Is Capitalized Cost Reduction Tax Deductible The cap cost reduction is an amount you can pay upfront to lower your overall lease cost So if your total lease cost is 4 000 you could pay 1 000 upfront

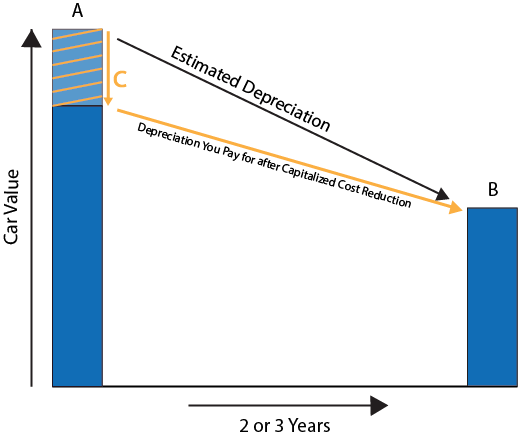

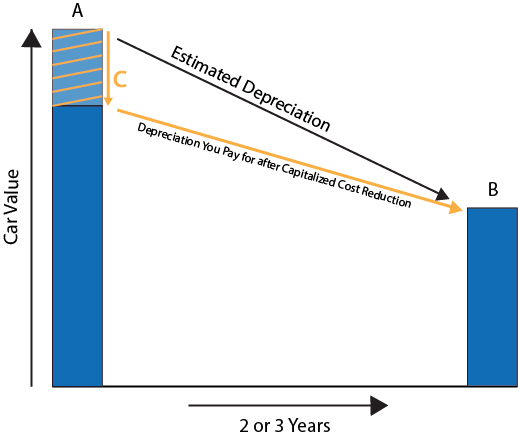

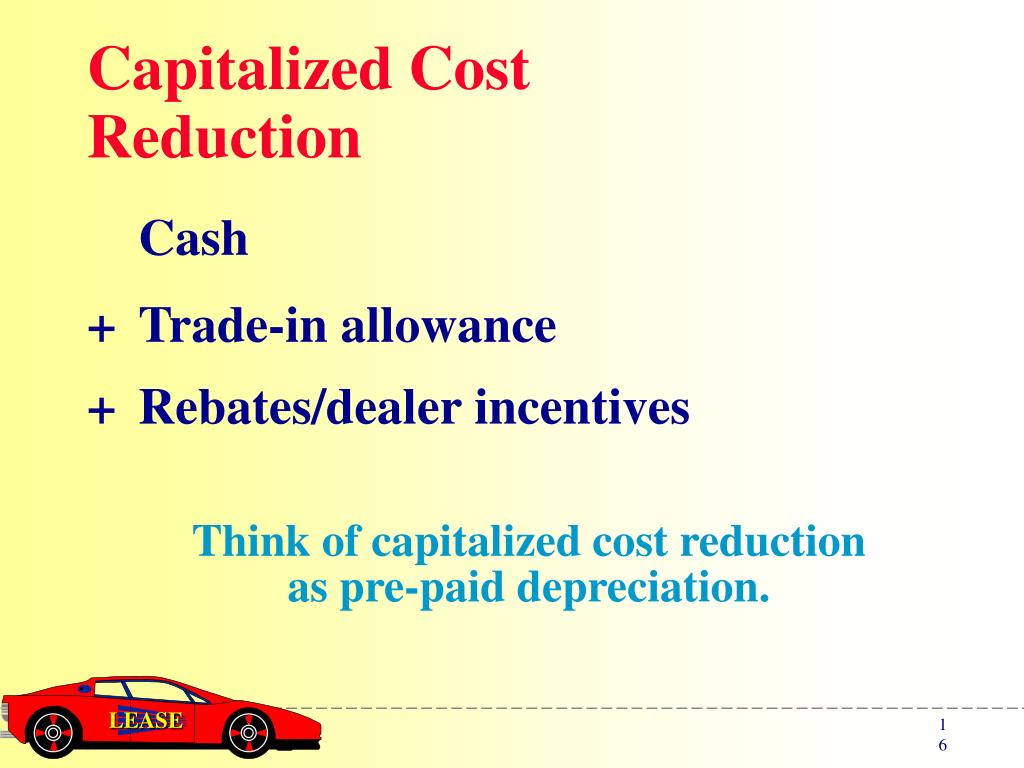

A capitalized cost reduction is the sum of any down payment trade in allowance or rebate that reduces your monthly lease payment You can and should negotiate your capitalized cost reduction A lease cap reduction can save you money in upfront costs but it can cost you some additional money in terms of taxes The term lease cap reduction applies primarily to

Is Capitalized Cost Reduction Tax Deductible

Is Capitalized Cost Reduction Tax Deductible

https://www.awesomefintech.com/term/cards/capitalized-cost-reduction/card_1.png

What Is Capitalized Cost Reduction Your Questions Answered Tresl

https://mytresl.com/wp-content/uploads/2020/01/Lease-capitalized-cost-reduction.png

What Is Capitalized Cost Reduction Your Questions Answered Tresl

https://mytresl.com/wp-content/uploads/2020/01/Blog_Captalized-Cost-Reduction-600x400.png

Your lease down payment is deducted over the life of the lease per IRS publication 463 From IRS publication 463 Deductible payments If you choose to use Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for the purposes of a trade or rental business They

At the beginning of a lease you may have to pay a capitalized cost reduction It is analogous to a down payment you might make when purchasing a car except that a capitalized cost reduction payment does Capital expenditures aren t directly tax deductible but they can indirectly reduce a company s taxes through the depreciation they generate

Download Is Capitalized Cost Reduction Tax Deductible

More picture related to Is Capitalized Cost Reduction Tax Deductible

What Is Capitalized Cost Definition And Meaning Business Jargons

https://businessjargons.com/wp-content/uploads/2015/11/capitalized-cost.jpg

Capitalized Cost AwesomeFinTech Blog

https://www.awesomefintech.com/term/cards/capitalizedcost/card_3.png

Capitalized Cost AwesomeFinTech Blog

https://www.awesomefintech.com/term/cards/capitalizedcost/card_1.png

If you make a down payment Capitalized Cost Reduction on your auto lease you will be charged state and local sales tax on the down payment amount in most states and in In CCA 202005019 the IRS concluded that the Taxpayer had to capitalize and not deduct both the excess markup payments and the participation payments because they were

How Tax Deductions for Capital Expenditures Work While OpEx can be fully deducted in the year they are incured CapEx must generally be deducted over a period Determine how the taxpayer should treat facilitative costs it must capitalize depending on the party target or acquirer and the type of transaction e g asset

What Is Implied By A Capitalized Cost Reduction Velin And Associates

https://cpaservice.weebly.com/uploads/2/5/1/3/25132582/published/cost-reduction-concept-art.jpg?1514439324

What Is Capitalized Cost Reduction GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2020/08/capitalgainstax_shutterstock_180503318-1024x576.jpg

https://www.finn.com/en-US/blog/leasing/capitalized-cost-reduction

The cap cost reduction is an amount you can pay upfront to lower your overall lease cost So if your total lease cost is 4 000 you could pay 1 000 upfront

https://www.thebalancemoney.com/wha…

A capitalized cost reduction is the sum of any down payment trade in allowance or rebate that reduces your monthly lease payment You can and should negotiate your capitalized cost reduction

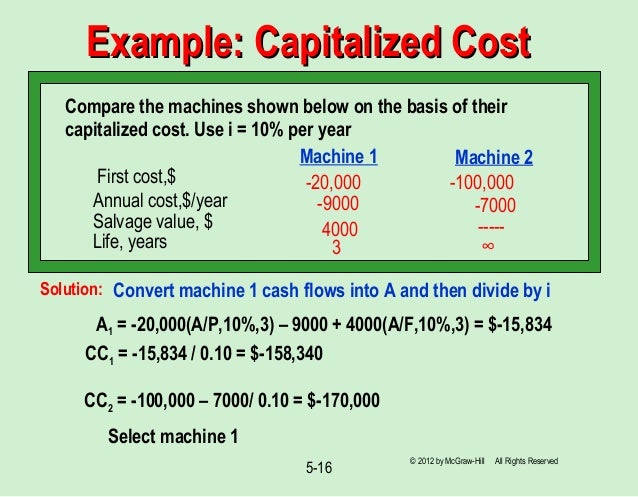

Chapter 5 Present Worth Analysis

What Is Implied By A Capitalized Cost Reduction Velin And Associates

Solved The Capitalized Cost C Of An Asset Is Given By The Chegg

SOLUTION Engineering Economy Capitalized Cost Studypool

PPT Engineering Economics PowerPoint Presentation Free Download ID

Capital Cost Comparison Capitalized Cost Analysis YouTube

Capital Cost Comparison Capitalized Cost Analysis YouTube

Capitalized Cost What Is Cap Cost In Car Leasing

Are Research And Development Costs Capitalized Or Expensed Universal

PPT LEASING PowerPoint Presentation Free Download ID 1278676

Is Capitalized Cost Reduction Tax Deductible - Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for the purposes of a trade or rental business They