Irs Tax Refund Explore options for getting your federal tax refund how to check your refund status how to adjust next year s refund and how to resolve refund problems

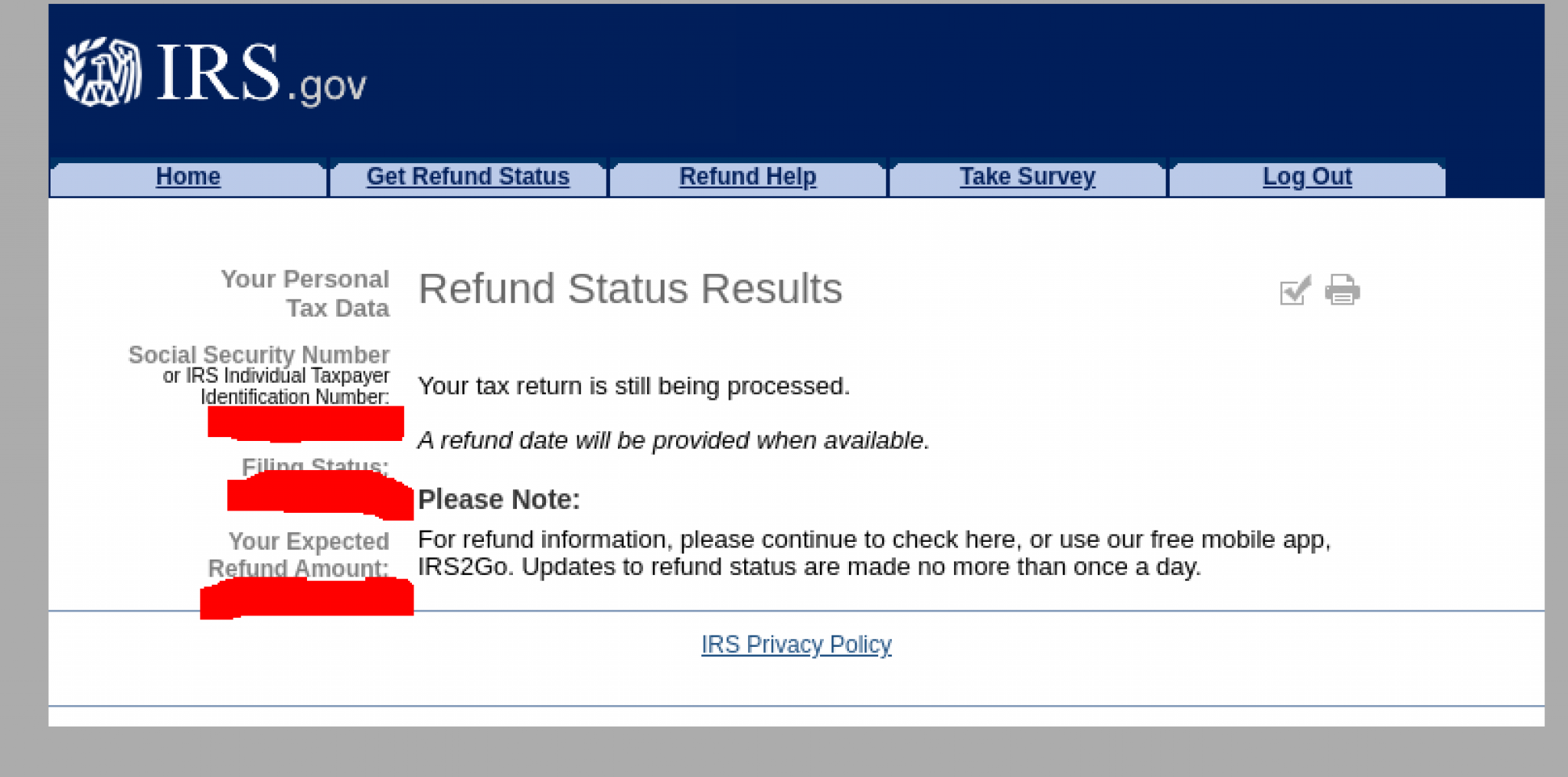

Get Refund Status Please enter your Social Security Number Tax Year your Filing Status and the Refund Amount as shown on your tax return All fields marked with an asterisk are required Enter the SSN or ITIN shown on your tax return You can start checking on the status of your refund within 24 hours after e filing a tax year 2023 return 3 or 4 days after e filing a tax year 2021 or 2022 return 4 weeks after mailing a return Where s My Refund will give you a personalized refund date after we process your return and approve your refund

Irs Tax Refund

Irs Tax Refund

https://eefri.org/wp-content/uploads/2022/11/IRS-wheres-My-Refund-2048x1015.png

Taxes What To Do If You Really Need Your Tax Refund Fast

https://www.gannett-cdn.com/-mm-/f1b9f8bfb499d8802d458de2dc965881db65eb99/c=0-101-2732-1644&r=x1683&c=3200x1680/local/-/media/2018/02/16/USATODAY/USATODAY/636543893899472736-tax-refund-stamp.jpg

From Refunds To Filing Here Are Tax Tips You Need To Know ABC Columbia

https://www.abccolumbia.com/content/uploads/2020/01/tax_refund_2_.58ad2540b4575.5e306c8f8554a.png

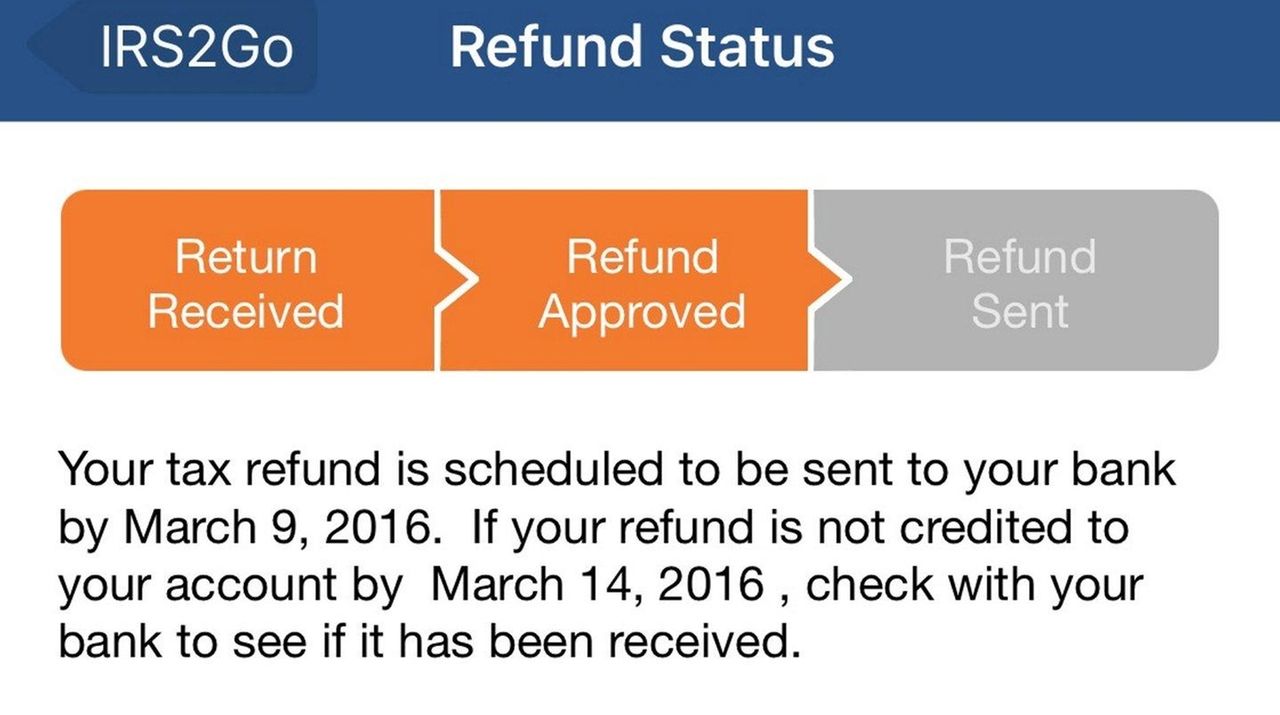

IRS Tax Tip 2022 26 February 16 2022 Tracking the status of a tax refund is easy with the Where s My Refund tool It s available anytime on IRS gov or through the IRS2Go App Taxpayers can start checking their refund status within 24 hours after an e filed return is received Refund timing Pay your taxes Get your refund status Find IRS forms and answers to tax questions We help you understand and meet your federal tax responsibilities

Does the refund hotline have all of the same information as the Where s My Refund website or on the IRS2Go mobile app updated December 22 2023 Our automated refund hotline 800 829 1954 will not be able to give you your refund status for any year other than the 2023 tax year You can use the tool to check the status of your return 24 hours after e filing a tax year 2023 return 3 or 4 days after e filing a tax year 2022 or 2021 return 4 weeks or more after mailing a return

Download Irs Tax Refund

More picture related to Irs Tax Refund

What Are The 2015 Refund Cycle Dates PriorTax

https://www.priortax.com/filing-late-taxes/wp-content/uploads/2014/09/refundcyclechart2015-1024x875.png

How To Check Your IRS Refund Status In 5 Minutes

https://assets-global.website-files.com/645d153299ce00e5b32eb70b/64c152c359cf168a2d4cf0b4_IRS_Refund_Status_Results_revised.jpeg

Where Is My Refund 2019 How Long Does It Take IRS To Process Taxes

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/15/USATODAY/usatsports/tax-refund_gettyimages-476093165.jpg?width=3200&height=1680&fit=crop

Locating a Refund If you filed a tax return and are expecting a refund from the IRS you may want to find out the status of the refund or at least get an idea of when you might receive it The IRS issues most refunds in 21 calendar days You can check the status of your refund with the Where s My Refund tool or the IRS2Go mobile app You can start checking on the status of your refund within 24 hours after the IRS has received your electronically filed return or 4 weeks after you mailed a paper return Follow these steps for tracking your federal income tax refund Gather the following information and have it handy

[desc-10] [desc-11]

Details About IRS Tax Refund It s Tracking On Missing Refunds

https://www.aotax.com/wp-content/uploads/2017/11/IRS-Tax-Refund.png

IRS Warns Of Tax Refund Delays Jan 13 2015

http://i2.cdn.turner.com/money/dam/assets/150113190754-irs-tax-refund-1024x576.jpg

https://www.irs.gov/refund

Explore options for getting your federal tax refund how to check your refund status how to adjust next year s refund and how to resolve refund problems

https://sa.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp

Get Refund Status Please enter your Social Security Number Tax Year your Filing Status and the Refund Amount as shown on your tax return All fields marked with an asterisk are required Enter the SSN or ITIN shown on your tax return

10 Smart Ways To Use Your IRS Refund Check SavingAdvice Blog

Details About IRS Tax Refund It s Tracking On Missing Refunds

IRS E file Refund Cycle Chart For 2023

Tax Largie Inc Blog TAX LARGIE INC

IRS Tax Refund Calendar 2023 When Will State And Federal Tax Refunds

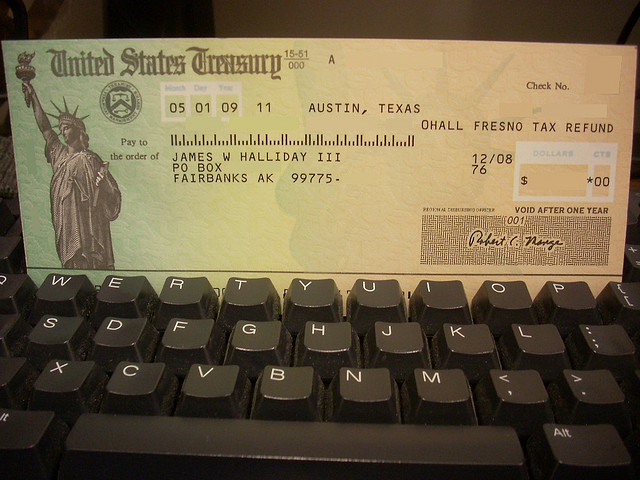

Tax Refund 2019 Unexpected IRS Bills Burden Some Americans Budgets

Tax Refund 2019 Unexpected IRS Bills Burden Some Americans Budgets

File Taxes Free At IRS Website Track Refund Status With App Newsday

TaxConnections Is A Where To Find Leading Tax Experts And Tax Resources

The IRS Tax Refund Schedule 2023 Where s My Refund Irs Taxes

Irs Tax Refund - [desc-12]