Is A Whole House Fan Tax Deductible Because of this and the fact that they don t require chemical coolants to operate the IRS often allows taxpayers to claim the installation of a new whole house fan as part of an energy tax credit

A You may be able to take these credits if you made energy saving improvements to your principal residence during the taxable year In 2018 2019 2020 and 2021 the residential energy property credit is limited to an overall lifetime credit limit of 500 200 lifetime limit for windows Installing a whole house fan could potentially save you money come tax season But before you get too excited it s important to understand the eligibility criteria for home energy efficiency deductions and the specific benefits of whole house fans

Is A Whole House Fan Tax Deductible

Is A Whole House Fan Tax Deductible

https://www.spectrumelectricinc.com/blog/admin/uploads/2022/roof-vent.jpg

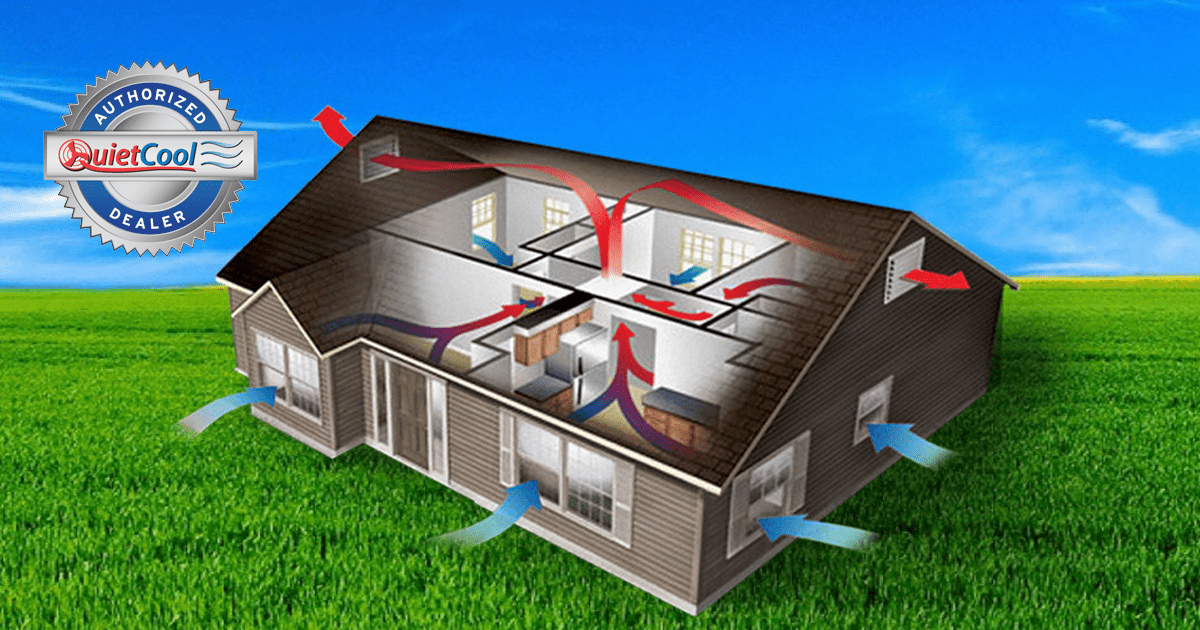

What Is A Whole House Fan How Do Whole House Fans Work

https://www.acwholesalers.com/images/1869-whole-house-fan-in-home.jpg

An Attic Air Wholehouse Fan Cool Down Save Big Chicago Suburbs

http://attic-air.com/wp-content/uploads/2017/06/wholehousefan.png

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500 Good news for anyone considering a solar attic fan for their home The federal tax credit that makes it a much more affordable option has been extended Originally set to step down to a lower percentage tax credit in 2021 the 26 percent rate of 2020 has been extended through 2022

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 Key Takeaways The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy audits to reduce

Download Is A Whole House Fan Tax Deductible

More picture related to Is A Whole House Fan Tax Deductible

Ducted Whole House Fan Reviews 4 Best Picks

https://airflowacademy.com/wp-content/uploads/2021/06/quietcool-ducted-whole-house-fan.jpeg

Pros And Cons Of Whole house Fan Oregonlive

https://www.oregonlive.com/resizer/FzRiQllX9qIZz9crw0yqUMXxF-Q=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.oregonlive.com/home/olive-media/width2048/img/hg_impact/photo/wholehousefanjpg-39a9de5b136423a9.jpg

2023 Whole House Fan Cost To Install HomeGuide

https://res.cloudinary.com/liaison-inc/image/upload/f_auto/q_auto/v1664156002/content/homeguide/homeguide-whole-house-fan-installation-example-cropped-t_r8cilv.jpg

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022 Home improvement expenses aren t tax deductible if they re solely for spaces that you also use for personal purposes For example while a kitchen reno is amazing and freshens up the space it s not a business expense and can t be deducted from your taxes

[desc-10] [desc-11]

Famous Is A Whole House Generator Tax Deductible References US Folder

https://i.pinimg.com/originals/38/30/ad/3830ad2ad1f0ed3ebd2507fc87e8c489.jpg

What Is A Whole House Fan And How Does It Work Air Health

https://airhealth.com/product_images/uploaded_images/picture-for-whole-house-fan-post-web.jpg

https://pocketsense.com/wholehouse-tax-credit-home-improvement...

Because of this and the fact that they don t require chemical coolants to operate the IRS often allows taxpayers to claim the installation of a new whole house fan as part of an energy tax credit

https://ttlc.intuit.com/community/investments-and-rental...

A You may be able to take these credits if you made energy saving improvements to your principal residence during the taxable year In 2018 2019 2020 and 2021 the residential energy property credit is limited to an overall lifetime credit limit of 500 200 lifetime limit for windows

Whole House Fans

Famous Is A Whole House Generator Tax Deductible References US Folder

Justalilshabby

Buy 6000 CFM 30 In Belt Drive Deluxe Whole House Fan With Shutter

Is A Whole House Natural Gas Generator Tax Deductible Engel Roatt1937

Whole Life Insurance Tax Deduction References Qarbit

Whole Life Insurance Tax Deduction References Qarbit

Considerations When Using Whole House Fans San Diego CA

Is House Cleaning Tax deductible

Whole House Fan Installation How To Install A Whole House Fan

Is A Whole House Fan Tax Deductible - [desc-13]