Is Disability Income Taxable If Paid By Employer If you pay the premiums of a health or accident insurance plan through a cafeteria plan and you didn t include the amount of the premium as taxable income to

Social security and Medicare taxes paid by employer If you and your employer have an agreement that your employer pays your social security and Medicare taxes without If you retired on disability you must include in income any disability pension you receive under a plan that is paid for by your employer You must report your taxable disability

Is Disability Income Taxable If Paid By Employer

Is Disability Income Taxable If Paid By Employer

https://www.lionsgatefinancialgroup.ca/wp-content/uploads/2021/11/Investing-3-1200x800-layout1194-1gnv4d6.png

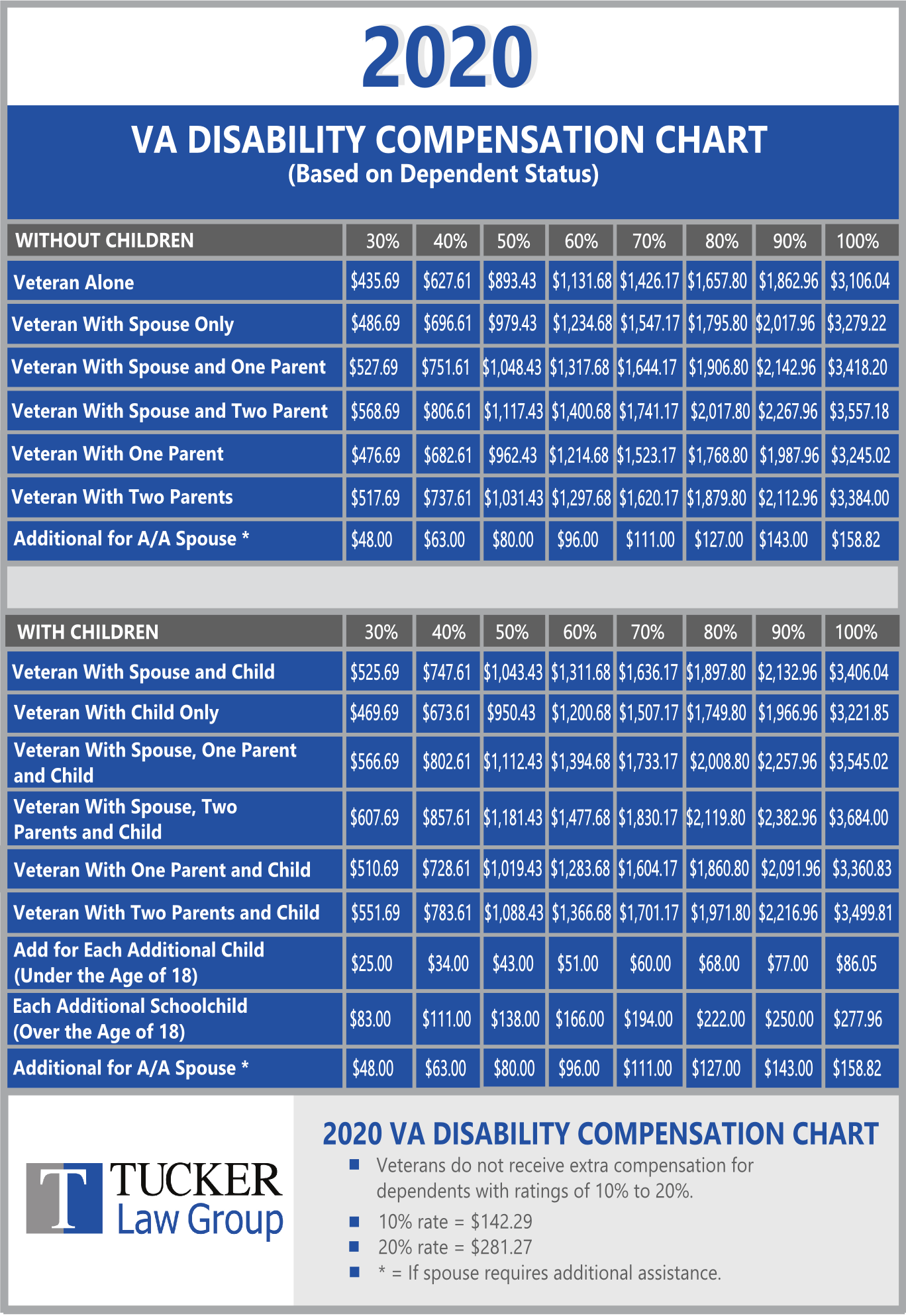

2024 Military Disability Pay Chart

https://tuckerdisability.com/wp-content/uploads/2020/10/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1-1.png

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

If the income is paid directly to you by your employer it s taxable to you as ordinary salary or wages would be Taxable disability benefits are also subject to How Disability Income Benefits Are Taxed If you ve recently begun receiving disability income you may wonder how it s taxed The answer is It depends The key

Disability income from insurance policies is taxable if the premiums were paid by an employer or a flexible spending account States might tax disability income The key factor is who paid it If your employer will directly pay the disability income to you it will be taxable to you as ordinary salary and wages would be Taxable

Download Is Disability Income Taxable If Paid By Employer

More picture related to Is Disability Income Taxable If Paid By Employer

Is Disability Income Taxable Gilliland Associates PC

https://www.gillilandcpa.com/wp-content/uploads/2022/08/Gilliland-Blog-1-1024x683-1024x585.png

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

Are Disability Income Benefits Taxable

https://apps.educationquest.org/fafsa/images/20192020/1040_UntaxedIncome.jpg

If the premiums were paid by your employer and weren t included in your taxable income the disability is taxable If you paid the premiums out of your own For these purposes if the premiums were paid by your employer but the amount paid was included as part of your taxable income from work the premiums will

Employer paid insurance Generally if your company pays the disability insurance premiums for your employees you can consider this a tax deductible business Generally if your employer paid the premiums then the disability income is taxable to you If you paid the premiums the taxability depends on whether you paid

What Is Taxable Income Explanation Importance Calculation Bizness

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

The Government Entitlement Program That s About To Dry Up The Fiscal

https://cdn.thefiscaltimes.com/sites/default/files/styles/article_hero_image/public/articles/07272012_disability_claim_article.jpg?itok=5cInMPU3

https://www.irs.gov/faqs/interest-dividends-other...

If you pay the premiums of a health or accident insurance plan through a cafeteria plan and you didn t include the amount of the premium as taxable income to

https://www.irs.gov/publications/p525

Social security and Medicare taxes paid by employer If you and your employer have an agreement that your employer pays your social security and Medicare taxes without

Disability Income Insurance Life Health Insurance Primordial

What Is Taxable Income Explanation Importance Calculation Bizness

What is taxable income Financial Wellness Starts Here

Is Disability Income Taxable Credit Karma

8 2023 Social Security Tax Limit Ideas 2023 GDS

VA Disability Pay Chart VA Disability Rates 2021

VA Disability Pay Chart VA Disability Rates 2021

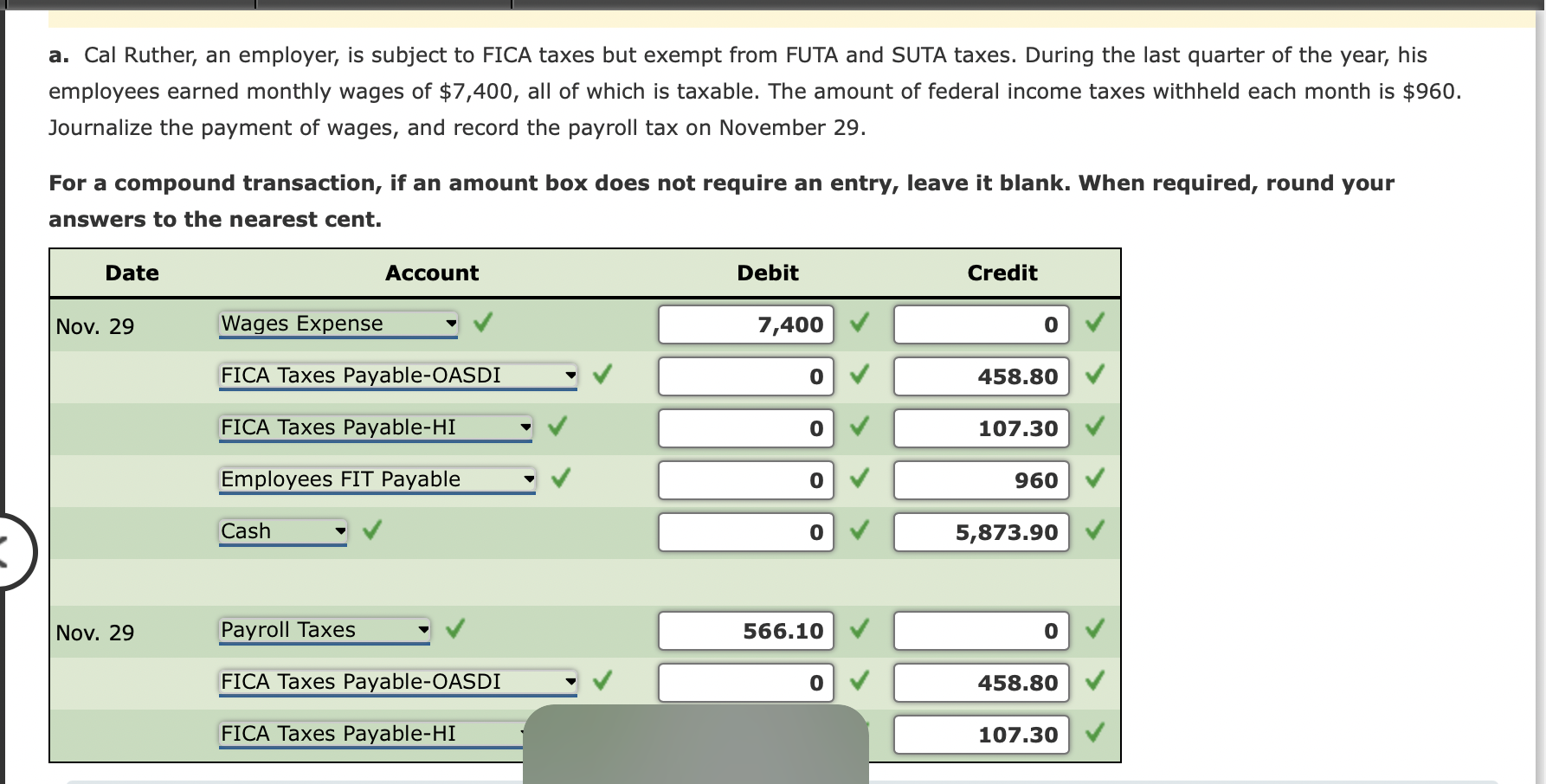

Solved Example 6 5 The Journal Entry To Record The Payroll Chegg

A Guide To Understand If Disability Income Is Taxable Trending Us

How To Find Average Income Tax Rate Parks Anderem66

Is Disability Income Taxable If Paid By Employer - The key factor is who paid it If your employer will directly pay the disability income to you it will be taxable to you as ordinary salary and wages would be Taxable