Irs Tax Refund Deadline Verkko 6 p 228 iv 228 228 sitten nbsp 0183 32 Get information about tax refunds and track the status of your e file or paper tax return You can check the status of your 2023 income tax refund 24 hours after e filing Please allow 3 or 4 days after e filing your 2021 and 2022 tax year returns

Verkko 6 syysk 2023 nbsp 0183 32 The latest date by law you can claim a credit or federal income tax refund for a specific tax year is generally the later of these 2 dates 3 years from the date you filed your federal income tax return or 2 years from the date you paid the tax Verkko 25 huhtik 2023 nbsp 0183 32 By law they only have a three year window from the original due date normally the April deadline to claim their refunds Some people may choose not to file a tax return because they didn t earn enough money to be required to file Generally they won t receive a penalty if they are owed a refund But they may miss out on

Irs Tax Refund Deadline

Irs Tax Refund Deadline

https://i.pinimg.com/originals/ff/fd/ff/fffdff9063a8c4ff65a223c70e8521eb.jpg

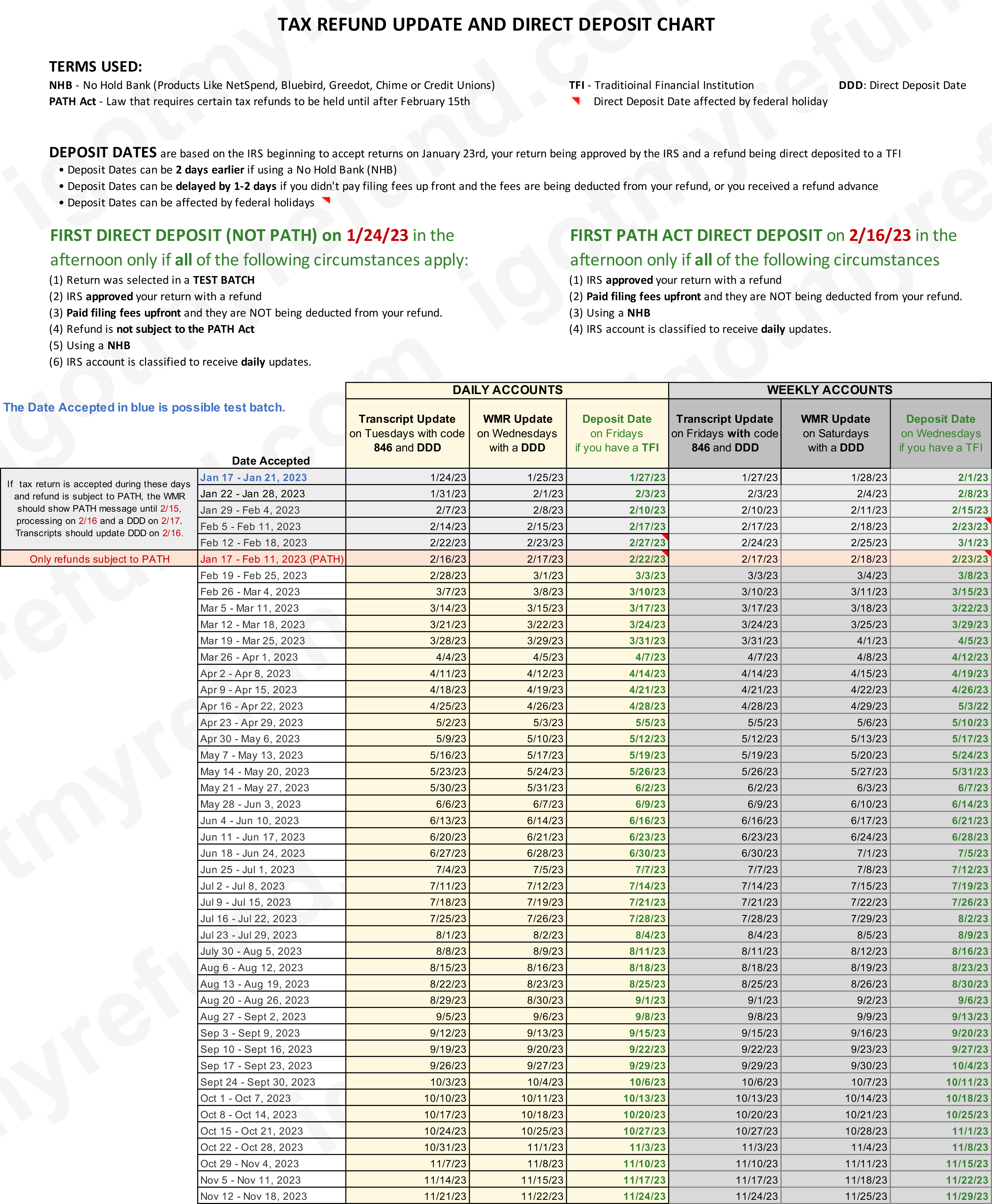

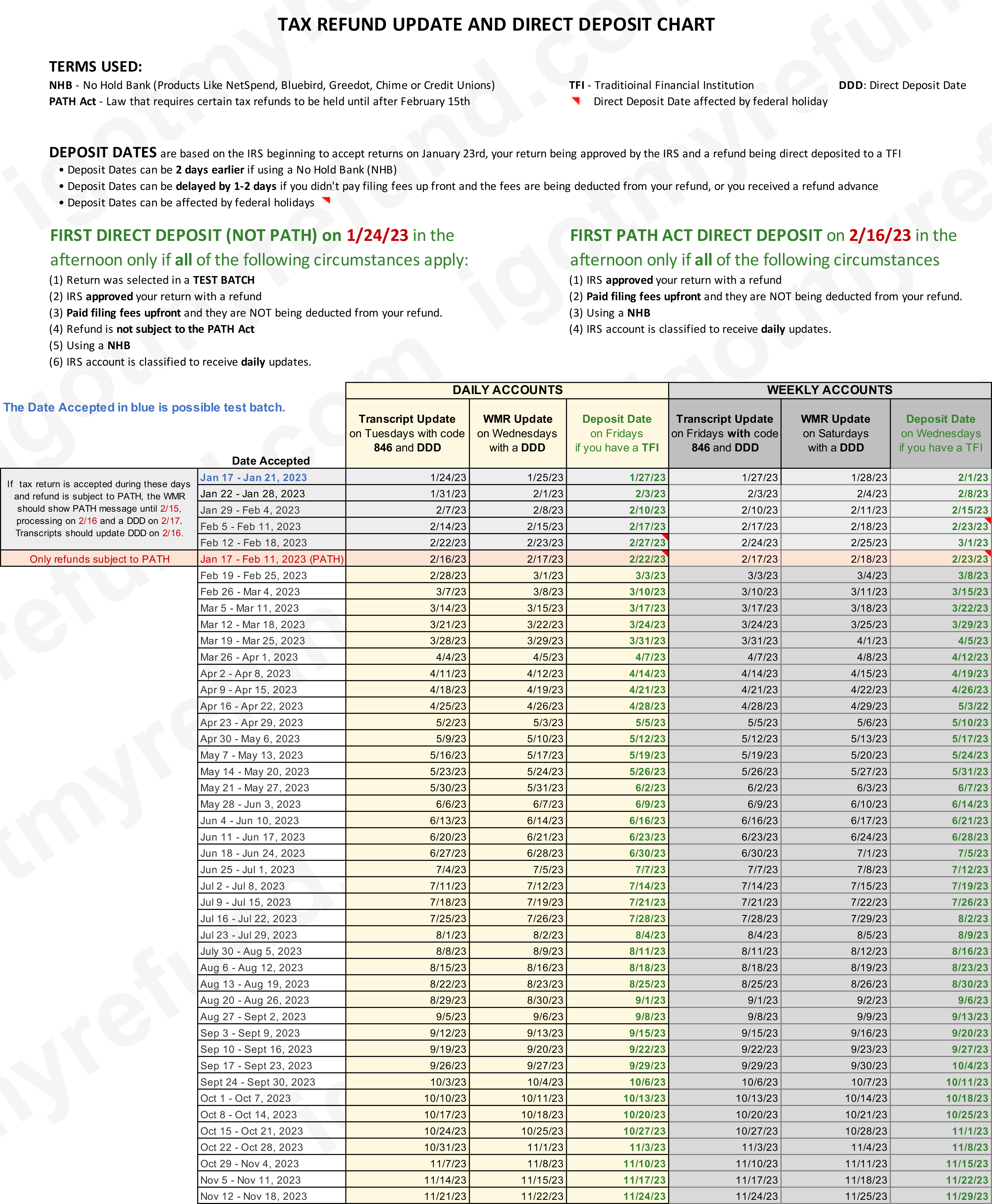

The IRS Refund Schedule 2021 Tax Deadline Tax Return Deadline Tax

https://i.pinimg.com/originals/7d/b0/9e/7db09ee47275620c9c16a4628885c0c1.jpg

The IRS Tax Refund Schedule 2023 Where s My Refund Irs Taxes

https://i.pinimg.com/736x/5f/5e/0f/5f5e0f1c9fdd61fa87df5215e135f24d.jpg

Verkko 18 huhtik 2023 nbsp 0183 32 Review information about due dates and when to file tax returns Find out how to request an extension of time to file Calendar Year Filers Most Common File on April 18 2023 Alabama California and Georgia disaster area taxpayers have a deadline extension to October 16 2023 Verkko 15 tammik 2021 nbsp 0183 32 Taxpayers will need to check Where s My Refund for their personalized refund date Overall the IRS anticipates nine out of 10 taxpayers will receive their refund within 21 days of when they file electronically with direct deposit if there are no issues with their tax return The IRS urges taxpayers and tax

Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 The IRS states that most electronically filed refunds are issued in 21 calendar days or less however refunds for paper returns could take at least another week or more depending on whether Verkko 29 maalisk 2021 nbsp 0183 32 IRS extends additional tax deadlines for individuals to May 17 WASHINGTON The Internal Revenue Service today announced that individuals have until May 17 2021 to meet certain deadlines that would normally fall on April 15 such as making IRA contributions and filing certain claims for refund This follows a previous

Download Irs Tax Refund Deadline

More picture related to Irs Tax Refund Deadline

Tax Filing Deadline Extended 30 Days But Cook Co News

https://cookco.us/news/wp-content/uploads/2021/03/tax-deadline-680x455.jpg

2019 Tax Refund Deadline Is Near 1 5 Million Taxpayers Must File To

https://www.pelhamplus.com/wp-content/uploads/2023/04/News-IRS-Tax-Refund-2020-Unemployment-1-1024x683.jpg

IRS Tax Refunds Are You Eligible For Up To 900 Payments Latin Post

https://1622179098.rsc.cdn77.org/data/images/full/147941/irs-tax-refunds-are-you-eligible-for-up-to-900-payments.jpg

Verkko 9 maalisk 2023 nbsp 0183 32 The deadline for filing 2022 taxes is Tuesday April 18 2023 If you request an extension the deadline is Monday October 16 2023 Keep reading to learn more about deadlines for 2022 tax returns and Verkko 28 helmik 2023 nbsp 0183 32 This is referred to as the lookback rule A taxpayer can only get a refund of amounts paid within the lookback period Since the IRS didn t extend the lookback period some taxpayer payments including estimated and withheld taxes deemed paid on April 15 fell outside the lookback period for taxpayers who didn t file

Verkko 19 lokak 2023 nbsp 0183 32 federal tax debt you owe The IRS can also hold refund checks when the two subsequent annual returns are missing That means you should file returns for 2021 and 2022 as soon as possible For the 2021 tax year with a filing deadline in April of 2022 the three year grace period ends April 18 2025 Verkko 20 jouluk 2023 nbsp 0183 32 Last year the average tax refund by the April deadline was 2 753 down from the prior year s 3 012 when pandemic related benefits helped boost refunds the IRS said How does inflation

IRS Announced Federal Tax Filing And Payment Deadline Extension The

https://blog.turbotax.intuit.com/wp-content/uploads/2021/03/tax-filing-deadline-extension.png?w=653&h=352&crop=1

IRS Refund Schedule 2024 When To Expect Your Tax Refund

https://thecollegeinvestor.com/wp-content/uploads/2024/01/TCI_-_2024-TAX-REFUND-CALENDAR-Updated-1.png

https://www.irs.gov/refund

Verkko 6 p 228 iv 228 228 sitten nbsp 0183 32 Get information about tax refunds and track the status of your e file or paper tax return You can check the status of your 2023 income tax refund 24 hours after e filing Please allow 3 or 4 days after e filing your 2021 and 2022 tax year returns

https://www.irs.gov/filing/time-you-can-claim-a-credit-or-refund

Verkko 6 syysk 2023 nbsp 0183 32 The latest date by law you can claim a credit or federal income tax refund for a specific tax year is generally the later of these 2 dates 3 years from the date you filed your federal income tax return or 2 years from the date you paid the tax

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

IRS Announced Federal Tax Filing And Payment Deadline Extension The

Taxes 2022 IRS Tax Deadline Is April 18 How To File Extension More

IRS Tax Refunds Update Extreme Delays Extend To TAS Office

IRS Check My Refund Check All The Necessary Details Here Eduvast

IRS E file Refund Cycle Chart For 2023

IRS E file Refund Cycle Chart For 2023

2023 Tax Refund Chart Printable Forms Free Online

Still Waiting On Your IRS Tax Refund How To Check The Status The US Sun

Irs Tax Clipart April 15 Tax Deadline Free Transparent Clipart

Irs Tax Refund Deadline - Verkko 15 huhtik 2022 nbsp 0183 32 You ll need IRS 4868 form April 18 also is the deadline for requesting a tax extension which gives taxpayers until Oct 17 to file their returns for 2021 However there is no extension on