Total Exemption In Income Tax Section 10 4D of the Income Tax Act provides for an exemption from tax for specified funds in respect of income accrued or arisen or received by them which is

91 rowsExempted income differs from income tax deduction in that tax Discover the most important exemptions under the Income Tax Act Section 10 Learn about various categories of income that are exempt from taxation

Total Exemption In Income Tax

Total Exemption In Income Tax

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Income Tax Slab For FY 2022 23 What You Need To Know

https://vakilsearch.com/blog/wp-content/uploads/2022/09/types-of-income-exempted-from-income-tax-in-india-1.png

Exempt Income means income which does not form part of the total income of the assessee Such income is not included altogether in the total income forming part of the five heads of Though the income earned is taxable the Act also allows for different types of exemptions which help you in lowering your taxable income These exemptions allow specific incomes to be tax

Section 10 of Income tax Act has listed the incomes which are not included in total income That means these incomes are not taxable and you are not required to pay any tax on Section 10 of the Income Tax Act deals with exempt incomes from your total taxable income Check the most common exemptions included under Section 10

Download Total Exemption In Income Tax

More picture related to Total Exemption In Income Tax

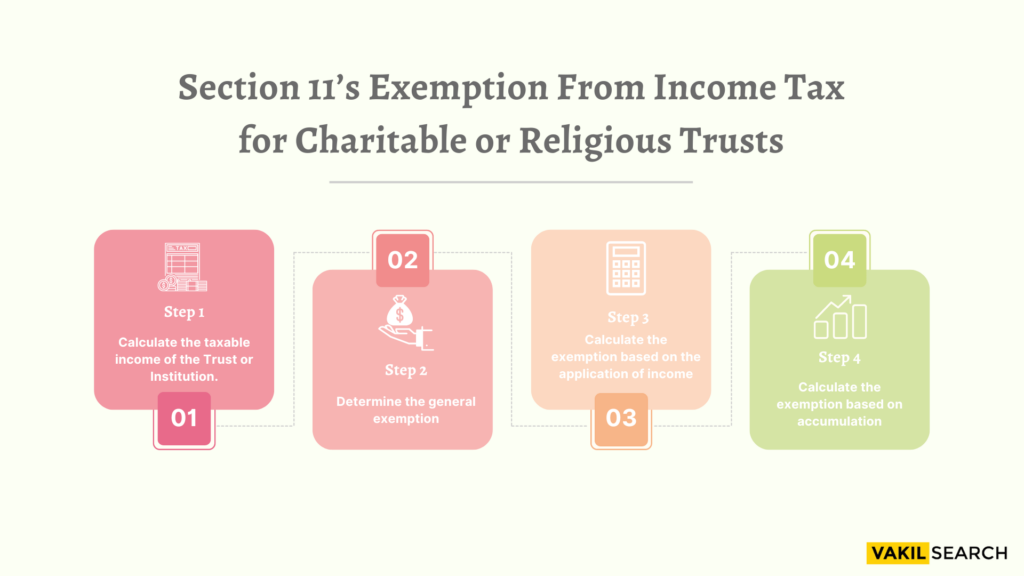

Section 11 Income Tax Act Exemptions For Charitable Trusts

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/08/SECTION-11S-INCOME-TAX-EXEMPTION-1024x576.png

Do This Work To Get Exemption In Income Tax Savings Upto 2 Lakh On

https://i.ytimg.com/vi/TpAgffgIbYU/maxresdefault.jpg

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Section 10 of the Income Tax Act of 1961 deals with income that is exempt from tax in India It outlines the specific categories of incomes that are either wholly or partly Section 10 of the Income tax Act 1961 provides exemptions to ease the income tax burden for salaried professionals It outlines criteria for tax exemptions and focuses on income

As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 The income tax Exempt Income is an income not chargeable to tax as per the Income Tax Act Read more about types of exempt income tax on it and reporting in ITR

Income Tax Exemption U s 10 23C iiiac Allowable When 50 Of Total

https://www.taxscan.in/wp-content/uploads/2023/08/Income-Tax-Exemption-u-Total-Receipts-Grant-Received-Institute-Liver-Biliary-Sciences-Govt-Delhi-HC-TTAXSCAN.jpg

Who Will Benefit From A Total Exemption Archyde

https://img-4.linternaute.com/O9yof2phRGOyLfAU4tU5ngFQhsE=/1240x/smart/55e40f15dbfa42db895c907324d6fe6f/ccmcms-linternaute/18981912.jpg

https://tax2win.in › guide

Section 10 4D of the Income Tax Act provides for an exemption from tax for specified funds in respect of income accrued or arisen or received by them which is

https://www.bankbazaar.com › tax › exempt-income.html

91 rowsExempted income differs from income tax deduction in that tax

HRA Exemption In Income Tax

Income Tax Exemption U s 10 23C iiiac Allowable When 50 Of Total

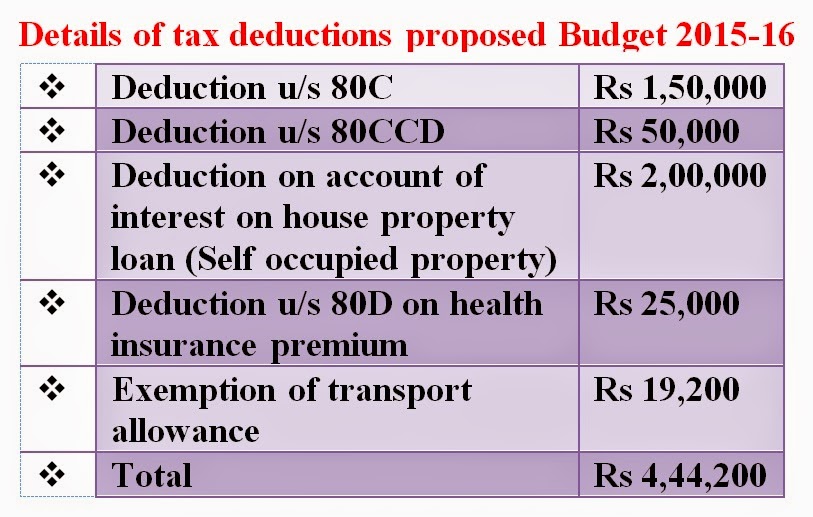

Income Tax Exemption Limit In The Budget 2015 16 StaffNews

HRA Exemption Calculator For Income Tax Benefits Calculation And

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

Income Tax Calculator For FY 2022 23 Kanakkupillai

DDEP Don t Push Us To Our Early Graves Pensioner Bondholders Plead

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Total Exemption In Income Tax - Exempt Income means income which does not form part of the total income of the assessee Such income is not included altogether in the total income forming part of the five heads of