Is Bank Interest Considered Earned Income Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 You must report any interest earned on a savings account even

Interest earned on 529 plans is usually exempt from federal taxes Money held in retirement accounts such as traditional IRAs or 401 k s are usually tax exempt until funds are withdrawn Taxable interest income is any money you earn on your investments or savings accounts When an account pays you interest for the money you have in that account or you earn an annual percentage yield APY on the money you have in the account then that earned interest is taxable

Is Bank Interest Considered Earned Income

Is Bank Interest Considered Earned Income

https://valueofstocks.com/wp-content/uploads/2021/11/cash-in-hand-money-iStock-1194243722.jpg

Is Social Security Considered Earned Income INCOMEBAU

https://i2.wp.com/www.socialsecurityintelligence.com/wp-content/uploads/2016/11/2021-Income-Limit-2048x1282.png

Is Rental Income Considered Earned Income

https://wp-assets.stessa.com/wp-content/uploads/2021/12/24070648/rental-income.jpg

Most interest that you receive or that is credited to an account that you can withdraw from without penalty is taxable income in the year it becomes available to you However some interest you receive may be tax exempt Most states consider interest from high yield savings accounts taxable Even New Hampshire which is a state with no income tax currently has a special income tax for interest income

The interest income you earn on bank accounts money market funds and certain bonds must be reported on your tax return as ordinary income Here s how it works Typically most interest is taxed at the same federal tax rate as your earned income including Interest on deposit accounts such as checking and savings accounts Interest on the value of gifts given for opening an account

Download Is Bank Interest Considered Earned Income

More picture related to Is Bank Interest Considered Earned Income

How To Calculate Net Revenue Interest CALCULATOR CVS

https://i2.wp.com/www.wallstreetmojo.com/wp-content/uploads/2019/01/Interest-Expense-Income-Statement.png

Why Banks Won t Increase Savings Account Rates Even After Interest

https://cdn.gobankingrates.com/wp-content/uploads/2015/11/why_banks_wont_increase_savings_account_rates.jpg

How To Qualify For The Earned Income Tax Credit M M Tax

https://mmtax.com/wp-content/uploads/2023/01/2022-earned-income-credit-table-chart-NARTRP.webp

What s interest Even if you re new to investing you re probably familiar with interest income It s paid by many bank products like savings accounts and CDs certificates of deposit It s also paid by bonds and money market products Your money earns interest when it is deposited in accounts in banks savings and loans and credit unions used to buy certificates of deposit or bonds lent to another person or business Interest is considered unearned income because money not a

Earned income is taxable money received as compensation from an employer or revenue generated from your business if you re self employed Learn how earned income works A Interest is the charge for the use of money B Interest income is considered unearned income C Interest income may be taxable or tax exempt D The U S government does not pay interest Determine whether the interest income is taxable or tax exempt

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

Interest Income Formula And Calculation

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/06/21155832/Interest-Income-Example-Calculation.jpg

https://www.investopedia.com/ask/answers/052515/...

Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 You must report any interest earned on a savings account even

https://www.investopedia.com/articles/tax/10/interest-income.asp

Interest earned on 529 plans is usually exempt from federal taxes Money held in retirement accounts such as traditional IRAs or 401 k s are usually tax exempt until funds are withdrawn

Times Interest Earned Ratio Interpretation CedricabbWeeks

Earned Income Tax Credit For Households With One Child 2023 Center

Dec t Detaliat Venituri How To Calculate Gross Annual Income nvins

Earned Income Advantages And Disadvantages Of Earned Income

Is Bank Interest Taxable Taxation Portal

Is A RMD Considered Earned Income Thrivent

Is A RMD Considered Earned Income Thrivent

Analyzing A Bank s Financial Statements An Example

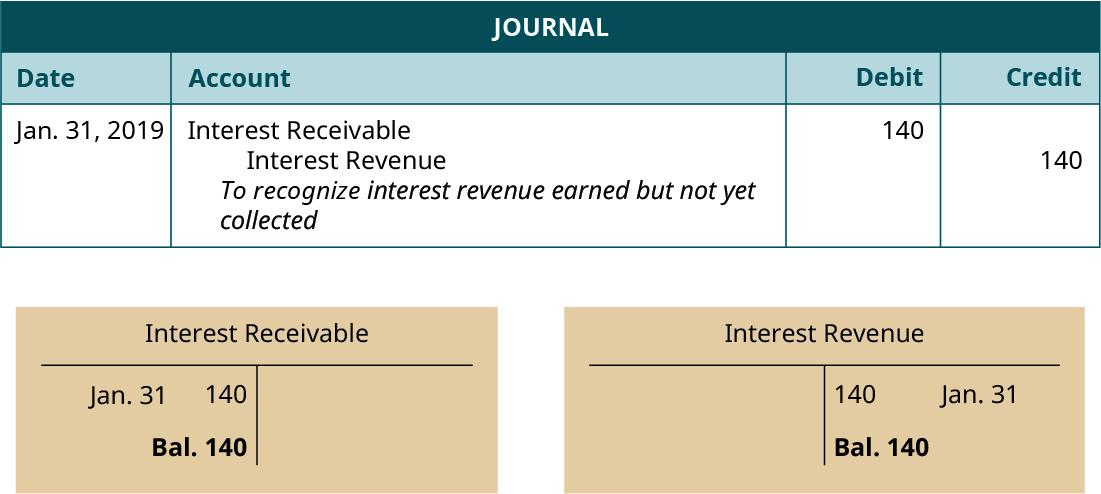

1 10 Adjusting Entry Examples Financial And Managerial Accounting

How To Calculate Earned Income For The Lookback Rule Get It Back

Is Bank Interest Considered Earned Income - Most interest that you receive or that is credited to an account that you can withdraw from without penalty is taxable income in the year it becomes available to you However some interest you receive may be tax exempt