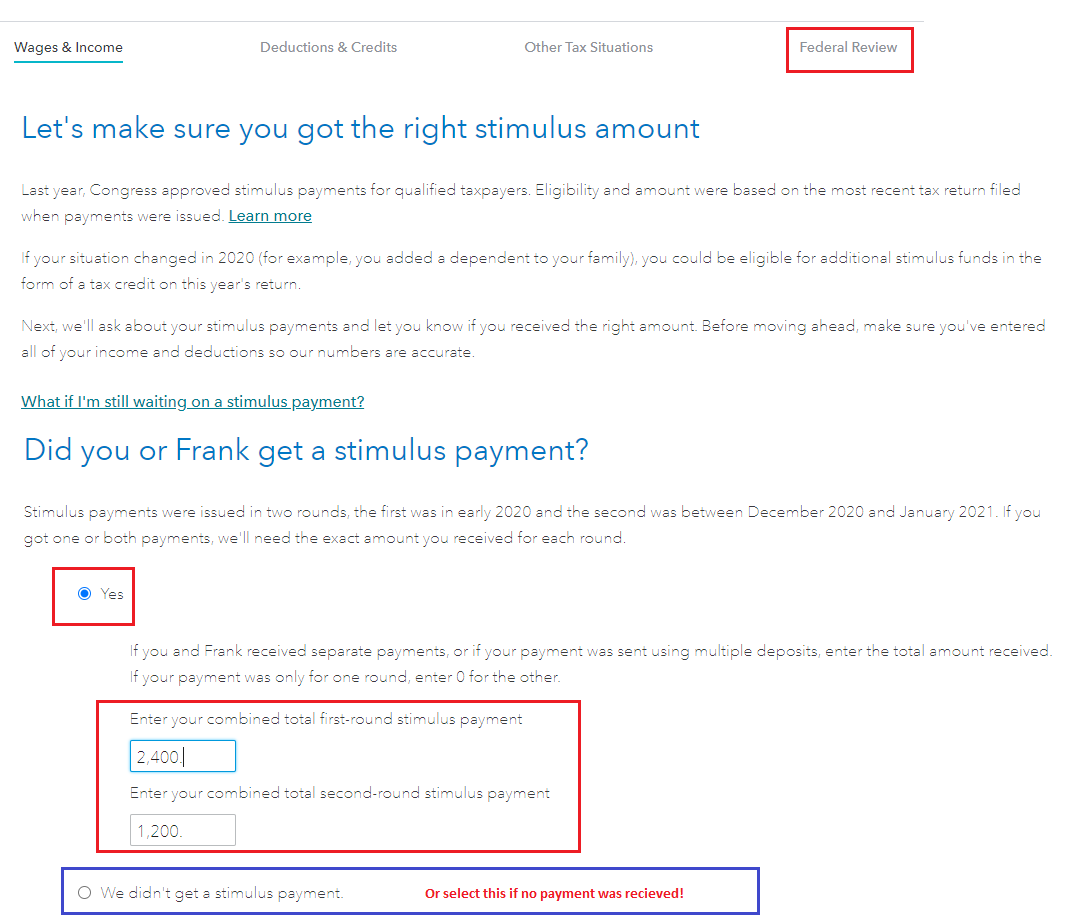

Irs Took Away Recovery Rebate Credit Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 28 ao 251 t 2023 nbsp 0183 32 August 28 2023 4 35 p m EDT 4 Min Read The Internal Revenue Service correctly calculated the allowable Recovery Rebate Credit for the vast majority of 2021 Web 13 avr 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit can reduce any taxes owed or be included in the tax refund for the 2021 tax year Filers must ensure to not mix information

Irs Took Away Recovery Rebate Credit

Irs Took Away Recovery Rebate Credit

https://www.recoveryrebate.net/wp-content/uploads/2023/02/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-103.jpg

Irs gov Recovery Rebate 1040 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040.png?w=486&h=629&ssl=1

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-8.png?fit=1060%2C795&ssl=1

Web 23 mai 2022 nbsp 0183 32 IRS mostly correct on recovery rebate credits TIGTA says The IRS correctly calculated taxpayers eligibility for a recovery rebate credit in the 2021 filing Web 24 f 233 vr 2023 nbsp 0183 32 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 20 d 233 c 2022 nbsp 0183 32 Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus

Download Irs Took Away Recovery Rebate Credit

More picture related to Irs Took Away Recovery Rebate Credit

Federal Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-5.jpg?fit=1140%2C641&ssl=1

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

Web 10 d 233 c 2021 nbsp 0183 32 To be eligible for the 2020 Recovery Rebate Credit you cannot be a dependent of another person You do not need to take any action as the notice is Web 6 avr 2021 nbsp 0183 32 The IRS has already begun mailing letters to some taxpayers who claimed the 2020 Recovery Rebate Credit and may be getting a different amount than they

Web 30 janv 2021 nbsp 0183 32 The IRS is aware of this situation and has provided some limited relief i e it won t reduce refunds to pay federal taxes owed by people who claimed the Recovery Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Irs Recovery Rebate Credit For College Students IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-for-college-students-irsuka.jpg?fit=1920%2C1080&ssl=1

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.accountingtoday.com/news/irs-processed-most-recovery...

Web 28 ao 251 t 2023 nbsp 0183 32 August 28 2023 4 35 p m EDT 4 Min Read The Internal Revenue Service correctly calculated the allowable Recovery Rebate Credit for the vast majority of 2021

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Irs Recovery Rebate Credit For College Students IRSUKA Recovery Rebate

Why Did Irs Change My Recovery Rebate Credit Useful Tips

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alproject

How Do I Claim The Recovery Rebate Credit On My Ta

What If I Did Not Receive Eip Or Rrc Detailed Information

What If I Did Not Receive Eip Or Rrc Detailed Information

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Irs Took Away Recovery Rebate Credit - Web 20 d 233 c 2022 nbsp 0183 32 Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus