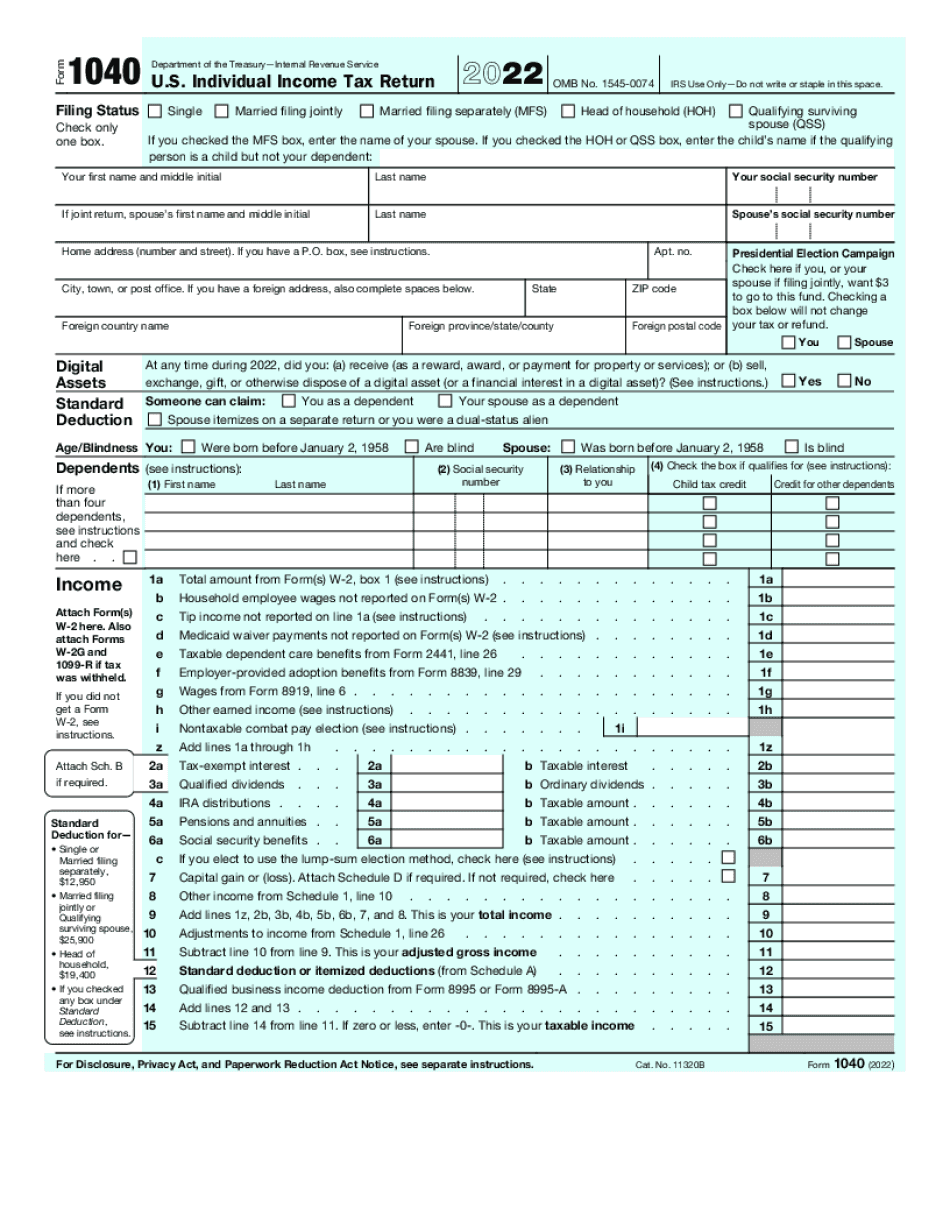

Irs Tax Return Submission Filing information for Personal taxes Find Free File options and a step by step overview of how to file Businesses and self employed Get your employer ID number EIN find Form 941 prepare to file make estimated payments access your business tax account and more Charities and nonprofits

Learn about IRS e file options including Free File to electronically file your individual tax returns E filing is fast easy and secure Tax software guides you through the process Search by state and form number the mailing address to file paper individual tax returns and payments Also find mailing addresses for other returns including corporation partnership tax exempt government entity and other returns

Irs Tax Return Submission

Irs Tax Return Submission

https://grimbleby-coleman.com/wp-content/uploads/2023/05/IRS-Tax-Relief-Image.jpg

IRS Sets New Rules On Cryptocurrency Trading

https://image.cnbcfm.com/api/v1/image/106910918-1626285229297-gettyimages-963468264-_DHP4870.jpeg?v=1626285285&w=1920&h=1080

3 Ways To Find Out How Much You Will Owe The IRS Tax Debt Relief Services

https://cig-alvi8tax.agilecollab.com/app/uploads/2019/04/tax-IRS-debt.jpg

File your taxes for free Find forms instructions Get answers to your tax questions Apply for an Employer ID Number EIN Check your amended return status Tools applications Document Upload Tool Upload documents in response to an IRS notice or letter Submit requested files Your Account File Your Taxes for Free Apply for an Employer ID Number EIN Check Your Amended Return Status Get an Identity Protection PIN IP PIN

See your personalized refund date as soon as the IRS processes your tax return and approves your refund See your status starting around 24 hours after you e file or 4 weeks after you mail a paper return File Your Taxes for Free Apply for an Employer ID Number EIN Check Your Amended Return Status Get an Identity Protection PIN IP PIN

Download Irs Tax Return Submission

More picture related to Irs Tax Return Submission

Form 1040a 2023 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/624/654/624654310/big.png

Gratis Apology Letter For Late Payment Of Tax

https://www.allbusinesstemplates.com/thumbs/4380e26e-682d-4d26-9bde-548750b40f6e_1.png

Form 20 F Due Date Form 20 F Pdf QFB66

https://i1.wp.com/facelesscompliance.com/wp-content/uploads/2020/05/Due-dates-2.jpg?fit=2476%2C1036&ssl=1

After you submit your federal tax return we ll direct you to your state tax tool so you can get started on your state income taxes If your submission is accepted and done or if it is rejected with an error that needs to be fixed we ll provide instructions on what to do Submit your return by the filing deadline Check the status of your tax refund Contact the IRS for help filing your tax return For the fastest information the IRS recommends finding answers to your questions online

You can access your personal tax records online or by mail including transcripts of past tax returns tax account information wage and income statements and verification of non filing letters If you need a transcript for your business find out how to Submit an issue Filing electronically is the safest fastest and most accurate way to file your tax return If you choose to prepare and file your own tax return depending on your circumstances the IRS may offer you three ways to electronically file e file your tax return for free

Facts How The IRS Communicates With Taxpayers Ft Myers Naples MNMW

https://www.markham-norton.com/wp-content/uploads/2022/11/Everyone-Should-Know-The-Facts-About-How-The-IRS-Communicates-With-Taxpayers--scaled.jpg

File Your Income Tax Return By 31st July Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/07/ITR-31st-july.png

https://www.irs.gov/filing

Filing information for Personal taxes Find Free File options and a step by step overview of how to file Businesses and self employed Get your employer ID number EIN find Form 941 prepare to file make estimated payments access your business tax account and more Charities and nonprofits

https://www.irs.gov/filing/e-file-options

Learn about IRS e file options including Free File to electronically file your individual tax returns E filing is fast easy and secure Tax software guides you through the process

Tax Return Employment Self Employment Dividend Rental Property

Facts How The IRS Communicates With Taxpayers Ft Myers Naples MNMW

How To Use Aadhaar Card For Electronic Tax Return Verification

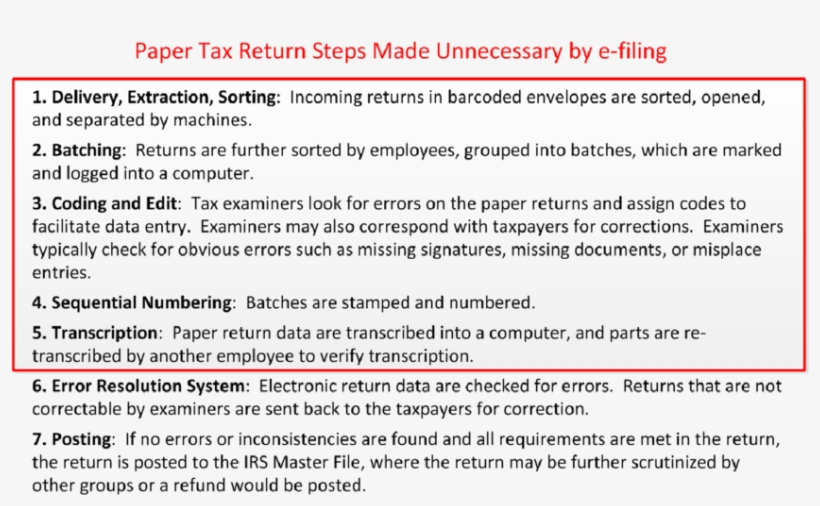

Irs Tax Return Submission Processing Pipeline Tax Free Transparent

IRS Tax Problems And How To Easily Get Them Resolved Today Irs Taxes

IRS Identity And Tax Return Verification Service

IRS Identity And Tax Return Verification Service

Fast FREE Shipping Shopping Made Fun Shop Now BEST Price Guaranteed

IRS Tax Return Submission Processing Pipeline Paper Return Submission

IRS Tax Return Submission Processing Pipeline Paper Return Submission

Irs Tax Return Submission - File your taxes for free Find forms instructions Get answers to your tax questions Apply for an Employer ID Number EIN Check your amended return status Tools applications Document Upload Tool Upload documents in response to an IRS notice or letter Submit requested files Your Account