Income Tax Exemption On Medical Expenditure Individuals above 60 who take health care insurance policies are entitled to deductions under section 80D of income tax on premiums and expenses incurred on medical tests This exemption is under Section 80 of the

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are satisfied a The Every individual or HUF who has purchased medical insurance can claim for a tax deduction under Section 80D of Income Tax Act 1961 The taxpayer can avail tax benefits on insurance taken for self spouse dependent

Income Tax Exemption On Medical Expenditure

Income Tax Exemption On Medical Expenditure

https://www.signnow.com/preview/497/332/497332566/large.png

All You Need To Know On Exempted Income In Income Tax Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/04/income-exempted.png

![]()

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision

https://www.rebelliouspixels.com/wp-content/uploads/2020/03/tax_free_residency-1536x1066.jpg

Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be spouse children parents brothers You can take advantage of Section 80D s income tax benefits for paying medical insurance premiums for yourself your spouse children and your elderly parents as well as for

It will not be considered for income tax exemption under medical reimbursement but can be considered for tax deduction separately under Section 80D of the Income Tax Act Deduction U s 80D of the Income Tax Act 1961 in respect of Medical Insurance Premium Mediclaim paid to keep in force insurance by individual either on his own health or

Download Income Tax Exemption On Medical Expenditure

More picture related to Income Tax Exemption On Medical Expenditure

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

https://www.signnow.com/preview/497/332/497332572/large.png

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/331/497331433/large.png

Example Of Taxable Supplies Jspag

https://bestlettertemplate.com/wp-content/uploads/2020/10/Tax-Clearance-Letter-1086x1536.png

There are three items of medical expenditure on which deductions are permissible 1 Medical Insurance Premium 2 Preventive Health Check Up expenses and 3 Medical expenses like Purchase of medicines Doctor The Income Tax Act allows tax exemption of up to Rs 15 000 on medical reimbursements paid by the employer What is the Eligibility to Claim Medical Expenditure

The deduction under section 80DDB can be claimed irrespective of whether you have paid a premium for a health insurance policy or not The deduction is available on the Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents and

Writing Religious Exemption Letters

https://i0.wp.com/www.xu.edu.ph/images/notices/xucmpc/img/TAX_EXEMPTION_LETTER-1.jpg

How To Claim Income Tax Exemption On Conveyance Allowance

https://1.bp.blogspot.com/-h-U53cYF3CA/XwQpygxnKTI/AAAAAAAATdc/5AacU7Z6mdktvsO49v4joJgVm1Sy3StuwCLcBGAsYHQ/s660/INCOME-TAX-1.jpg

https://www.adityabirlacapital.com › abc-of-…

Individuals above 60 who take health care insurance policies are entitled to deductions under section 80D of income tax on premiums and expenses incurred on medical tests This exemption is under Section 80 of the

https://economictimes.indiatimes.com › w…

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are satisfied a The

Why Your Tax exempt Organization Must Meet Its Critical Disclosure

Writing Religious Exemption Letters

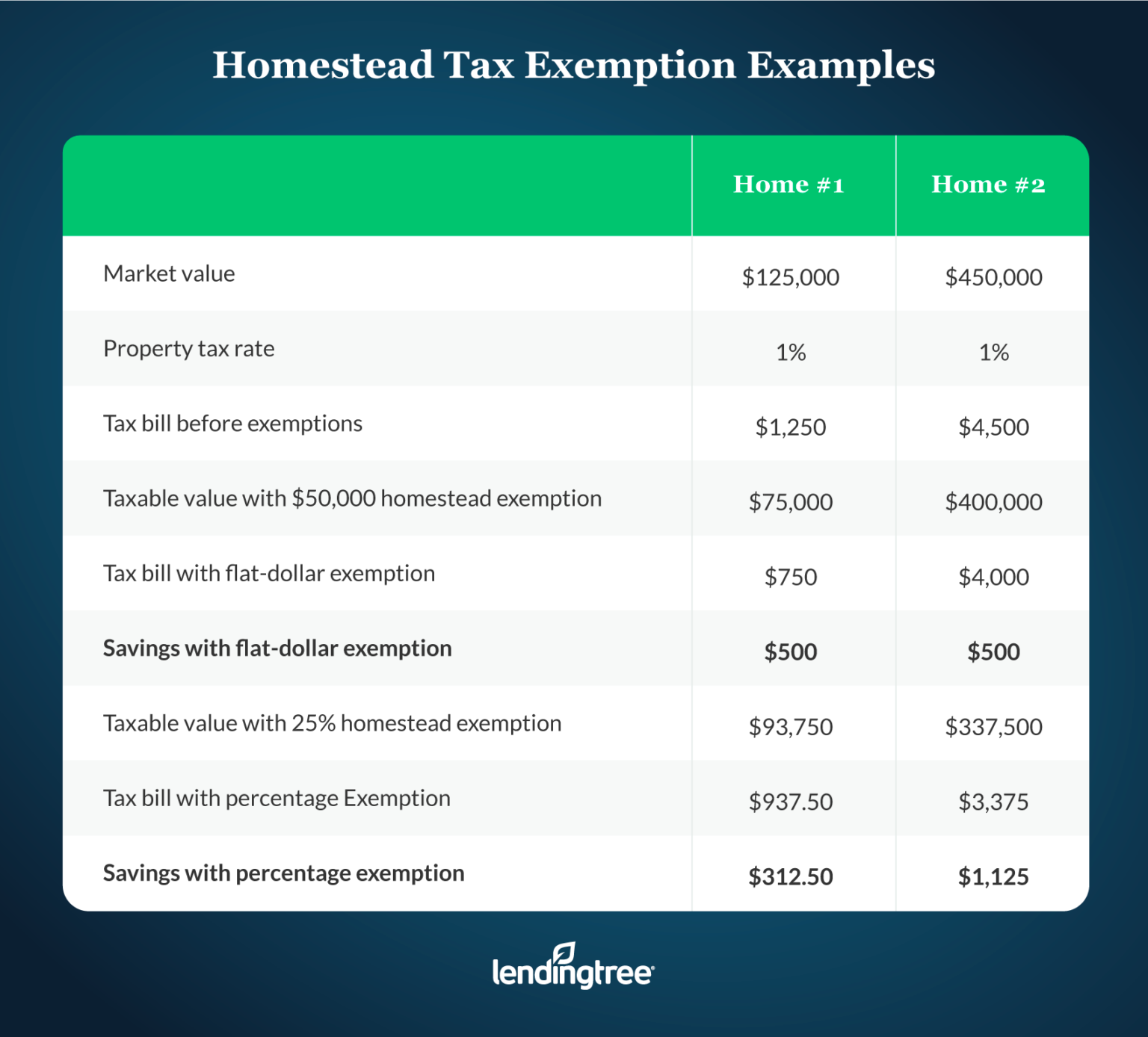

What Is A Homestead Exemption And How Does It Work LendingTree

Custom Invoice And Tax Exemption ThemeIsle Docs

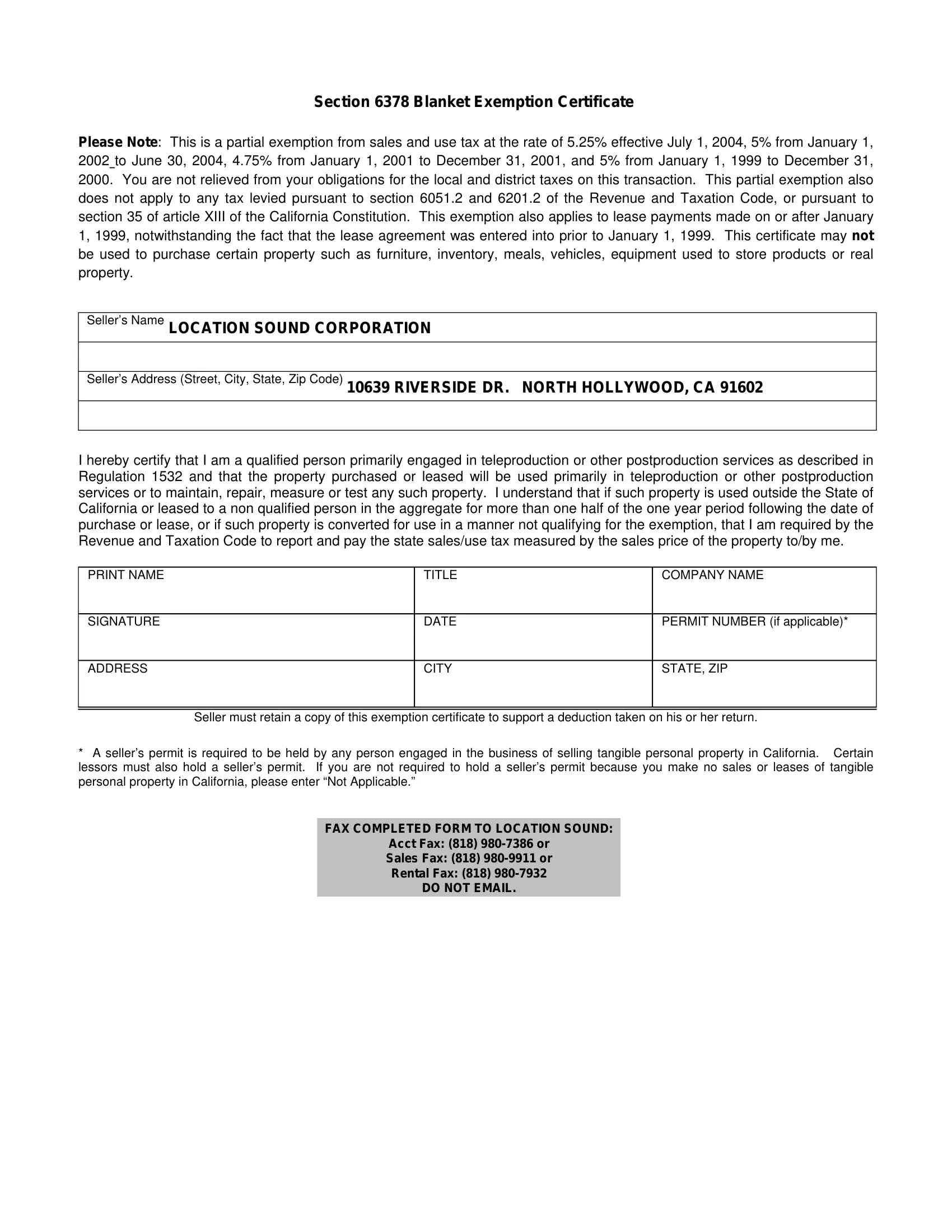

6378 Exemption Certificate PDF Form FormsPal

Private Sector Employees Can Now Claim Tax Exemption For Leave Travel

Private Sector Employees Can Now Claim Tax Exemption For Leave Travel

Tax Exempt Status Documentation Charles Town Presbyterian Church

Pin On Retirement

Your Money Tax Exemption On Covid 19 Therapy Expenditures Paid By

Income Tax Exemption On Medical Expenditure - Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be spouse children parents brothers