Irs Tax Credit For New Ac Unit Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and

Irs Tax Credit For New Ac Unit

Irs Tax Credit For New Ac Unit

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

California Earned Income Tax Credit CalEITC

https://res.cloudinary.com/yansusanto/image/upload/v1622380808/CA.png

EU built Electric Vehicle Tax Credit Approval Will Face Internal And

https://s1.cdn.autoevolution.com/images/news/approval-of-tax-credit-for-union-built-evs-will-face-internal-and-foreign-disputes-173073_1.jpg

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the The rebates can help you save money on select home improvement projects that can lower your energy bills DOE estimates these rebates will save households up to 1 billion annually on energy bills

The renewed Energy Efficient Home Improvement Tax Credit 25C program increases the HVAC tax credit limit for installing CEE Top Tier high efficiency equipment it is retroactive to January 1 2022 and Which Tax Credits Are Potentially Available for HVAC Systems The rebates would apply for heating and cooling systems installed between Jan 1 2023 and Dec 31 2032 The following HVAC tax credits could be

Download Irs Tax Credit For New Ac Unit

More picture related to Irs Tax Credit For New Ac Unit

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

Another Way To Save New Tax Credit For Plan Participants

https://insights.rpag.com/hubfs/Imported_Blog_Media/GettyImages-1077235824-1.jpg

Art And Cosmetic Industries Are Benefiting From IRS Tax Credit Pros

https://data.ibtimes.sg/en/full/63750/irs-tax-credit-pros.jpg

How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Tax Credit Bill For Rural Physicians Passes House Committee

https://1.bp.blogspot.com/-A3hfue5TdzI/YCYQAXI0PtI/AAAAAAAARg0/NBzdPnoWGtQyKMN7CrCBjv4WwAt1xY2-gCLcBGAsYHQ/s1628/O%2527Donnell%252C%2BTerry.jpg

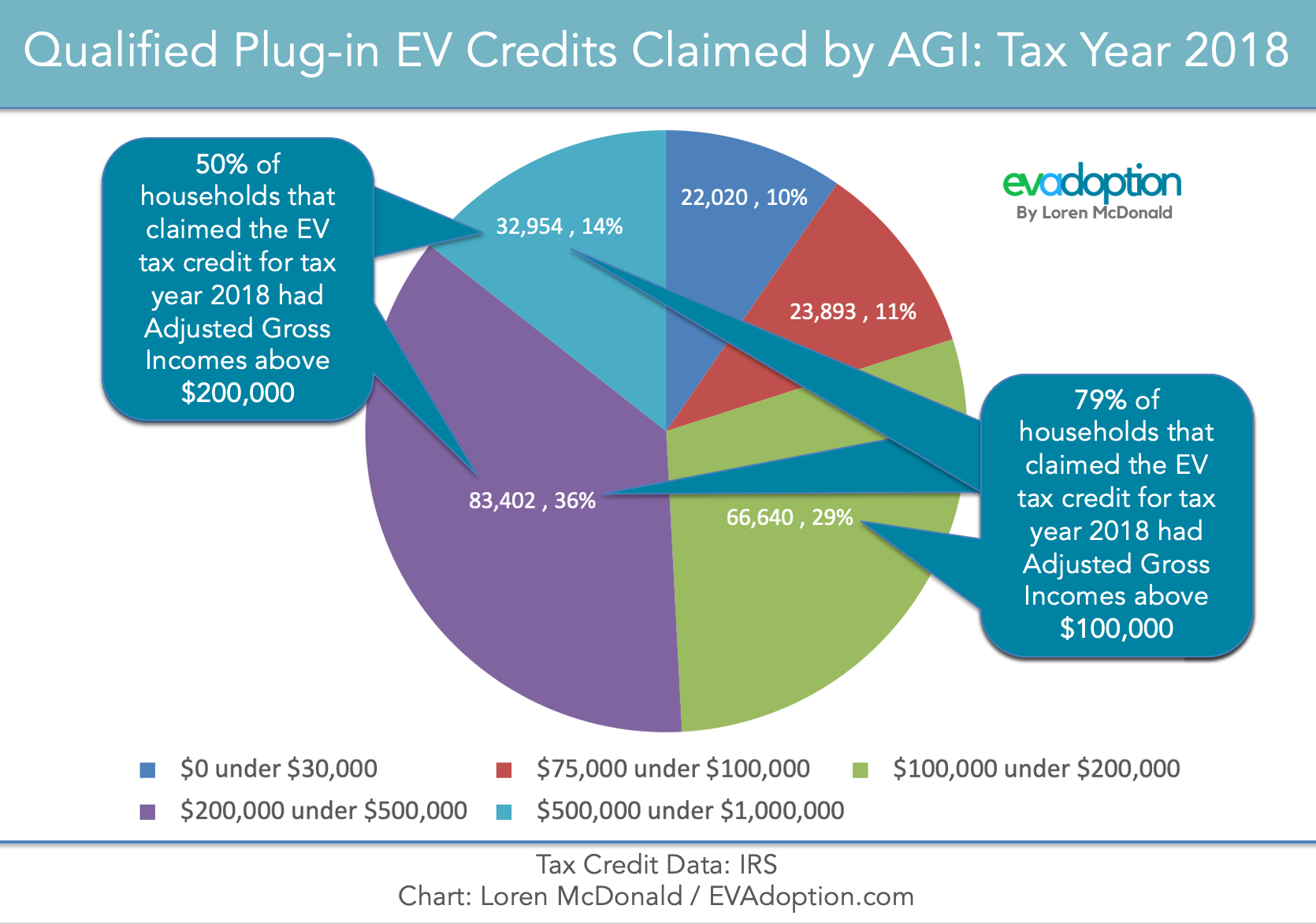

IRS Tax credit by Household AGI 2018 updated EVAdoption

https://evadoption.com/wp-content/uploads/2021/02/IRS-Tax-credit-by-Household-AGI-2018-updated.png

https://www.energystar.gov/about/federal-tax...

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal

https://www.irs.gov/credits-deductions/home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were

A Little Known Tax Credit For Your Business The ERTC Helium Advisors

Tax Credit Bill For Rural Physicians Passes House Committee

Get Your Full Illinois Property Tax Credit When Selling A Home

Learn About The NEW State Tax Credit For Working Families Key

IRS Changes For Tax Year 2022 Returns Next Step Enterprises

Everything You Need To Know About Child Tax Credits And The 2022 Tax

Everything You Need To Know About Child Tax Credits And The 2022 Tax

Modifications To The 45Q Tax Credit Great Plains Institute

New Business Tax Credit May Help Child Care Crisis In Kansas

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

Irs Tax Credit For New Ac Unit - Using the Federal Energy Tax Credits can help you add value to your home and make it more energy efficient by installing Energy Star rated appliances If it s time