Is A Redundancy Payment Tax Free Australia Tax free Remaining genuine redundancy payment any money above the tax free limit known as employment termination payment ETP Taxed at concessional rates up to

A genuine redundancy payment is tax free up to a certain limit based on the number of whole years of service the employee has completed see Table 4 For the 2020 21 Casual employees Employees of a small business Anyone who has been employed for less than a year The conclusion of a fixed term contract or an apprenticeship is not

Is A Redundancy Payment Tax Free Australia

Is A Redundancy Payment Tax Free Australia

https://www.kewlaw.co.uk/wp-content/uploads/Depositphotos_40508669_m-2015.jpg

Redundancy Notice Sample Template Word PDF

https://www.wonder.legal/Les_thumbnails/redundancy-notice.png

Termination Pay Redundancy CooperAitken Chartered Accountants

http://www.cooperaitken.co.nz/wp-content/webpc-passthru.php?src=https://www.cooperaitken.co.nz/wp-content/uploads/2020/08/Redundancy.png&nocache=1

The calculated tax free portion of the total redundancy payment The balance of any outstanding annual leave long service leave or accrued sick leave if your employment contract allowed sick leave to 100 included as assessable income and taxed at 32 maximum Includes Medicare Levy if applicable Pro Tax Tip You must receive your redundancy payments within 12 months of stopping work

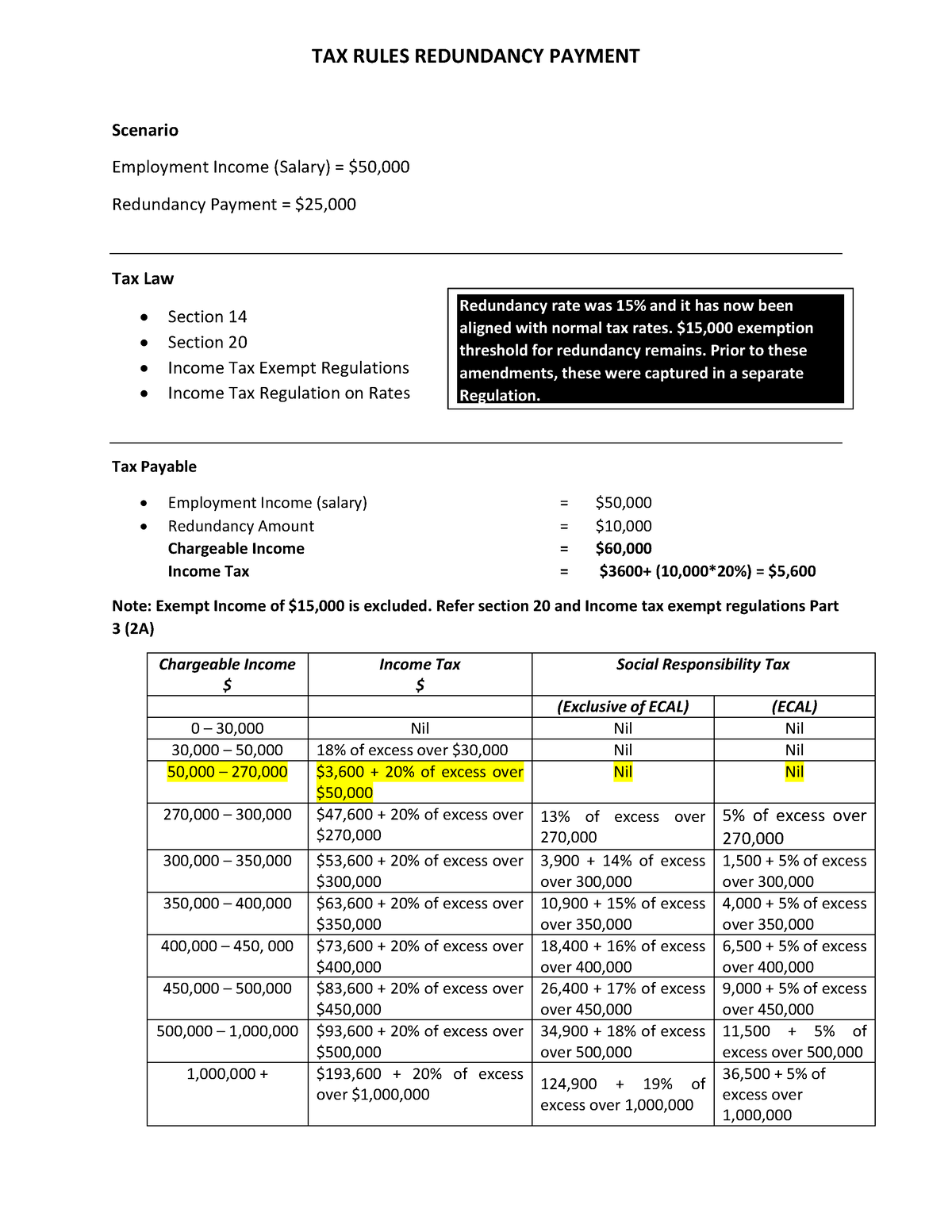

Genuine Redundancies In this case the ex employee does not owe any tax on redundancy payments they receive up to a certain threshold This threshold or Redundancy payments are tax free within certain limits and can be broadly classified into three categories A golden handshake or gratuity A severance payment

Download Is A Redundancy Payment Tax Free Australia

More picture related to Is A Redundancy Payment Tax Free Australia

How Is A Redundancy Payment Taxed Wingate Financial Planning

https://wingatefp.com/wp-content/uploads/2021/04/pexels-pixabay-209224-scaled-1-1024x683.jpg

Letter Of Termination Of Employment Redundancy

https://www.wonder.legal/Les_thumbnails/letter-of-termination-of-employment-redundancy.png

Termination Letter Redundancy Free Template Sample Lawpath

https://i.pinimg.com/originals/2a/a8/88/2aa8882f9424f9e3356dffa7784d6353.png

The tax free portion of a genuine redundancy payment Payments made more than 12 months NS1 after termination Certain CGT small business concession payments How much tax does an employee pay on redundancy The tax your employee pays on redundancy depends on several factors Their redundancy pay

Tax Free Redundancy Payments Genuine redundancy payments are tax free up to a certain limit based on the number of years the employee has worked The tax free limit depends on the number of years you work for the employer paying the redundancy Genuine redundancy payments above the tax free limit are included in

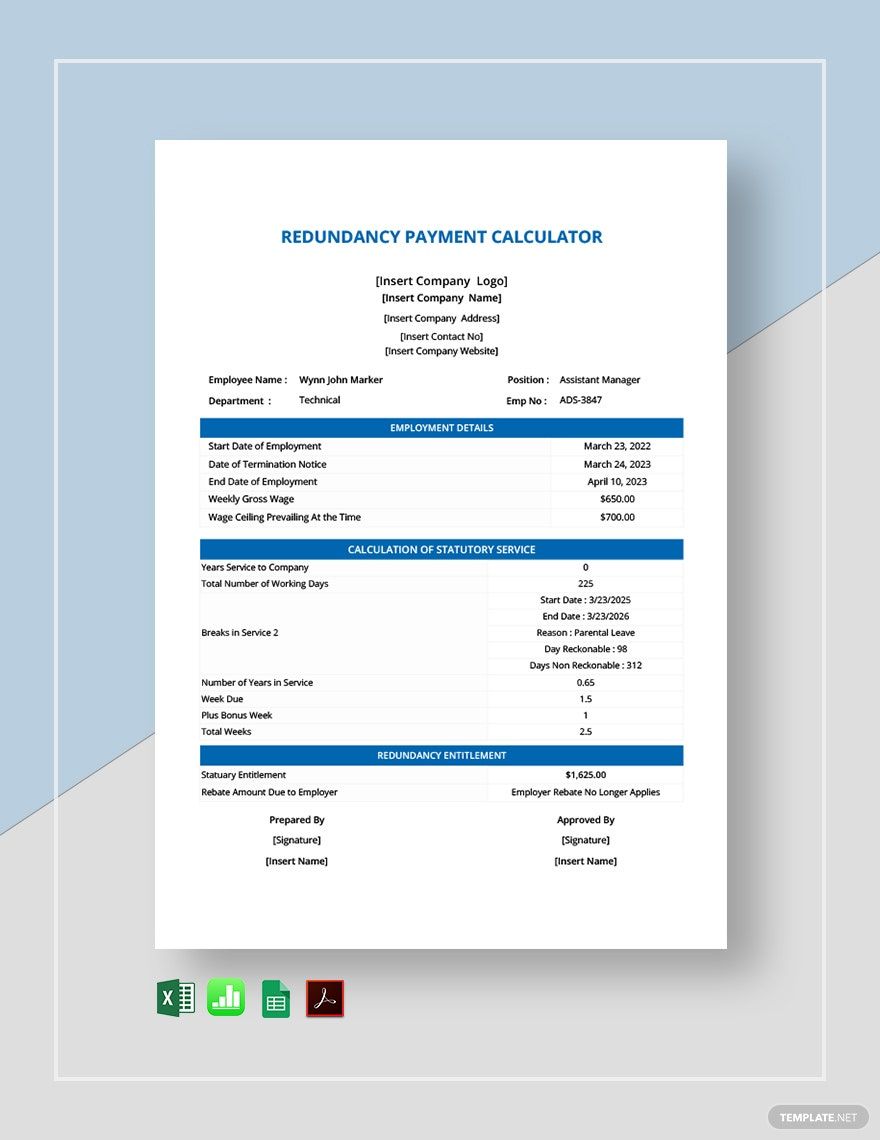

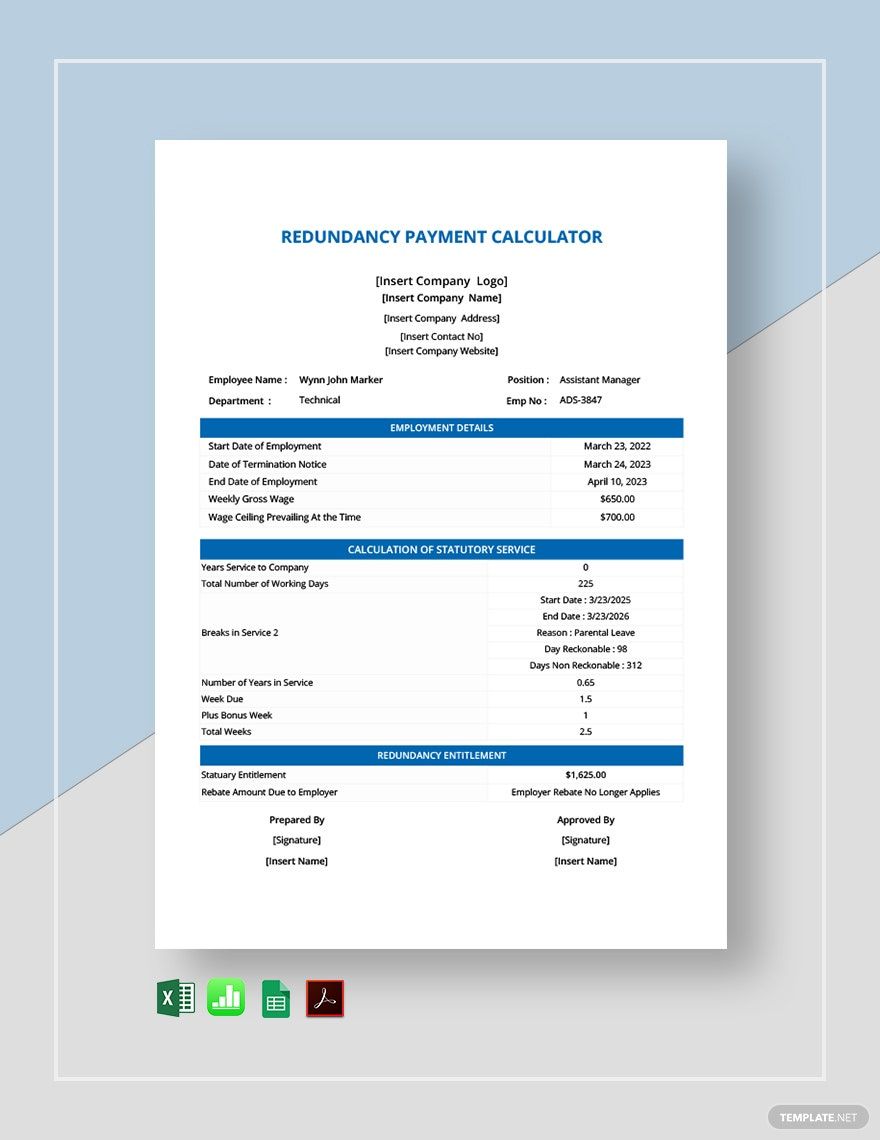

Free Redundancy Payment Calculator Template Download In Google Docs

https://images.template.net/44503/Redundancy-Payment-Calculator-1.jpg

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

https://www. commbank.com.au /articles/tax/tax-on...

Tax free Remaining genuine redundancy payment any money above the tax free limit known as employment termination payment ETP Taxed at concessional rates up to

https:// theabic.org.au /storage/app/media/resources...

A genuine redundancy payment is tax free up to a certain limit based on the number of whole years of service the employee has completed see Table 4 For the 2020 21

Pin On Letter Template

Free Redundancy Payment Calculator Template Download In Google Docs

How To Calculate Redundancy Pay In Australia 2022 Update

Is My Redundancy Payment Tax Free

7 Top Tips For Writing A Redundancy Letter with Example

How Is A Redundancy Payment Taxed In Australia Slow Fortune Get

How Is A Redundancy Payment Taxed In Australia Slow Fortune Get

What Tax Do I Pay On Redundancy Payments Accounting Firms

Redundancy Payment What To Do With It

Taxation OF Redundancy Payment TAX RULES REDUNDANCY PAYMENT Scenario

Is A Redundancy Payment Tax Free Australia - Job seekers Redundancy payments and options Watch this video to find out what you need to consider if you get a redundancy payment This video gives you