Is Daycare Tax Deductible In Ontario Allowable expenses you can claim You may include payments made to any of the following individuals or institutions caregivers providing child care services day nursery

The Ontario Child Care Tax Credit is calculated as a percentage of your Child Care Expense Deduction The Child Care Expense Deduction provides provincial and federal Canada Revenue Agency Questions and Answers About Child Care Expenses Canada Revenue Agency Income Tax Folio S1 F3 C1 Child Care Expense

Is Daycare Tax Deductible In Ontario

Is Daycare Tax Deductible In Ontario

https://kbdinsurance.com/wp-content/uploads/2022/07/what-is-a-deductible-in-car-insurance-1.jpg

Pin On Products

https://i.pinimg.com/originals/1d/7a/b7/1d7ab76f6318fcd2feac16fa2afebdba.jpg

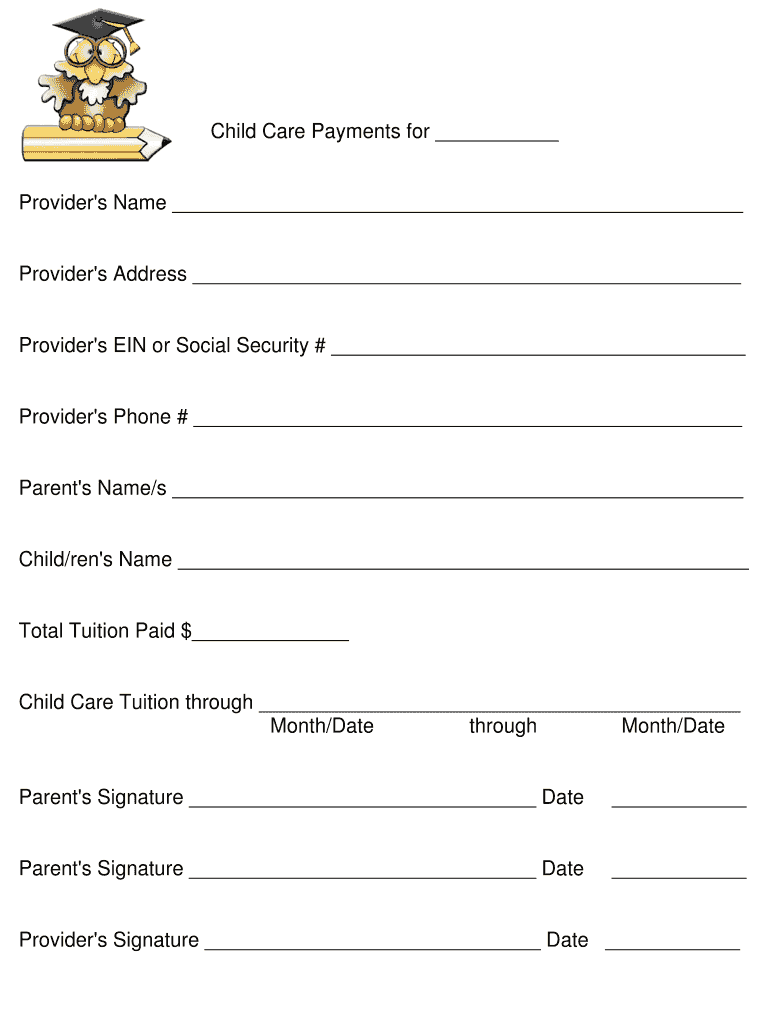

Daycare Tax Statement Daycare Tax Form Illustration Par Watercolortheme

https://www.creativefabrica.com/wp-content/uploads/2023/02/09/Daycare-Tax-StatementDaycare-Tax-Form-Graphics-60564329-2.jpg

Child care expenses 101 Daycare summer camp nurseries and nanny services are all deductible expenses for parents but the tax deduction must be Child care expenses including babysitters and daycare are tax deductible but there are limitations on who can claim the expenses For example in a two parent

Child care costs are not claimed as a non refundable tax credit but as a deduction from income on the personal tax return A non refundable tax credit is always The Canadian child benefits are different from the daycare tax deduction in Ontario The benefits are paid to parents whether or not they are working The daycare

Download Is Daycare Tax Deductible In Ontario

More picture related to Is Daycare Tax Deductible In Ontario

Hey SLPs Do YOU Know What Is Tax Deductible In Your Private Practice

https://file-uploads.teachablecdn.com/ca21a025529949aa88ec354b2bc36ff1/cfea973f79a542cf810a9f5522769ed6

Daycare Business Income And Expense Sheet To File childcare

https://i.pinimg.com/originals/de/09/f5/de09f5c78c889823cfbf86690091fee6.jpg

School Supplies Are Tax Deductible Wfmynews2

https://media.wfmynews2.com/assets/WFMY/images/181276e9-96af-4e3f-b43a-1cdd1d198fdc/181276e9-96af-4e3f-b43a-1cdd1d198fdc_1920x1080.jpg

Basic limit per child part B of the T778 1 child x 8 000 2 children x 5 000 18 000 Actual daycare expenses incurred 7 000 So they will be able to If actual expenses incurred totalled 9 600 but the maximum allowable deduction is 8 000 the refundable tax credit would be 53 x 8 000 4 240 For 2021 only the credit would be 4 240 x 1 2 5 088 If the

Child care expenses are not deductible when they are paid to a member of the same benefit unit such as an older sibling or to a person with a legal obligation to support the July 8 2022 4 min read Key takeaways If you pay for child care you may be able to claim a deduction when you file your tax return You may be able to claim for things such as day

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

Summer Daycare Expense Are They Deductible Ideal Tax

https://www.idealtaxsolution.com/wp-content/uploads/2015/09/SANY0049.jpg

https://www.canada.ca/en/revenue-agency/services/...

Allowable expenses you can claim You may include payments made to any of the following individuals or institutions caregivers providing child care services day nursery

https://www.ontario.ca/page/ontario-child-care-tax-credit

The Ontario Child Care Tax Credit is calculated as a percentage of your Child Care Expense Deduction The Child Care Expense Deduction provides provincial and federal

Tax Deductions You Can Deduct What Napkin Finance

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Printable Home Daycare Registration Forms Printable Forms Free Online

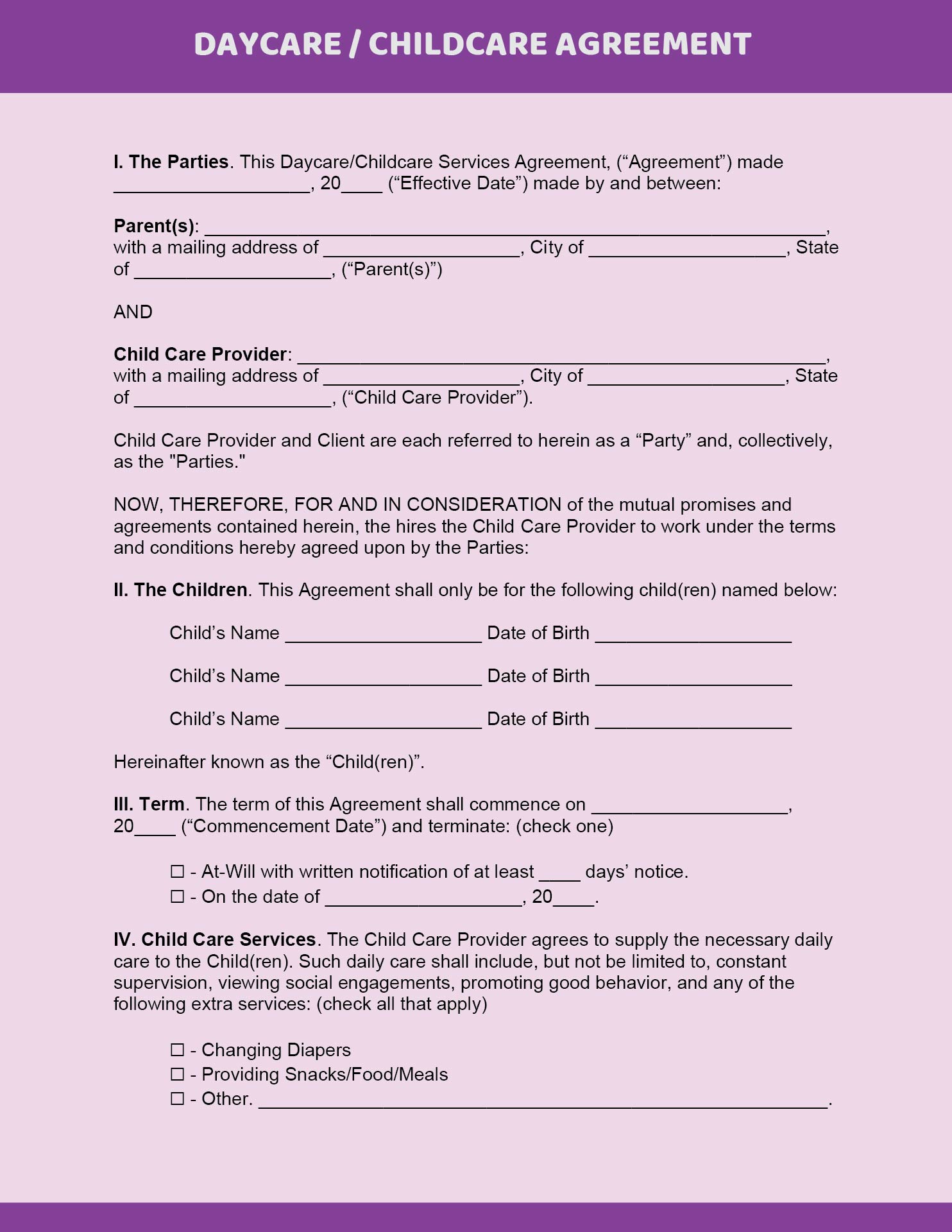

Daycare Tax Statement PDF Form Fill Out And Sign Printable PDF

Free 2022 Tax Worksheet

Deductible In Insurance Insurance Deductible Explained

Deductible In Insurance Insurance Deductible Explained

Child Daycare Excel Tax Cheat Sheet Deductible Expenses Etsy

Taxes For In Home Daycare Home Daycare Daycare Organization Family

Tax Deductible Donations Through The Episcopal Church St Andrew s

Is Daycare Tax Deductible In Ontario - Line 21400 Child care expenses Who is eligible You or another person may be eligible to claim child care expenses you incurred to look after a child in your care Eligibility