Irs Stimulus Tax Rebate Web 20 d 233 c 2022 nbsp 0183 32 Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus payment

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Irs Stimulus Tax Rebate

Irs Stimulus Tax Rebate

https://media.wcnc.com/assets/WCNC/images/7710c714-dfb9-48c1-b286-e0823fd4abe6/7710c714-dfb9-48c1-b286-e0823fd4abe6_1140x641.jpg

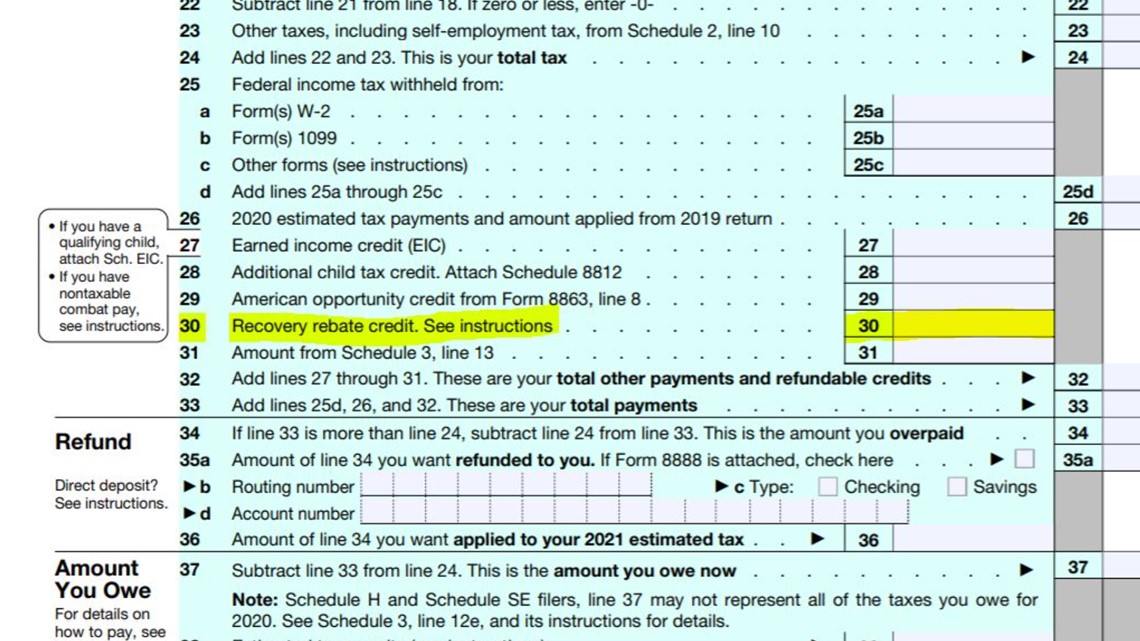

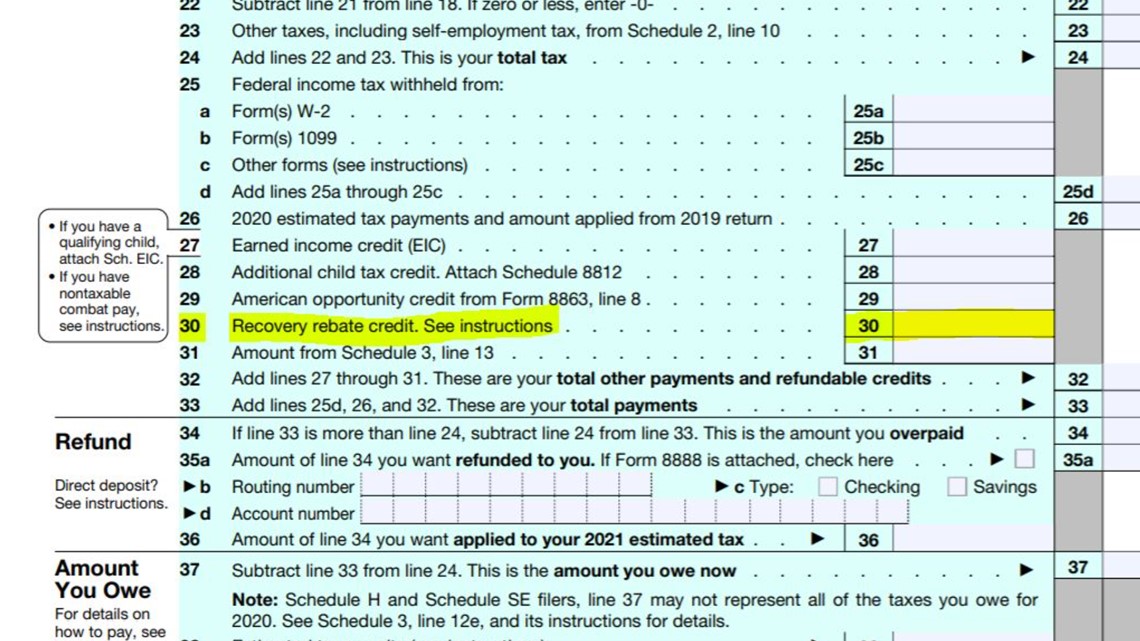

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

![]()

Irs Stimulus Payments Check Status StimulusProTalk

https://www.stimulusprotalk.com/wp-content/uploads/irs-stimulus-check-tracker-heres-how-to-track-your.jpeg

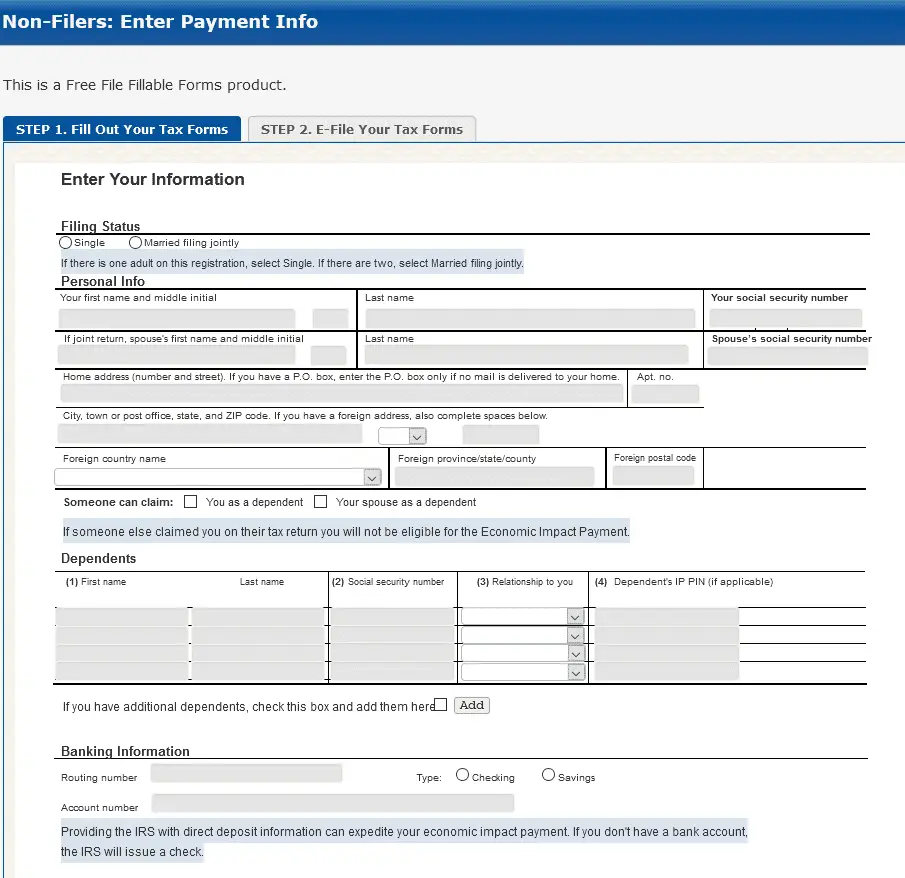

Web The IRS has issued all first second and third Economic Impact Payments Most eligible people already received their Economic Impact Payments People who are missing Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 WASHINGTON IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early

Web 9 f 233 vr 2023 nbsp 0183 32 The IRS has agreed that it will not offset your stimulus rebate to pay for federal tax debts but the agency cannot extend this discretion for state and other federal Web 9 sept 2023 nbsp 0183 32 Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have received special rebates and

Download Irs Stimulus Tax Rebate

More picture related to Irs Stimulus Tax Rebate

Stimulus Checks Get My Payment IRS Launches Stimulus Check Tracking

https://www.abc4.com/wp-content/uploads/sites/4/2020/04/My-Post-2-1-1.jpg?w=1280&h=720&crop=1

Irs Rebate Checks 2023 RebateCheck

https://www.rebatecheck.net/wp-content/uploads/2023/04/fourth-stimulus-checks-tax-return-irs-stimulusprotalk.jpeg

100 Million Stimulus Checks Start Arriving Today Here s How To Track

https://amaznews.com/wp-content/uploads/2021/03/This-Is-What-a-Real-Paper-Stimulus-Check-Looks-Like.jpg

Web 7 sept 2023 nbsp 0183 32 IRS weighs in on state rebate payments In most cases according to the IRS taxpayers who receive special state payments one time refunds rebates or other Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 27 avr 2023 nbsp 0183 32 Note Stimulus checks have ended and the IRS quot Get My Payment quot tool has been taken down The government issued 931 billion in stimulus checks in 2020 and Web 10 d 233 c 2021 nbsp 0183 32 You should complete the Recovery Rebate Credit Worksheet or use tax preparation software to determine if you may claim the Recovery Rebate Credit on your

Federal Individual Income Tax Rates By Year 1913 2013

https://flaglerlive.com/wp-content/uploads/taxes-tax-returns.jpg

Irs Gov Non Filers Form For Stimulus Check StimulusInfoClub

https://www.stimulusinfoclub.com/wp-content/uploads/new-irs-site-could-make-it-easy-for-thieves-to-intercept-some-stimulus.png

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 d 233 c 2022 nbsp 0183 32 Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus payment

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Federal Individual Income Tax Rates By Year 1913 2013

IRS Offers Tool To Track Your Stimulus Payment

Did Not Get A Stimulus Check Check For A Recovery Rebate Credit

Irs Tax Fourth Stimulus Checks Ohio Maurine Stiles

Recovery Rebate Credit 2020 Calculator KwameDawson

Recovery Rebate Credit 2020 Calculator KwameDawson

Irs Get My Payment Second Stimulus StimulusProTalk

Recovery Rebate Tax Credit Guidelines 2022 How To File For The

What You Need To Know About New IRS Stimulus Tax Breaks Affordable

Irs Stimulus Tax Rebate - Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 WASHINGTON IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early