Is Discount Taxable Under Gst Discounts that are given before or at the time of sale can be deducted from transaction value at the time of sale no GST will be levied on the same However such

GST liability of the supplier would be reduced if both supplier and receiver of the goods or services are aware of the discount before supply i e GST would not be Relevant statutory provision for value of taxable supply in case of a discount Section 15 3 of the CGST Act 2017 similar provision exits in SGST UTGST Act 2017

Is Discount Taxable Under Gst

Is Discount Taxable Under Gst

https://i.ytimg.com/vi/VuO6V4vhChc/maxresdefault.jpg

Unadjusted Mobilisation Advance As On 01st July 2017 Immediately

https://charteredonline.in/wp-content/uploads/2020/01/payments-provisions-in-cpwd-contract-1-638.jpg

Renting Of Warehouse For Agriculture Produce Taxable Under GST

https://4.bp.blogspot.com/-5PzCkmCW-s8/WzCbgDqbXtI/AAAAAAAAAV0/Bf4GNiCfUAwIEc_Qc_M9S6NN4GK3G_OWgCEwYBhgL/s1600/slider-02.jpg

There will be no differentiation in GST between trade and cash discounts In fact GST segregates the discounts allowed into two categories Those given before Learn how to charge and account for GST when you provide discounts and rebates such as prompt payment discounts and volume rebates

GST laws treat trade discounts equally to cash discounts Cash discounts are recorded in books while trade discounts are not Trade discounts are typically used for wholesale GST treats all the discounts such as trade discounts cash discounts volume turnover discounts etc Instead the treatment varies with the timing of discount

Download Is Discount Taxable Under Gst

More picture related to Is Discount Taxable Under Gst

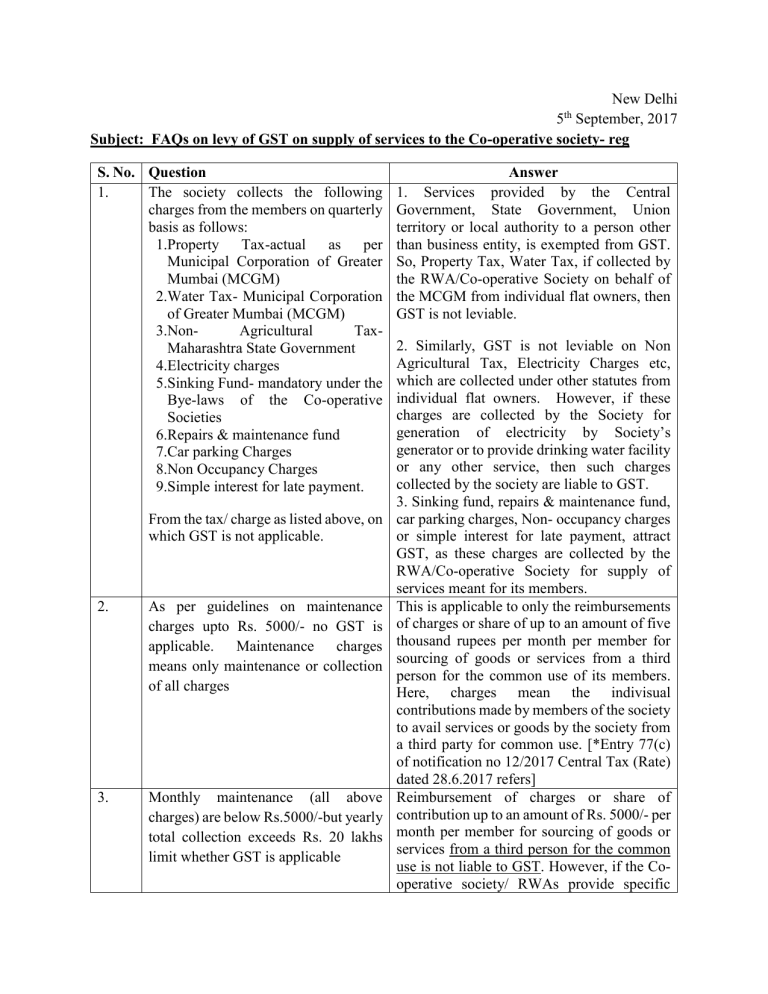

Gst faq cooperative society

https://s3.studylib.net/store/data/025227359_1-39abd1127d57fbffa11450cc15e4b270-768x994.png

Value Of Taxable Supply In GST 23 Important Questions Answered Value

https://caknowledge.com/wp-content/uploads/2017/06/Value-of-taxable-supply-under-GST.jpg

Beautiful Gst Tax Invoice Template Excel Sample Network Diagram In

https://i.pinimg.com/originals/a2/61/8c/a2618c3520ae70e2ddc425517848892c.jpg

Discounts under GST regime Section 15of the CGST Act 2017 The value of the supply shall not include any discount which is given a Before or at the time of Discounts given after supply will be allowed only if certain conditions are satisfied Please read part II of this article which deals with discounts and impact of

Discounts provided after the supply can also be excluded while determining the taxable value provided two conditions are met namely discount is established in terms of a pre Discounts offered by suppliers to customers including staggered discount under Buy more save more scheme and post supply volume discounts established

How To Create Service Purchase Order In SAP MM Tech Azmaan

https://techazmaan.com/wp-content/uploads/2021/01/1.-Service-purchase-order-min.png

Lottery Gambling Betting Taxable Under GST Act SC The Hindu

https://th-i.thgim.com/public/news/national/wigigd/article33244590.ece/alternates/LANDSCAPE_1200/KERALALOTTERY

https://gsthero.com/blog/2019/12/02/gst-on...

Discounts that are given before or at the time of sale can be deducted from transaction value at the time of sale no GST will be levied on the same However such

https://taxguru.in/goods-and-service-tax/treatment...

GST liability of the supplier would be reduced if both supplier and receiver of the goods or services are aware of the discount before supply i e GST would not be

Did You Know Advance Received Is Taxable Under GST

How To Create Service Purchase Order In SAP MM Tech Azmaan

Here s The List Of The Goods And Their Associated Rates

Whether Amount Forfeited On Account Of Breach Of Sale Of Land Agreement

Concept Of Casual Taxable Person Under GST Integra Books

SAC Code List Under GST SAC Code Finder Services Accounting Code

SAC Code List Under GST SAC Code Finder Services Accounting Code

Supply Under GST Definition Meaning And Scope Of Taxable Supply YouTube

GST Invoice Format In Excel Word PDF And JPEG Format No 5

Invoice Sample In Word And Pdf Formats

Is Discount Taxable Under Gst - In GST law discounts can be claimed as deduction from transaction value of supply of goods services when given in face of tax invoice