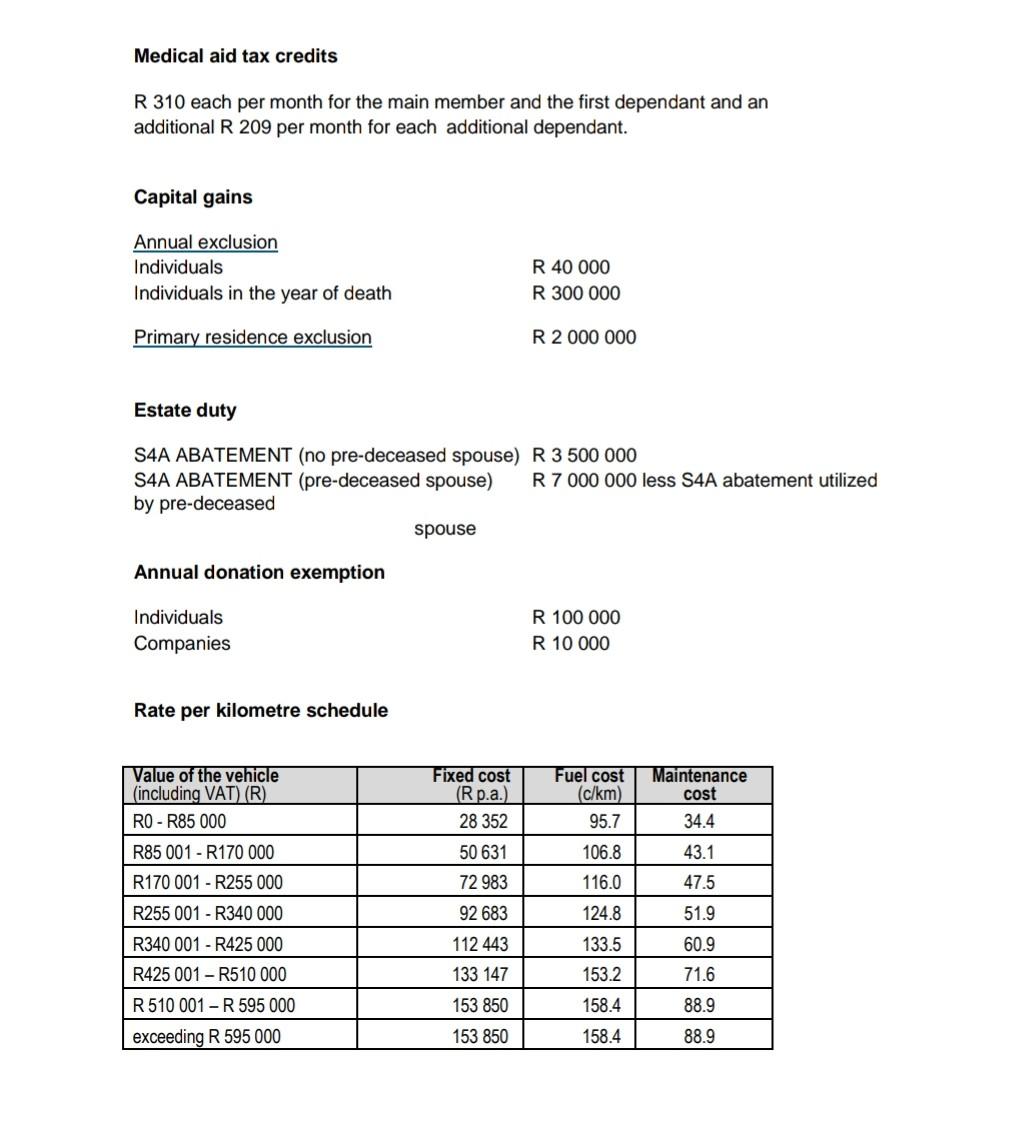

Income Tax Rebate On Medical Bills Web 17 juil 2019 nbsp 0183 32 In the case that the respective patient is a senior citizen then the maximum amount of deduction is Rs 1lakh Section 80DDB deduction limits Please note the

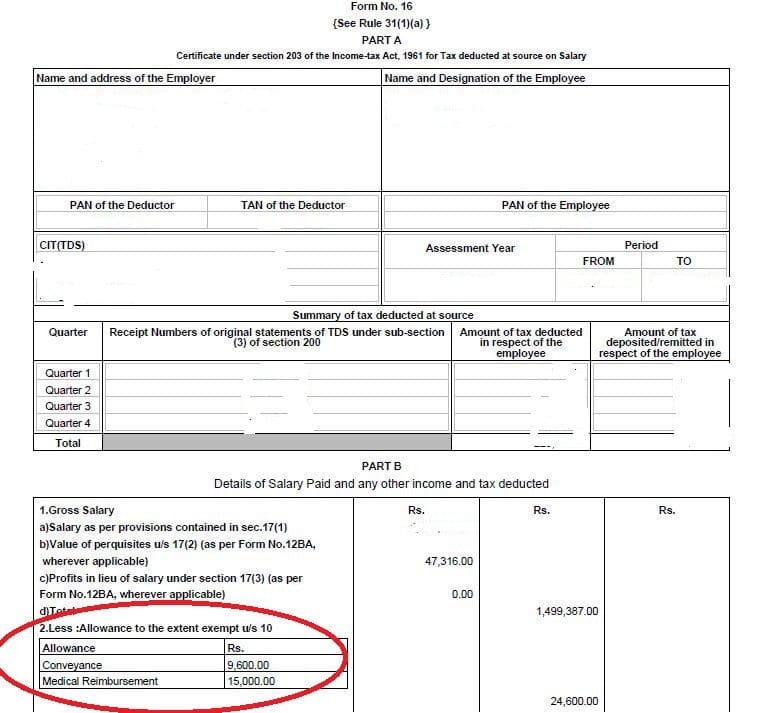

Web 13 mai 2017 nbsp 0183 32 The Income Tax Act allows tax exemption of up to Rs 15 000 on medical reimbursements paid by the employer What is the Eligibility to Claim Medical Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self

Income Tax Rebate On Medical Bills

Income Tax Rebate On Medical Bills

http://www.relakhs.com/wp-content/uploads/2014/11/Medical-allowance-form-16.jpg

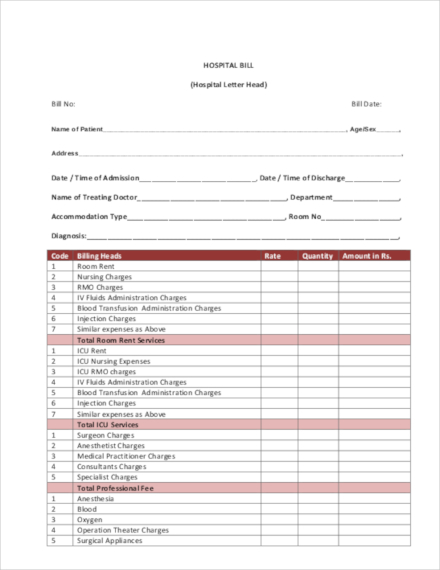

Sample Of A Medical Bill Medical Billing Pinterest Bill O brien

https://s-media-cache-ak0.pinimg.com/originals/3c/53/f7/3c53f7e40090a87f6b39f42a2cc20f0c.jpg

Solved QUESTION TWO 30 MARKS The Following Information Is Chegg

https://media.cheggcdn.com/study/ae2/ae2e3510-2d3b-40ee-8f9c-99f39b17ccc4/image

Web 14 juin 2018 nbsp 0183 32 As per section 80D a taxpayer can deduct tax on premiums paid towards medical insurance for self spouse parents and dependent children Individuals and Web 12 juin 2020 nbsp 0183 32 This is dealt in section 17 2 of the Income Tax Act as perquisite The whole amount of expenses incurred by the employer will be allowable expenditure to such employer under Income Tax Act In case

Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions Web 20 sept 2020 nbsp 0183 32 Although the Income Tax Act permits deductions on medical expenditures but you need to know if you are eligible to claim the benefits Also Read Deductions

Download Income Tax Rebate On Medical Bills

More picture related to Income Tax Rebate On Medical Bills

Health Insurance Tax Deduction FY 2019 20 AY 2020 21 Section 80D

https://www.relakhs.com/wp-content/uploads/2019/02/Income-tax-benefit-on-health-insurance-premium-under-section-80D-FY-2019-20-AY-2020-21-medical-insurance.jpg

Editable Medical Bill Template Pdf

https://eforms.com/images/2016/10/medical-invoice-template.png

![]()

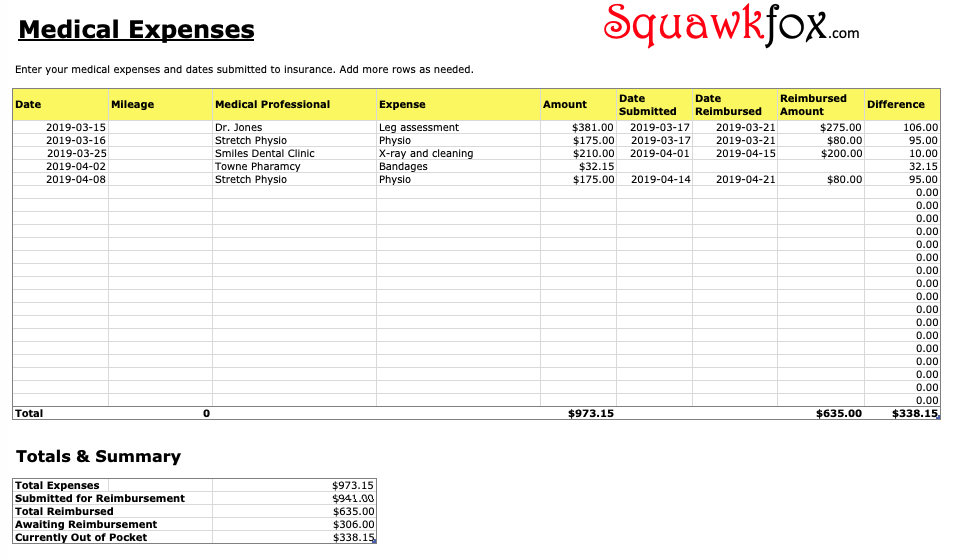

Hospital Patient Medical Bill Tracker Template Word Excel Templates

https://www.wordexceltemplates.com/wp-content/uploads/2015/04/Patient-medical-bill-tracker.jpg

Web 12 janv 2023 nbsp 0183 32 Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems simple there are a variety of rules about Web 16 nov 2022 nbsp 0183 32 What is it An Additional Medical Expenses Tax Credit also known as an AMTC is a rebate which in itself is non refundable but which is used to reduce the

Web If you have spent less than Rs 15 000 then only the incurred expense is tax free E g if your medical expense in a year with supporting bills was Rs 9 000 you will get a tax exemption of Rs 9 000 only out of the Web 9 f 233 vr 2023 nbsp 0183 32 Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can incur an amount higher than INR 15 000 on medical

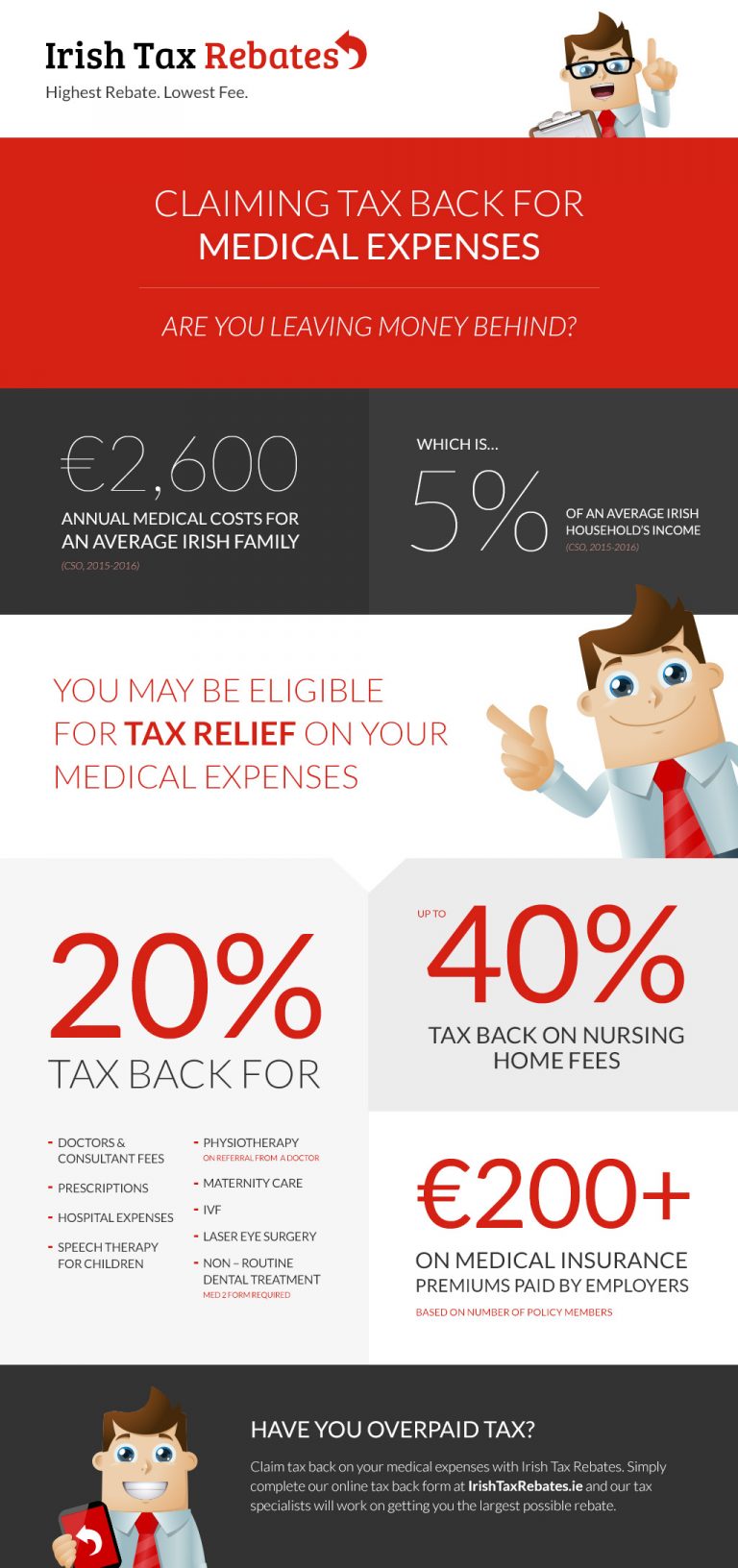

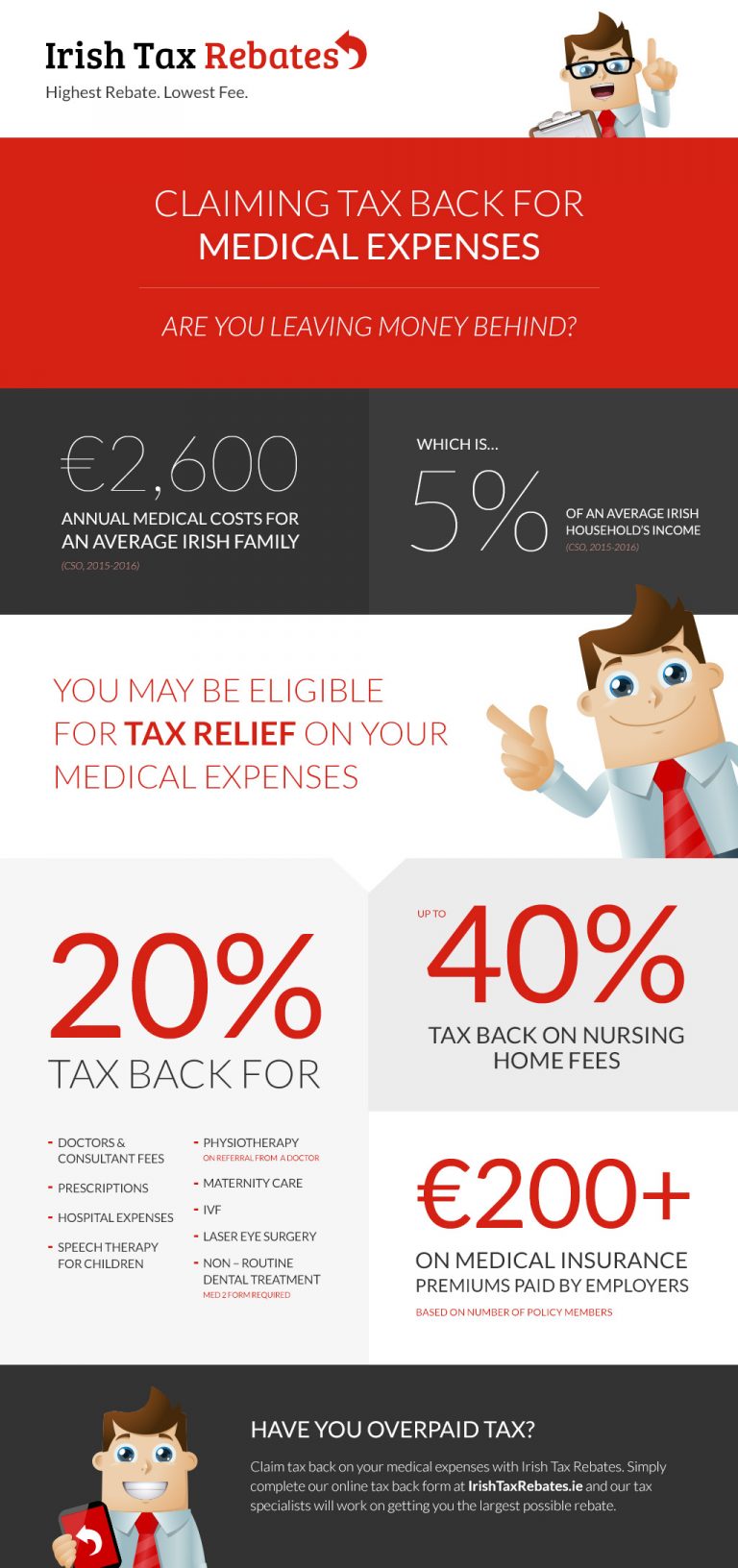

Tax Back On Medical Expenses Infographic Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2018/04/itr-infographic-1-768x1632.jpg

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

https://3.bp.blogspot.com/-4Id9T3np6TI/W7YTc5WnDBI/AAAAAAAASjk/QbYRDVMQcsQoXHoU4geurcLL1b1We92VgCLcBGAs/s1600/DEDUCTION%2BFOR%2BMEDICAL%2BINSURANCE%2BPREMIUM-PREVENTIVE%2BHEALTH%2BCHECK%2BUP%2B-MEDICAL%2BTREATMENT%2BSECTION%2B80D.png

https://tax2win.in/guide/section-80ddb

Web 17 juil 2019 nbsp 0183 32 In the case that the respective patient is a senior citizen then the maximum amount of deduction is Rs 1lakh Section 80DDB deduction limits Please note the

https://cleartax.in/s/income-tax-benefit-employee-from-medical...

Web 13 mai 2017 nbsp 0183 32 The Income Tax Act allows tax exemption of up to Rs 15 000 on medical reimbursements paid by the employer What is the Eligibility to Claim Medical

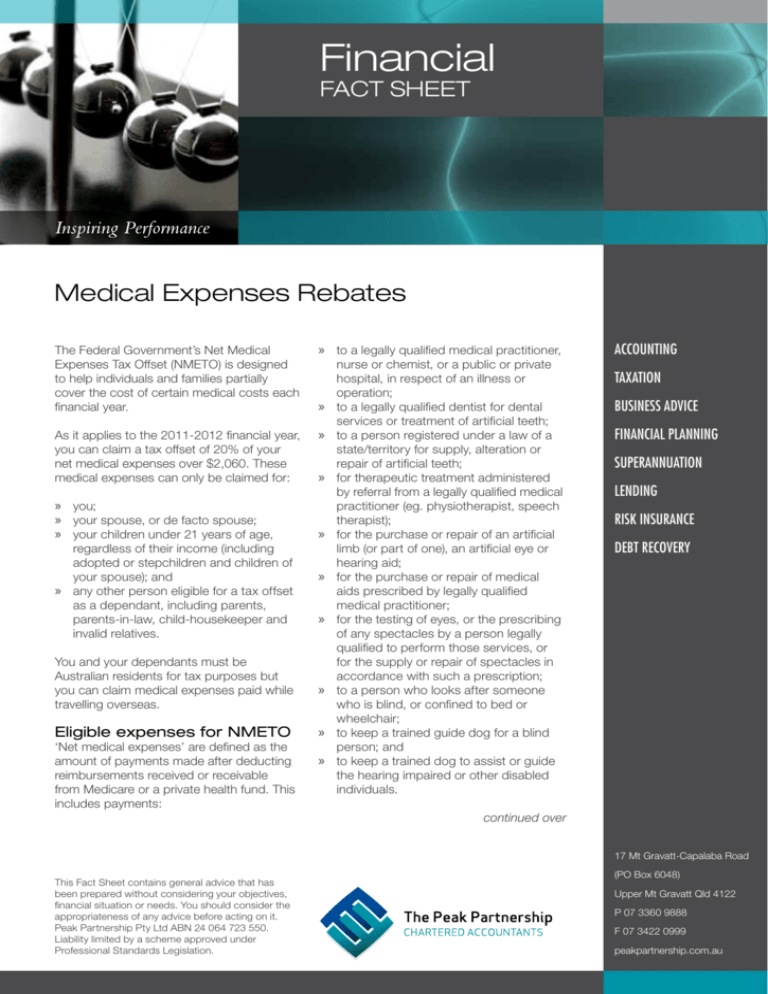

Medical Expenses Rebates

Tax Back On Medical Expenses Infographic Irish Tax Rebates

Corporate Medical Billing Invoice Template Venngage

In SA Tax Credits For Medical Aid Contributions eBiz Money

10 Pay Stub Format Sampletemplatess Sampletemplatess C83

Can I Claim Ppi Back From My Catalogue

Can I Claim Ppi Back From My Catalogue

2007 Tax Rebate Tax Deduction Rebates

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Free Medical Bill Receipt Template Pdf Word Eforms Medical Receipt

Income Tax Rebate On Medical Bills - Web 12 juin 2020 nbsp 0183 32 This is dealt in section 17 2 of the Income Tax Act as perquisite The whole amount of expenses incurred by the employer will be allowable expenditure to such employer under Income Tax Act In case