Maximum Exemption Limit Income Tax Verkko 22 jouluk 2023 nbsp 0183 32 you are 65 or older If you are married or in a civil partnership and jointly assessed you are exempt from Income Tax where your total income is less than the

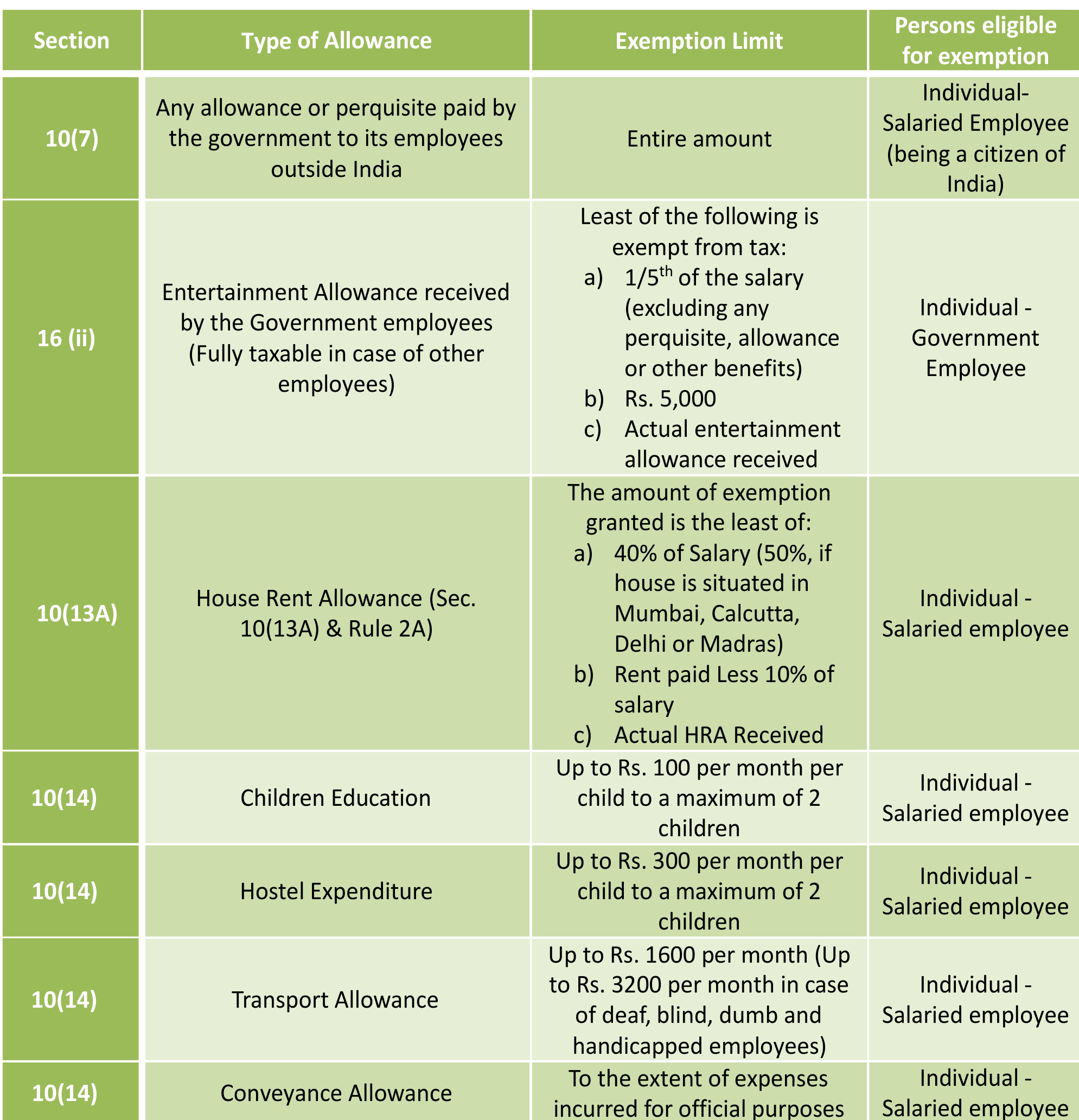

Verkko Every person being an Individual HUF AOP BOI or AJP shall be required to file return of income if his total income before claiming exemption or deduction under 10 38 Verkko 11 hein 228 k 2017 nbsp 0183 32 Children Education Allowance If you are receiving children education allowance from your employer then you are eligible

Maximum Exemption Limit Income Tax

Maximum Exemption Limit Income Tax

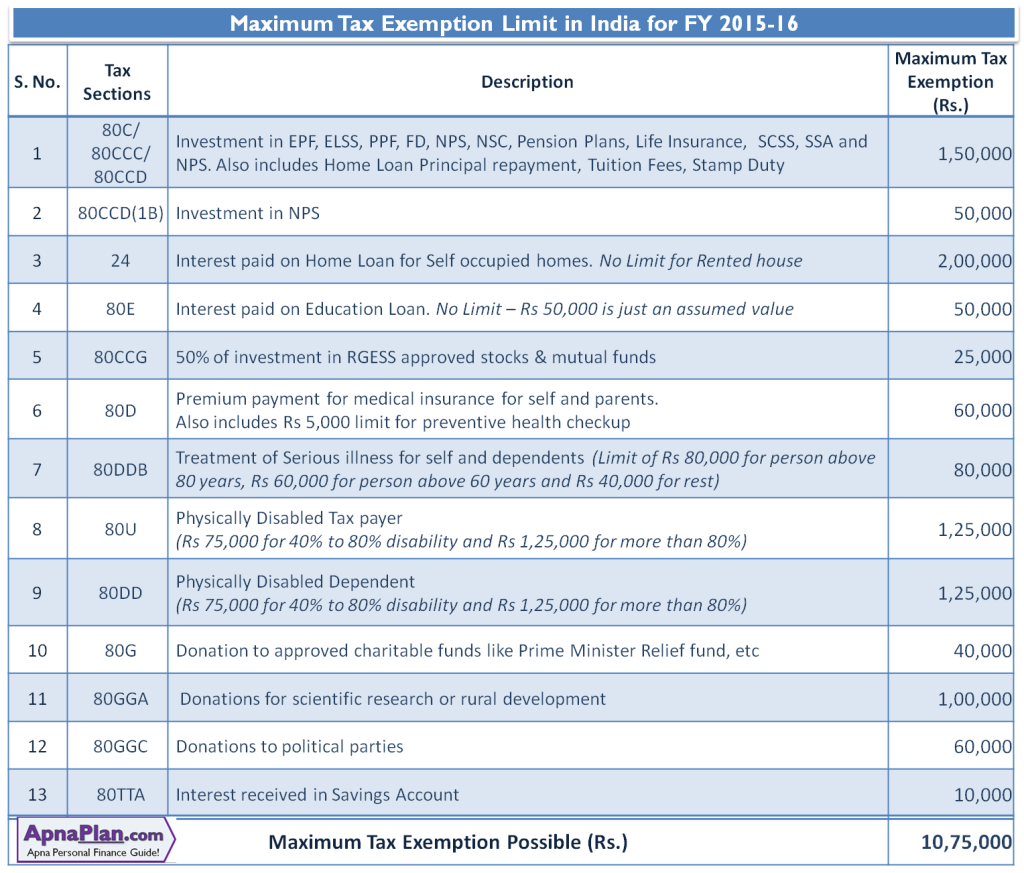

https://www.apnaplan.com/wp-content/uploads/2015/04/Maximum-Tax-Exemption-Limit-in-India-for-FY-2015-16-1024x873.png

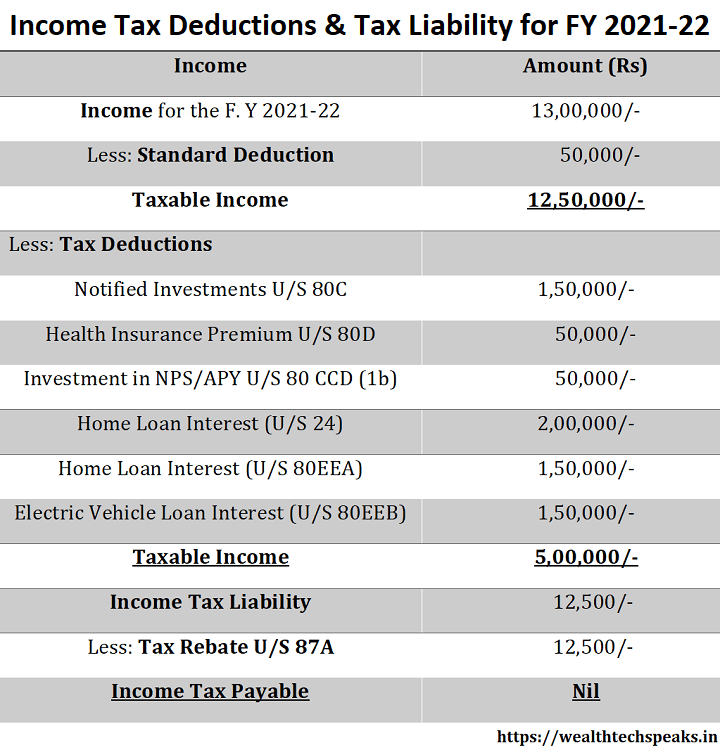

Income Tax Exemption List Fy 2021 22 TAX

https://wealthtechspeaks.in/wp-content/uploads/2021/03/Tax-Deduction-Calculation.png

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

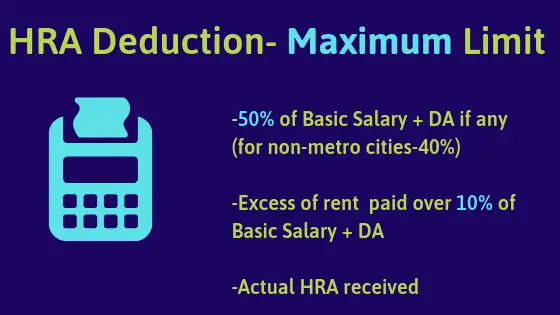

Verkko 19 maalisk 2018 nbsp 0183 32 a Total HRA received from your employer b Rent paid less than 10 of basic salary DA c 40 of salary Basic salary DA for non metros and 50 of Verkko Current rates and allowances How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your

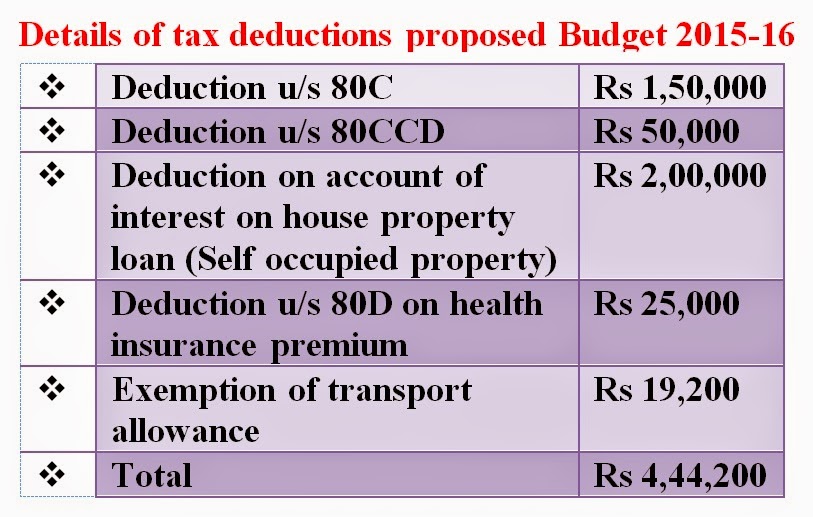

Verkko 11 tammik 2023 nbsp 0183 32 What Is The Maximum Exemption Under Section 10 Section 10 of the Income Tax Act maximum limit is of Rs 2 50 lakhs for people below 60 years Verkko 21 syysk 2022 nbsp 0183 32 In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD 1B This means

Download Maximum Exemption Limit Income Tax

More picture related to Maximum Exemption Limit Income Tax

Adjust LTCG Against The Basic Exemption Limit And Save Income Tax

https://www.nitinbhatia.in/wp-content/uploads/2016/08/LTCG.jpg

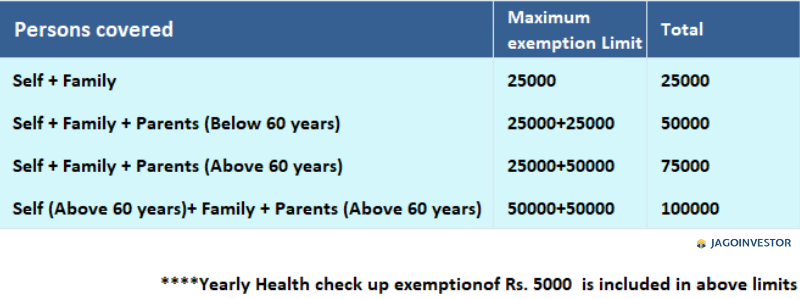

How Much Tax Benefit Can Be Claimed U s 80D Rules Limits

https://www.jagoinvestor.com/wp-content/uploads/files/80D-exemption-image-1.png

HRA Calculator 2019 20 In depth Guide Including HRA Agrement Format

https://moneyjigyasu.com/wp-content/uploads/2018/10/Spread-your-words-bring-a-book-11.png

Verkko 13 helmik 2023 nbsp 0183 32 For example for the 2022 tax year 2023 if you re single under the age of 65 and your yearly income is less than 12 950 you re exempt from paying Verkko Income Tax Exemption Limit The basic exemption limit for individuals below the age of 60 years is Rs 2 50 lakhs For senior citizens the exemption limit is Rs 3 lakhs

Verkko 5 toukok 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid Verkko Maximum deduction allowed under section 80C every year from the taxpayer s total income Companies partnership firms and LLPs cannot avail the benefit of this

Income Tax Basic Exemption Limit In India some Facts To Know ITR Guide

https://1.bp.blogspot.com/-HdGx2LzOXew/XKXFPMuqWuI/AAAAAAAAAD8/YrVDaA4WpG8fmaFG-Aw4ijQxSko4cZD5QCLcBGAs/s1600/Income-tax-basic-exemption-limit.jpg

Income Tax Rules Fy 2019 2020 Carfare me 2019 2020

https://wealthtechspeaks.in/wp-content/uploads/2019/02/Income-Tax-Deductions-FY-2019-20.jpg

https://www.revenue.ie/en/personal-tax-credits-reliefs-and-exemptions/...

Verkko 22 jouluk 2023 nbsp 0183 32 you are 65 or older If you are married or in a civil partnership and jointly assessed you are exempt from Income Tax where your total income is less than the

https://incometaxindia.gov.in/charts tables/threshold_limits.htm

Verkko Every person being an Individual HUF AOP BOI or AJP shall be required to file return of income if his total income before claiming exemption or deduction under 10 38

Income Tax Exemption Limit In The Budget 2015 16 Central Govt

Income Tax Basic Exemption Limit In India some Facts To Know ITR Guide

All About Allowances Income Tax Exemption CA Rajput Jain

Anything To Everything Income Tax Guide For Individuals Including

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Chapter VI A 80G Deduction For Donation To Charitable Institution

Chapter VI A 80G Deduction For Donation To Charitable Institution

Income Tax Deduction Section 80TTA Section 80TTB Tax2win Blog

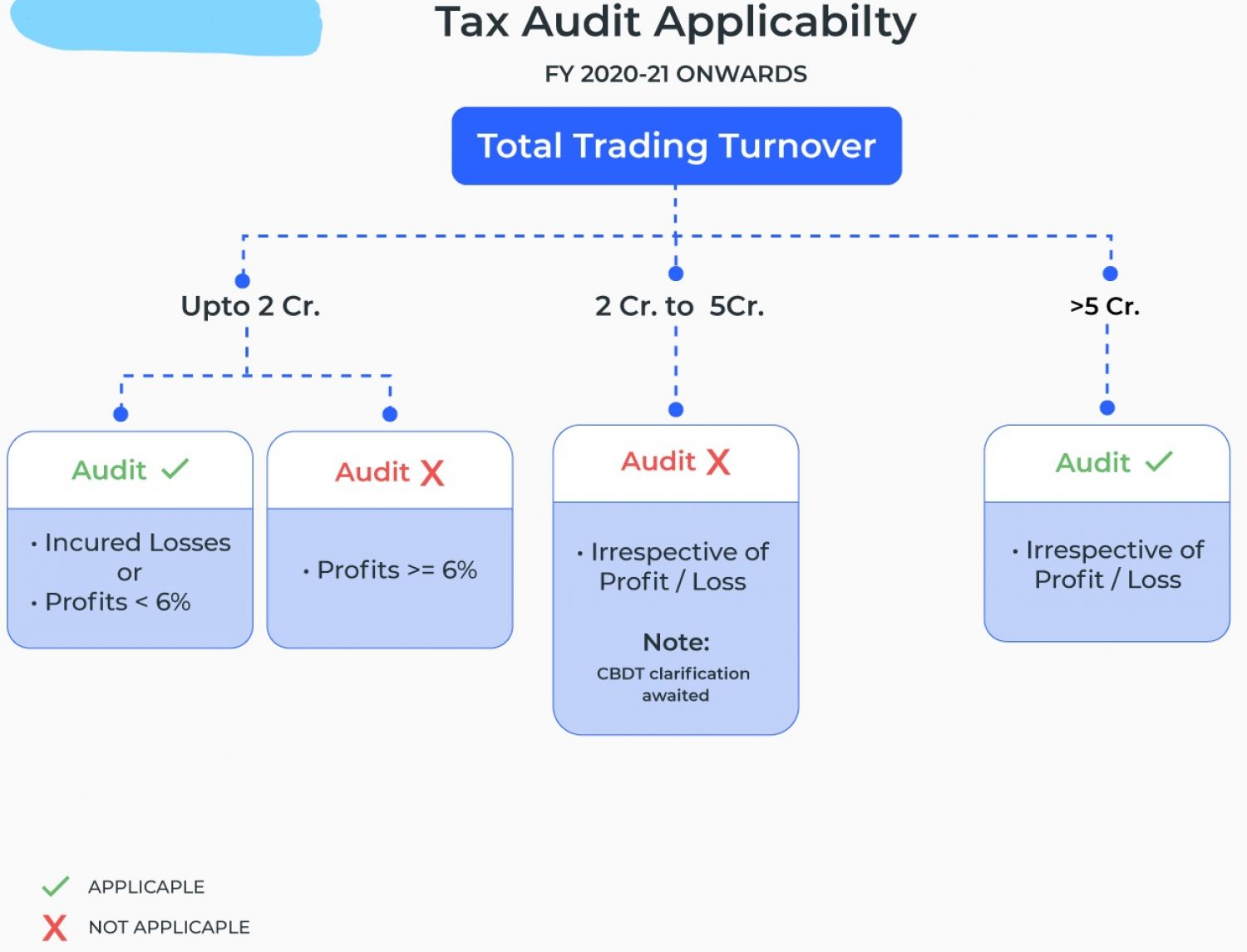

Income Tax Auditor Income Tax Audit Limit Income Tax Audit Applicability

Income Tax Deductions Available For The Financial Year 2017 18

Maximum Exemption Limit Income Tax - Verkko A Resident Individual less than 60 years or HUF or any other Person other than Company Firm to Bank for not deducting TDS on Interest Income if the income is