Is A Vendor Discount Considered Income In accounting a cash discount or sales discount is any discount you get from a supplier typically for paying your bill promptly A 2 10 net 30 discount for

Discounts may be classified into two types Trade Discounts offered at the time of purchase for example when goods are purchased in bulk or to retain loyal customers A purchase discount is offered to a business by suppliers to encourage early settlement of invoices The discount is a

Is A Vendor Discount Considered Income

Is A Vendor Discount Considered Income

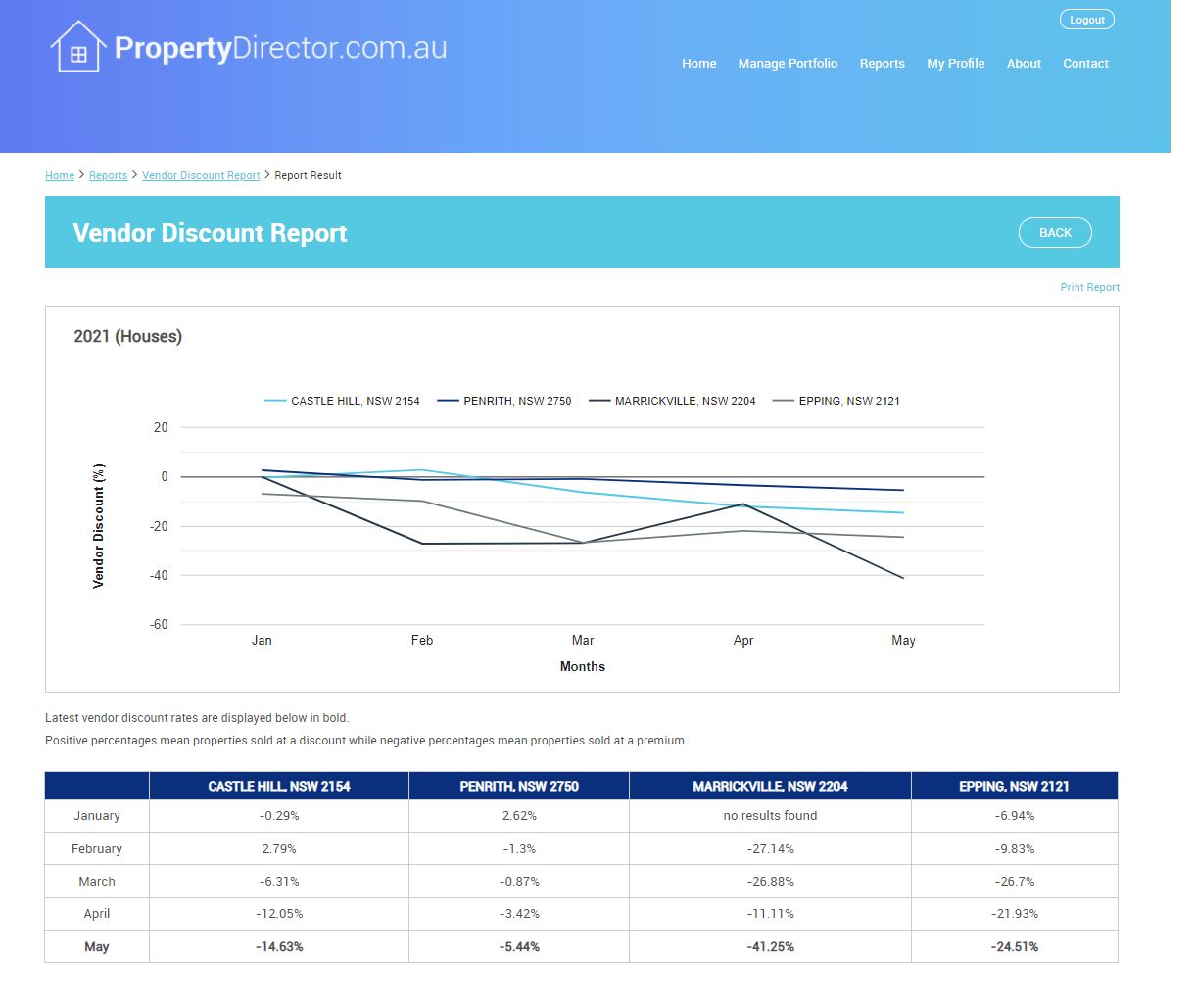

https://www.propertydirector.com.au/public/blog/1640351360-1623644351317.jpg

Is Rental Income Considered Earned Income

https://wp-assets.stessa.com/wp-content/uploads/2021/12/24070648/rental-income-768x512.jpg

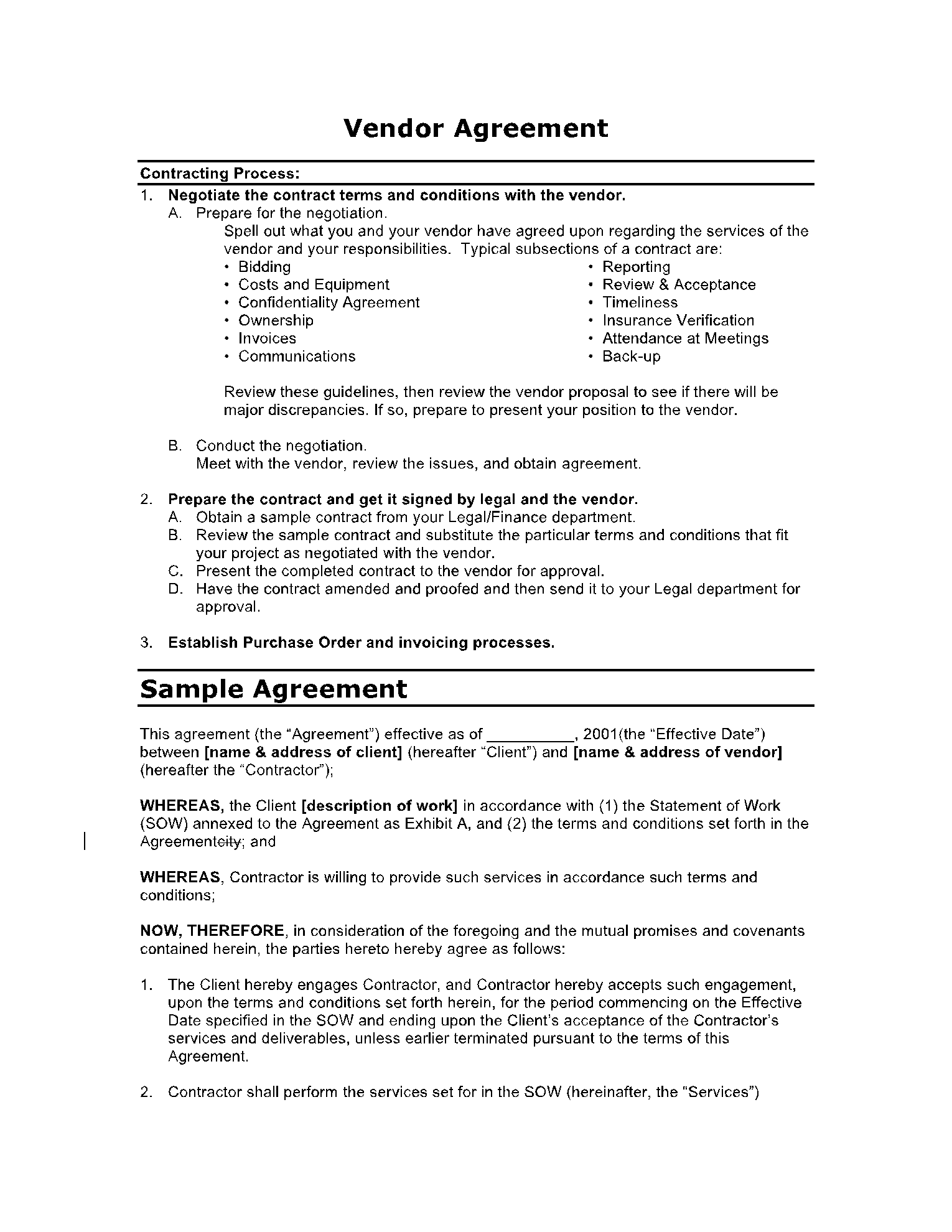

Vendor Discount Letter Template

http://writolay.com/wp-content/uploads/2021/11/88-vendor-discount-leter-724x1024.png

Discount Received Income Statement Crediting discount received has the effect of reducing gross purchases by the amount of cash discount received Consequently The sales discounts account appears in the income statement and is a contra revenue account which means that it offsets gross sales resulting in a smaller

Some suppliers offer discounts of 1 or 2 from the sales invoice amount if the invoice is paid in 10 days instead of the usual 30 days For instance let s assume that a company Yes discounts can be categorized as income You might want to create an Income account for the discount Then create an item for the discount to be applied

Download Is A Vendor Discount Considered Income

More picture related to Is A Vendor Discount Considered Income

Is Selling My Property Considered Income

https://cdn.carrot.com/uploads/sites/12684/2020/04/Is-Selling-My-Property-Considered-Income_.png

Figure 1 From Revenue Sharing Vs Wholesale Price Contracts In Assembly

https://ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/2be55f2e301f32b721b5e149f5741c0fa75ec29b/34-Figure1-1.png

Vendor Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2021/09/12175429/Vendor-Invoice-Template.png

So discounts received are considered as an income and are generally recorded in the company s income statement as other income Using the same example the buyer who A vendor discount means you paid less than what was owed It should reduce the cost of what was paid for BUT QB is incapable of doing that As a result the

The cash discount given by the supplier is a credit to the discount received account in the income statement and reduces the expenses of the business There are two methods an entity can use when accounting for discounts The first is to create a contra revenue account and the second is to simply net the

When Is A Gift Considered Income Mincher Koeman

https://familylawyerab.com/wp-content/uploads/2020/04/jonathan-francisca-YHbcum51JB0-unsplash.jpg

Contractor client Contract For Services Coursesmusli

https://source.cocosign.com/images/agreement-template/vendor/vendor_1.jpg

https://bizfluent.com/how-6365095-record-discounts...

In accounting a cash discount or sales discount is any discount you get from a supplier typically for paying your bill promptly A 2 10 net 30 discount for

https://accounting-simplified.com/financial/...

Discounts may be classified into two types Trade Discounts offered at the time of purchase for example when goods are purchased in bulk or to retain loyal customers

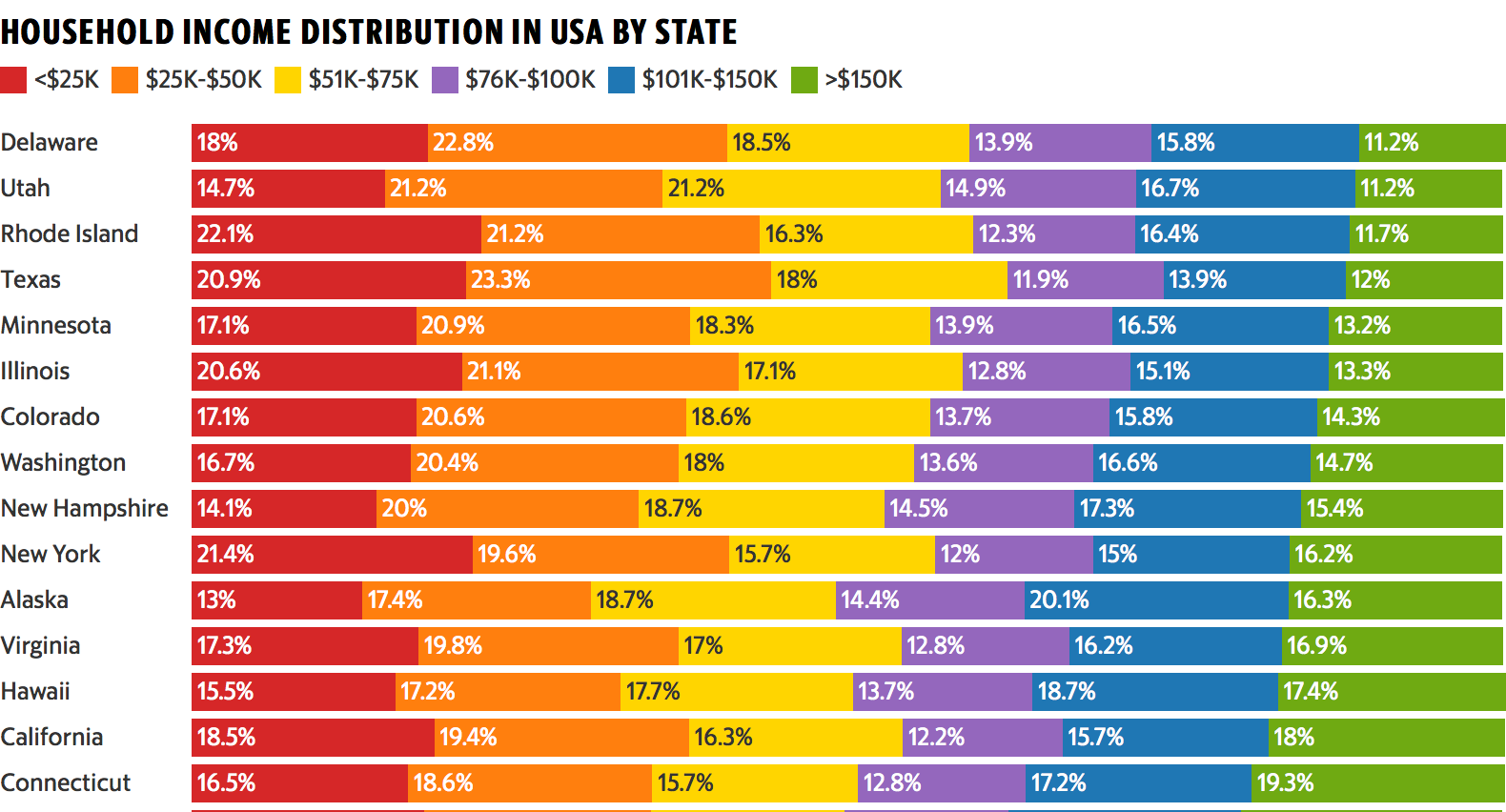

Visualizing Household Income Distribution In The U S By State

When Is A Gift Considered Income Mincher Koeman

Etailers DIPP s Discount Dilemma Entry Easier For Global Ecommerce

Vendor Discounts CUPE 4705 Local

FLORIDA SALES TAX COUPONS V DISCOUNTS

Ultimate Guide To Vendor Events For Direct Sellers

Ultimate Guide To Vendor Events For Direct Sellers

Social Security Income Limit What Counts As Income Social Security

What Is Considered Income For Federal Income Tax Reporting Purposes In

Could This Be Considered An Income Claim R antiMLM

Is A Vendor Discount Considered Income - Some suppliers offer discounts of 1 or 2 from the sales invoice amount if the invoice is paid in 10 days instead of the usual 30 days For instance let s assume that a company