Is Education Loan Tax Deductible Is student loan interest tax deductible Yes but within limits Learn more about how the student loan interest tax deduction works

For tax free educational assistance received in 2023 reduce the qualified educational expenses for each academic period by the amount of tax free educational assistance allocable to that academic period Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

Is Education Loan Tax Deductible

Is Education Loan Tax Deductible

https://images.prismic.io/pigeon-loans/731fa247-4f28-4040-9e77-d1f0909bc76a_leon-dewiwje-ldDmTgf89gU-unsplash.jpg?auto=compress,format&rect=0,0,4365,2912&w=820&h=547

Free Education Loan Tax Saving Calculator And Tax Exemption Rules For

https://i.ytimg.com/vi/RXQRbu4ePv8/maxresdefault.jpg

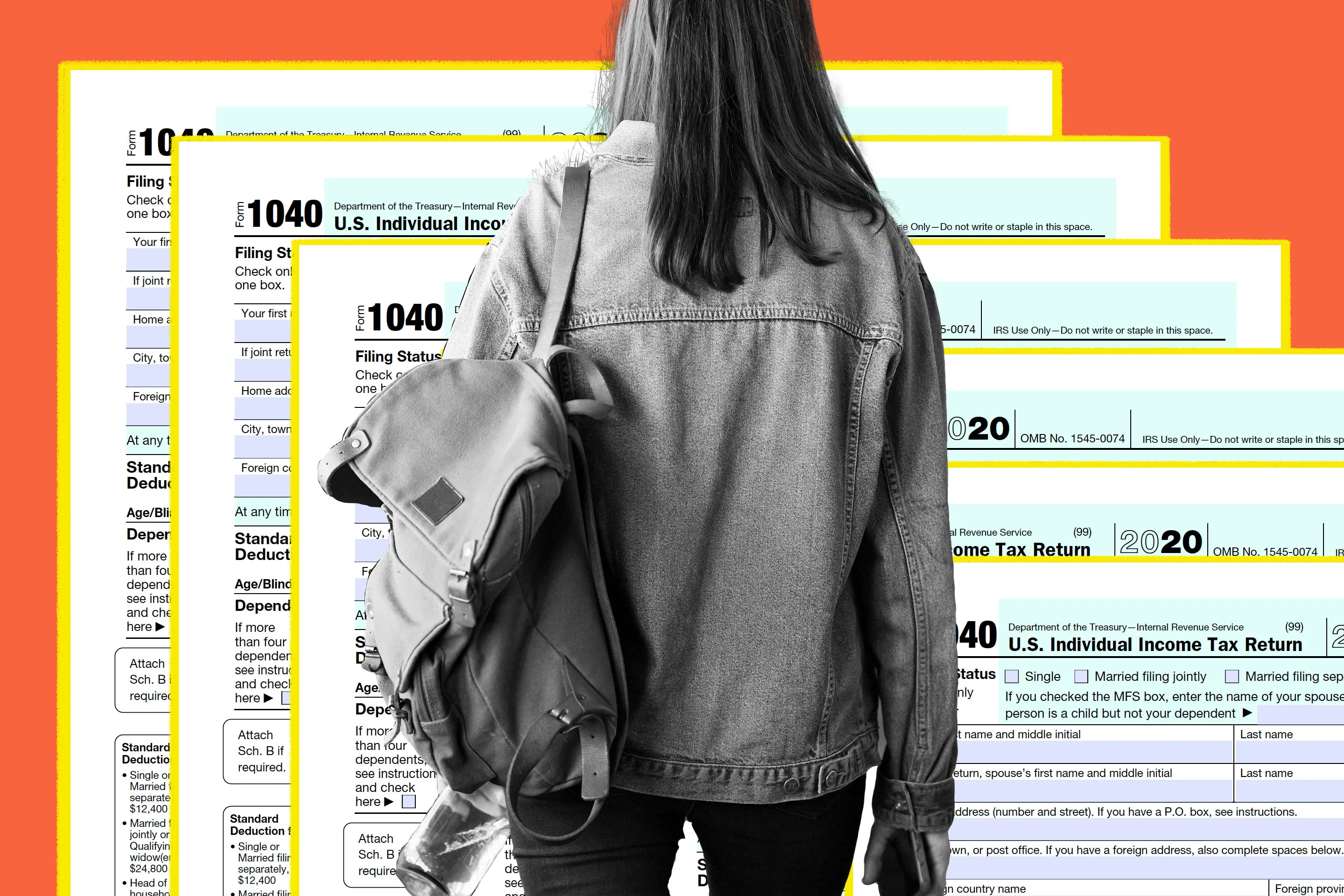

How To Claim The Tax Deduction For Student Loan Interest In 2021

https://img.money.com/2021/01/Student_Loan_Tax_Deduction.jpg?quality=85

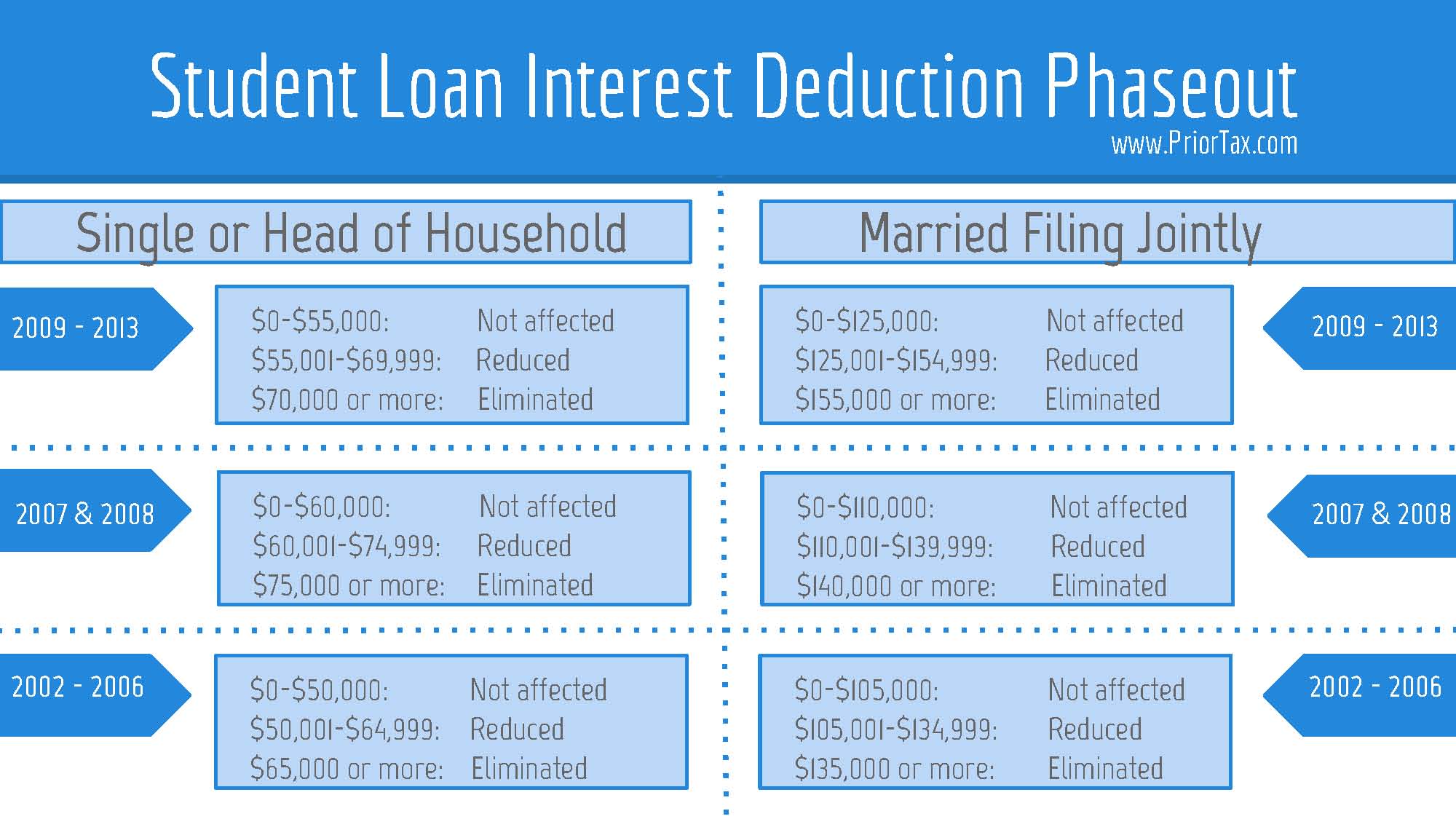

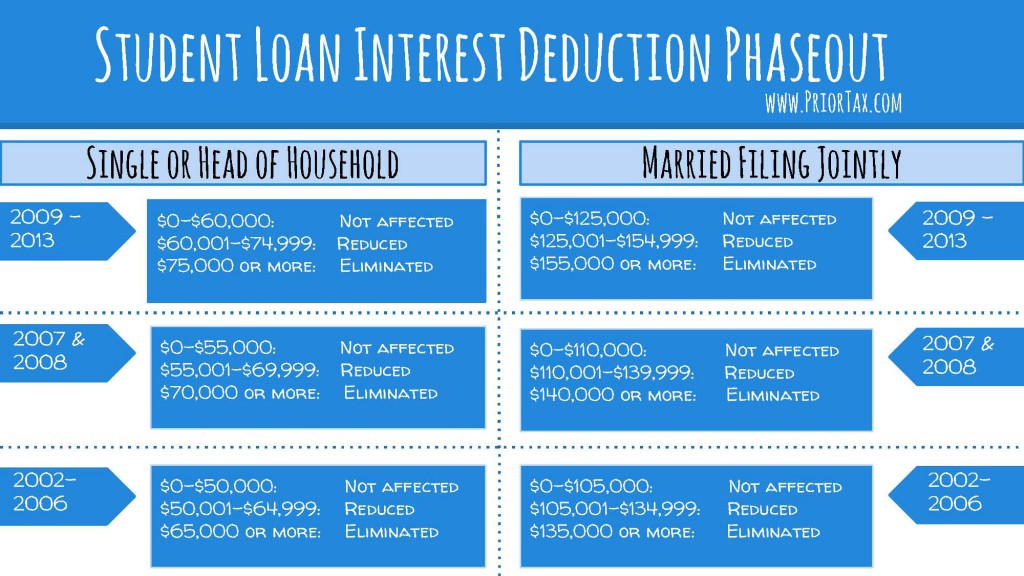

However if your modified adjusted gross income MAGI is less than 80 000 160 000 if filing a joint return there is a special deduction allowed for paying interest on a student loan also known as an education loan used for higher education Income Tax department offers tax deductions on education loans to ease financial burden Section 80E of IT Act allows deductions on education loan interest Criteria includes loan from financial institutions study purpose and loan borrowers

Luckily taxpayers who make student loan payments on a qualified student loan may be able to get some relief if the loan they took out solely paid for higher education In many cases the interest portion of your student loan payments paid during the tax year is tax deductible Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available only in old tax regime

Download Is Education Loan Tax Deductible

More picture related to Is Education Loan Tax Deductible

Are Business Loan Payments Tax Deductible

https://www.thimble.com/wp-content/uploads/2020/10/business-loan-payments-tax-blog.jpg

/loan_shutterstock_573964660-5bfc316e46e0fb0083c18cfd.jpg)

Are Personal Loans Tax Deductible

https://www.investopedia.com/thmb/6yQWt7i6lZEVqHhz3-CJhNTE9wA=/680x440/filters:fill(auto,1)/loan_shutterstock_573964660-5bfc316e46e0fb0083c18cfd.jpg

Pin On Finances

https://i.pinimg.com/originals/8b/8c/39/8b8c3967ac759c21d52eb6712c7b0617.jpg

The IRS allows a deduction of as much as 2 500 of interest paid on qualifying student loan debt per tax year In other words if you pay 1 000 in student loan interest during the 2019 tax Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is available for a maximum of 8 years or till the interest is repaid whichever is earlier

The student loan interest tax deduction is for students and their parents who are repaying federal student financial aid It s the above the line adjustment to your adjusted gross income AGI if you have paid interest to a When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying expenses that you pay with those funds towards educational tax credits

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Are My Student Loan Payments Tax Deductible WNY Asset Management

https://www.wnyasset.com/wp-content/uploads/2022/04/WNYAsset_StudentLoanRepayment-1280x720.jpg

https://www.forbes.com/advisor/taxes/student-loan...

Is student loan interest tax deductible Yes but within limits Learn more about how the student loan interest tax deduction works

https://www.irs.gov/publications/p970

For tax free educational assistance received in 2023 reduce the qualified educational expenses for each academic period by the amount of tax free educational assistance allocable to that academic period

Is Student Loan Interest Tax Deductible RapidTax

Tax Benefits On Home Loan Know More At Taxhelpdesk

Student Loan Interest Deduction 2013 PriorTax Blog

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

Is Your Business Loan Tax Deductible

FINANCIAL PLANNING Interest On Student Loan Is Tax Exempt

FINANCIAL PLANNING Interest On Student Loan Is Tax Exempt

Is My Business Loan Repayment Tax Deductible IIFL Finance

Is Student Loan Repayment Tax Deductible US Student Loan Center

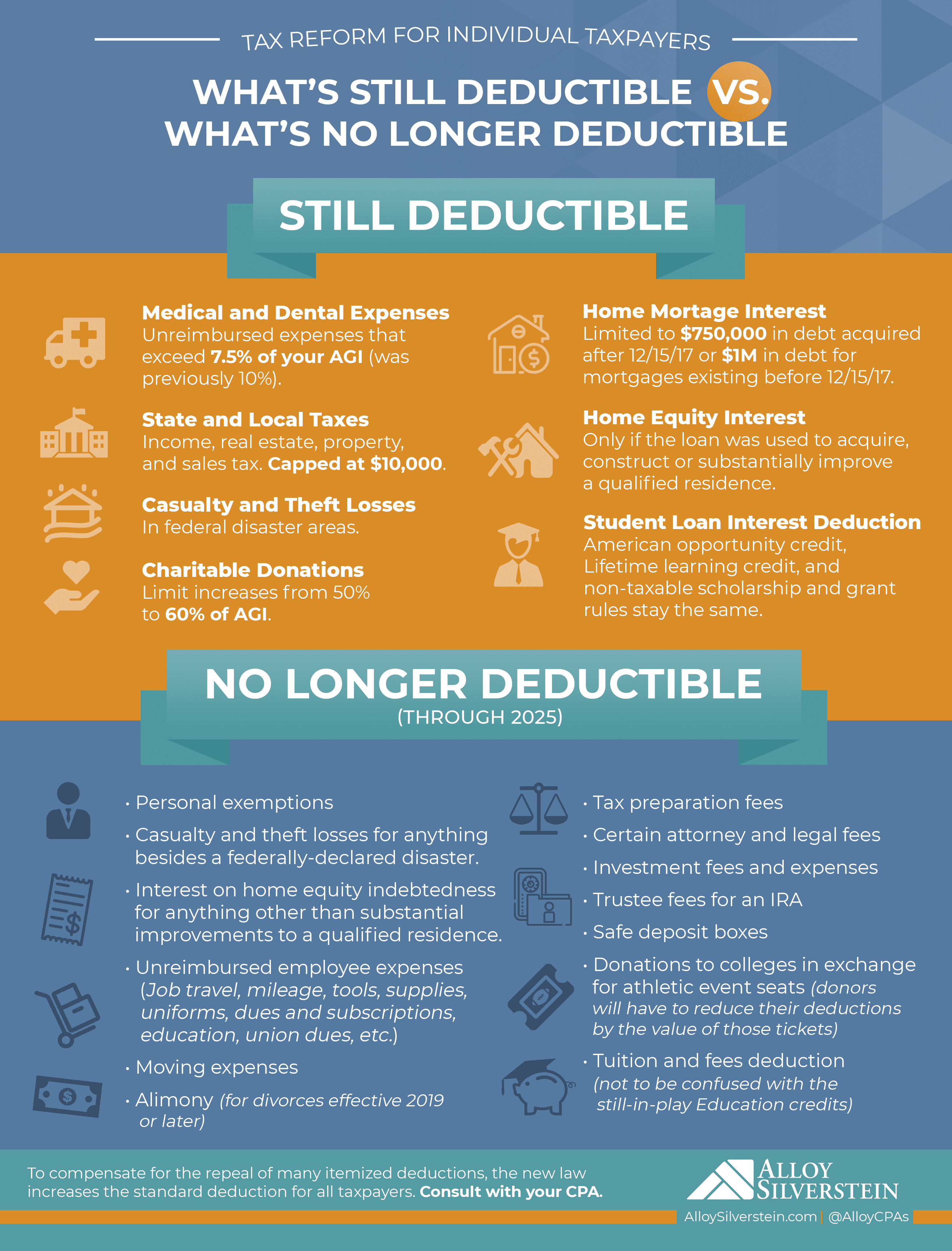

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Is Education Loan Tax Deductible - Depending on your tax filing status and how much money you earn you may be eligible to deduct up to 2 500 in student loan interest on your taxes each year When you take a tax deduction it