Irs Tax Credit On Hybrid Cars If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug

Clean vehicle tax credits We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Irs Tax Credit On Hybrid Cars

Irs Tax Credit On Hybrid Cars

https://images.cars.com/cldstatic/wp-content/uploads/toyota-bz4x-2023-18-charging-cable-charging-port-exterior-red-suv-scaled.jpg

The Florida Hybrid Car Rebate Save Money And Help The Environment

https://cdn.osvehicle.com/do_hybrid_cars_get_a_tax_rebate.png

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

https://www.taxproadvice.com/wp-content/uploads/tax-credits-drive-electric-northern-colorado-932x1024.png

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 Looking at buying a clean vehicle Clean Vehicle Credits can help you maximize your refund at tax time The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit for qualified plug in electric

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids A year ago nearly every new electric vehicle and plug in hybrid on the market qualified for a federal tax credit of up to 7 500 provided it was manufactured in North America But the rules

Download Irs Tax Credit On Hybrid Cars

More picture related to Irs Tax Credit On Hybrid Cars

Art And Cosmetic Industries Are Benefiting From IRS Tax Credit Pros

https://data.ibtimes.sg/en/full/63750/irs-tax-credit-pros.jpg

EV Federal IRS Tax Credit Survival Is Good News For Consumers In

http://www.inwheeltime.com/wp-content/uploads/2017/12/Pacifica-Hybrid-1.jpg

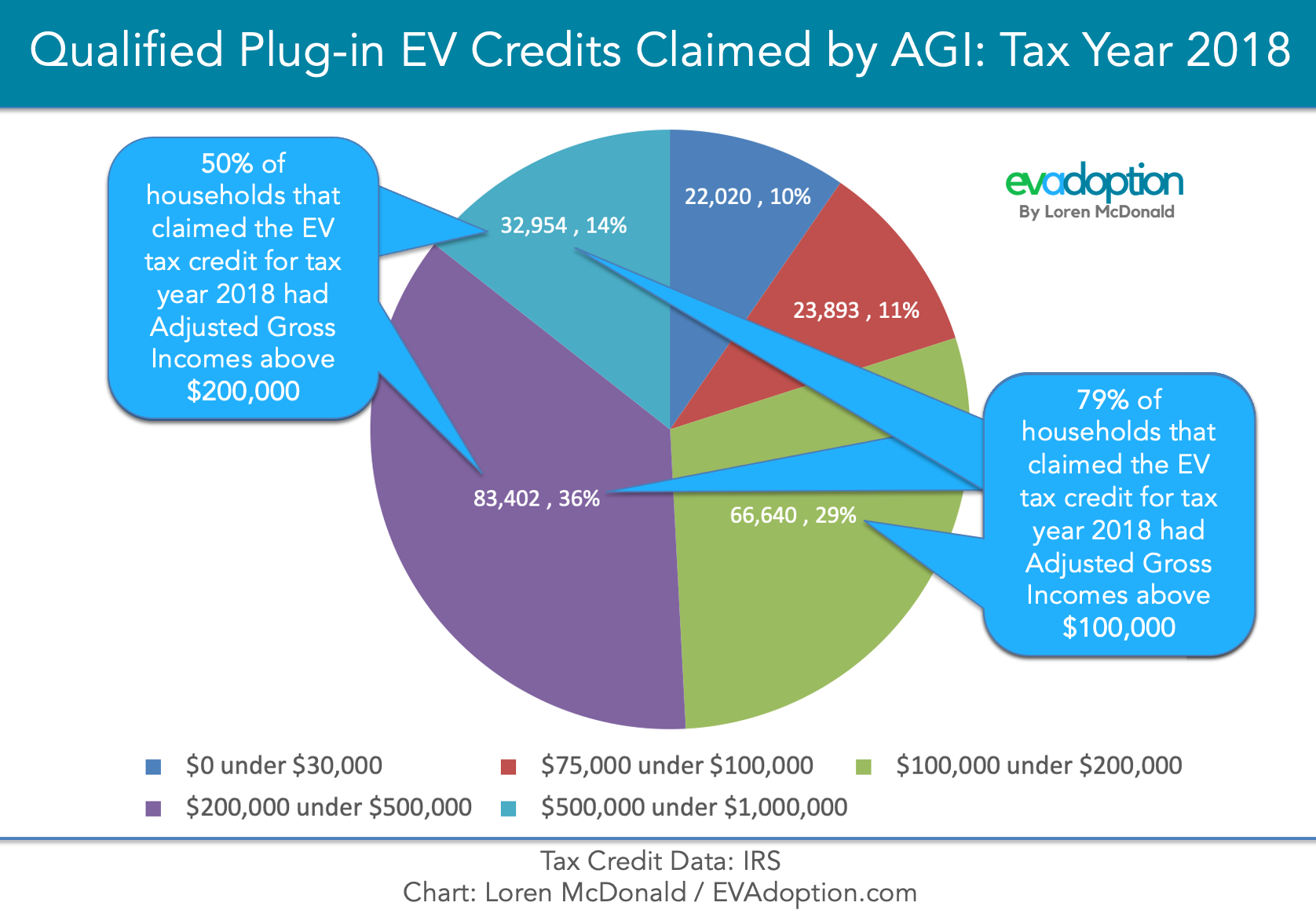

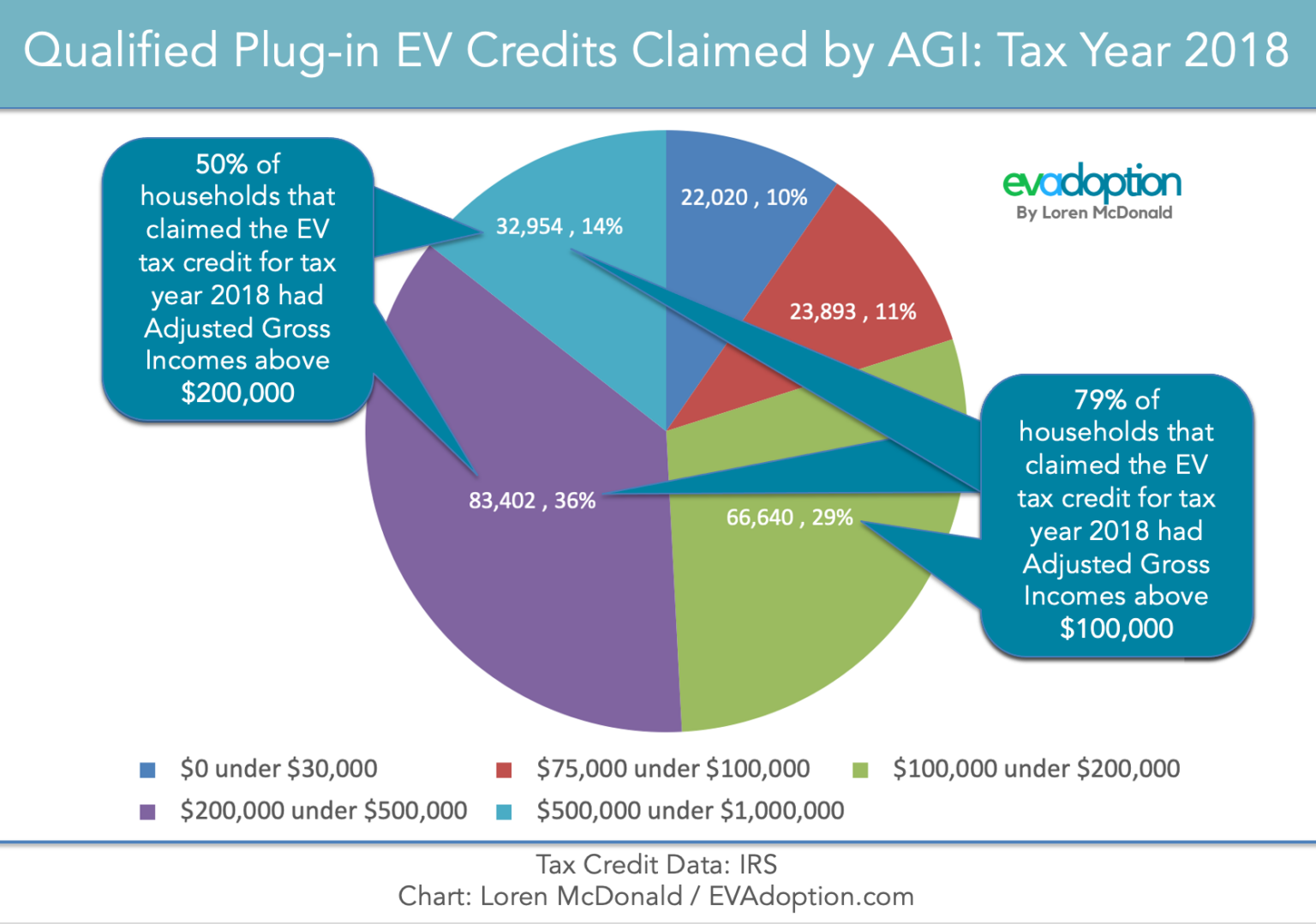

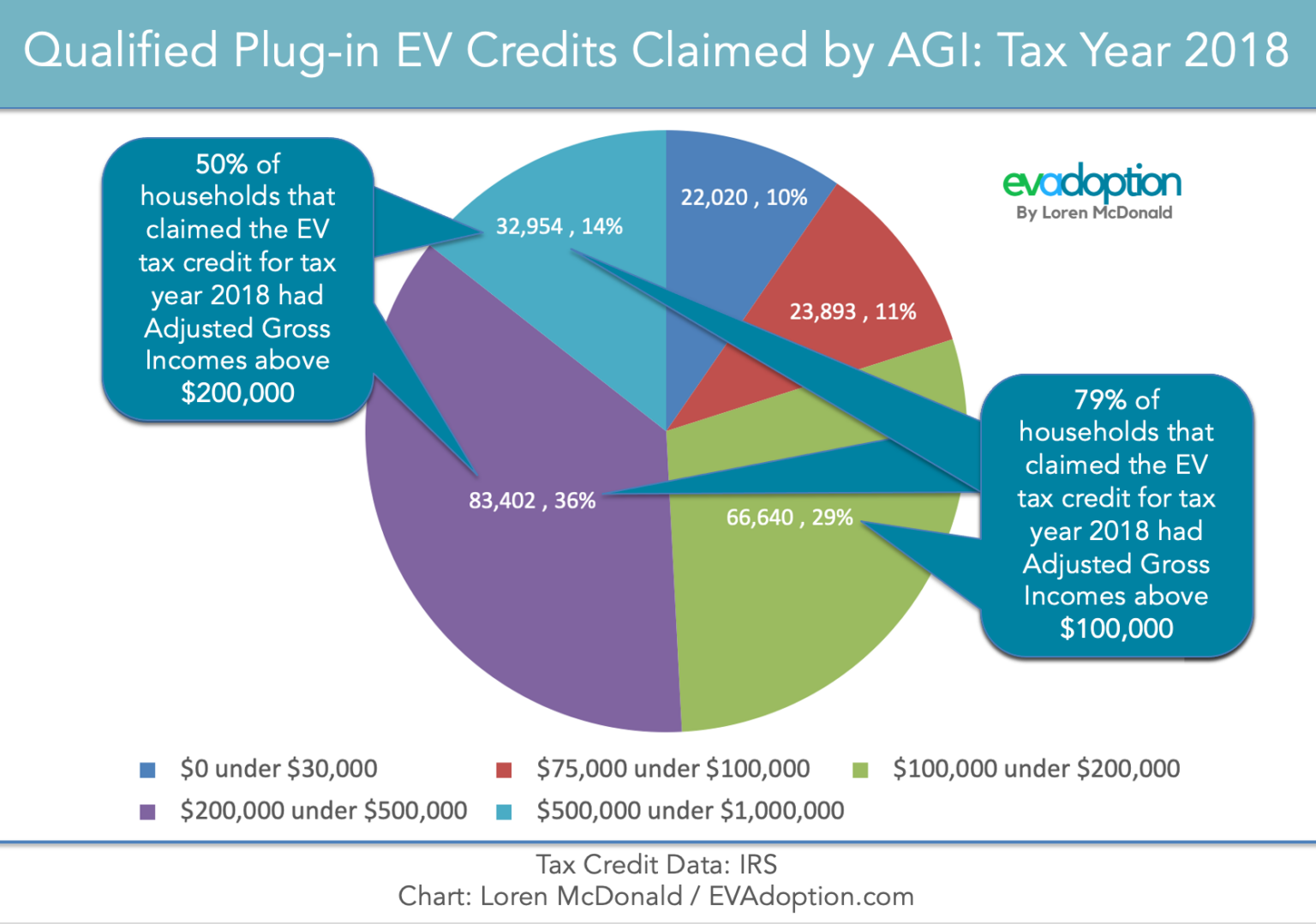

IRS Tax credit by Household AGI 2018 updated FINAL2 EVAdoption

https://evadoption.com/wp-content/uploads/2021/02/IRS-Tax-credit-by-Household-AGI-2018-updated-FINAL.png

All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric

Which EVs qualify for tax credits Here s a list of car models new and used that qualify for EV federal tax credits As of late 2023 just seven plug in hybrids are eligible for a federal tax credit but there s a workaround

IRS Tax credit by Household AGI 2018 updated EVAdoption

https://evadoption.com/wp-content/uploads/2021/02/IRS-Tax-credit-by-Household-AGI-2018-updated-1536x1078.png

Irs Form 1116 Printable Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/2125/21255/2125508/irs-form-1116-foreign-tax-credit_print_big.png

https://www.irs.gov/newsroom/qualifying-clean...

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug

https://www.irs.gov/clean-vehicle-tax-credits

Clean vehicle tax credits We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to

Employee Retention Credit IRS Tax Credit

IRS Tax credit by Household AGI 2018 updated EVAdoption

35 Important Pros Cons Of Hybrid Cars E C

AAAMA American Acupuncture Alternative Medicine Association

Beware IRS Dirty Dozen List Includes R D Tax Credit Security Sales

Dominican Republic Adoption Agency Adoption From The Dominican

Dominican Republic Adoption Agency Adoption From The Dominican

Find Out If You Qualify For An IRS Tax Credit Worth Up To 3 600 The

Our Staff Office Of Student Accounts

American Acupuncture Alternative Medicine Association

Irs Tax Credit On Hybrid Cars - The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs