Irs Tax Extension Form 7004 Online Learn how to e file an automated extension using Form 7004 and the restrictions that apply Form 7004 can be e filed through the Modernized e File MeF platform All the returns shown on Form 7004 are eligible for an automatic extension of time to file from the due date of the return

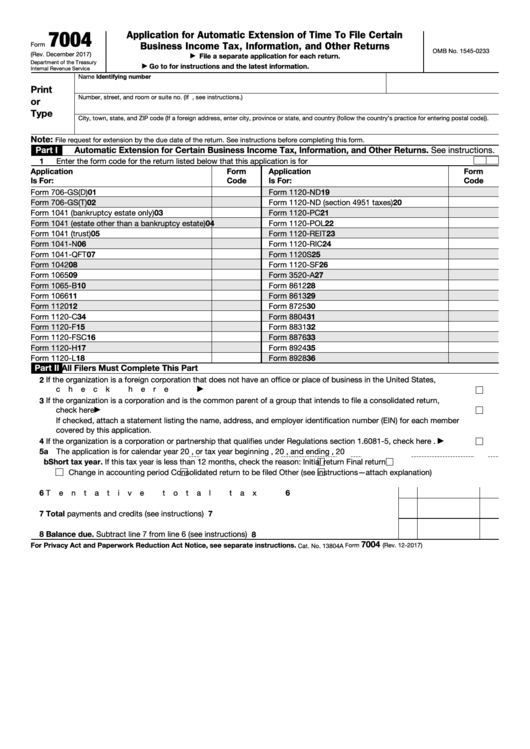

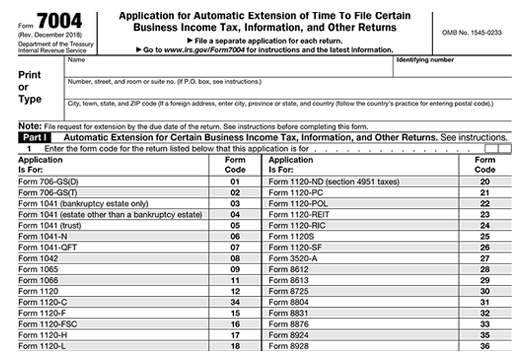

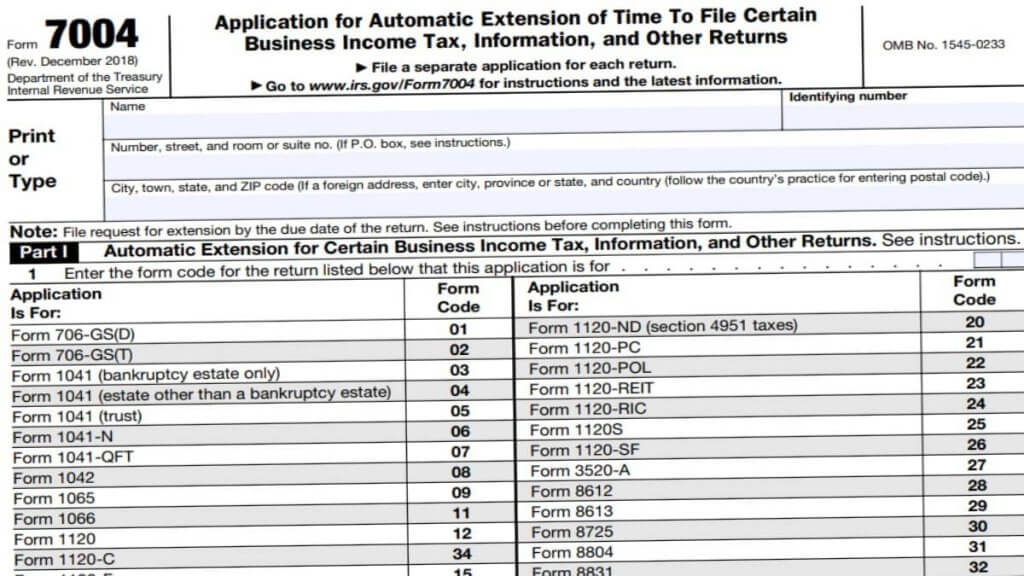

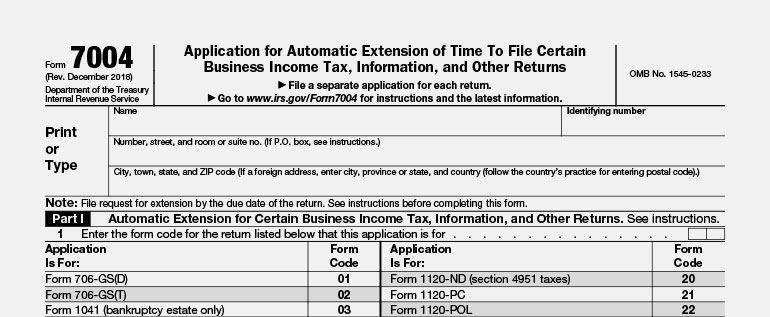

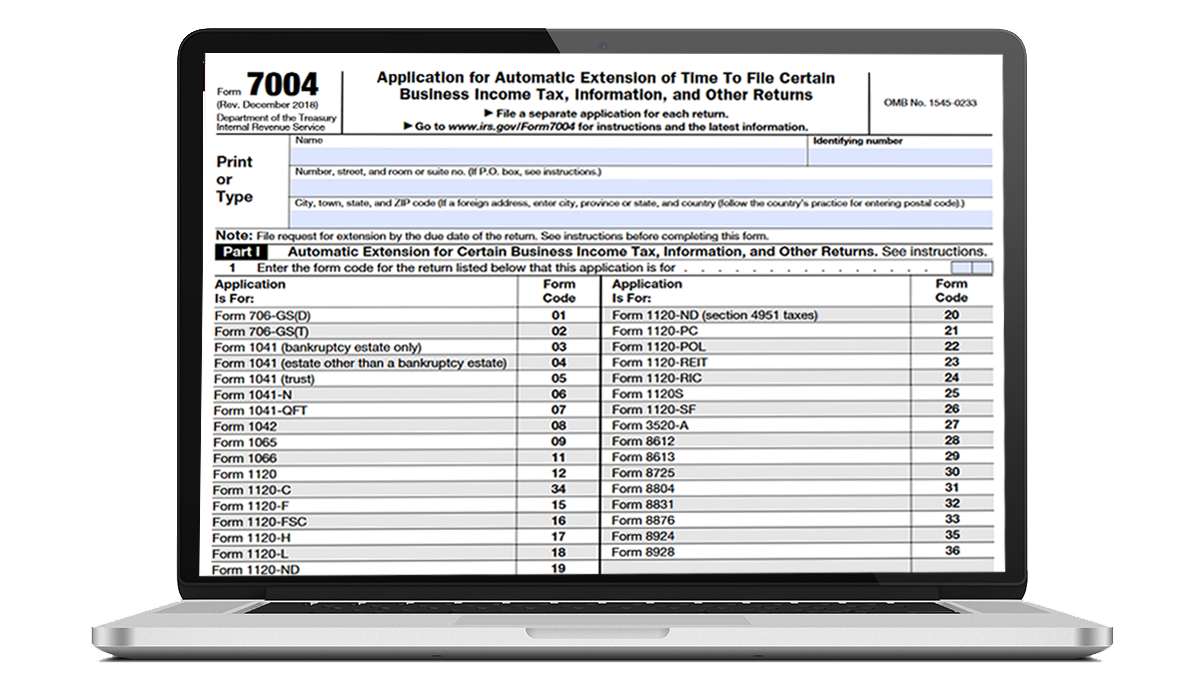

Form 7004 Rev December 2018 Department of the Treasury Internal Revenue Service Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns File a separate application for each return Go to www irs gov Form7004 for instructions and the latest information OMB No 1545 0233 1 File Form 4868 Application for Automatic Extension of Time To File U S Individual Income Tax Return You can file by mail online with an IRS e filing partner or through a tax professional 2 Estimate how much tax you owe for the year on the extension form Subtract the taxes you already paid for the filing year Find more on

Irs Tax Extension Form 7004 Online

Irs Tax Extension Form 7004 Online

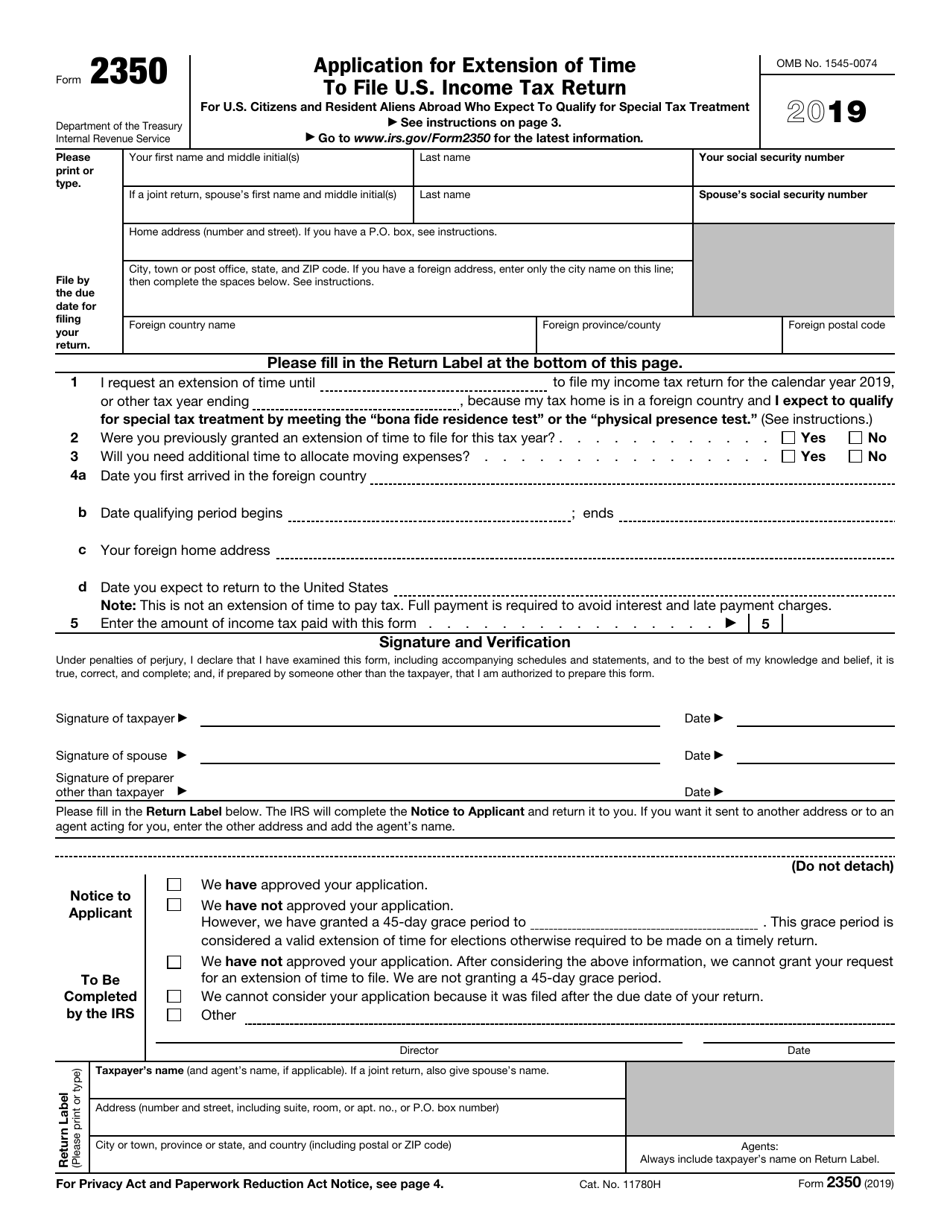

https://uploads-ssl.webflow.com/5f9a1900790900e2b7f25ba1/62547502a2486c6ddefbf6e3_personalTaxExtension.png

![]()

Free Fillable Irs Form 7004 Printable Forms Free Online

https://cdn.shortpixel.ai/client/q_glossy,ret_img,w_695/https://www.excelcapmanagement.com/wp-content/uploads/2019/09/FORM-7004-page-001-e1569485733414.jpg

Form 7004 Fillable Form Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/302/3027/302777/page_1_thumb_big.png

Use Form 7004 to request an automatic extension of time to file certain business income tax information and other returns The extension will be granted if you complete Form 7004 properly make a proper estimate of the tax if applicable file Form 7004 by the due date of the return for which the extension is requested and pay any tax Form 7004 Application for Automatic Extension of Time to File Certain Business Income Tax Information and Other Returns Form 1138 Extension of Time for Payment of Taxes by a Corporation Expecting a Net

Use the chart to determine where to file Form 7004 based on the tax form you complete Select the appropriate form from the table below to determine where to send the Form 7004 Application for Automatic Extension of Time to File Certain Business Income Tax Information and Other Returns A taxpayer who needs to file Forms 7004 for multiple form types may submit the Forms 7004 electronically For example taxpayers submitting one Form 7004 with Type of Return Code 31 for the Form 8804 and another Form 7004 with Type of Return Code 09 for the Form 1065 may file the Forms electronically

Download Irs Tax Extension Form 7004 Online

More picture related to Irs Tax Extension Form 7004 Online

Form 7004 Fillable Form Printable Forms Free Online

https://www.expressextension.com/Content/Images/newImages/form7004Img.png

Irs Form 7004 Fillable Printable Forms Free Online

https://amulettejewelry.com/wp-content/uploads/2018/08/irs-form-7004-irs-tax-extension-form-online-3-11-212-applications-for-of-time-to-file-internal-335-2017-efile-7004-print-2016-2018-business-llc-4868-1040-1099-printable-e-official-electronic-768x930.jpg

Tax Extension Form Printable Printable Forms Free Online

https://www.taxuni.com/wp-content/uploads/2020/09/Business-Tax-Extension-7004-Form-2021-1024x576.jpg

In plain terms Form 7004 is a tax form most business owners can use to request more time to file their business income tax returns To successfully use Form 7004 you ll have to Complete Form 7004 Estimate and pay the taxes you owe File Form 7004 before or on the deadline of the appropriate tax form Make sure you calculate your tax Generally Form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns To file Form 7004 using TaxAct From within your TaxAct return Online or Desktop click Filing to

IRS Form 7004 is the Application for Automatic Extension of Time to File Certain Business Income Tax Information and Other Returns It s used to request more time to file business tax returns for partnerships multiple member LLCs filing as partnerships corporations or S corporations Form 7004 is a document that enables business owners to request a tax filing extension for certain tax forms The IRS uses the form to document the businesses that have requested an extension and to grant those extensions On the form businesses can indicate the specific tax forms they need an extension for Once filed Form 7004 grants you an

The Small Business Owners Guide To Form 7004 To Get A Tax Extension

https://www.deskera.com/blog/content/images/2022/05/tax-7004.jpg

File IRS Tax Extension Form 7004 Online TaxBandits Fill Online

https://www.pdffiller.com/preview/459/107/459107609/big.png

https://www.irs.gov/e-file-providers/e-filing-form...

Learn how to e file an automated extension using Form 7004 and the restrictions that apply Form 7004 can be e filed through the Modernized e File MeF platform All the returns shown on Form 7004 are eligible for an automatic extension of time to file from the due date of the return

https://www.irs.gov/pub/irs-pdf/f7004.pdf

Form 7004 Rev December 2018 Department of the Treasury Internal Revenue Service Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns File a separate application for each return Go to www irs gov Form7004 for instructions and the latest information OMB No 1545 0233

Free Fillable Irs Form 7004 Printable Forms Free Online

The Small Business Owners Guide To Form 7004 To Get A Tax Extension

Tax Filing Mistakes To Avoid When Filing IRS Extension Forms 4868 And

How To File A Business Tax Extension In 2022 Tax Hive

E File IRS Form 7004 Business Tax Extension Form 7004 Online

Cheapest Way To File IRS Business Tax Extension With Form 7004 ONLINE

Cheapest Way To File IRS Business Tax Extension With Form 7004 ONLINE

Extension Form 7004 For 2022 TaxExcise IRS Authorized

IRS Tax Extension Form 7004 And Form 4868 Are Due This April 15

File Form 1065 Extension Online Partnership Tax Extension

Irs Tax Extension Form 7004 Online - A taxpayer who needs to file Forms 7004 for multiple form types may submit the Forms 7004 electronically For example taxpayers submitting one Form 7004 with Type of Return Code 31 for the Form 8804 and another Form 7004 with Type of Return Code 09 for the Form 1065 may file the Forms electronically