Hba Interest Rebate In Income Tax Web 28 mars 2017 nbsp 0183 32 The Income Tax Act allows to claim a deduction of such interest also called the pre construction interest A deduction in five equal instalments starting from

Web 25 mars 2016 nbsp 0183 32 20 OF TOTAL Rs 56 741 74 Principle and Interest on Home Loan paid during the current financial year in which I got the Web 12 juin 2023 nbsp 0183 32 Know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

Hba Interest Rebate In Income Tax

Hba Interest Rebate In Income Tax

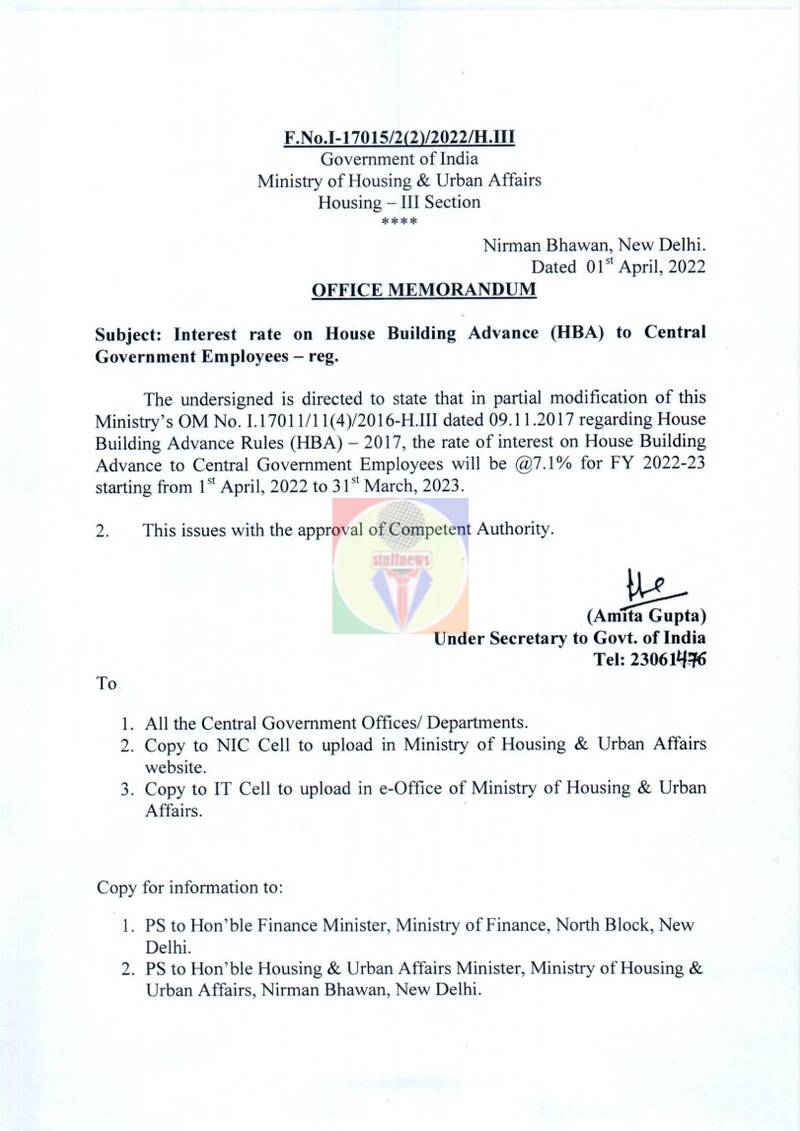

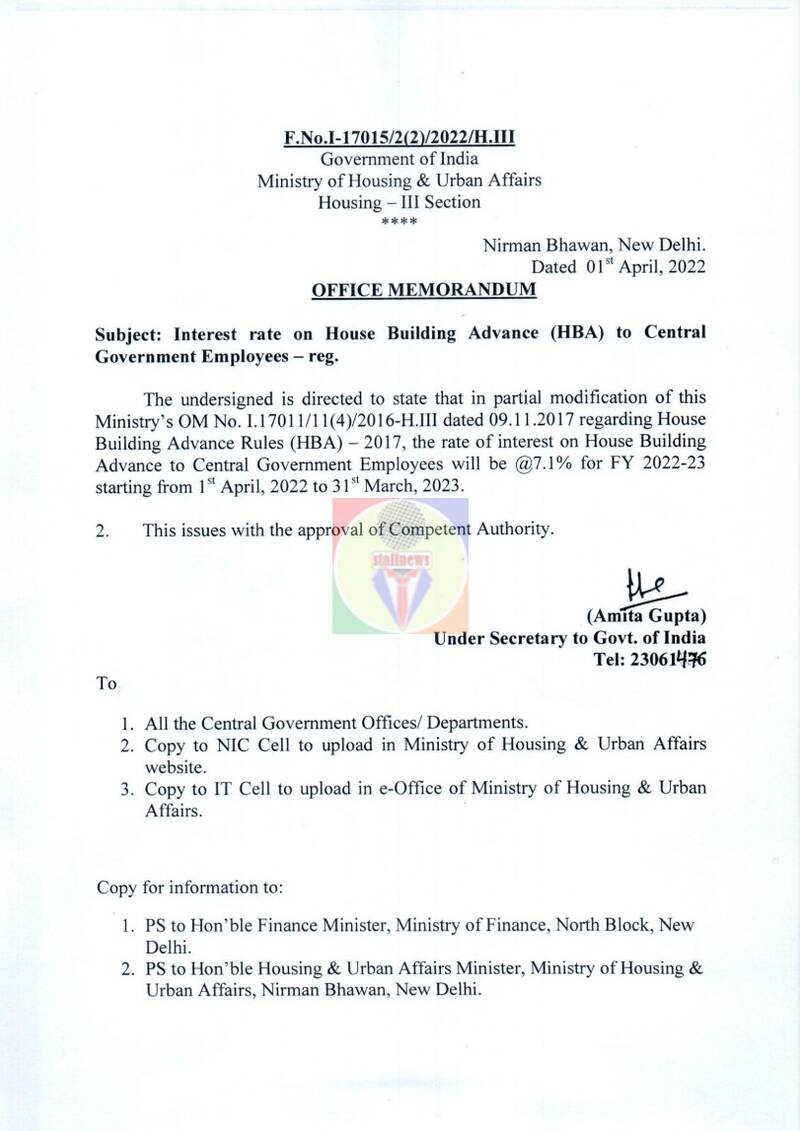

https://www.staffnews.in/wp-content/uploads/2022/04/interest-rate-on-house-building-advance-hba-for-fy-2022-23.jpg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

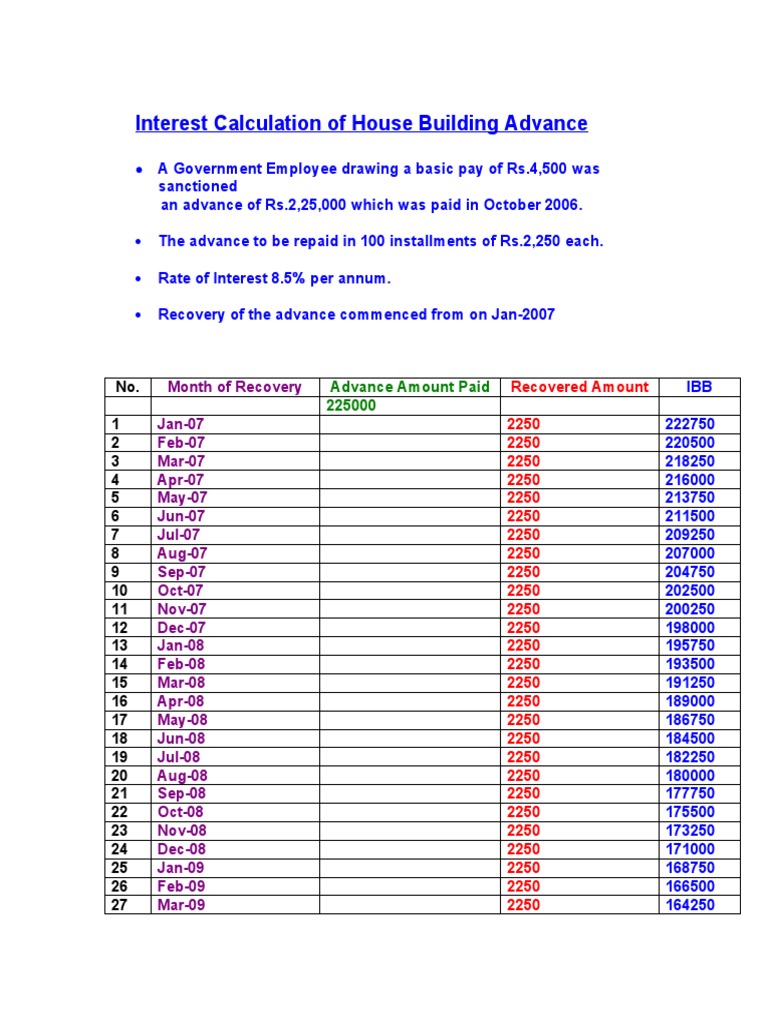

HBA Interest Calculation Personal Finance Factor Income Distribution

https://imgv2-1-f.scribdassets.com/img/document/23687839/original/7c4c753386/1619033836?v=1

Web Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can Web Interest repayment Thus as is clear from the above table deduction for both interest and principal can be claimed under different sections of the Income Tax Act These sections

Web 28 mars 2022 nbsp 0183 32 The interest rate on HBA loans is typically between 6 and 9 5 and is determined by the entire loan amount The sanctions included a higher interest rate of Web You can claim up to Rs 150 000 or the actual interest repaid whichever is lower You can claim thisinterest only when

Download Hba Interest Rebate In Income Tax

More picture related to Hba Interest Rebate In Income Tax

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.coursehero.com/qa/attachment/24027424/

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/3b6/3b6e0b0f-5f0b-4b1a-993f-e6359e2d4ede/phpXXJUd2

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

Web 11 janv 2023 nbsp 0183 32 Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions Web Home Loan Interest Deduction Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You

Web 2 juil 2018 nbsp 0183 32 The amount deduction shall be the interest payable or Rs 50 000 whichever is less The deduction is available for A Y 2017 18 and subsequent assessment years till Web This Rs 50 000 deduction is in addition to the already applicable Rs 2 lakh limit under the Income Tax Act By filing under you can get an annual deduction on your home loan

Va A Decidir Comedia Apellido How To Calculate Rebate Abierto Pl tano

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/625ef7c5d41bc15cd3a8ec08_138-a.png

Taxes 2023 IRS Says California Most State Tax Rebates Aren t

https://assets3.cbsnewsstatic.com/hub/i/r/2022/04/18/bc29efd4-8f27-4c87-90c8-747eac1fcd9e/thumbnail/1200x630/f8794c3cda3ff3cc4a04aac97f532fdb/hypatia-h_0d32f8ab1663c2148ee4151ae6500dae-h_f470ece42eb4c37c3d363bc8cefc94bf.jpg

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 The Income Tax Act allows to claim a deduction of such interest also called the pre construction interest A deduction in five equal instalments starting from

https://blog.saginfotech.com/tax-benefit-on-h…

Web 25 mars 2016 nbsp 0183 32 20 OF TOTAL Rs 56 741 74 Principle and Interest on Home Loan paid during the current financial year in which I got the

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Va A Decidir Comedia Apellido How To Calculate Rebate Abierto Pl tano

Income Tax Rebate Is A Bait Video Dailymotion

Interim Budget 2019 20 The Talk Of The Town Trade Brains

What Is Rebate In Income Tax Nirmala Sitaraman Gives Big Relief To

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

DEDUCTION UNDER SECTION 80C TO 80U PDF

Hba Interest Rebate In Income Tax - Web 19 avr 2021 nbsp 0183 32 April 19 2021 11 53 IST Tax benefits for home loans are available for interest payment as well as for repayment of the principal amount I get many questions