Is A New Energy Efficient Furnace Tax Deductible In August 2022 the Inflation Reduction Act amended two credits available for energy efficient home improvements and residential clean energy equipment so that they last longer and have a greater

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements

Is A New Energy Efficient Furnace Tax Deductible

Is A New Energy Efficient Furnace Tax Deductible

https://irp-cdn.multiscreensite.com/8ecf6514/dms3rep/multi/Depositphotos_8707708_l-2015.jpg

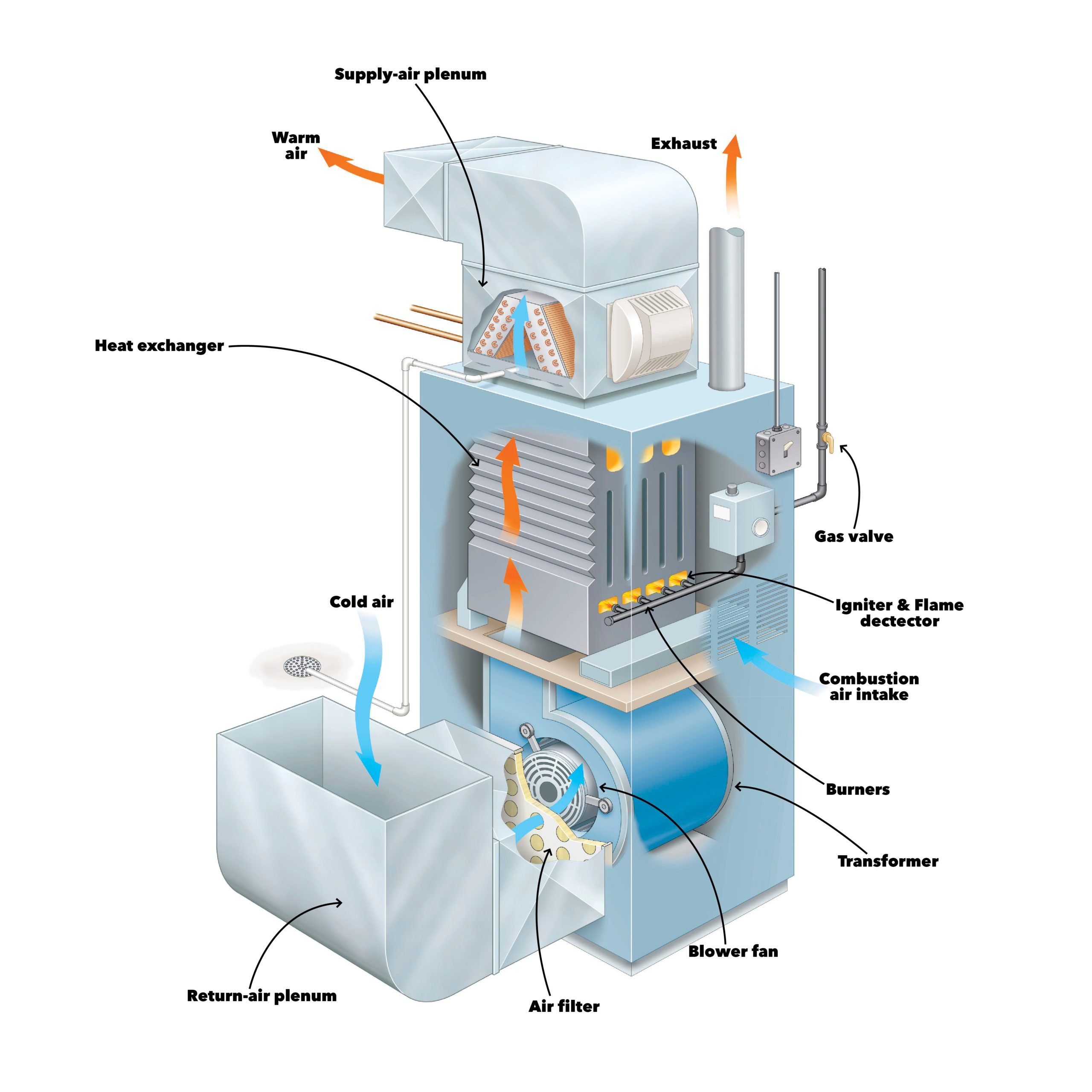

How Does A Gas Furnace Work The Family Handyman

https://www.familyhandyman.com/wp-content/uploads/2021/01/Furance-Illustration_AS-scaled.jpg

Is Your Furnace Efficient Energy Efficient Furnace Energy Efficient

https://i.pinimg.com/originals/f4/09/7e/f4097e2f5cad0d4b50750909e4e2c318.jpg

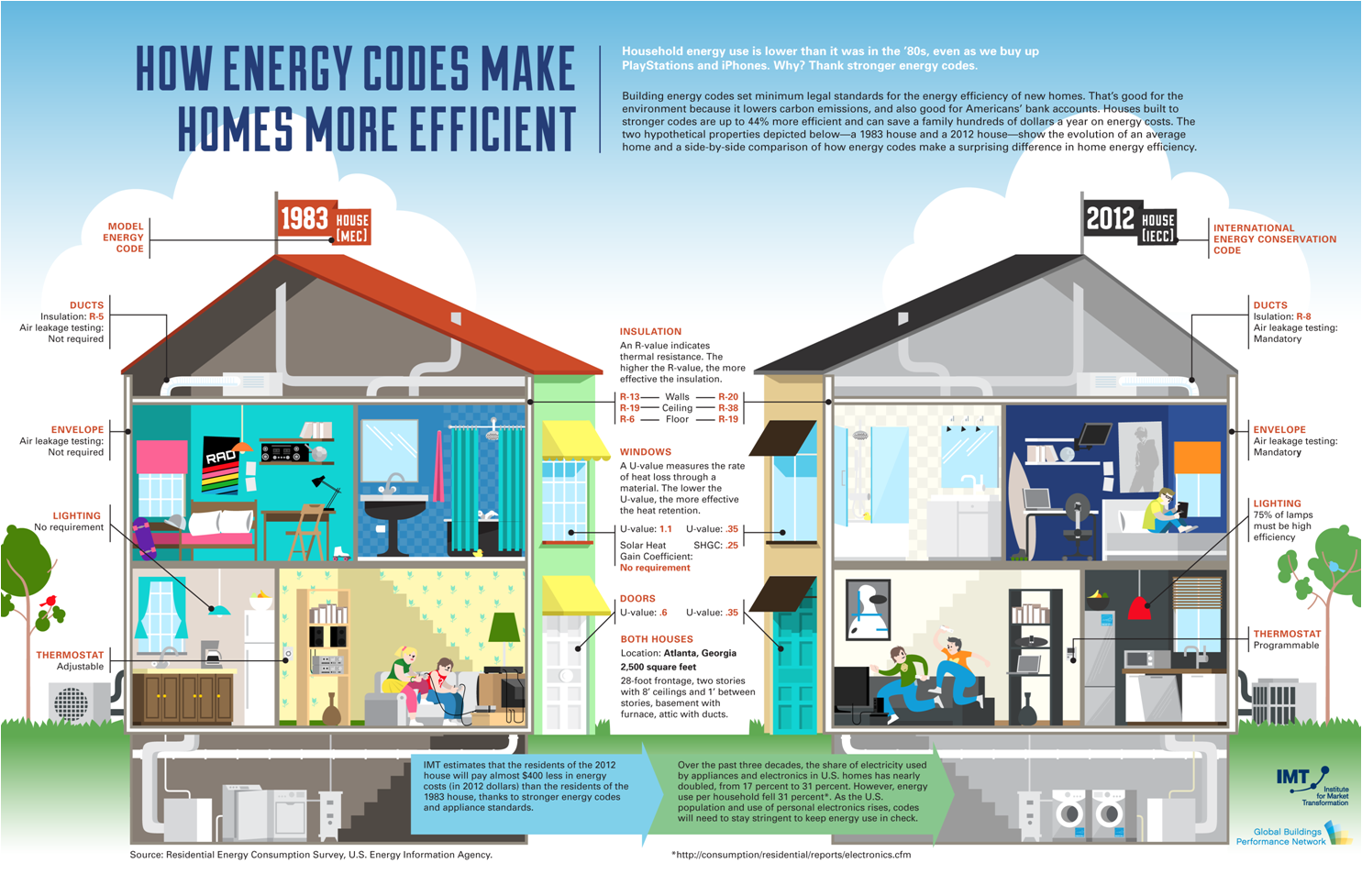

Energy Efficient Home Improvement Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you

The Energy Efficient Home Improvement Credit EEHIC was introduced under the Inflation Reduction Act IRA of 2022 It rewards you with tax breaks for installing qualifying energy efficient HVAC The energy efficient home improvement credit is allowed to offset regular income tax reduced by the foreign tax credit plus alternative minimum tax Sec 26

Download Is A New Energy Efficient Furnace Tax Deductible

More picture related to Is A New Energy Efficient Furnace Tax Deductible

Rheem High Efficiency Furnace Comfort Craft LLC

http://comfortcraftllc.com/wp-content/uploads/2019/02/20181120_140852-12.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Are Energy Saving Windows Deductible On Taxes Pocket Sense

https://img-aws.ehowcdn.com/877x500p/s3-us-west-1.amazonaws.com/contentlab.studiod/getty/cache.gettyimages.com/d6db28f8a22747a1b1e5314a596aeeeb.jpg

For example homeowners can cut their tax bill by installing new energy efficient windows doors water heaters furnaces air conditioners etc That s because the IRA extends and Other energy efficiency upgrades Oil furnaces or hot water boilers if they meet or exceed 2021 Energy Star efficiency criteria and are rated by the manufacturer for use with fuel

Energy Efficient Home Improvement income tax credits are available for central air conditioning systems boilers furnaces air source heat pumps and biomass The IRS offers several ways for taxpayers to cut their tax bills through investing in certain energy efficient appliances and home improvements This can

Buy A New Energy Efficient Furnace GTA Furnace

https://gtafurnace.ca/wp-content/uploads/2012/12/Goodman-Furnace.jpg

High Efficiency Furnace Shop Authentic Save 67 Jlcatj gob mx

https://hvac-boss.com/wp-content/uploads/2021/02/High-efficiency-furnace-heat-exchange-1003x1024.jpg

https://turbotax.intuit.com/tax-tips/home...

In August 2022 the Inflation Reduction Act amended two credits available for energy efficient home improvements and residential clean energy equipment so that they last longer and have a greater

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

De Hart Plumbing Heating And Cooling Manhattan And Junction City KS

Buy A New Energy Efficient Furnace GTA Furnace

Making Your Home Energy Efficient Is Tax Deductible Finerpoints

Hydrojetting Sewer Drain Cleaning Service De Hart Plumbing Heating

Pin On Department Of Green Energy Inc

Water Heater Repair DeHart Plumbing Junction City Manhattan KS

Water Heater Repair DeHart Plumbing Junction City Manhattan KS

DeHart Plumbing HVAC Service Junction City Wamego And Manhattan KS

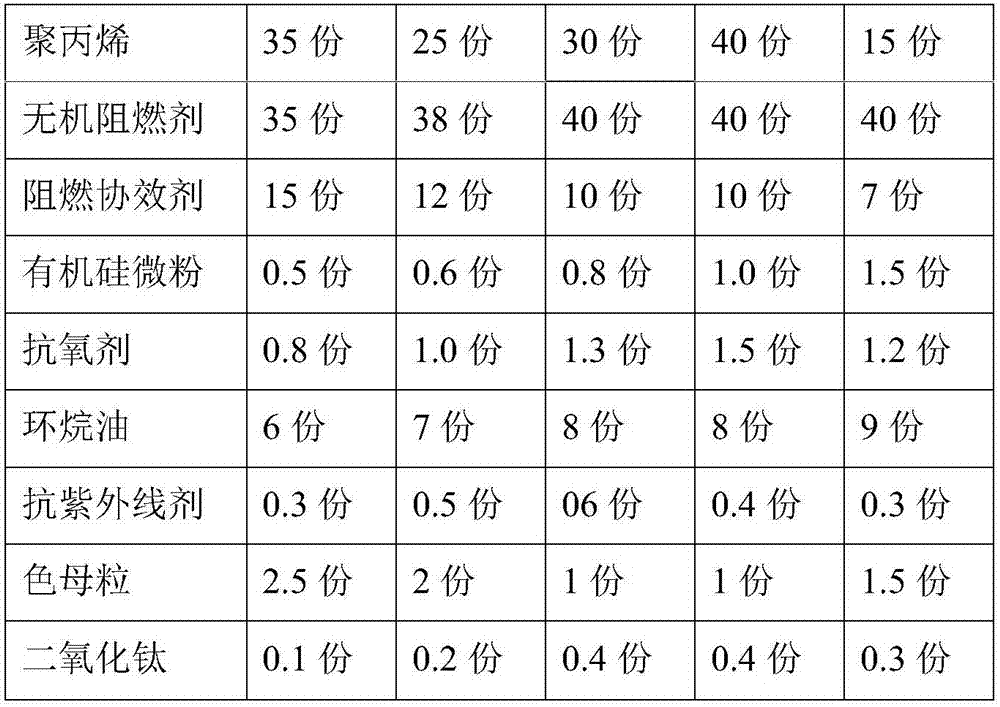

Safe Charging Pile For New Energy Automobile Eureka Patsnap Develop

Environment friendly TPE Material For New Energy Electric Vehicle

Is A New Energy Efficient Furnace Tax Deductible - Energy Efficient Home Improvement Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation