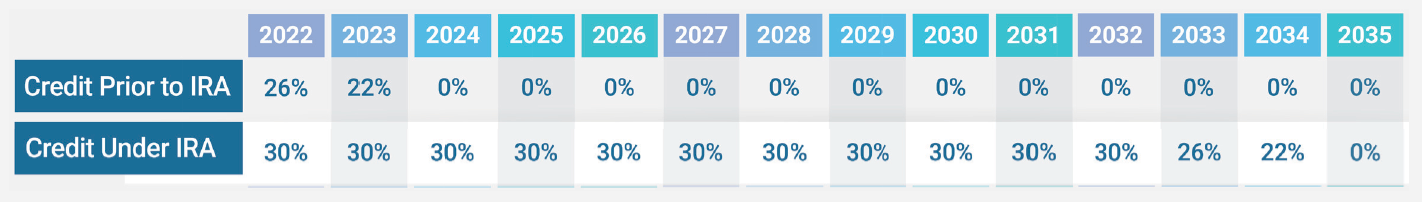

Solar Tax Credit Extension For 2023 And Beyond Utility Resource Guide

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

How Does The Federal Solar Tax Credit Work CRJ Contractors

Irs Solar Tax Credit 2023 Form - Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house