Is Cost Of Sales Tax Deductible An expense that meets the definition of ordinary and necessary for business purposes can be expensed and therefore is tax deductible Some business expenses

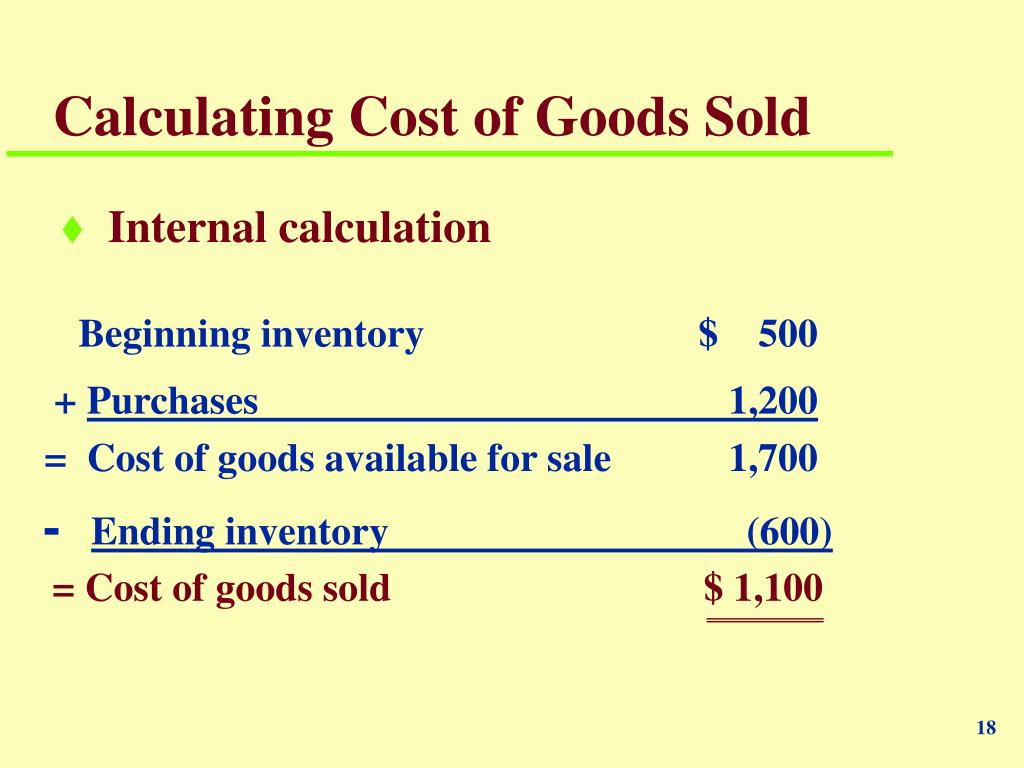

You deduct the tax in the taxable year you pay them The categories of deductible taxes are State local and foreign income taxes or state and local general By deducting total costs from total sales revenues you get the amount of gross income you received from the resale of your products The problem is assigning a value to the

Is Cost Of Sales Tax Deductible

Is Cost Of Sales Tax Deductible

https://www.accounting-basics-for-students.com/images/Cost_of_goods_sold8_corrected_550.jpg

Sales Tax

https://www.yycadvisors.com/images/RateofSalesTax.png

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

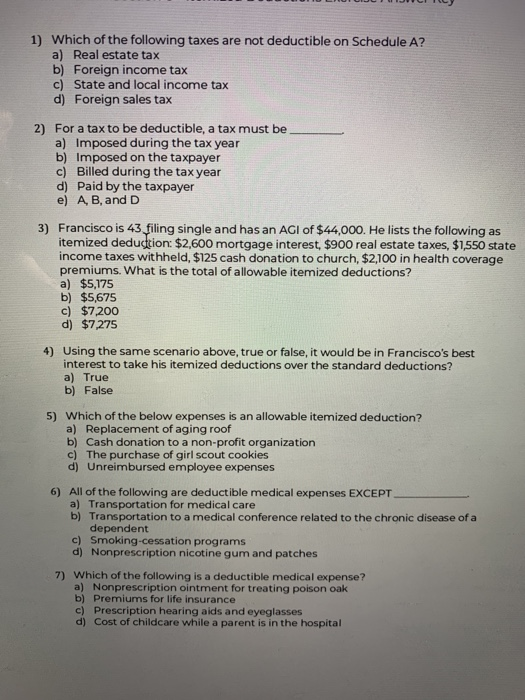

Businesses can deduct sales tax on eligible business expenses Any sales tax you pay on a service for your business or on the purchase or use of property Sales taxes are deductible but there are limitations You must itemize The IRS doesn t allow taxpayers to claim the sales tax deduction using the standard deduction Can t claim income tax If you

What is the sales tax deduction The sales tax deduction gives taxpayers the opportunity to reduce their tax liability when they deduct state and local sales taxes or state and local Itemized deductions claimed on Schedule A Unemployment income reported on a 1099 G Business or 1099 NEC income Stock sales including crypto investments Rental

Download Is Cost Of Sales Tax Deductible

More picture related to Is Cost Of Sales Tax Deductible

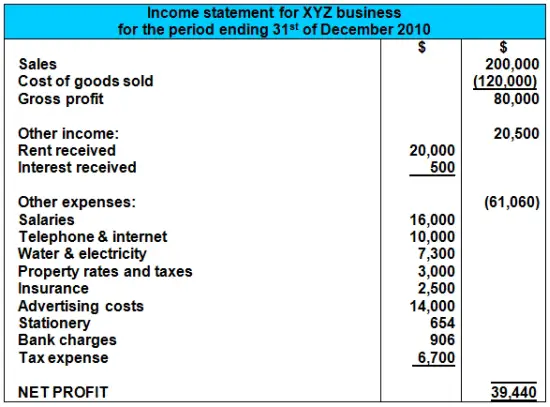

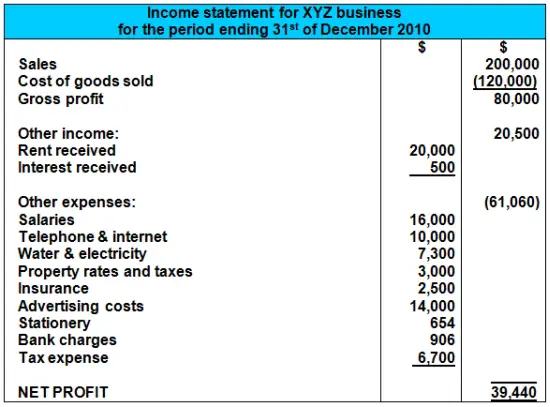

What Is Cost Of Sales And How To Calculate It CruseBurke

https://cruseburke.co.uk/wp-content/uploads/2021/10/cost-of-sales.png

Calculation Of Sales Tax Definition Formula Examples How To Find

https://eurekamathanswerkeys.com/wp-content/uploads/2021/11/Calculation-of-Sales-Tax-1024x576.png

-480a.jpg)

Visualizing Taxes By State

https://cdn.howmuch.net/articles/133_Sales-Tax-(combined)-480a.jpg

Use the Sales Tax Deduction Calculator The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you Promotion Expense A cost that a business incurs to make its products or services better known to consumers usually in the form of giveaways The IRS

They add this amount to their home s tax basis Its basis is now 225 000 instead of 200 000 They subtract 225 000 from the 720 000 realized from the home s sale to The deduction is for business costs and fees only not personal costs incurred when filing your taxes You can deduct your state tax preparation fees too

Tax Deductible Bricks R Us

https://www.bricksrus.com/wp-content/uploads/2018/03/35808436_l-1.jpg

The State By State Complexities Of Sales Tax Compliance Sales Tax

https://i.pinimg.com/originals/8c/9c/09/8c9c0967772c02b5e5e53f140c73b69a.jpg

https://www.investopedia.com/terms/b/businessexpenses.asp

An expense that meets the definition of ordinary and necessary for business purposes can be expensed and therefore is tax deductible Some business expenses

https://www.irs.gov/taxtopics/tc503

You deduct the tax in the taxable year you pay them The categories of deductible taxes are State local and foreign income taxes or state and local general

Mass Sales Tax Calculator VerdunMaman

Tax Deductible Bricks R Us

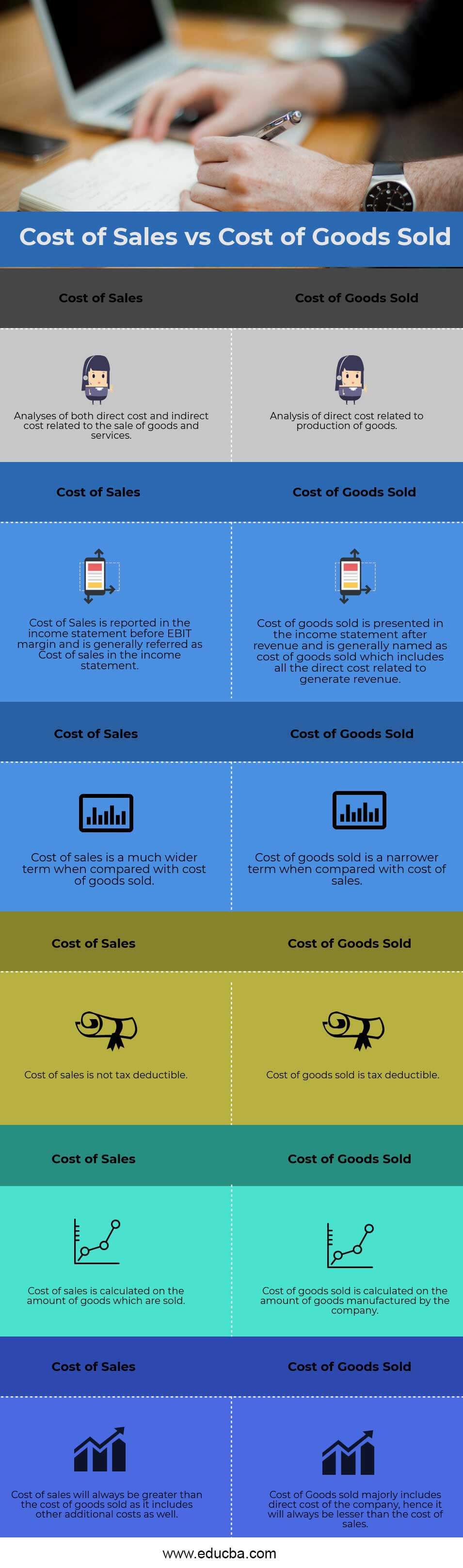

Cost Of Sales Vs Cost Of Goods Sold Top 6 Differences With Infographics

How To Calculate Cost Of Goods Sold Using Specific Identification Haiper

Tax Deductions Write Offs To Save You Money Financial Gym

Solve My Sales Tax

Solve My Sales Tax

Solve My Sales Tax

Sales Tax Rates Reached 10 year High In 2020 Accounting Today

Solved 1 Which Of The Following Taxes Are Not Deductible On Chegg

Is Cost Of Sales Tax Deductible - Sales taxes are deductible but there are limitations You must itemize The IRS doesn t allow taxpayers to claim the sales tax deduction using the standard deduction Can t claim income tax If you