Income Tax Return Medical Expenses Verkko 31 maalisk 2023 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income

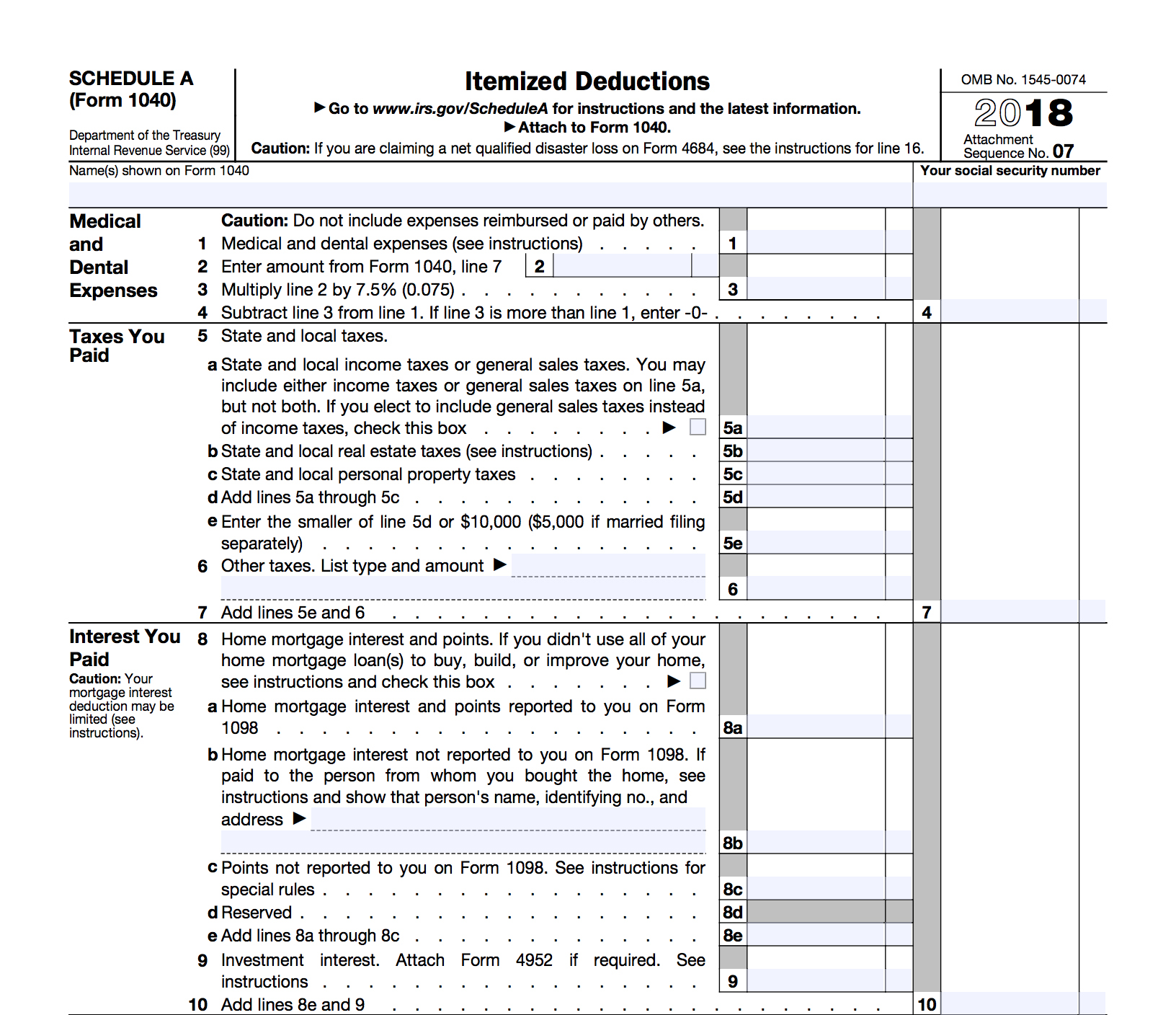

Verkko 20 lokak 2023 nbsp 0183 32 OVERVIEW Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a Verkko You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment

Income Tax Return Medical Expenses

Income Tax Return Medical Expenses

https://db-excel.com/wp-content/uploads/2019/09/schedule-c-expenses-worksheet-home-design-ideas-home.jpg

1040 Deductions 2016 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1040-deductions-2016.jpg

Income Tax Return ITR File

https://naukaritime.com/wp-content/uploads/2023/05/COMPUTER-2023-05-17T074559.484.jpg

Verkko 12 tammik 2023 nbsp 0183 32 The Deduction and Your AGI Threshold You can calculate the 7 5 rule by tallying up all your medical expenses for the year then subtracting the amount equal to 7 5 of your AGI For Verkko 23 elok 2023 nbsp 0183 32 To claim qualifying medical expenses on your tax return you ll need to complete Schedule A and file it with your Form 1040 If you re using one of today s

Verkko 9 toukok 2023 nbsp 0183 32 The IRS recently issued some frequently asked questions addressing when certain costs are qualified medical expenses for federal income tax purposes Basic rules and IRS Verkko 15 maalisk 2023 nbsp 0183 32 For the tax year 2022 the taxes you file in 2023 the standard deduction is 12 950 single 19 400 head of household and 25 900 if married filing jointly You can t take the standard deduction

Download Income Tax Return Medical Expenses

More picture related to Income Tax Return Medical Expenses

https://c.pxhere.com/photos/c2/d6/tax_return_control_tax_office_form_finance_money_income_tax_billing-1038566.jpg!d

Tax Expenses Template

https://db-excel.com/wp-content/uploads/2019/01/tax-return-spreadsheet-australia-regarding-rental-property-expenses-spreadsheet-template-australia-expense.jpg

File Medical Expenses Tax Return

https://lh6.googleusercontent.com/proxy/KmHDwMuawhsAYqoHPWBiS55ZogPvilTsak5NZXCm3zFPYBcvK29uJIpK_i2xhhxzvDHgYrdrg7JDu0FOEDsx25uJ9Qc=s0-d

Verkko 25 lokak 2022 nbsp 0183 32 For tax years 2022 and 2023 individuals are allowed to deduct qualified and unreimbursed medical expenses that are greater than 7 5 of their adjusted Verkko 17 helmik 2023 nbsp 0183 32 In order to deduct your medical expenses they must add up to more than 3 000 7 5 percent of 40 000 Furthermore you can deduct only the amount

Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 President Trump s Tax Cuts and Jobs Act allowed taxpayers in 2017 and 2018 to deduct the total amount of medical expenses that exceed 7 5 of their Verkko 5 tammik 2021 nbsp 0183 32 Qualified Medical Expenses are generally the same types of services and products that otherwise could be deducted as medical expenses on your yearly

Latest ITR Forms Archives Certicom

https://i0.wp.com/certicom.in/wp-content/uploads/2022/06/Understanding-updated-and-revised-income-tax-returns.jpg?fit=1920%2C1080&ssl=1

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

https://www.nerdwallet.com/article/taxes/med…

Verkko 31 maalisk 2023 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income

https://turbotax.intuit.com/tax-tips/health-care/medical-expenses...

Verkko 20 lokak 2023 nbsp 0183 32 OVERVIEW Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a

Income Tax Return Filing Details Required For Income Tax Return Filings

Latest ITR Forms Archives Certicom

Medical Expenses You Can Claim On Your Canadian Income Tax Return The

20 Commonly Missed Tax Deductions taxes tips Http www

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

Income Tax Return Filing Last Date Revised ITR Deadline For Taxpayers

Income Tax Return Filing Last Date Revised ITR Deadline For Taxpayers

What Are The Consequences Of Not Filing The Income Tax Return Income

How To Pay Income Tax

How To Compute Income Tax On Salary Kanakkupillai

Income Tax Return Medical Expenses - Verkko 12 tammik 2023 nbsp 0183 32 The Deduction and Your AGI Threshold You can calculate the 7 5 rule by tallying up all your medical expenses for the year then subtracting the amount equal to 7 5 of your AGI For