Total Rebate In Income Tax Web 11 avr 2023 nbsp 0183 32 Exclude income that is exempt or not included in the total income

Web 7 lignes nbsp 0183 32 16 mars 2017 nbsp 0183 32 Arrive at your total income after reducing the tax deductions Declare your gross income and Web Here are the eligibility criteria to claim income tax rebate under Section 87A of the Income

Total Rebate In Income Tax

Total Rebate In Income Tax

https://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Web 1 f 233 vr 2023 nbsp 0183 32 Tax rebate is the refund you receive for the taxes mainly TDS or Tax Deducted at Source you paid in the previous year As per current provisions before Budget 2023 you can get a tax rebate on Web The rates of Surcharge and Health amp Education cess are same under both the tax

Web 16 ao 251 t 2022 nbsp 0183 32 The rebate applies to the total tax payable before the addition of the 4 Web 20 ao 251 t 2022 nbsp 0183 32 What is Rebate Section 87 In simple terms rebate is deduction from

Download Total Rebate In Income Tax

More picture related to Total Rebate In Income Tax

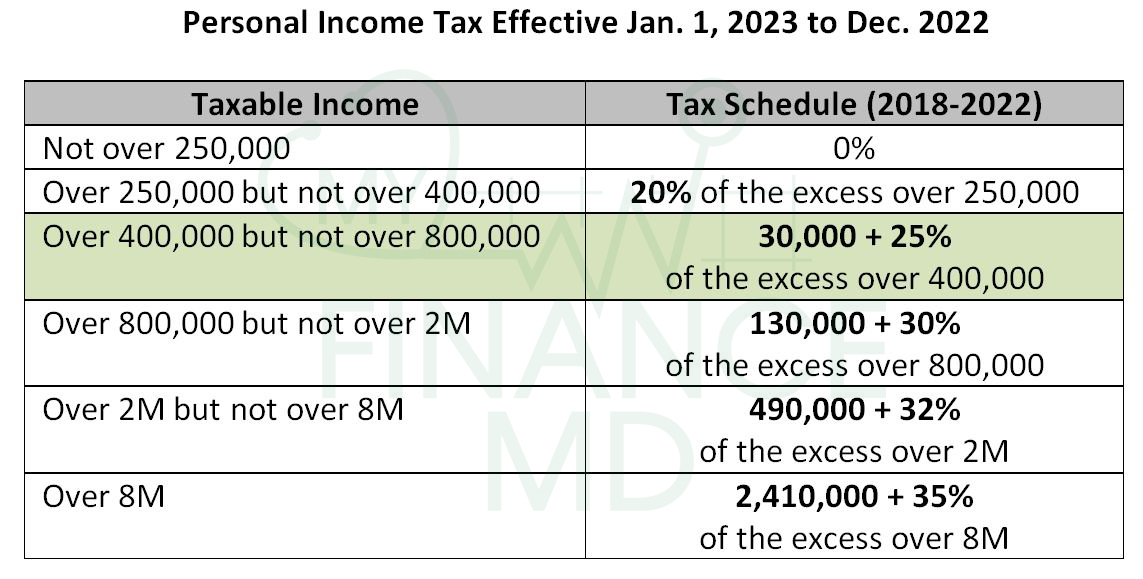

How To Compute And File The 2nd Quarter Income Tax Return TRAIN

https://myfinancemd.com/wp-content/uploads/2018/08/Personal-Income-Tax-myfinancemd.jpg

Tax Rebate For Individual Deductions For Individuals reliefs

https://2.bp.blogspot.com/-g9VZoH0Ab_0/XFpOxmUGmyI/AAAAAAAAFUM/ICy1j3WB8_stsbqaWTnl-lNqcgayVPNBACLcBGAs/s1600/rebate%2Bunder%2Bsection%2B87A%2Bafter%2Bbudget%2B2019.png

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Web 6 f 233 vr 2023 nbsp 0183 32 The income tax rebate will be up to Rs 12 500 on the total tax liability before adding the health and education cess of 4 New Tax Regime With effect from the FY 2023 24 a taxpayer can claim a tax Web Your rebate income is the total amount of your taxable income excluding any assessable

Web 3 f 233 vr 2023 nbsp 0183 32 What are the steps to claim tax rebate under Section 87A The steps to Web 1 d 233 c 2022 nbsp 0183 32 The National Bureau of Economic Research credited this tax rebate with

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

https://i.pinimg.com/originals/04/6c/93/046c93de3420d11217b08ec3f970154b.png

https://www.bajajfinserv.in/insights/income-tax-rebate

Web 11 avr 2023 nbsp 0183 32 Exclude income that is exempt or not included in the total income

https://cleartax.in/s/income-tax-rebate-us-87a

Web 7 lignes nbsp 0183 32 16 mars 2017 nbsp 0183 32 Arrive at your total income after reducing the tax deductions Declare your gross income and

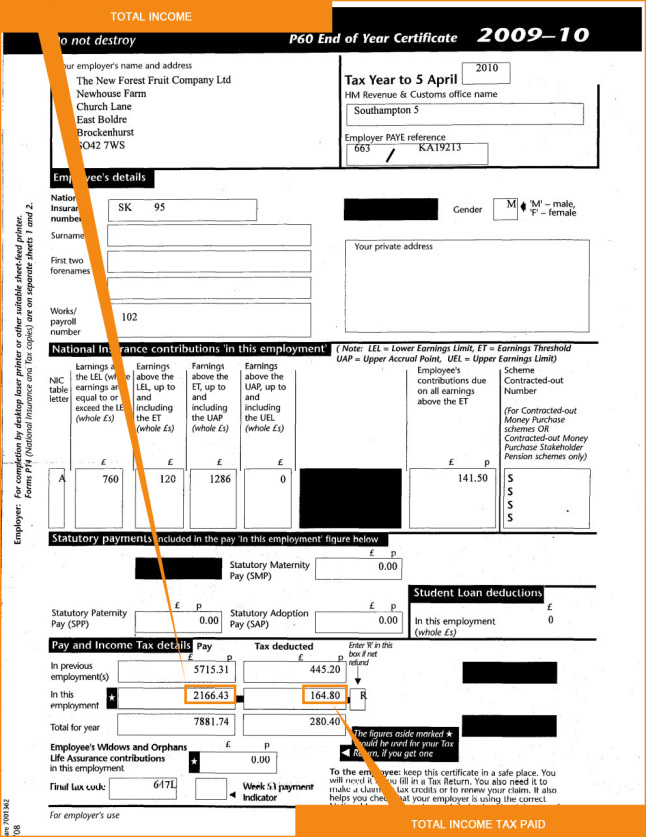

How To Check Your P60 Form Or Payslips For Tax Rebate Payslips

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Income Tax Deductions List FY 2019 20

Total Rebate In Income Tax - Web 25 mai 2021 nbsp 0183 32 Income Tax rebate is the refund or reduction amount offered by the