What Medical Expenses Can You Claim On Taxes OVERVIEW Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your deductions TABLE OF CONTENTS Deducting medical expenses How to claim medical expense deductions

Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems simple there are a variety of rules about taking the deduction that you should know before filing your taxes Introduction This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

What Medical Expenses Can You Claim On Taxes

What Medical Expenses Can You Claim On Taxes

https://cdn6.ep.dynamics.net/s3/rw-media/residential-offices/wp-content/blogs.dir/sites/886/2022/01/21150933/What-expenses-can-you-claim.jpg?height=529&maxheight=2560&maxwidth=2560&quality=60&scale=both&width=794&format=jpg

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

Medical Expenses You Can Claim Back From Tax Momentum Multiply Blog

https://blog.multiply.co.za/wp-content/uploads/2019/07/save-on-medical-expenses.jpg

Key Takeaways If you incurred substantial medical expenses not covered by insurance you might be able to claim them as deductions on your tax return These costs include health insurance You can deduct these medical expenses Cost of medical care from any of these types of practitioners Acupuncturists Chiropractors Dentists Eye doctors Medical doctors Occupational therapists Osteopathic doctors Physical therapists Podiatrists Psychiatrists Psychoanalysts giving medical care

General information How to claim medical expenses Credits or deductions related to medical expenses Certain medical expenses require a certification Common medical expenses you can claim Attendant care and care in a facility Care treatment and training Construction and renovation Devices equipment and supplies Gluten free food products For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be

Download What Medical Expenses Can You Claim On Taxes

More picture related to What Medical Expenses Can You Claim On Taxes

Business Expenses What Can You Claim

https://www.uhyhn.co.nz/wp-content/uploads/2016/04/Business-expenses-pic.jpg

What Are Expenses Its Types And Examples Tutor s Tips

https://i0.wp.com/tutorstips.com/wp-content/uploads/2020/02/What-are-Expenses-1.png?resize=1080%2C608&ssl=1

How Much Medical Expense Can You Claim On Taxes 27F Chilean Way

https://www.27fchileanway.cl/wp-content/uploads/2023/05/how-much-medical-expense-can-you-claim-on-taxes.jpg

Can You Claim Medical Expenses on Your Taxes While many out of pocket medical bills are deductible you have two hurdles to overcome before you can benefit from claiming The IRS provides a list of approved medical and dental expenses that you can claim on your tax return You re probably aware that you can deduct unreimbursed payments to doctors dentists and other medical practitioners However here are a few deductible items that may surprise you 1 Acupuncture

Medical Expenses You Can Deduct Many medical related costs can be included in your itemized deductions Remember that you can only claim medical expenses that you paid for this year whether it s for you your spouse or another dependent Dependents can include children and other relatives you care for Here are The IRS determines which medical and dental expenses qualify for tax deductions and you ll be excited to find that it s actually a fairly expansive list Here are just some commonly claimed medical expenses Medications and aids If you have to pay for prescription medications you can deduct those costs from your taxable income

How To Claim Medical Expenses On Your Tax Return

https://www.searche.co.za/wp-content/uploads/Claim-Medical-Expenses.webp

What Medical Expenses Can You Write Off On Your Taxes This Year

https://static.wixstatic.com/media/6144d7_d36d75f9335a4e6da92fc85df1c00d09~mv2.png/v1/fill/w_980,h_515,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/6144d7_d36d75f9335a4e6da92fc85df1c00d09~mv2.png

https://turbotax.intuit.com/tax-tips/health-care/...

OVERVIEW Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your deductions TABLE OF CONTENTS Deducting medical expenses How to claim medical expense deductions

https://www.thebalancemoney.com/medical-expense...

Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems simple there are a variety of rules about taking the deduction that you should know before filing your taxes

Can I Claim Medical Expenses On My Taxes

How To Claim Medical Expenses On Your Tax Return

How Many Kids Can You Claim On Taxes Hanfincal

How To Claim Self Employed Expenses Small Business Tax Deductions

Expense Claim Form Template Excel Printable Word Searches

How Does The Medical Expense Tax Credit Work In Canada

How Does The Medical Expense Tax Credit Work In Canada

Can I Write Off Medical Expenses Canada 27F Chilean Way

Complete Must Have List Of Rental Property Expenses The Profit Property

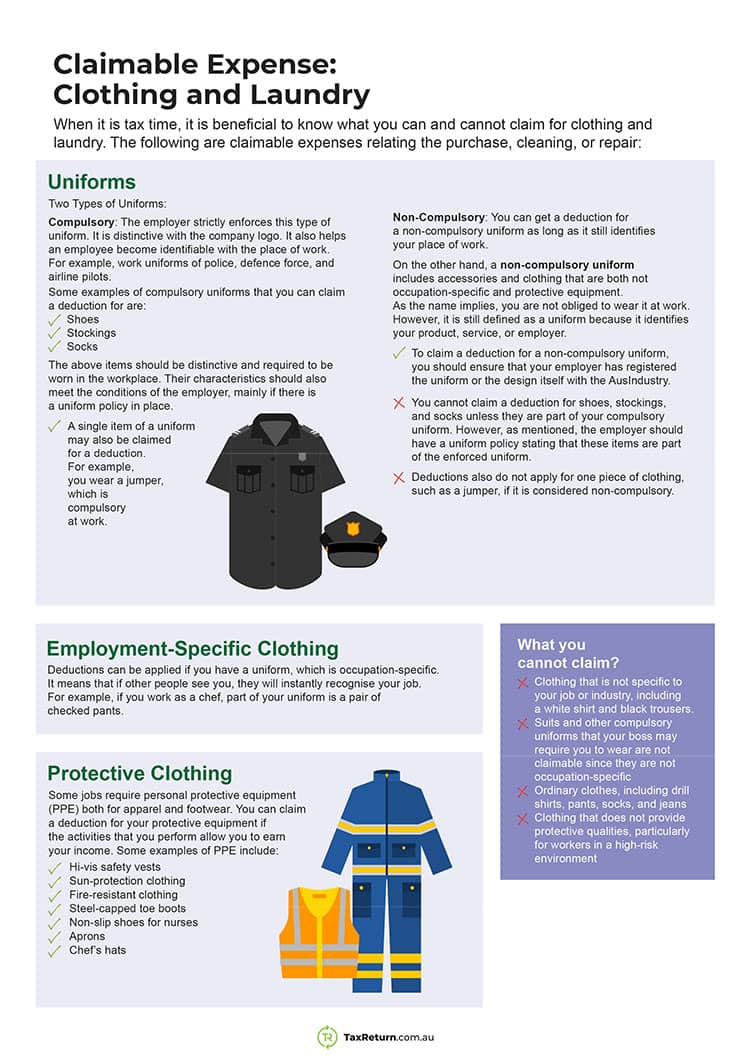

Claimable Expenses What You Can Claim On Your Tax Return

What Medical Expenses Can You Claim On Taxes - The IRS allows you to deduct expenses for many medically necessary products and services including surgeries prescription medications and dental and vision care You can t deduct medical expenses that are for general health purposes like nutritional supplements and vitamins