Total Income Tax Rebate In India Web 11 avr 2023 nbsp 0183 32 As per Section 87A of the Income Tax Act if the total income of an individual does not exceed a certain threshold currently Rs 5 lakh they are eligible for

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount Web 1 f 233 vr 2023 nbsp 0183 32 Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will

Total Income Tax Rebate In India

Total Income Tax Rebate In India

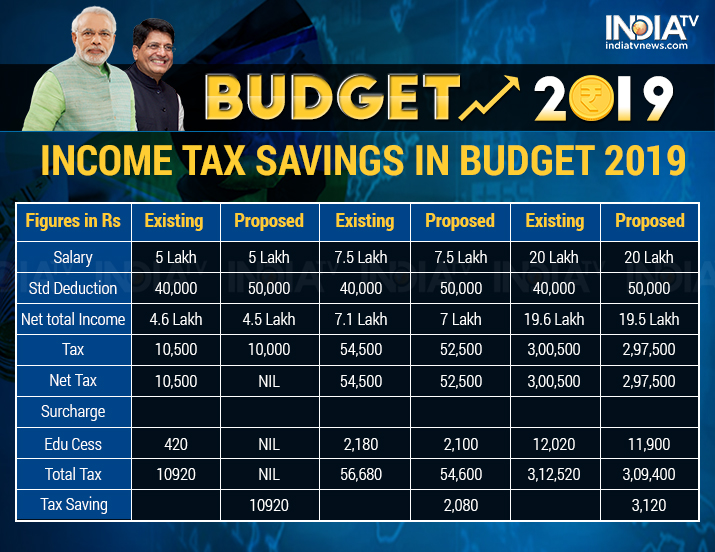

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

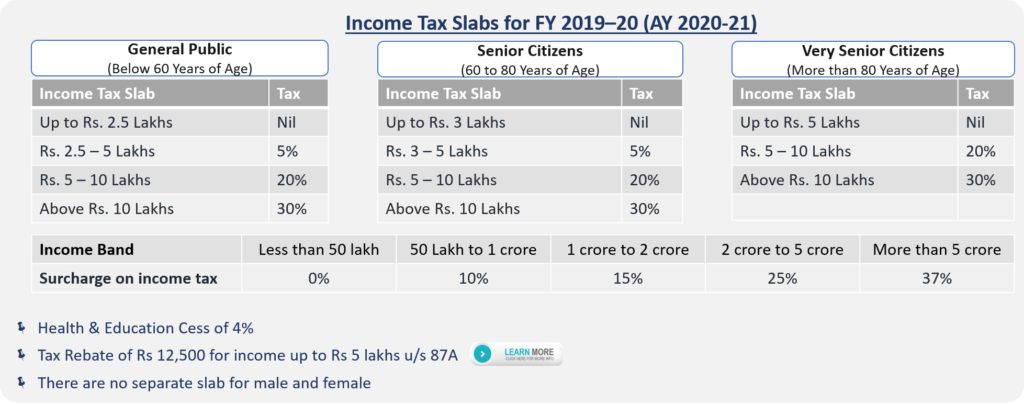

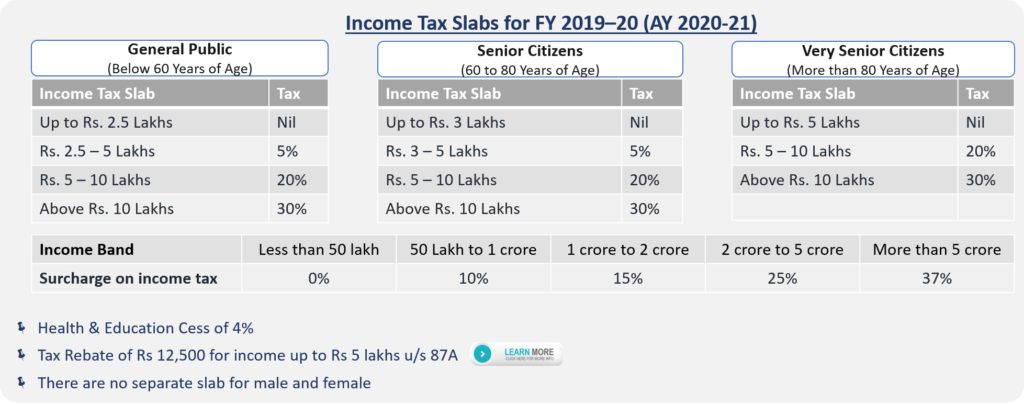

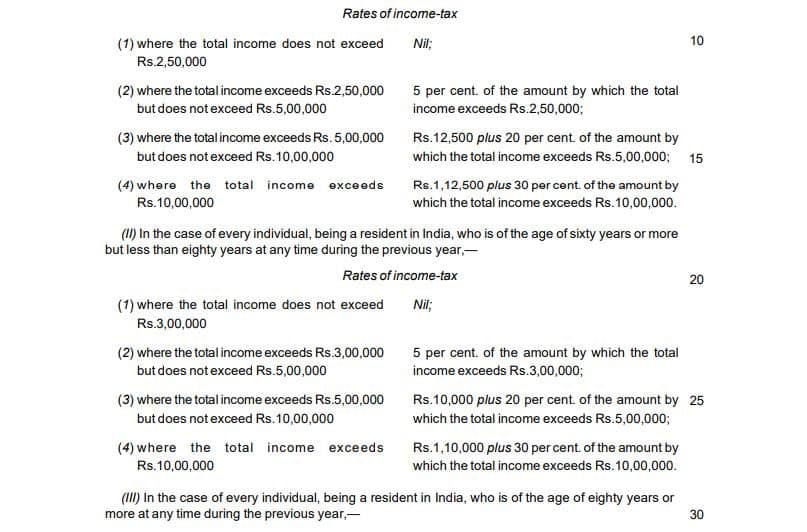

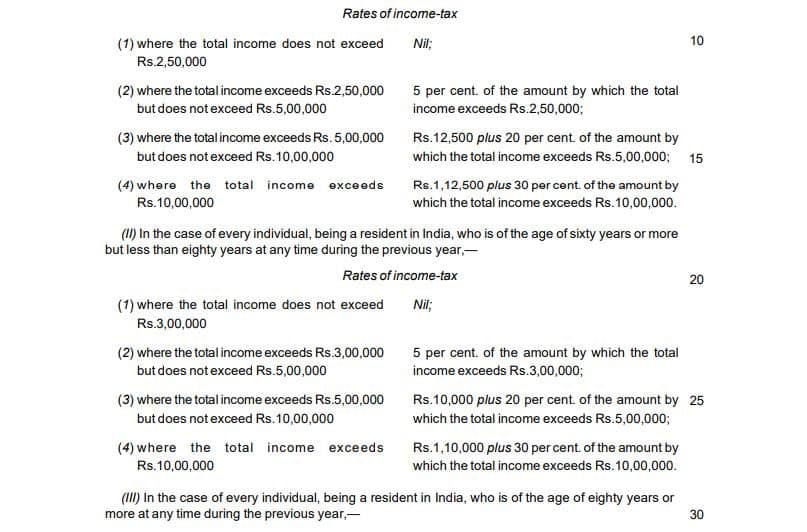

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

Web 24 mars 2017 nbsp 0183 32 Income tax department with a view to encourage savings and investments amongst the taxpayers have provided various deductions from the taxable income under Web What is Income Tax Calculator How to Use the Income Tax Calculator for FY 2023 24 What is Income Tax Calculator An income tax calculator is an online tool that helps you figure out how much tax you need to pay

Web 1 f 233 vr 2023 nbsp 0183 32 Budget 2023 Budget 2023 Income Tax rebate limit raised to 7 lakh from 5 lakh Finance Minister Nirmala Sitharaman announces that there will not be any new tax for income up to 3 lakh reduces the Web 1 ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following

Download Total Income Tax Rebate In India

More picture related to Total Income Tax Rebate In India

Interim Budget 2019 Check How Will Income Tax Rebate Announced By Fin

https://resize.indiatvnews.com/en/resize/newbucket/715_-/2019/02/income-tax-savings-in-budget-2019-1549027494.jpg

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Web Standard Deduction of Rs 50 000 Entertainment Allowance Deduction in respect of this is available to a government employee to the extent of Rs 5 000 or 20 of his salary or Web 19 janv 2023 nbsp 0183 32 Step 5 Consolidate your net tax Rebate under Sec 87A Tax rebate is a form of tax incentive provided by the government to individuals earning an income below a specified limit In case your total

Web 15 mars 2022 nbsp 0183 32 Section 87A If a resident and taxpayer s gross income after deduction is less than Rs 5 lakh the individual can claim tax relief The maximum amount available Web If the individual is an employee the maximum income tax rebate in India they can avail is lesser of 10 of their salary or 10 of their gross income Individuals who are self

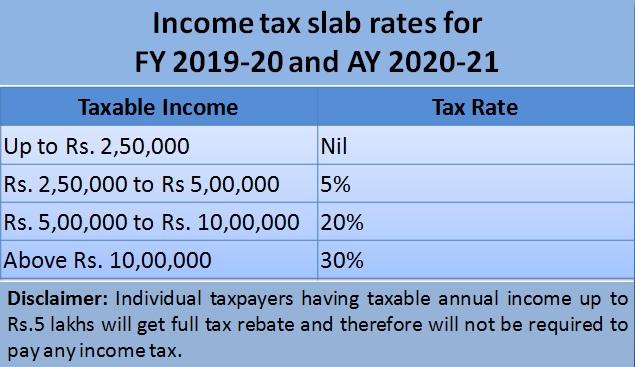

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

https://www.apnaplan.com/wp-content/uploads/2019/04/Income-Tax-Slabs-for-FY-2019-20-AY-2020-21-1024x404.png

Daily current affairs

http://www.benevolentacademy.com/wp-content/uploads/2023/03/budget-2023-income-tax-india-tv-4-1675237269.jpg

https://www.bajajfinserv.in/insights/income-tax-rebate

Web 11 avr 2023 nbsp 0183 32 As per Section 87A of the Income Tax Act if the total income of an individual does not exceed a certain threshold currently Rs 5 lakh they are eligible for

https://www.bankbazaar.com/tax/tax-rebate.html

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Incometax Individual Income Taxes Urban Institute This Service

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Tax Rebate For Individual Deductions For Individuals reliefs

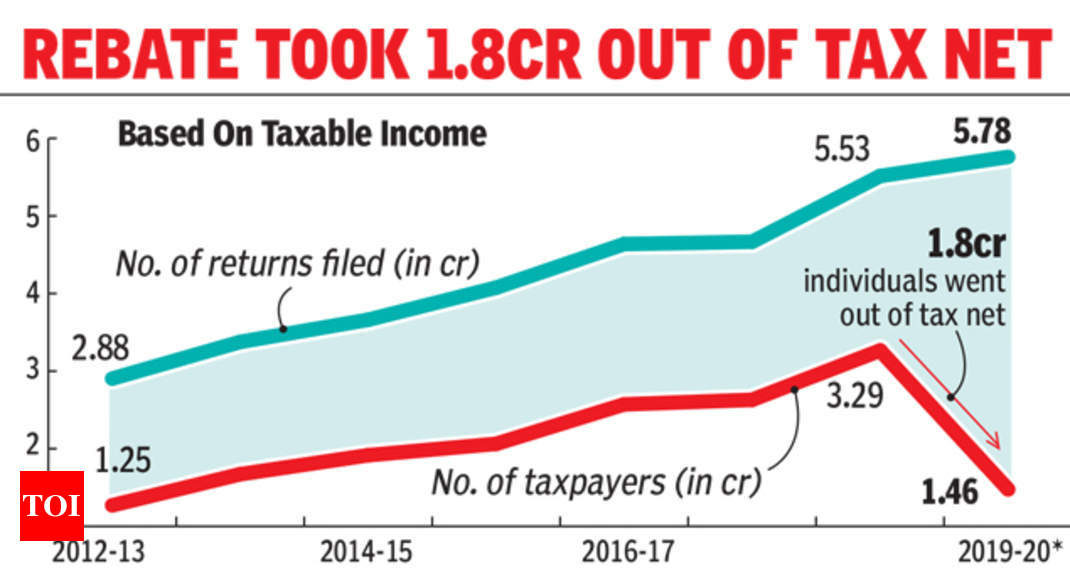

Why Number Of Income Tax Payers Halved In Just One Year Times Of India

Income Tax Rebate In Interim Budget 2019 Comes With A Big Rider India

Income Tax Rebate In Interim Budget 2019 Comes With A Big Rider India

2007 Tax Rebate Tax Deduction Rebates

Fortune India Business News Strategy Finance And Corporate Insight

Standard Deduction For 2021 22 Standard Deduction 2021

Total Income Tax Rebate In India - Web 1 ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following