Illinois Homeowner Rebate Web 8 ao 251 t 2022 nbsp 0183 32 Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020

Web 30 sept 2022 nbsp 0183 32 A maximum of a 300 property tax rebate or the equivalent of a 2021 qualified property tax credit can go to those reporting a gross income of 500 000 or Web 11 ao 251 t 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be

Illinois Homeowner Rebate

Illinois Homeowner Rebate

https://www.buildchicago.org/wp-content/uploads/2022/04/Screen-Shot-2022-04-09-at-10.22.36-AM.png

September 5 2022 Meadville Tax Service

https://meadvilletaxservice.com/wp-content/uploads/pexels-kindel-media-7579042-scaled-1300x976.jpg

ILHAF Metrics Version

https://assets-global.website-files.com/617033bdd8cf10d9f75baef2/6307d47f6ea90a91af5e6565_8-26-22_Pie-p-1600.png

Web 23 ao 251 t 2022 nbsp 0183 32 The maximum for the individual income and property tax rebates is 300 with up to three dependents qualifying as a dependent for the income tax rebate Who is eligible for 2022 Illinois tax Web 30 juin 2022 nbsp 0183 32 Property tax rebates for eligible homeowners will be issued up to 300 It is reserved for individuals who made less than 500 000 for returns with a federal filing status of married filing

Web 27 avr 2023 nbsp 0183 32 Income Requirements To qualify for the Property Tax Rebate Illinois 2023 program applicants must have an annual household income of 75 000 or less This Web The Illinois Emergency Homeowner Assistance Fund ILHAF program is now accepting applications for assistance The Illinois Emergency Homeowner Assistance Fund

Download Illinois Homeowner Rebate

More picture related to Illinois Homeowner Rebate

Illinois Homeowner Considers Small Estate Affidavit To Avoid Probate As

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAQSnGV.img

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

https://www.houseloanblog.net/wp-content/uploads/2021/12/220003_SM_BLOG_Homeowner-Tax-Breaks-2022-IMAGE-1024x587.jpg

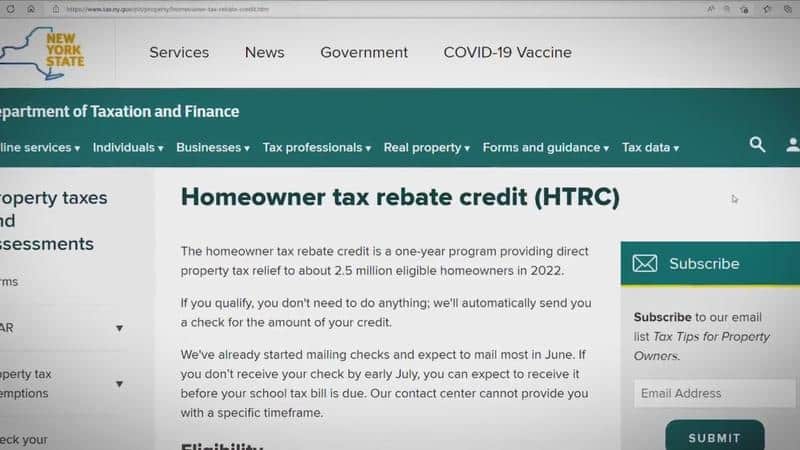

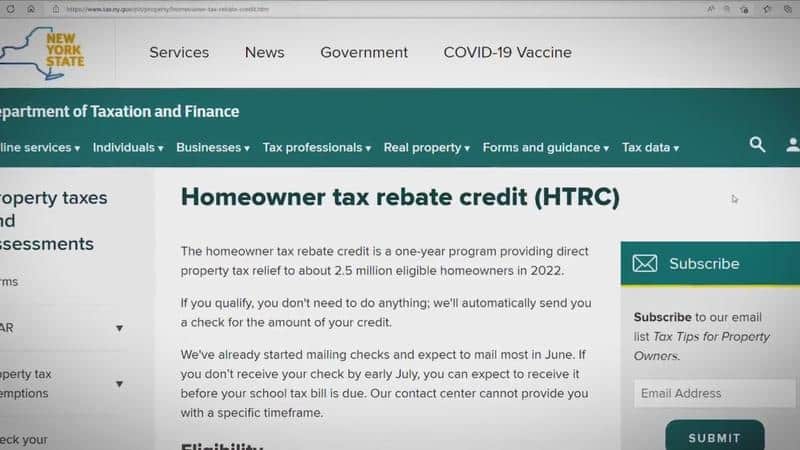

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1752&h=986&crop=1

Web The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence Web 24 ao 251 t 2022 nbsp 0183 32 The median rebate will be 279 The problem is the median Illinois homeowner has paid 2 288 more in property taxes during Pritzker s term That means

Web 17 oct 2022 nbsp 0183 32 Millions of Illinois residents are eligible for an income tax rebate property tax rebate or both thanks to Gov J B Pritzker s 1 8 billion Illinois Family Relief Plan Web 17 oct 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be

Homeowner Tax Rebate Credit Coming Timeline For Getting Your Check

https://www.fingerlakes1.com/wp-content/uploads/2022/07/homeowner-tax-rebate-credit-coming-timeline-for-getting-your-check.jpg

Illinois Homeowner Assistance Fund Opens April 11 To Help Struggling

https://www.illinoisrealtors.org/wp-content/uploads/2021/04/Things-you-should-know-graphic-IR-ROI-logos-1200628c72dpi4.jpg

https://taxschool.illinois.edu/post/navigating-the-illinois-income-and...

Web 8 ao 251 t 2022 nbsp 0183 32 Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020

https://www.sj-r.com/story/news/state/2022/09/30/illinois-tax-rebate...

Web 30 sept 2022 nbsp 0183 32 A maximum of a 300 property tax rebate or the equivalent of a 2021 qualified property tax credit can go to those reporting a gross income of 500 000 or

Illinois Homeowner Guide To AC Installation DIY Or Hire A Pro Joliet

Homeowner Tax Rebate Credit Coming Timeline For Getting Your Check

ILHAF Metrics Version

Illinois Homeowner Fights Off Intruders Kills 1 Suspect Crime News

Specials And Rebates For AC Services And Installation Texas York

American Finances Updates How To Claim The 850 Homeowner Rebate The

American Finances Updates How To Claim The 850 Homeowner Rebate The

Illinois Homeowner s Handbook On Home Repair Free Download Borrow

FireSmart Rebate Program Deadline Extended To July 18 Village Of

PPT Recent Illinois Homeowner Insurance Trends PowerPoint

Illinois Homeowner Rebate - Web 27 avr 2023 nbsp 0183 32 Income Requirements To qualify for the Property Tax Rebate Illinois 2023 program applicants must have an annual household income of 75 000 or less This