Is An Air Conditioning Unit Tax Deductible Heating ventilation and air conditioning HVAC replacement costs can be significant expenses for businesses that own or lease real estate Find out about how to distinguish between deductible repairs and more extensive work that must be capitalized

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work More information about reliance is available

Is An Air Conditioning Unit Tax Deductible

Is An Air Conditioning Unit Tax Deductible

https://www.robertsheating.com/blog/wp-content/uploads/2022/07/condensers.jpeg

Is A New HVAC Unit Tax Deductible Christiansonco

https://www.christiansonco.com/wp-content/uploads/2021/07/ac-air-appliance-change-checking-clean-condition.jpg

10 Signs It Is Time To Replace Your Air Conditioning Unit First

https://firstpremierhomewarranty.com/wp-content/uploads/2022/07/10-Signs-It-Is-Time-To-Replace-Your-Air-Conditioning-Unit.jpg

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 In one taxable year a taxpayer purchases and installs the following two exterior doors at a cost of 1 000 each windows and skylights at a total cost of 2 200 and one central air conditioner at a cost of 5 000

Here are the highlights of ENERGY STAR certified equipment that is eligible for the tax credits Products That Qualify Central air conditioning 300 for air conditioners recognized as ENERGY STAR Most Efficient Air source heat pumps This is a commonly asked question and while the answer for Are my HVAC repairs tax deductible is a straightforward no an HVAC upgrade needs a bit more clarifying We ll explain what kind of improvements are considered tax deductible and at what point you can claim them

Download Is An Air Conditioning Unit Tax Deductible

More picture related to Is An Air Conditioning Unit Tax Deductible

RA2 Computer Controlled Air Conditioning Unit Armfield

https://armfield.co.uk/wp-content/uploads/2019/11/Armfield_Air-conditioning-teaching-system-1536x1536.png

How To Hire An Air Conditioning Repair Company In Chesterfield MO IntHow

https://www.inthow.com/wp-content/uploads/2021/10/hire-air-conditioning-repair-company-in-chesterfield.jpg

How To Choose The Right Air Conditioning Unit KCR Inc Blog

https://www.callkcr.com/wp-content/uploads/2022/06/How-to-Choose-the-Right-Air-Conditioning-Unit-SOCIAL.png

Homeowners can take advantage of tax credits on HVAC units purchased and installed between 2023 and 2034 The credit you qualify for can very depending on the type of heating and cooling system There are a handful of other tax credits homeowners looking to start their home improvement project can qualify for Is Your HVAC Replacement Tax Deductible Private residential home improvements are considered nondeductible personal expenses by the IRS meaning your HVAC replacement isn t tax deductible However new AC installation is considered a home improvement that increases your home s basis

Most recently you could claim a 26 non refundable tax credit on qualified costs paid to purchase and install certain qualified solar equipment fuel cells or other covered renewable or alternative energy equipment The Inflation Reduction Act renamed the credit to the Residential Clean Energy Credit and extended the credit through 2034 Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps

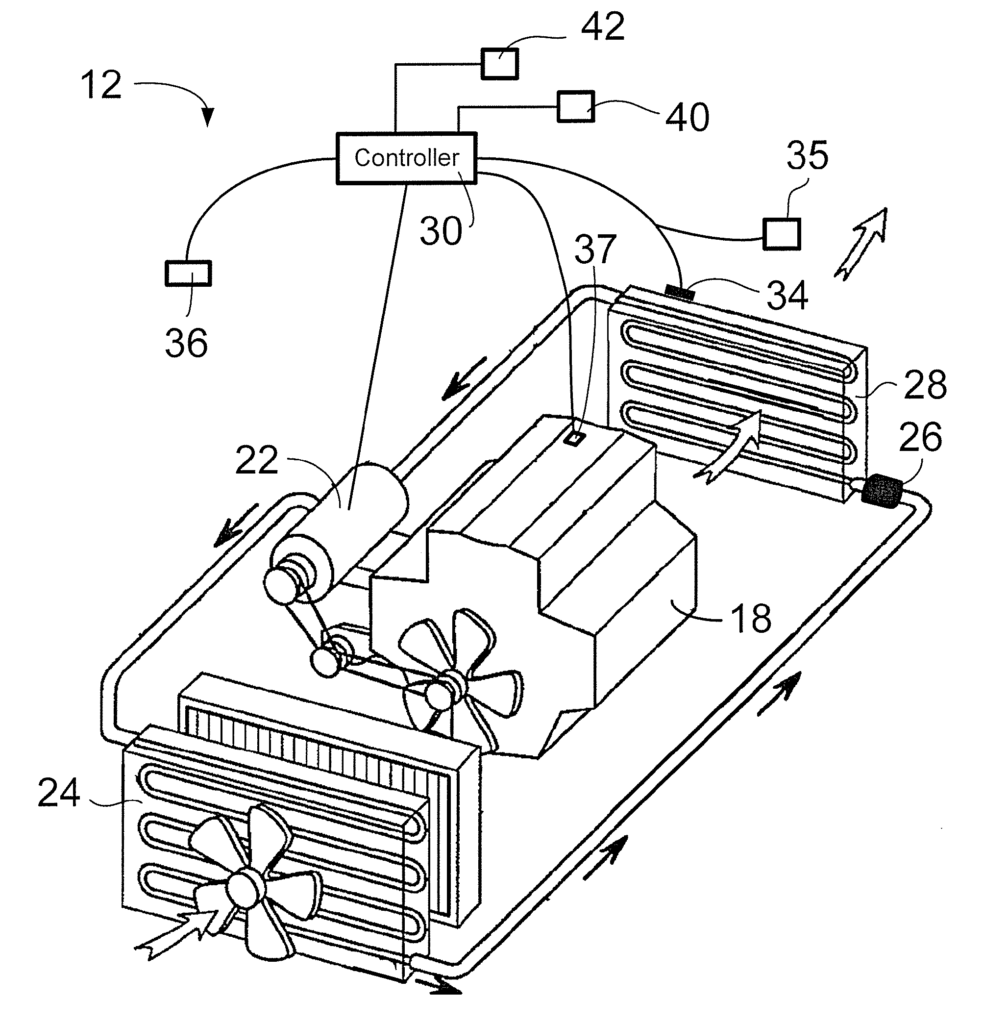

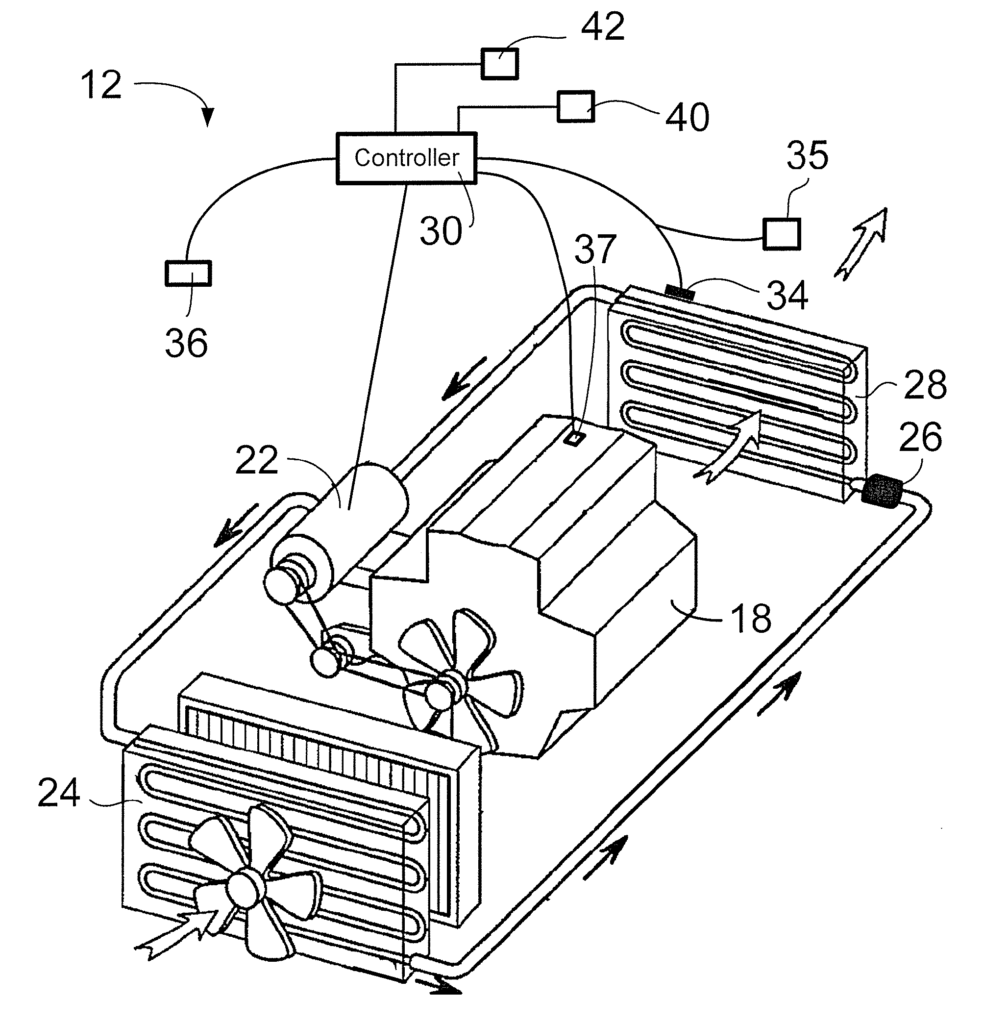

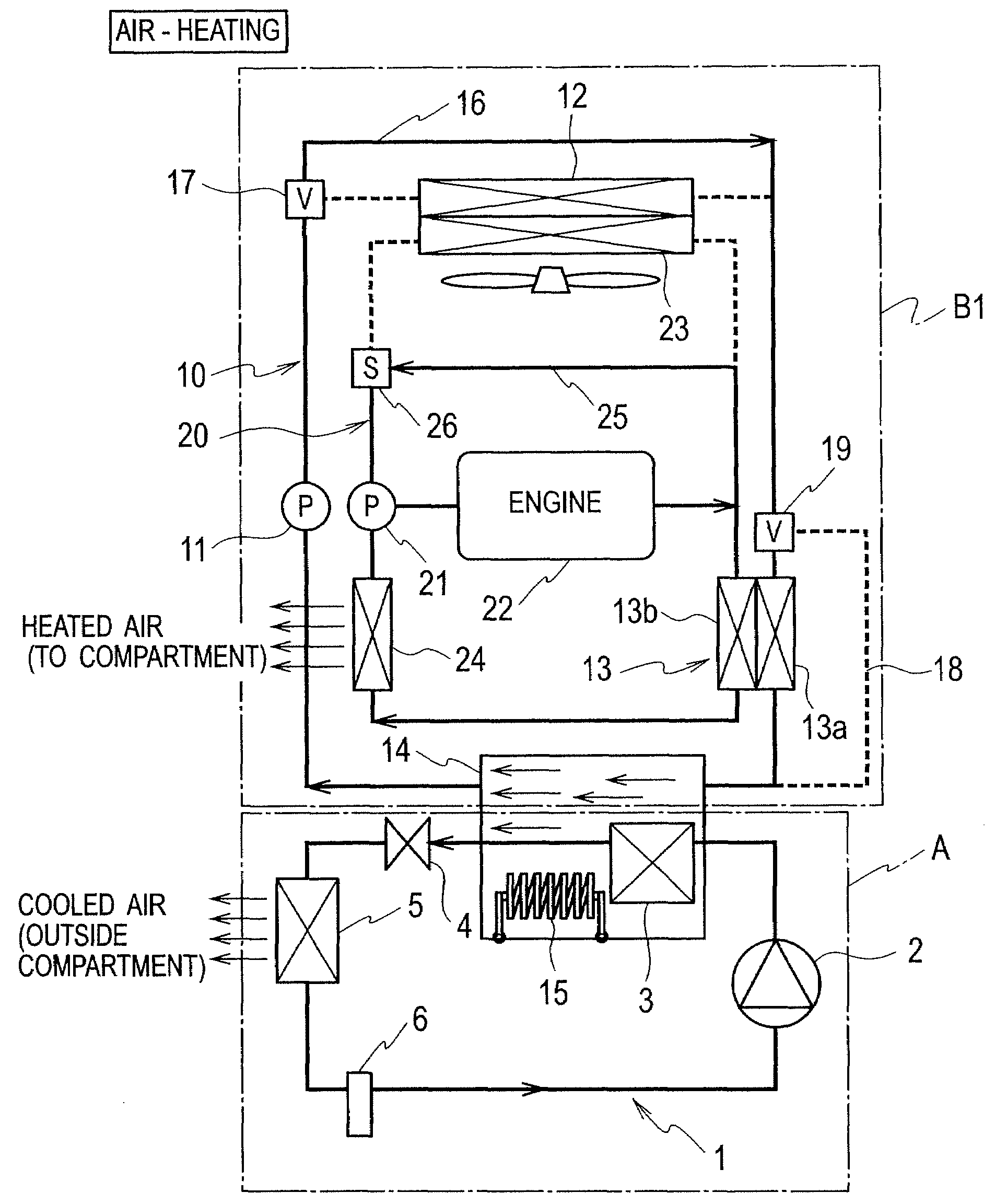

TODAY S PATENT VEHICLE AIR CONDITIONING SYSTEM Patent Blog

https://todayspatent.com/wp-content/uploads/sites/6/2022/06/12-983x1024.png

8 Ways To Make Your Air Conditioning Unit More Efficient The Leading

https://www.acs-aircon.co.uk/wp-content/uploads/2023/04/air-conditioning-maintenance-in-Surrey.jpg

https://www.thetaxadviser.com › newsletters › apr › ...

Heating ventilation and air conditioning HVAC replacement costs can be significant expenses for businesses that own or lease real estate Find out about how to distinguish between deductible repairs and more extensive work that must be capitalized

https://www.energystar.gov › about › federal-tax...

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners

Air Conditioning Filters Air Conditioning Unit Energy Usage Energy

TODAY S PATENT VEHICLE AIR CONDITIONING SYSTEM Patent Blog

Central Air Conditioner Price AC Cost Calculator Modernize

Air Conditioning System Eureka Patsnap Develop Intelligence Library

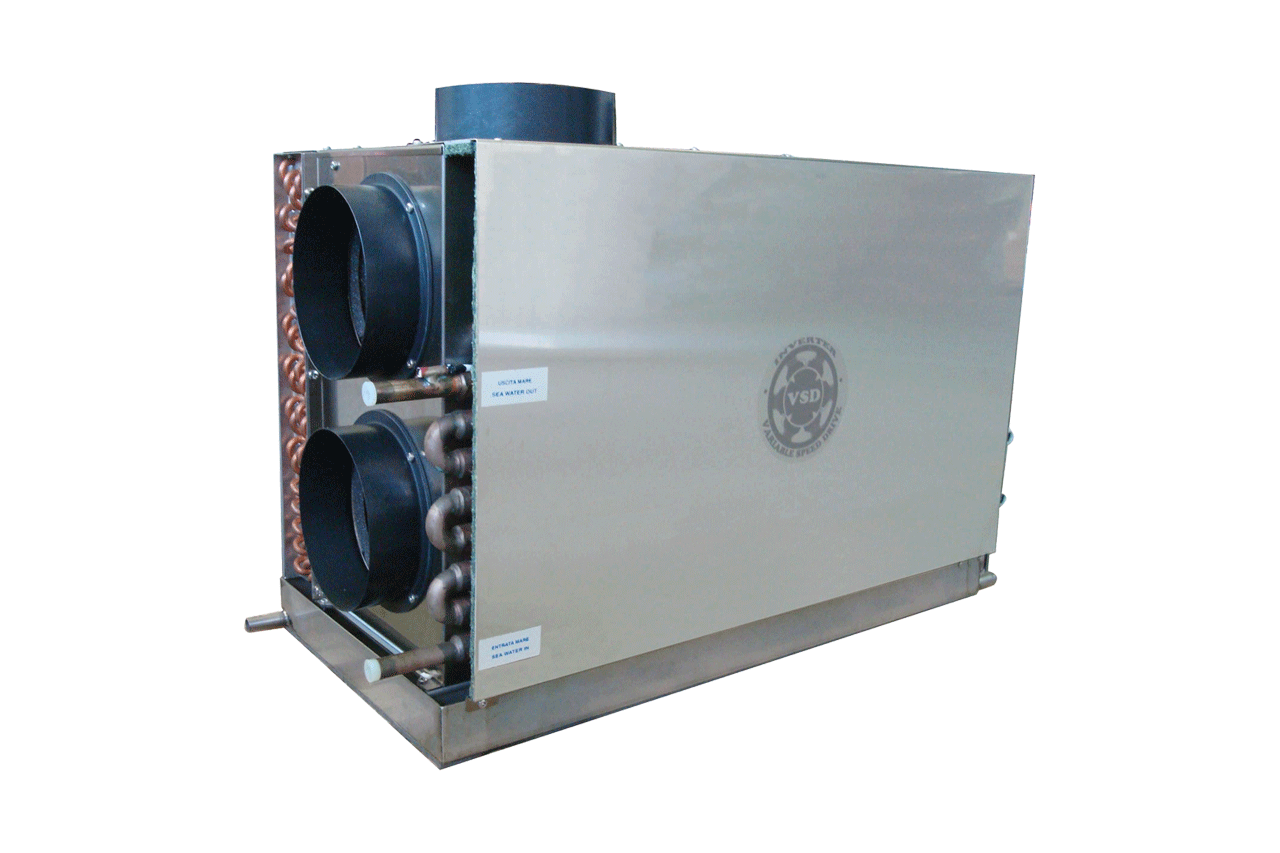

I21 VSD VSD INVERTER AIR CONDITIONING UNIT Uflex

Different Types Of Home Air Conditioning Units Castlat Group

Different Types Of Home Air Conditioning Units Castlat Group

Air conditioning System And Display Control Method Of Air conditioning

How To Choose The Perfect Air Conditioning Unit For Your Home

Air Conditioning System For Vehicle Eureka Patsnap Develop

Is An Air Conditioning Unit Tax Deductible - In one taxable year a taxpayer purchases and installs the following two exterior doors at a cost of 1 000 each windows and skylights at a total cost of 2 200 and one central air conditioner at a cost of 5 000