Income Tax Claiming Medical Expenses Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents While many out of pocket medical bills are deductible you have two hurdles to overcome before you can benefit from claiming medical bills on your federal income tax return

Income Tax Claiming Medical Expenses

Income Tax Claiming Medical Expenses

https://static.india.com/wp-content/uploads/2022/07/income-tax.png

Income Tax Elimination Institute For Reforming Government

https://reforminggovernment.org/wp-content/uploads/2021/12/EliminateTheTax@2x.png

Receive Answers To Income Tax Test Questions Immediately Blog

https://assignmentshark.com/blog/wp-content/uploads/2017/10/income-tax-test-questions-answers.jpg

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you You can claim medical expenses on line 33099 or 33199 of your tax return under Step 5 Federal tax Line 33099 You can claim the total eligible medical expenses you or your

133 rowsYou can claim eligible medical expenses on line 33099 or line 33199 of your tax return Step 5 Federal tax Line 33099 Medical expenses for self spouse or Health expenses are claimed through your Income Tax Return If you are a Pay As You Earn PAYE taxpayer you also have the option to claim relief in real time

Download Income Tax Claiming Medical Expenses

More picture related to Income Tax Claiming Medical Expenses

Quick Guide Who Should Claim Medical Expenses On Taxes Canada

https://www.olympiabenefits.com/hubfs/Who should claim medical expenses on taxes Canada-1.png

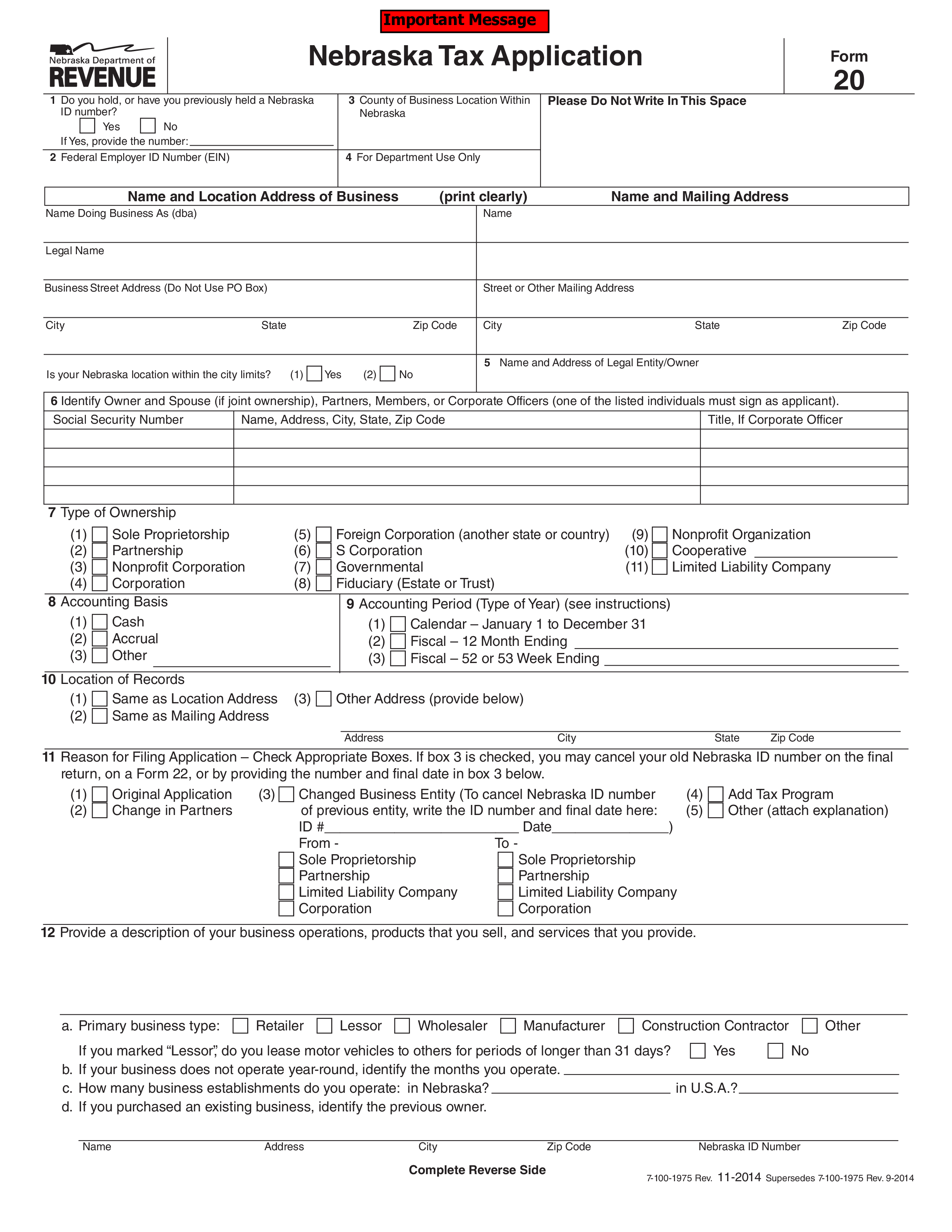

Kostenloses Income Tax Job Application Form

https://www.allbusinesstemplates.com/thumbs/9457204e-5366-4f57-8428-dbfe96dae55c_1.png

https://c.pxhere.com/photos/c2/d6/tax_return_control_tax_office_form_finance_money_income_tax_billing-1038566.jpg!d

This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses Richardson evaded income taxes for 2017 2018 and 2019 by claiming to owe only about 28 500 although he made more than 1 2 million as a software

You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can also take tax free health savings You can only deduct unreimbursed medical and dental expenses for you your spouse and dependent that exceed 7 5 of your adjusted gross income AGI It s

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

https://journalistsresource.org/wp-content/uploads/2018/04/tax-forms.jpg

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/income-tax-filing-form-number.jpg

https://turbotax.intuit.com/tax-tips/heal…

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents

Common Income Tax Mistakes American Profile

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

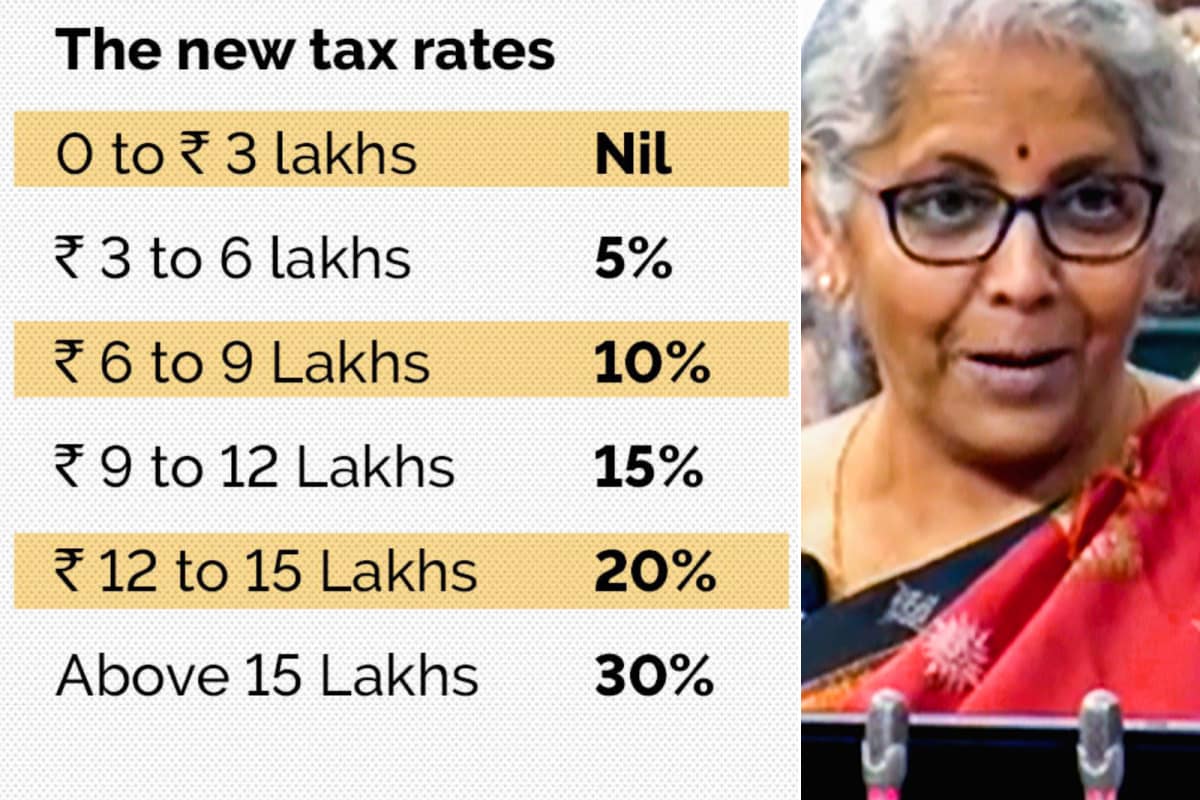

Income Tax Statistics 2023 Tax Brackets USA UK And More

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

Income Tax Rates Free Of Charge Creative Commons Green Highway Sign Image

State Individual Income Tax Rates Tax Policy Center

State Individual Income Tax Rates Tax Policy Center

Earned Income Tax Credit Worksheet 2013 Worksheet Resume Examples

CNN News18 News Anchor Journalist Columnist Blogger Page363

Income Tax Department Recruitment 2021 155 MTS Income Tax Inspector

Income Tax Claiming Medical Expenses - If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your Adjusted Gross