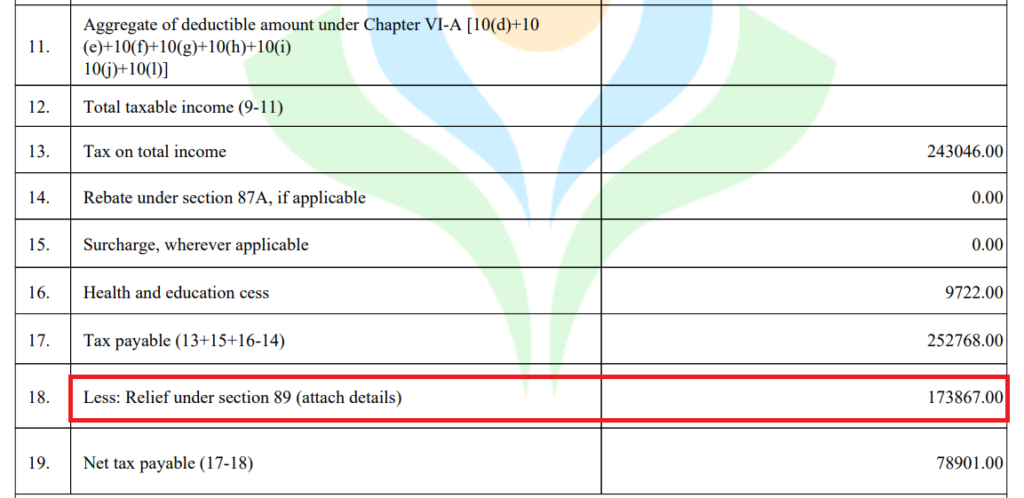

Is Arrears Of Salary Taxable For claiming relief under section 89 1 for arrears of salary received it is mandatory to file Form 10E with the Income tax department If Form 10E is not filed and relief is claimed

Arrears or Salary advances are taxable in the year of receipt The income tax department allows tax relief u s 89 of the Income Tax Act to save the taxpayer from Yes Arrears of Salary is always taxable When an employee receives arrears of salary for the previous years which was not taxed earlier on the due basis then the

Is Arrears Of Salary Taxable

Is Arrears Of Salary Taxable

https://www.pockethrms.com/wp-content/uploads/elementor/thumbs/salary-arrears-ptcl2jjrq1v6hiwy8ptctejrd29n5jsj8x4c1cqry8.png

Arrears Of Salary Are Taxable In The Year Of Receipt

https://ttplimages.imgix.net/tax-practice-images/IT-SL-R-2.jpg?w=1200

Arrears Definition Different Types Salary Arrears Vs Pension Arrears

https://jupiter.money/blog/wp-content/uploads/2022/07/4.-A_guide_to_arrears.jpg

If in case of receipt of past salary salary in advance or receipt of family pension in arrears you are allowed some tax relief under section 89 1 Here s how you can calculate the Section 89 of the Income Tax Act 1961 provides relief to taxpayers who receive arrears of salary or profits in lieu of salary in a particular financial year This

Yes arrears of your salary is taxable under the Income tax Act 1961 Getty Images 2 5 Can you claim income tax relief for arrears Yes If the assessee has Need help calculating tax on salary arrears or advances Minimize your tax liability and claim maximum relief under Section 89 with our expert Tax Advisory Service

Download Is Arrears Of Salary Taxable

More picture related to Is Arrears Of Salary Taxable

Income Tax Returns Filing Taxable Or Not PF And Gratuity To Salary

https://cdn.zeebiz.com/sites/default/files/2018/08/29/50605-itr-6.jpg

Arrears Of Salary Taxability Relief Under Section 89 1 Learn By

https://assets.learn.quicko.com/wp-content/uploads/2021/02/11153055/Salary-Arrears-1024x498.png

Income From Salary MCQ 30 Free MCQs ScholarsZilla

https://scholarsclasses.com/blog/wp-content/uploads/2021/11/Income-from-Salary-MCQ.jpg

Generally the amount of salary arrears is significant which increases the tax liability of the employee but many of you might not be aware that the Income Tax Arrear salary is taxed in the year it is received not the year to which it pertains This can potentially lead to a higher tax liability for the year when arrears are

[desc-10] [desc-11]

Romania Salary Guide 2021 2022 Hays

https://www.hays.ro/documents/29502643/29655156/salary.svg

Income Tax Return Filing Are Arrears Of Salary Taxable How To Claim

https://img.etimg.com/thumb/msid-101240155,width-1070,height-580,overlay-etwealth/photo.jpg

https://help.myitreturn.com/hc/en-us/articles/...

For claiming relief under section 89 1 for arrears of salary received it is mandatory to file Form 10E with the Income tax department If Form 10E is not filed and relief is claimed

https://learn.quicko.com/salary-arrears-taxability-relief-section-89

Arrears or Salary advances are taxable in the year of receipt The income tax department allows tax relief u s 89 of the Income Tax Act to save the taxpayer from

Definition Of Salary What Is The Salary Accounting Glossary InfoComm

Romania Salary Guide 2021 2022 Hays

Tax Deduction On Employee Salary Arrears U S 89 With Calculation

Salary Complaint Templates At Allbusinesstemplates

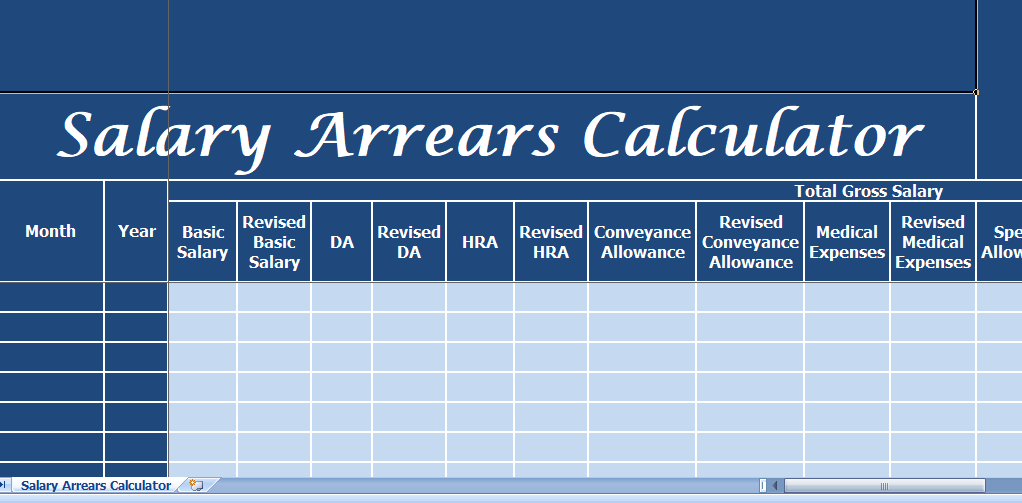

Salary Arrears Calculator Excel Template For Free

Salary Salary YouTube

Salary Salary YouTube

EXCEL Of Salary Arrears Calculator xlsx WPS Free Templates

Computation Of Salary Income Section 15 17

Arrears Of Salary Calculation PDF

Is Arrears Of Salary Taxable - [desc-12]