Is Army Pension Taxable Uk Document updated Armed Forces Pension members guide to taxation of pension benefits under the heading Taxation 23 July 2021 Added Pension Sharing Order Corrections Factsheet 22 July

1 The Armed Forces Pension Schemes AFPS are registered pension schemes and provide tax privileged savings Tax incentives are provided to encourage pension saving but there is a cost of The only time that the pension becomes tax free is in the event of a medical discharge where the Principal Invaliding Condition giving rise to the discharge is due to service AND attracts a Guaranteed Income Payment from the Armed Forces Compensation Scheme or

Is Army Pension Taxable Uk

Is Army Pension Taxable Uk

https://api.army.mil/e2/c/images/2019/04/30/551375/original.jpg

Financial Concept Pension Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/170000/velka/financial-concept-pension.jpg

Your State Pension Forecast Explained Which

https://media.product.which.co.uk/prod/images/original/12b4afe2cd76-statepensiongraphicforgareth1.jpg

Veterans UK have seen an increase in member s calls to the Armed Forces Pension Payment provider Equiniti Paymaster querying individual tax codes Where members are in employment and in The maximum pension you can receive is up to 48 5 of your final pensionable pay plus a tax free lump sum of three times your annual pension For AFPS 05 your pension is 1 70th of your final pensionable earnings multiplied by the years and days of service

Most pension schemes require both employer and employee to make monthly contributions However the Armed Forces Pension Schemes are unusual as you make no contributions Your pension when paid is guaranteed because it is paid by the government out of taxation Armed Forces pensions are occupational pensions earned by virtue of reckonable service RS in the Armed Forces The state pension is a non means tested benefit based on the number of National Insurance Contributions NICs you have paid

Download Is Army Pension Taxable Uk

More picture related to Is Army Pension Taxable Uk

Rezervace Pension FAMILY

https://files.previo.cz/13871/www/logo.png

:max_bytes(150000):strip_icc()/GettyImages-128223993-e05c8f147fd7481b9b5ad7b1567f7e3c.jpg)

Is Social Security Taxable Income 2021 Social Security Calculator

https://www.investopedia.com/thmb/i2TODlvybrZcu2-CqFnnUr8UvZ8=/2145x0/filters:no_upscale():max_bytes(150000):strip_icc()/GettyImages-128223993-e05c8f147fd7481b9b5ad7b1567f7e3c.jpg

Is My Pension Taxable

https://taxsaversonline.com/wp-content/uploads/2022/07/Is-My-Pension-Taxable-768x512.jpg

2019 20 on your Armed Forces Pension Scheme AFPS Exceeding this limit means that you MAY be liable to pay an AA tax charge however it does not automatically mean that you will pay a tax Any Armed Forces Pension Scheme member who paid an AA tax charge either directly or through scheme pays for any tax years between 6 April 2015 and 5 April 2022 must use the Tax Administration

The normal pension AFPS is taxable A war pension ie medical retirement for injury on duty is both tax free and discounted as income for some means tested benefits Death in Service benefits are available to eligible dependants who will receive benefits that may consist of a tax free lump sum in some circumstances and a taxable pension for life

Write Off An Employee s Loan Tax Tips Galley And Tindle

https://galleyandtindle.co.uk/wp-content/uploads/2020/06/employee-loans.jpg

Kentucky Teachers Defend A Broken Pension System National Review

https://i0.wp.com/www.nationalreview.com/wp-content/uploads/2018/04/budget-pensions.jpg?fit=1200%2C700&ssl=1

https://www.gov.uk › guidance › pensions-and...

Document updated Armed Forces Pension members guide to taxation of pension benefits under the heading Taxation 23 July 2021 Added Pension Sharing Order Corrections Factsheet 22 July

https://assets.publishing.service.gov.uk › ...

1 The Armed Forces Pension Schemes AFPS are registered pension schemes and provide tax privileged savings Tax incentives are provided to encourage pension saving but there is a cost of

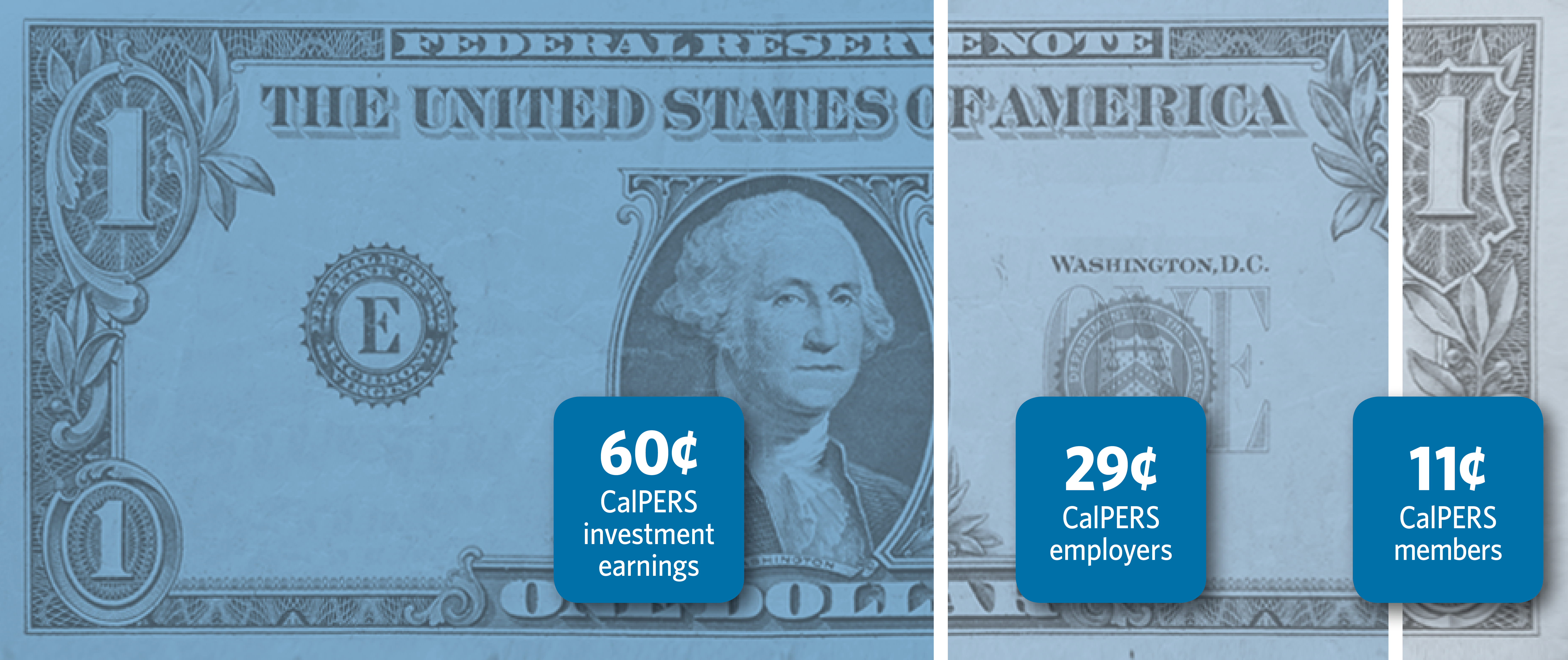

Who Pays For CalPERS Pensions CalPERS

Write Off An Employee s Loan Tax Tips Galley And Tindle

Taxable Payments Annual Report Bosco Chartered Accountants

APTF KOTABOMMALI Check Pension Details

Retirement Income Retirement Pension Retirement Advice Investing For

Pension Analysis Scarborough Capital Management

Pension Analysis Scarborough Capital Management

Pension For Older Adults Will Be 6 Thousand Pesos In 2024 Ministry Of

Old Pension Scheme

Pension Fund Free Of Charge Creative Commons Green Highway Sign Image

Is Army Pension Taxable Uk - AFPS 05 provides an automatic tax free pension lump sum of three times the pension It is open to the member to give up some or all of the tax free lump sum in order to improve their taxable pension This is called inverse commutation